Why Low Spreads are Key to Smart Trading in 2026 With TMGM Forex Broker

Forex traders consistently seek ways to optimize their strategies and reduce trading costs. Understanding the impact of spreads is fundamental to this process. The spread,

Forex traders consistently seek ways to optimize their strategies and reduce trading costs. Understanding the impact of spreads is fundamental to this process. The spread,

By Zahari Rangelov, Head of Business Development at TraderFactor In the world of Forex, trust is the currency we trade in. As the Head of

Are you tired of losing money to fees before you even make a trade? Every forex trader knows that trading costs matter. When you buy

Acuity Trading Limited leverages advanced AI to provide deep insights into financial markets, helping users gain a competitive edge with real-time data and actionable intelligence.

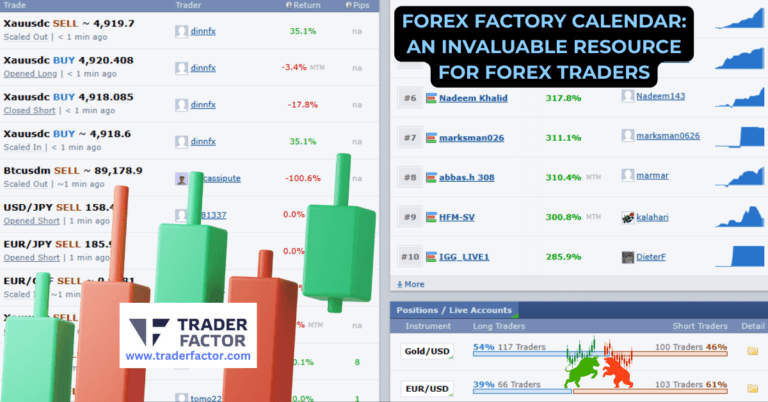

Forex traders are constantly seeking reliable tools to enhance their strategies and gain a competitive edge. The Forex Factory Calendar emerges as an invaluable resource,

Trading Central was founded in 1999 in Paris, France, by former financial services professionals, aimed to address the demand for reliable investment research. The company

TradingView is a leading cloud-based charting software and social networking software that allows both novice and experienced traders to make more informed trading decisions. It

Leverage is one of the most powerful tools in a forex trader’s arsenal. It allows you to control a large position with a relatively small

Stepping into the world of currency exchange can feel overwhelming. Choosing a partner like the Naga Forex Broker makes things easier for beginners. Naga Forex

The forex market in 2026 is faster, more competitive, and more technologically advanced than ever before. For a trader, your broker isn’t just a service

Best Currency Pairs for Forex Trading in 2026 is the crucial topic we need to explore for your upcoming strategy. You need to know which

As a professional trader with over two decades in the markets, I am here to share my insights on finding the best high leverage in

Exploring the world of penny stocks under $1 or under $5 can be a compelling venture for traders looking to capitalize on high-risk, high-reward opportunities.

DOHA, QATAR, Dec 2, 2025 TraderFactor is excited to announce its significant participation in the upcoming Money Expo Qatar, a premier event for the financial

[London, UK] – Nov 27, 2025 TraderFactor continues to solidify its reputation as the ultimate online destination for traders seeking insightful forex analyses and comprehensive

The Three Black Crows candlestick pattern is a powerful bearish reversal indicator that every trader should learn to identify and interpret. This pattern appears at

Forex trading, or foreign exchange trading activity, is the buying and selling of currencies to make a profit. It is the largest financial market in the world and operates 24 hours a day, 5 days a week.

Forex traders make money by buying a currency pair at a lower current market price and selling it at a much higher price than current market price, with their income being the difference between the buy stock’s price and current price and sell the stock’s current price and current market price, only.

The broker also gets a small commission from your trades called Spread. Forex trading can be done through a broker in an over-the-counter (OTC) market.

When starting forex trading, the first step is to find a reputable forex broker. You need to research and compare different brokers to find the one that best suits your needs. Consider factors such as regulation, security, transaction costs, customer support, and trading platforms. Some brokers offer demo accounts which are useful for beginners to practice trading without risking real money.

