IC Funded Prop Firm stands out as a promising option for forex traders seeking to amplify their trading potential. This review explores how the firm appeals to traders with scalable evaluation plans, a competitive profit-sharing model, and access to renowned platforms like MetaTrader 4 and 5. With a wealth of educational resources, IC Funded supports traders at all levels, providing tools for continuous learning and improvement. Dive into this review to uncover how IC Funded might elevate your trading journey while navigating these aspects.

Key Takeaway

- Phase 1: Achieve a 10% profit target without exceeding daily and total drawdown limits.

- Phase 2: Demonstrate consistency with a 5% profit target, under tighter drawdown constraints.

- No Time Limit: Traders can take as long as they need, alleviating the pressure of a ticking clock.

- Flexible Strategies: Use of various trading styles and instruments is permitted, fostering a diverse trading approach.

Table of Contents

ToggleCompany Overview

IC Funded, managed by Finocom Services Ltd in Hong Kong, stands as a moderate-risk proprietary trading firm that specializes in scalable evaluation plans. Catering primarily to forex traders, the prop firm offers a dynamic path for those seeking a funded account. It’s designed to accommodate varying levels of expertise, welcoming both seasoned and novice funded traders.

The firm’s innovative approach allows traders to navigate through a systematic evaluation process before accessing increased funding tiers. Starting with as little as $5,000, traders can scale up to $250,000 and eventually up to $500,000. This structure is particularly appealing to those who aim to expand their trading capacity gradually while managing risk effectively.

IC Funded’s model is centered around supporting prop trading by providing substantial backing and resources. It ensures traders can leverage their skills without the immediate financial burden typical of independent trading setups. By fostering a supportive environment, the forex prop firm not only enhances traders’ potential but also aligns their success with the firm’s growth, creating a mutually beneficial ecosystem in the competitive world of forex trading.

IC Funded Trading Platform

Delving into the trading conditions at IC Funded, traders encounter a landscape designed for strategic growth and risk management. This prop trading firm offers a variety of funded trading accounts, accommodating different levels of experience and investment sizes. With leverage options up to 1:50, traders can maximize their market exposure while adhering to controlled risk parameters.

IC Funded sets itself apart by supporting both MetaTrader 4 and MetaTrader 5 platforms, which are essential for traders using automated strategies. This flexibility is enhanced by the availability of a prop firm that is tailored to assist traders in navigating complex market conditions effectively. The firm’s trading conditions are structured to foster a disciplined trading approach, with strict risk management protocols including a maximum daily drawdown of 5% and a total drawdown limit of 10%.

Moreover, the spreads start from 0 pips, which is particularly advantageous for high-frequency traders who benefit from low-cost transactions. The initial fee is refundable with the first withdrawal, aligning with the firm’s commitment to serious and calculated trading ventures. Through these measures, IC Funded solidifies its position as a robust platform for funded trading.

MetaTrader4 (MT4), MetaTrader5 (MT5), and cTrader are three of the most popular trading platforms in the forex and CFD trading markets. Each platform offers distinct features catering to different types of traders, from beginners to advanced and algorithmic traders. Here’s a detailed comparison of their key functionalities:

MetaTrader4 (MT4)

MT4 is renowned for its simplicity and efficiency, providing a robust set of trading tools that include multiple order types, one-click trading, and a comprehensive set of analysis tools. It supports automated trading through Expert Advisors (EAs).

The platform features an intuitive and user-friendly interface, making it particularly appealing to beginners. Its simplicity does not compromise on functionality, allowing traders to execute trades and manage accounts effortlessly. MT4 offers advanced charting tools with numerous built-in technical indicators and charting objects. Traders can customize charts extensively, which aids in technical analysis.

MT4’s popularity is bolstered by its community support and a vast marketplace for trading robots and indicators. It allows for hedging, which is a crucial feature for many traders.

