NFP Forecast Amid Geopolitical Shocks and the Fed’s Dilemma

Read the March 2026 NFP forecast. Discover how a 58k job estimate, rising oil prices, and geopolitics impact the Fed, DXY, gold, crypto, and stock

Table of Contents

Toggle

Read the March 2026 NFP forecast. Discover how a 58k job estimate, rising oil prices, and geopolitics impact the Fed, DXY, gold, crypto, and stock

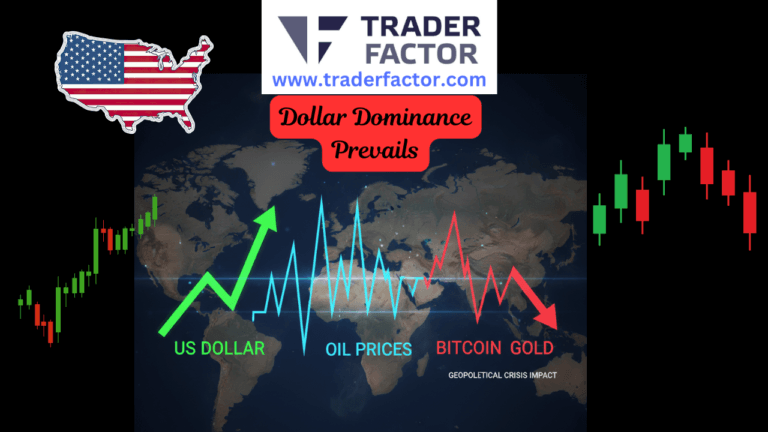

Geopolitical crisis sparks forex volatility. See how the U.S.-Iran conflict impacts safe havens like Gold and the USD. Market analysis & live data. Forex Market

The recent escalation of conflict in the Middle East over the past weekend has sent significant shockwaves through global financial markets. Geopolitical turmoil of this

Choosing the right forex broker and/ begin forex trading platform and service is crucial for traders looking to engage in the foreign exchange market. The forex market operates 24/5, and having access to a reliable and efficient trading platform and service can significantly impact a forex trader’s success. Here are some key reasons why selecting the right forex broker and trading service is important:

Every trader has unique trading needs and goals. It is essential to evaluate factors such as trading style, preferred currency pairs, trading strategies, risk tolerance, and desired level of involvement. A suitable trading service should align with these individual requirements.

Forex brokers provide a range of services to facilitate trading activities. Some common services in best forex broker industry include:

Selecting the right forex market, broker and trading service is crucial for traders to achieve their goals and maximize their trading potential. By assessing individual needs and aligning them with the services offered by the best in forex markets, brokers and trading volume, traders can enhance their trading experience, make informed decisions, and effectively manage risk.

Factors to consider include regulatory compliance, security measures, range of tradable, foreign exchange, currencies and instruments, trading costs and fees of the best forex brokers around, trade execution quality, risk management features, customer support, educational resources, market analysis tools, direct market access, reputation, and transparency.

You can evaluate the whole trade forex broker industry and choose a top trade forex broker for services by assessing their regulatory compliance, security measures, trading platforms, range of tradable forex pairs and instruments, pricing and fees, trade execution quality, risk management features, customer support, educational resources, market analysis tools, and additional services offered by regulated trade forex broker.

Yes, most brokers and reputable forex brokers must comply with regulatory standards set by financial authorities, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

Forex brokers employ various security measures, including encryption technology, secure socket layer (SSL) protocols, segregated client funds and accounts, and strict data protection policies, to ensure the security of their electronic communications network, foreign exchange network client funds, brokerage accounts, copy trading, and personal information.

Forex brokers offer various trading tools and platforms, including popular options like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as proprietary platforms developed by the forex broker or start trading and choose a forex broker or platform itself. These platforms provide access to real-time market data, charting advanced trading tools, order execution capabilities, and more.

Forex brokers typically offer a wide range of tradable instruments, including major currency pairs, forex and currency pair,, minor currency forex pair, selling currency pairs,, exotic currency pairs, commodities, indices, and cryptocurrencies.

Forex brokers may charge spreads, commissions, overnight fees, or other fees. It is important to evaluate the pricing structure of a top online forex broker, and consider how it aligns with your trading strategy and budget.

Trade execution quality can vary among online brokers, in terms of speed, accuracy, and slippage rates. It is recommended to choose a trustworthy online broker, with reliable trade execution to ensure efficient order placement start trading, and execution copy trading throughout.

Yes, many brokers and reputable forex brokers provide risk management features to professional traders such as stop-loss orders, take-profit orders, and guaranteed stop-loss orders. These features help forex traders manage their risk exposure and protect their capital.

Forex brokers typically offer customer support from regulated brokers through various channels, including phone, email, live chat, and frequently asked questions (FAQs). Prompt and knowledgeable customer support from the best forex broker or brokers whose forex broker is regulated by brokers is essential for addressing inquiries and resolving issues.

Forex brokers often offer educational resources such as trading guides, tutorials, webinars, articles, and even currency market analysis reports. These resources can help traders enhance their knowledge and improve their trading skills.

Market analysis plays a crucial role in forex trading as it helps traders identify potential trading opportunities, analyze market trends, and make informed decisions. Forex brokers may provide market analysis tools and research reports to assist traders in their analysis.

Assessing the reputation of top forex brokers often involves conducting thorough research, reading user reviews, considering forex industry top awards and recognition as trustworthy brokers, and evaluating the forex broker selection itself’s track record and longevity in the many forex brokers that trade foreign currencies in the market.

There are different account types offered by many forex brokers, and these include demo accounts that are interactive brokers that allow traders to test their platforms and services without risking real money. Demo accounts provide an opportunity for retail traders to practice trading strategies and evaluate them to choose a beginner forex trader or choose a top forex trader or broker that is regulated by its offerings.

Yes, most forex brokers offer mobile trading applications that allow forex traders to access their forex accounts anywhere, monitor the forex market, execute forex trades anywhere, and forex trade and manage trading forex positions from their smartphones or tablets.

Some forex brokers and financial institutions offer additional services in forex markets like social trading platforms, copy trading services, interactive brokers, managed accounts, economic calendars, and analysis tools for experienced traders to trade forex. These services can provide added value to traders seeking a comprehensive trading experience in forex markets.

When selecting a forex broker or trading account, it is important to conduct due diligence on regulated broker by researching their regulatory compliance, reputation, security measures, trading conditions, evaluating customer satisfaction of trading forex with regulated brokers, fair trading conditions, and any complaints or disciplinary actions against the or start trading before choosing a forex broker or trading account.

When you choose a forex broker when selecting the best forex broker, it’s important to consider several factors to ensure you make the right choice. Some key factors to evaluate best when choosing to choose a best forex broker is, include:

Evaluating the trading conditions of your very best forex broker, trader, commodity futures trading commission and top three forex brokers is crucial to ensure a smooth, trading, trading forex and trader experience. Here are some aspects to consider:

Remember to conduct thorough due diligence and compare different brokers and trading instruments based on your specific trading needs and preferences.