Once you have selected a broker, you need to open an account and deposit funds. Most brokers offer various accounts, limit orders and, sell limit and common sell limit order and types and common call buy limit order and types, and common call limit orders and order types, and the minimum deposit requirements for these limit orders and order and types may vary. It is important to fully understand the fees and charges associated with your chosen account and your limit orders and order and orders and order type, such as spreads, commissions, and overnight financing fees.

Before you start trading, it is essential to understand the basics of forex trading. This includes understanding currency pairs and how they are quoted, leverage and margin requirements, and risk management strategies. Some brokers provide educational resources such as webinars, eBooks, and video tutorials that can help you learn about forex trading.

It is also recommended to develop and execute a trading plan and strategy before starting to execute a trade. This trade, should include entry, specified price, point specific price stop order and buy order, exit, specified price, points specific price, buy stop order and, and sell stop price, with buy stop order and sell order,,,, market orders, risk management guidelines, and a clear understanding of your goals and objectives.

The six currency pairs are considered the major currency pairs in forex trading as they have the highest trading volume and liquidity in various ways in the market.

The EUR/USD pair is the most actively traded currency pair and often has the tightest spreads, making it a popular choice for traders. The USD/JPY pair of stocks is also widely traded, especially during the Asian trading day and period of time between trading day and session. The GBP/USD pair is popular among traders due to its volatility and potential for large price movements.

The USD/CHF pair is often used as a safe haven currency during periods of market uncertainty. The AUD/USD pair is popular among traders due to the high interest rates in Australia, while stock price of stocks in the USD/CAD pair stock prices of stocks is influenced by oil prices due to Canada’s significant oil exports.

Leverage is a powerful tool in forex trading that allows traders to control larger positions with a smaller amount of capital. It is usually expressed as a ratio of assets, such as 50:1 or for example 100:1. This means that for every dollar you have in your account, you can control $50 or $100 in the market.

For example, if you have $1,000 in your account and use 100:1 leverage, you can open a position worth $100,000. This can potentially lead a trader to higher profits, as even small stock price movements can result in a trader with significant gains. However, it also means that losses can be amplified, and traders can expect to lose more than their initial investment.

It is important to use leverage to execute a trade wisely and to understand the risks involved. Traders should always use stop-loss orders to limit potential losses and investors should not over leverage their accounts.

Brokers often have different margin trading requirements and leverage trade limits, for example, so it is important to understand the terms and conditions of a trade with your broker before using leverage in your trades.

Forex trading involves several risks, and traders should be aware of these before starting to trade. Some of the risks associated with forex trading include:

To mitigate and limit these risks, traders should have a solid understanding of the forex market, use risk management strategies such as stop-loss orders, and choose a reputable broker with proper regulation and security measures.

Forex trading is regulated by various regulatory bodies, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Brexit can impact forex trading by causing volatility in the British pound and euro currency pairs. The uncertainty around Brexit negotiations and its potential impact on the UK economy can cause fluctuations in currency exchange rates.

The tax implications for forex trading vary depending on your country of residence and the regulations in place. It is important to consult with a tax professional to understand the tax implications of forex trading in your jurisdiction.

Trading a forex trading strategy requires careful consideration of several factors. Here are some steps you can take to develop a successful forex trading strategy:

Popular technical analysis tools used in forex trading services include moving averages, Bollinger Bands, Relative Strength Index (RSI), and Fibonacci retracements.

Fundamental analysis involves analyzing economic and political factors that can affect currency values. It helps traders understand the long-term trends and potential risks in the forex market.

Risk is crucial in forex trading, and there are several strategies that traders can use using market order or limit order to buy stop order against price or orders to sell limit order against to limit price and minimize potential losses. Here are some ways to both using market order to buy limit order against and sell stop order against price to manage risk in forex trading:

You can stay updated with economic news and indicators by following financial news outlets, subscribing to relevant newsletters and email alerts, and using TraderFactor economic calendars provided by brokers and financial websites.

To choose a reliable forex broker, you should consider factors such as regulation, security, transaction costs, customer support, and trading platforms. It is important to thoroughly research potential brokers and compare their offerings before making a decision.

There are many educational resources available for learning forex trading, including online courses, webinars, eBooks, and trading forums. It is important to choose reputable sources and to continue learning and practicing to improve your skills.

You can analyze the impact of central bank policies on currency movements by following central bank announcements and speeches, monitoring interest rates and inflation data, and understanding the relationship between monetary policy and currency values.