MetaTrader5 (MT5)

MT5 builds on the foundations of MT4, offering more order types and a depth of market feature. It supports more asset classes beyond forex and CFDs, including stocks and futures. While maintaining a level of simplicity, MT5’s interface is more advanced and modernized compared to MT4. It also features an economic calendar integrated into the platform for real-time news and event updates.

With more timeframes and technical indicators than MT4, MT5 provides enhanced charting tools. It supports more graphical objects and has a more powerful strategy tester for EAs. MT5 offers a multi-threaded strategy tester and an embedded chat system for traders to share insights. It also supports netting and hedging accounts, although some brokers may disable hedging.

cTrader

cTrader stands out with its advanced trading tools, including a user-friendly interface with Level II pricing and fast order execution. It is particularly favored for its superior algorithmic trading capabilities through cAlgo. cTrader is known for its sleek, modern interface that is highly customizable. It provides an intuitive environment that enhances the trading experience for both new and experienced traders.

It offers extensive charting features with numerous timeframes and indicators. cTrader’s charts can be detached and viewed on multiple screens, which is highly beneficial for professional traders. One of cTrader’s standout features is its transparency in trading, offering detailed trade and account history reports. It also supports cloud-based storage for trading preferences and settings, allowing traders to access their accounts from any device.

IC Funded Prop Challenges

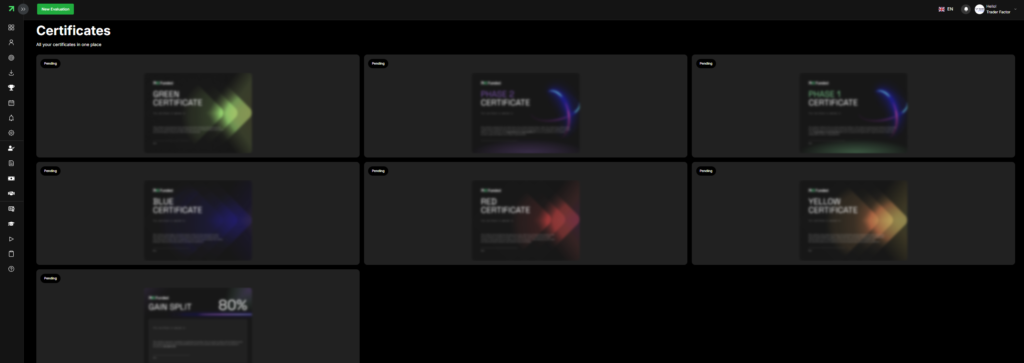

IC Funded offers traders a structured opportunity to access significant capital through its distinctive prop challenges. Designed to test and hone trading skills, these challenges provide a thorough evaluation process that allows traders to demonstrate their capabilities without putting their own funds at risk.

