MFGtrading Automated Forex Trading Systems is a company that offers automated trading systems for the forex market. Automated trading systems are computer programs that automatically execute trades on behalf of the user based on pre-defined rules and algorithms.

About

MFGtrading is one of the most innovative fintech companies in the field of financial markets and investments. The company’s team has many years of professional experience in the field of trading with the full spectrum of financial instruments, risk management and information technology.

It has created reliable systems for automatic trading in the financial markets, which are available to clients as automated bots for trading accounts services.

The company is NOT a CFD broker and does not accept client deposits. It refers clients to the best forex broker partner where they open their own accounts in their name and deposit their funds into them.

Features

Automated Trading Systems

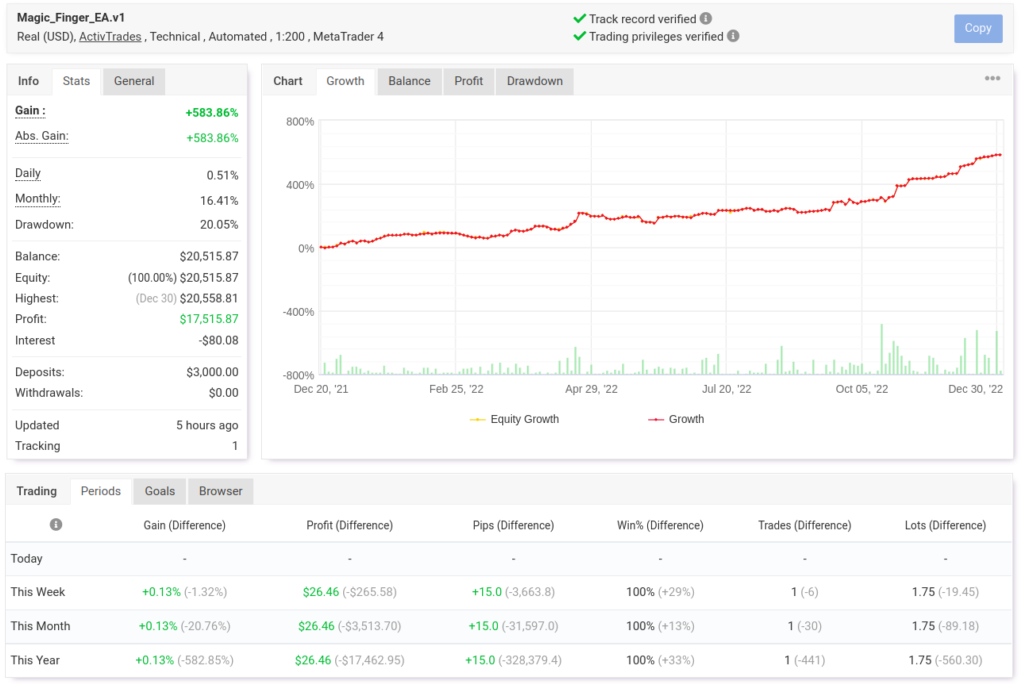

It’s one of the best algorithmic trading systems or Automated Trading Systems (ATS) developed by professional fx traders to ensure the best trading results and eliminate the risk of human error.

Professional Risk Management And Monitoring

Professional risk managers monitor/adjust the automated forex software systems to run smoothly and efficiently to ensure optimal performance.

Segregated Client Accounts

Your funds are deposited into your own account with some of our partner brokers or investment banks so that you have constant access to monitor activity and receive daily statements.

Products and Services

Individuals Automated Bot for Trading Accounts

This product offers a solution for providing anticipatory growth through advanced trading technologies.it is suitable for individual traders without enough experience, time and focus to trade the financial markets efficiently and secure a return.

Institutions Automated Bot for Trading Accounts

This innovative fintech product is specially designed for institutional investors/companies looking to further diversify their asset portfolios and provide a very good annual return on their investment.

Training, Consultancy, Risk Management & Proprietary Trading

They offer professional trader training for individual or institutional/corporate clients. Has extensive experience in financial markets to offer trading solutions and risk management strategies.

Membership Terms and Fees

Its hard to find efficient free forex auto trading robot software. Below are the fees and terms for using the MFGtrading automated trading systems for individual traders and for institutional/company trading accounts through Bot. The rates are competitive among the other top forex automated trading systems in the market.

- For individual traders:

| €750 * | €1500 * | €3000 * |

| Yearly Membership | Yearly Membership | Yearly Membership |

| Minimum Required Deposit In Some Of Our Partner Brokers: €3,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €10,000 Inclusive | Minimum Required Deposit In Some Of Our Partner Brokers: €10,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €20,000 Inclusive | Minimum Required Deposit In Some Of Our Partner Brokers: €20,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €40,000 Inclusive |

| * Price is VAT excl. | * Price is VAT excl. | * Price is VAT excl. |

2. For institutional/company trading accounts:

| €3000 * | €6000 * | €12 000 * |

| Yearly Membership | Yearly Membership | Yearly Membership |

| Minimum Required Deposit In Some Of Our Partner Brokers: €10,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €50,000 Inclusive | Minimum Required Deposit In Some Of Our Partner Brokers: €50,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €100,000 Inclusive | Minimum Required Deposit In Some Of Our Partner Brokers: €100,000 Maximum Deposit In Some Of Our Partner Brokers: Up To €200,000 Inclusive |

| * Price is VAT excl. | * Price is VAT excl. | * Price is VAT excl. |

- They can analyze large amounts of data and execute trades faster than a human trader could.

- Reduced emotion-based trading.

- 24-hour trading.

- Backtested and optimized to improve performance.

Cons

- No guarantee of profitability

- Probability of technical failures or glitches

What Automated Forex Trading is?

Automated Forex trading is an online and best trading platform that uses automated forex trading algorithms and programmable software to open and close trades in the currency markets. It can be used as a tool to help automate the buying and selling of currencies, using preset rules based on market conditions.

Is Automated Forex Trading profitable?

Fully automated Forex robot trading has the potential to be highly profitable, provided that the trader knows how to use the system and makes good decisions when setting up their trades. Forex robot trade also eliminates emotional influences on decision-making and reduces execution time, allowing for more accurate and timely trades.

How does Automated Forex Trading work?

Automated Forex trading works by using programmable software that scans the markets for favorable exchange rates and then executes trades on behalf of the trader. Many automated forex trading platforms also use technical analysis methods such as trend lines, support and resistance levels to improve their accuracy further.

How do I choose the best-automated forex trading system for me?

Choosing the best automated Forex trading platform for yourself requires doing your research and comparing different options. Selecting a system that suits your currency trading style and offers good customer support and technical analysis tools is important.

Are there any risks associated with using an automated forex trading system?

Yes, there are risks with any automated forex trading program because the system uses already keyed-in data. These include operational risks, such as latency issues and execution errors, as well as market risks, such as changes in the currency rate due to sudden news events or lack of liquidity in certain markets.

Summary

Automated Forex Trading Systems, such as the MFGtrading system, have become increasingly popular among forex traders in recent years. These systems use algorithms and computer programs to streamline trading and remove emotion from decision-making. This can save time and potentially increase profits. While automated fx trading systems can be useful, they also come with risks. Forex robot trading systems can suffer from technical glitches, errors in the underlying algorithms, or unexpected market events that may cause the system to perform poorly or even incur losses.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts