If you’re looking for a reliable prop trading firm, Bullwaves Prime Prop Firm might catch your attention. This comprehensive Bullwaves Prime review covers everything you need. We’ll examine their prop trading challenges and conditions. You’ll discover their account sizes and trading rules. Their payment processes and customer support get detailed coverage. We analyze their platforms and educational resources too. Trading fees and commissions are also reviewed thoroughly. This objective analysis helps you make informed decisions. You’ll understand if Bullwaves Prime suits your trading goals. Let’s dive into this detailed prop firm evaluation.

Bullwaves Prime Prop Firm Review: Complete Trading Guide 2025

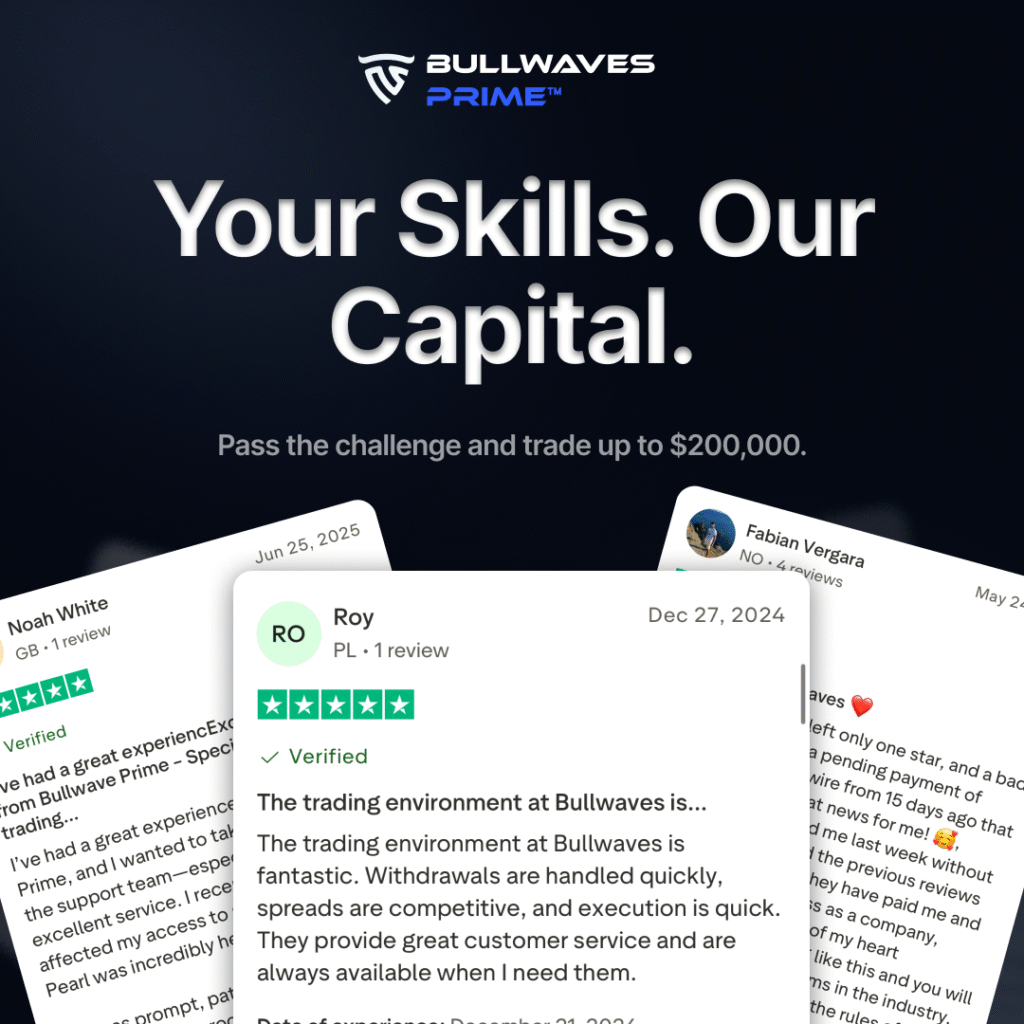

Bullwaves Prime Prop Firm is a proprietary trading company that provides access to trading capital for individuals worldwide. Traders use the firm’s funds instead of their own, operating under a set of defined rules and guidelines. To receive funding, traders must first complete an evaluation process, referred to as a challenge, which is designed to assess trading skills and consistency.