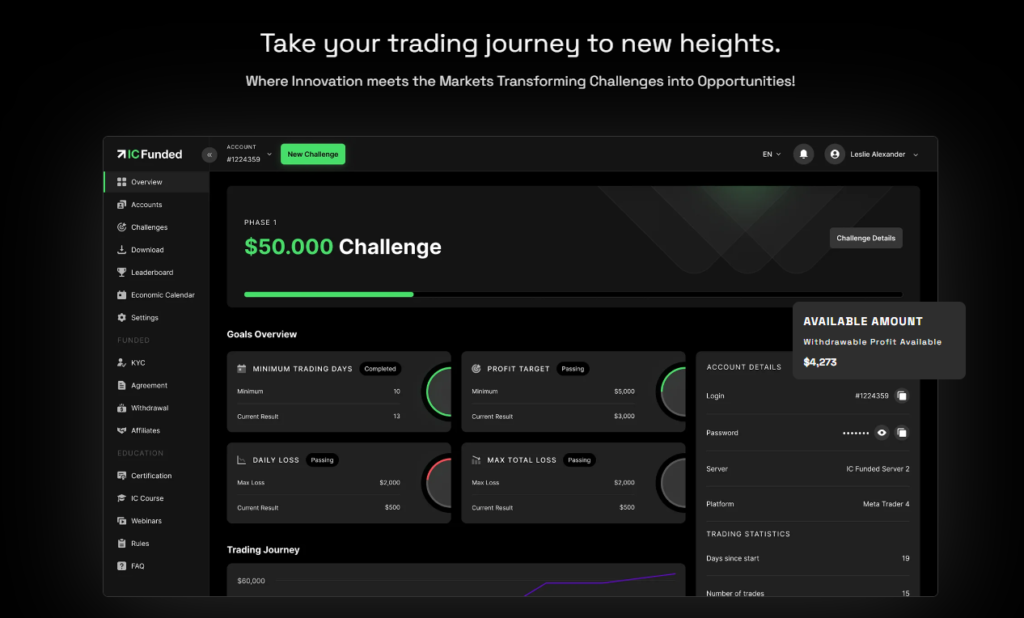

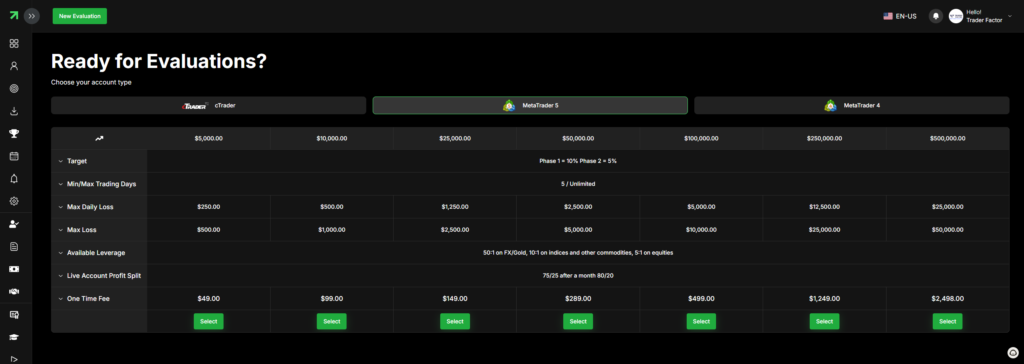

Evaluation Levels and Account Sizes

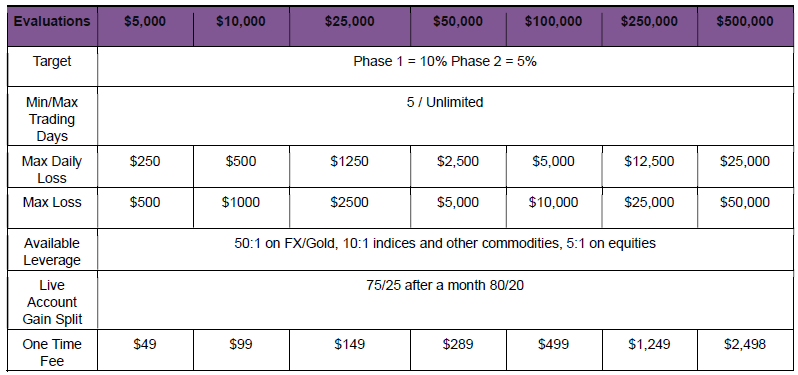

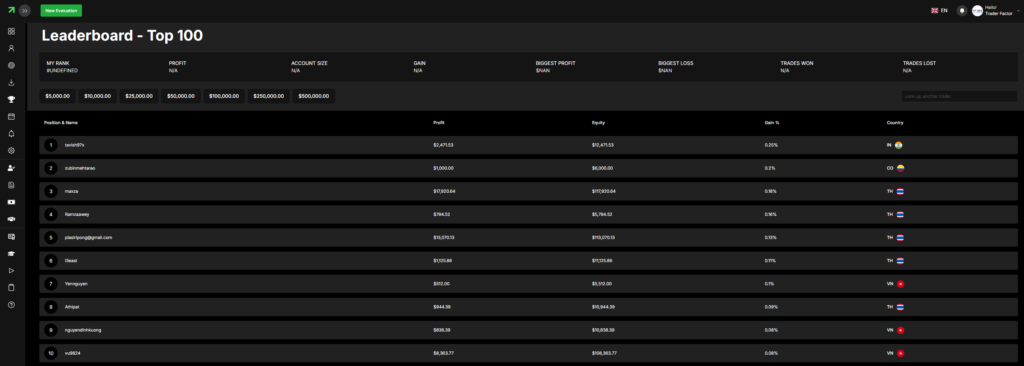

Traders can choose from seven distinct evaluation levels, with account sizes ranging from $5,000 to $500,000. These levels cater to different trading profiles and ambitions, with entry fees starting at just $49. This initial fee grants access to demo accounts, enabling traders to showcase their skills in a risk-free environment.

Two-Phase Challenge Process

To secure a funded account, traders must navigate through two phases: Evaluation and Verification.

Evaluation Stage

In this phase, traders aim to achieve a 10% profit target while adhering to stringent risk management rules. These rules include a maximum daily loss limit and a cap on overall allowable drawdown, both crucial for maintaining disciplined trading. Traders have the flexibility to reach their targets at their own pace, as long as they maintain consistency and avoid breaching the loss limits.

Verification Stage

Following successful completion of Phase 1, traders proceed to the Verification phase. Here, the profit target is reduced to 5%, but consistent performance remains essential. The same risk management rules apply, ensuring traders continue to exercise disciplined trading habits. The phase also requires traders to maintain consistent trading behavior, including position sizes and strategies.

Challenge Rules and Policies

IC Funded enforces several rules to maintain the integrity of the challenge:

- Accounts inactive for 30 consecutive days are subject to closure, ensuring active participation.

- KYC verification is needed to allow traders access to specific features and benefits, such as withdrawals and account upgrades.

- The initial challenge fee is refundable upon achieving the first profit share payout, minimizing risk for successful traders.

Funded Accounts and Profit Sharing

Upon completing both phases, traders are awarded a live funded account, allowing them to trade with real capital. The profit-sharing model is highly competitive, beginning with a 75/25 split in favor of the trader. This split can increase to 80/20 with sustained success, providing additional financial incentives for continued performance.

IC Funded’s prop challenges are a rigorous yet rewarding path for traders seeking to leverage their abilities with substantial trading capital. The comprehensive evaluation process, combined with favorable profit-sharing and low entry fees, makes IC Funded a compelling choice for disciplined traders aiming to advance their trading careers.

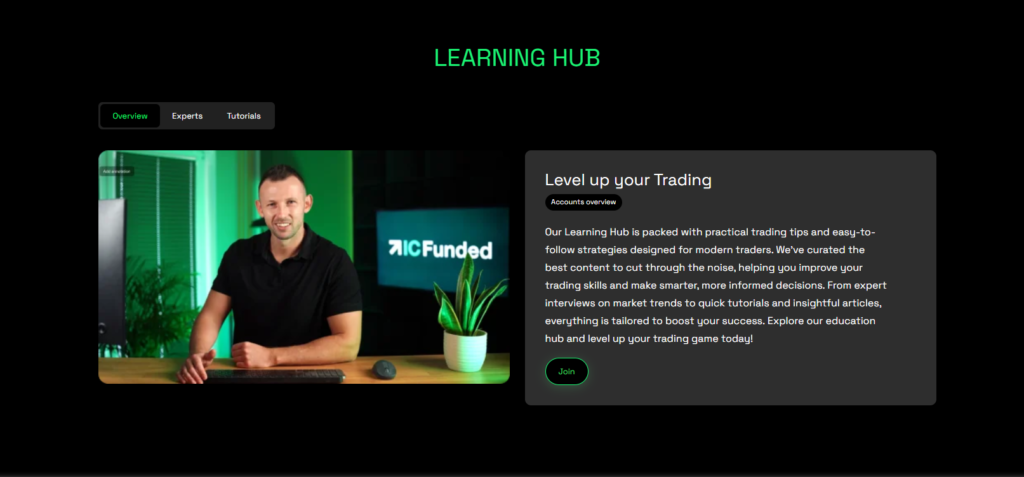

IC Funded Educational Resources

At IC Funded, educational resources play an important role in equipping traders with the skills necessary for success. The company’s commitment to education is evident in its extensive suite of materials which cater to both novice and advanced traders. These resources include detailed webinars, interactive tutorials, and insightful podcasts, all designed to enhance understanding and proficiency in trading.

Structured learning paths guide traders through the complexities of market dynamics, guaranteeing a solid foundation in both theory and application. This step-by-step approach helps demystify the often volatile trading landscape, making it more accessible and manageable. By focusing on trading psychology, IC Funded empowers its traders to maintain discipline and manage emotions, which are vital aspects of sustainable trading strategies.

Moreover, the firm provides in-depth articles and videos on advanced strategies that explore sophisticated trading techniques and tools. These resources are essential for traders looking to leverage their skills in more competitive environments. By continuously updating and expanding its educational content, IC Funded ensures that its traders are well-prepared to recognize and capitalize on market opportunities efficiently and effectively.

IC Funded Client Satisfaction

As one of the proprietary trading firms offering a funded forex account, IC Funded has sparked varied feedback from its clientele. The firm’s funded account challenge, designed to test traders’ skills before providing substantial capital, is a critical factor in this assessment. Traders appreciate the opportunity but sometimes find the challenge overwhelming.

Feedback suggests that while IC Funded ranks among the best prop firms for offering scalable funding and flexibility in trading strategies, some clients feel improvements could be made in support and guidance during the evaluation phases. Positive reviews often highlight the firm’s educational resources, which help traders navigate the intricacies of forex trading.

IC Funded Withdrawal and Security

While client satisfaction is reflective of experiences during the evaluation and trading phases, the process of withdrawing profits and the security measures in place are equally significant for traders at IC Funded. IC Funded guarantees that prop traders who succeed in their forex funded accounts can withdraw their earnings efficiently. The firm’s robust security protocols guard these transactions, reassuring traders that their finances are secure.

When a trader meets the target profits in the best funded trader program, they can submit a withdrawal request through various methods, including bank transfers and online payment systems. The procedure is streamlined to ensure quick processing, allowing traders to enjoy the fruits of their property trading labor without unnecessary delays.

Moreover, IC Funded prioritizes security to protect both the operational aspects of trading and the withdrawal process. The firm employs advanced encryption and continuously updates its security measures to address potential vulnerabilities. This proactive approach guarantees that traders’ details and funds remain protected against unauthorized access, making IC Funded a reliable choice for those looking to get funded and thrive in the competitive world of forex trading.

IC Funded Regulation and Fees

Though not directly overseen by bodies like the SEC or FCA, it maintains a semblance of reliability through its affiliation with Finocom Services Ltd in Hong Kong. This setup could leave traders questioning the robustness of the regulatory frameworks in place.

The firm’s fee structure is tiered, directly correlating with the amount of funding a trader wishes to manage. Initial fees range from $49 for smaller accounts to $2,498 for the upper tiers, targeting serious traders. The initial fee is refundable with the first withdrawal, committing traders to the platform once payment is made. This could be a deterrent for those testing the waters or uncertain about their long-term commitment to trading at such scales.

Moreover, the firm offers a competitive split of trading profits, starting at 75% for the trader which can increase to 80% upon successful completion of specific challenges.