Bullwaves Prime offers various account sizes and challenges, accommodating different trader experience levels. The firm features structured scaling programs, which allow for account growth based on consistent performance. Clear trading rules and risk parameters are provided, and participation is open to eligible traders seeking this style of opportunity.

Table of Contents

ToggleBullwaves Prime Prop Firm Challenges

To begin, Bullwaves Prime provides two main challenge types. Next, you decide which structure fits your needs since each challenge comes with clear requirements and rules. As a result, you can make informed choices.

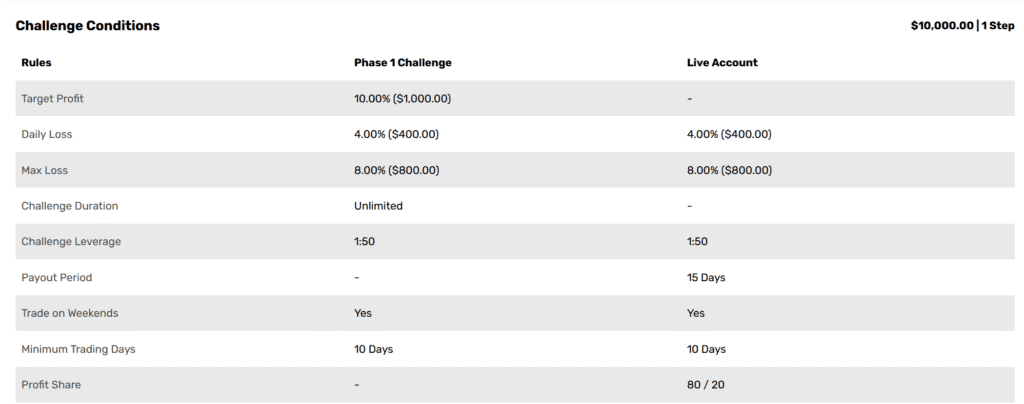

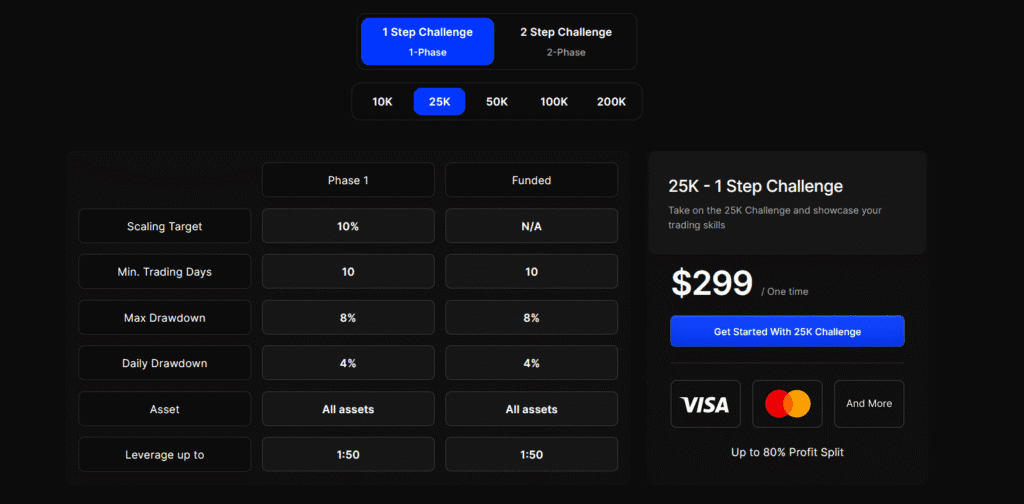

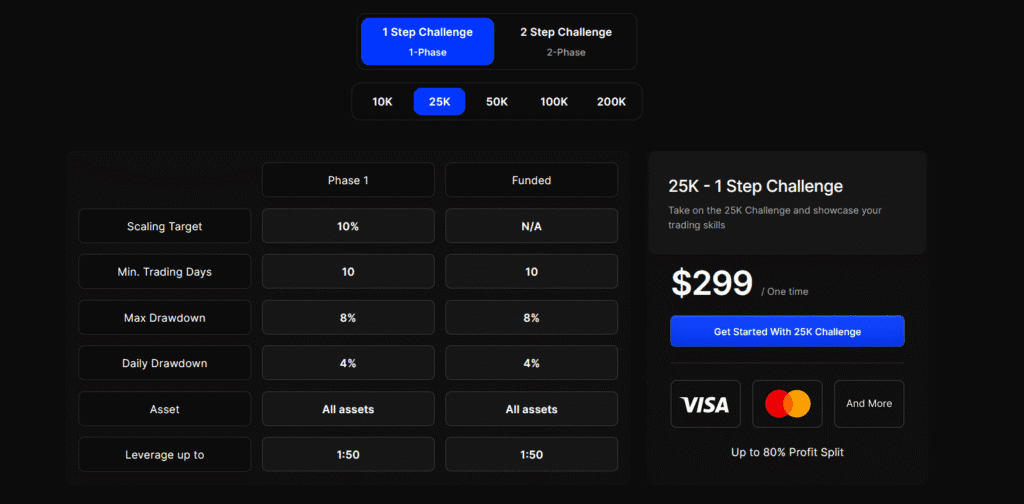

1-Phase Challenge Structure

Firstly, consider the 1-phase challenge format. Here, you complete a single evaluation phase. Therefore, this challenge usually moves faster than the other. You receive access to funded accounts directly. However, requirements in this phase can be stricter. With one phase, there’s less chance for corrections.

Regarding account sizes, there are several options. You can choose $10,000 to start out. Alternatively, try $25,000 or $50,000 options. Additionally, larger accounts include $100,000 and $200,000. Note that each account has its own price. Requirements also change with account size.