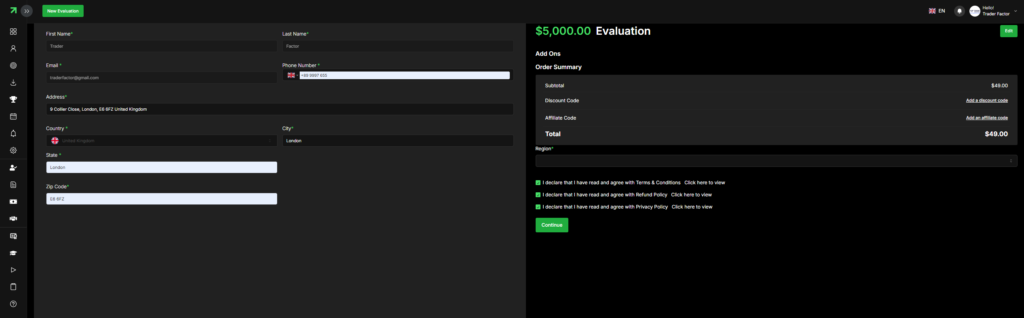

Signing up For IC Funded Account

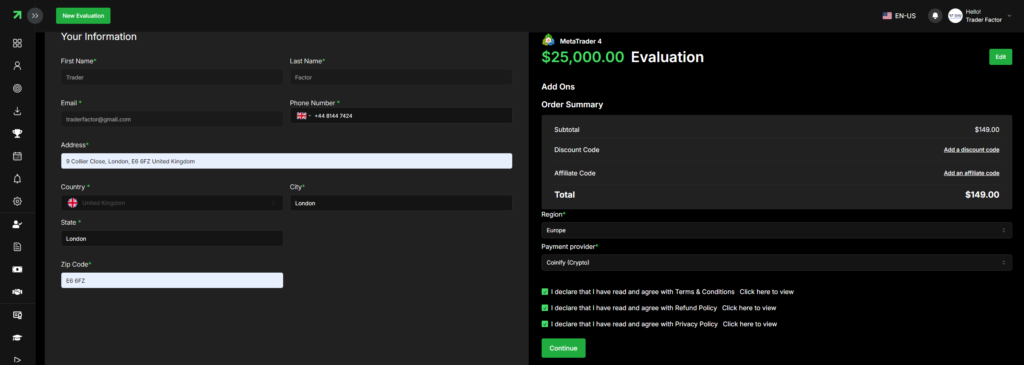

- Visit the IC Funded website to access all necessary resources for starting your funded trading journey.

- Proceed to the sign-up or registration section to initiate the process of becoming a funded trader.

- Review the diverse evaluation plans available, designed to meet various trading needs, with account sizes ranging from $5,000 to $500,000 and fees from $49 to $2,498.

- Select the evaluation plan that best aligns with your trading objectives.

- Create an account by entering your personal information, such as your name and email, and choose your preferred trading platform: MT4, MT5, or cTrader.

- Complete the payment for your chosen evaluation plan to gain access to the simulated trading environment.

- Begin the evaluation process, targeting profit goals of 10% for Phase 1 and 5% for Phase 2, while adhering to established risk management guidelines.

- Successfully complete both phases of the evaluation to qualify for a funded account, receiving trading capital based on your selected account size.

- Start trading with your live funded account, benefiting from profit splits beginning at 75%, potentially increasing to 80% after the first month of successful trading.

- Request withdrawals as you generate profits, utilizing IC Funded payout schedule, and continuously enhance your trading capabilities with your funded account.

- Join the IC Funded community and leverage the advantages of your trading success.

IC Funded Support

Supporting their traders with robust communication channels, IC Funded guarantees that participants have access to necessary aid around the clock. They’ve established a thorough support system that’s not only responsive but also well-equipped to handle queries and issues effectively. This approach ensures that all traders, regardless of their time zone or the complexity of their needs, can trade with confidence, knowing support is just a message away.

Key aspects of IC Funded’s support strategy include:

- 24/5 Availability: Traders can reach out via live chat or email throughout the trading week, ensuring they’re never left without assistance during essential trading hours.

- Multilingual Support: Catering to a global clientele, assistance is offered in multiple languages, which enhances understanding and reduces language barriers.