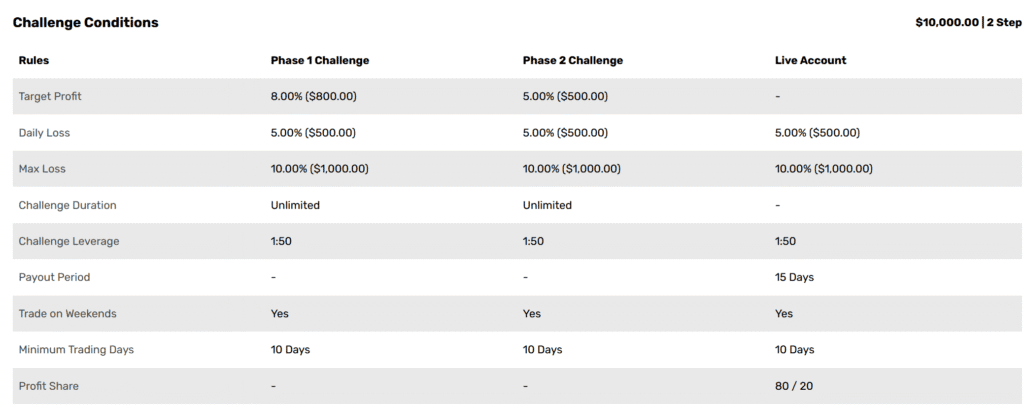

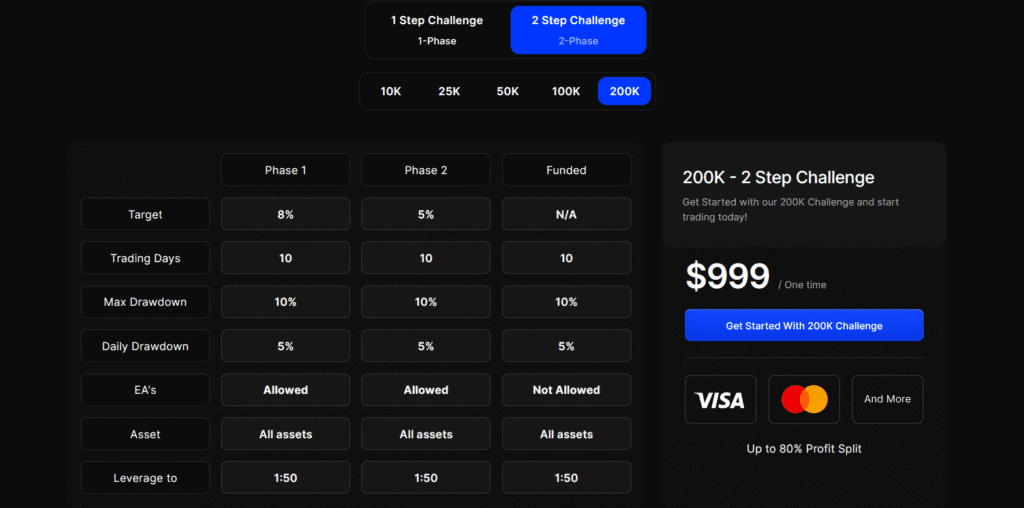

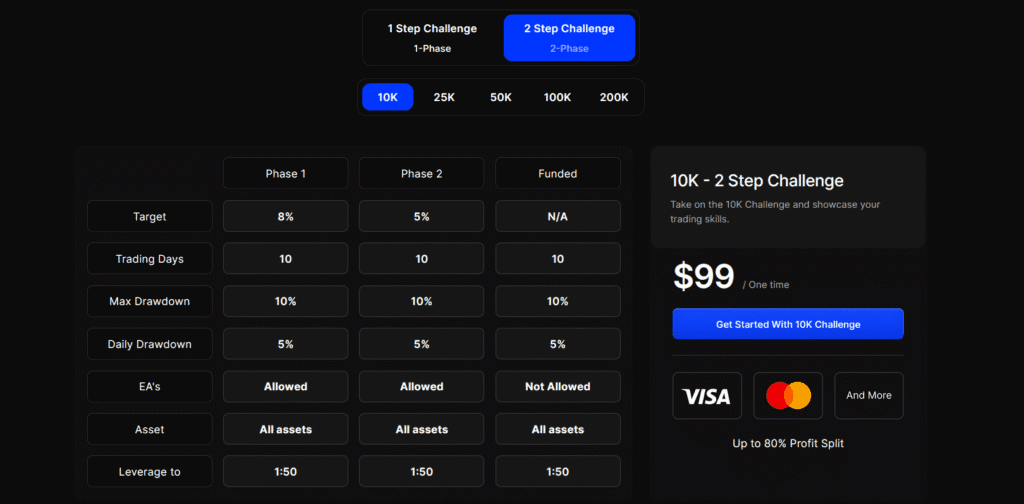

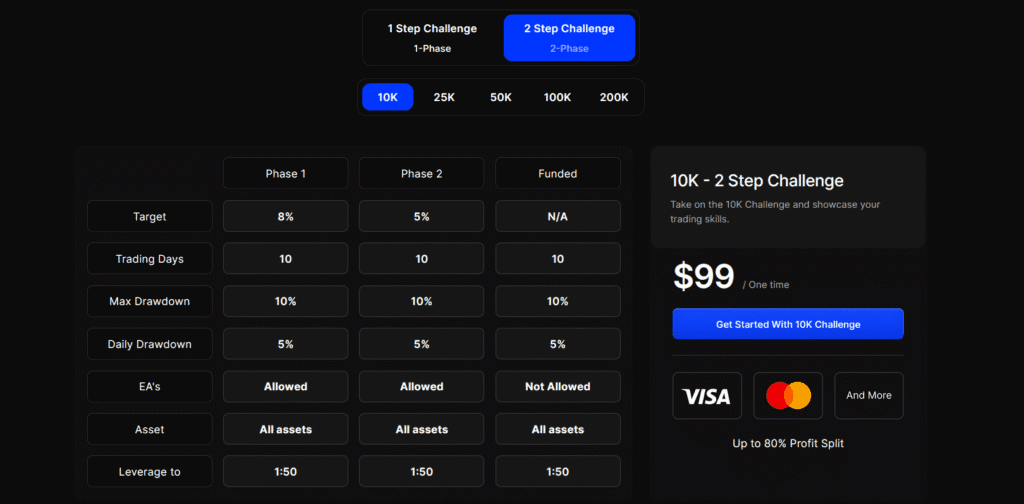

2-Phase Challenge Structure

On the other hand, the 2-phase challenge has two stages. First, you must pass phase one. Then, you move to phase two. This structure allows for gradual progression. Some may prefer this slower process. It provides more time to demonstrate skills overall.