- Educational Resources: Beyond direct communication, IC Funded provides a wealth of learning tools ranging from webinars to detailed trading guides, helping traders to continually enhance their skills.

- Active Social Media Presence: Regular updates and direct engagement on platforms like Twitter and Facebook keep traders informed and provide an additional layer of support.

This multifaceted approach not only resolves immediate issues but also builds a supportive trading community.

Pros and Cons of IC Funded

Pros of IC Funded

- Traders can progress through the evaluation stages at their own pace, as there are no time restrictions imposed. This flexibility allows for a more tailored approach to meeting the challenge requirements.

- The profit-sharing model is competitive, starting at 75% for the trader and can potentially increase to 80%. This incentivizes traders to maintain high performance and offers a rewarding financial structure.

- Access to a diverse array of trading instruments on popular platforms such as MetaTrader 4 and 5 enhances the overall trading experience, providing traders with the tools needed for effective strategy implementation.

Cons of IC Funded

- With initial fees that can reach up to $2,498 depending on the funding tier, the upfront cost is significant. This may be a deterrent for traders who are cautious about high initial expenditures.

- The restricted variety of available assets might not meet the needs of traders looking for a broader range of trading opportunities, potentially limiting their market engagement.

Partnership Programs

Through strategic partnerships, IC Funded enhances its offerings by collaborating with various educational and technological institutions. These partnerships are crucial in providing traders with the necessary tools and knowledge to succeed in the highly competitive trading environment.

Educational Collaborations

IC Funded teams up with renowned educational platforms to offer structured learning paths and specialized trading courses. These are designed to cater to both novice and experienced traders, ensuring a thorough understanding of market dynamics and trading strategies.

Technology Affiliations

By collaborating with leading technology providers, IC Funded integrates advanced trading tools and analytics into its platforms. This allows traders to execute trades more efficiently and gain insights through sophisticated analysis techniques.

Broker Connections

The firm maintains strong relationships with reputable brokers, ensuring that traders have access to excellent trading conditions and reliable execution speeds.

Community Development Initiatives

Through forums and webinars, IC Funded fosters a sense of community among its traders, encouraging knowledge sharing and support among peers.

These partnerships not only enhance the firm’s service offerings but also demonstrate IC Funded’s commitment to fostering a supportive and resource-rich environment for its traders.

Frequently Asked Questions

How Often Can Traders Update or Change Their Leverage Settings?

Traders can adjust their leverage settings at any time, providing flexibility to adapt to changing market conditions or personal trading strategies. This feature supports dynamic risk management and strategic trading approaches.

Are There Specific Trading Times When Spreads Might Be Wider?

Spreads often widen during major economic announcements or when the market opens after the weekend. This is due to decreased liquidity and increased volatility during these specific trading times.

What Are the Consequences of Hitting the Maximum Drawdown?

Hitting the maximum drawdown results in the trader’s account being closed. They’ll lose their current position and must restart the evaluation process if they wish to continue trading with the firm.

Can Traders From Any Country Participate in the IC Funded Programs?

Traders worldwide can participate in these programs, but they should verify if their country’s regulations allow engagement with international trading platforms to guarantee compliance and avoid legal issues. Please be aware that IC Funded doesn’t offer the program to certain countries.

Does IC Funded Provide Any Mobile Trading Applications?

IC Funded does not offer proprietary mobile trading applications but supports MetaTrader 4 and MetaTrader 5, which are accessible on mobile devices, allowing traders to manage and execute trades from anywhere.

Conclusion

IC Funded Prop Firm presents a robust opportunity for forex traders seeking to grow their trading capacity through scalable evaluation plans and access to popular trading platforms like MetaTrader 4 and 5. With an attractive profit-sharing model and comprehensive educational resources, the firm supports both novice and seasoned traders. IC Funded structured approach and focus on risk management make it a compelling choice for disciplined traders aiming to enhance their market presence.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.