Often, phase one sets specific trading targets. Therefore, you must meet profit goals consistently. Risk management rules always apply in both phases. In phase two, requirements may be less strict. Still, consistent performance remains important.

Available account sizes are the same as above. You start at $10,000 and may go up. Options also include $25,000, $50,000, $100,000, and $200,000. Each phase uses different evaluation criteria.

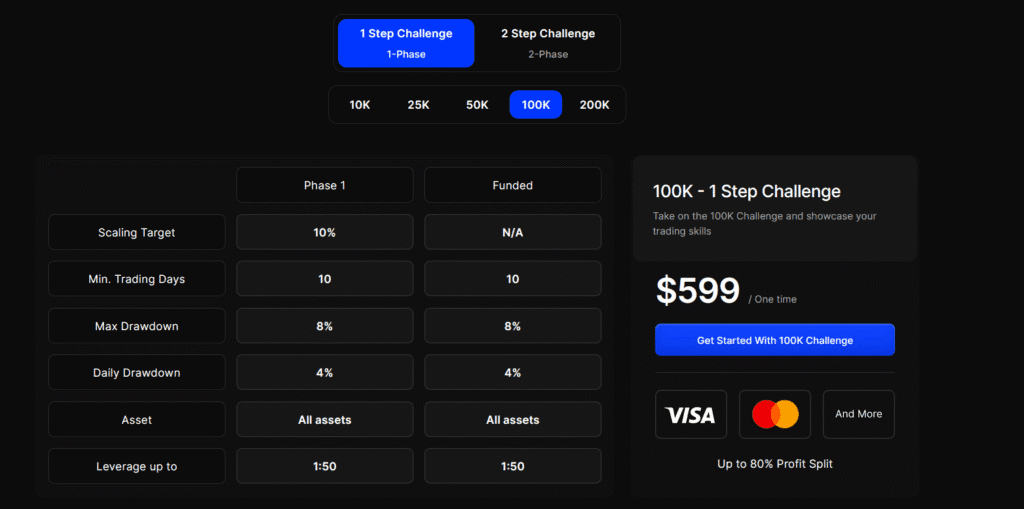

Challenge Pricing and Conditions

Now, let’s look at challenge costs. Account sizes come with different prices. Generally, larger accounts cost more. Because of this, consider your trading budget first. Some start with smaller accounts for less risk. Meanwhile, others prefer larger opportunities.

Each challenge has unique conditions. These include profit targets and drawdown limits. It’s vital to read all requirements before starting. Further, each challenge may have time limits. Some also require daily trading activity. In contrast, others focus on your overall performance.

It’s important to keep in mind that pricing and rules may change over time. So, always check the latest information. There you find all details explained clearly.

Choosing Your Challenge Type

When choosing, think about your trading style. For example, conservative traders pick the 2-phase challenge. Meanwhile, aggressive traders may choose the 1-phase version. Consider your risk tolerance before deciding. Also, reflect on your experience level.

Next, pick your account size carefully. Smaller accounts need a lower starting investment. However, they offer less earning potential. Larger accounts can pay more rewards. But, upfront costs are higher as a result.

Lastly, your schedule may affect your choice. A 1-phase challenge finishes quickly while a 2-phase challenge gives you more time. Consider if you trade full-time or part-time as both types can lead to funded accounts. Above all, consistent performance and risk management are essential. Your decision should match your trading approach.

Bullwaves Prime Prop Firm Pricing

Bullwaves Prime offers competitive pricing across all account sizes. Understanding these costs helps you choose the right option. Therefore, let’s examine each pricing tier and its value.

Lowest Price Entry Points

The lowest price starts at just $99 for accounts. This entry-level option provides access to professional trading capital. However, account sizes and conditions vary by price point.

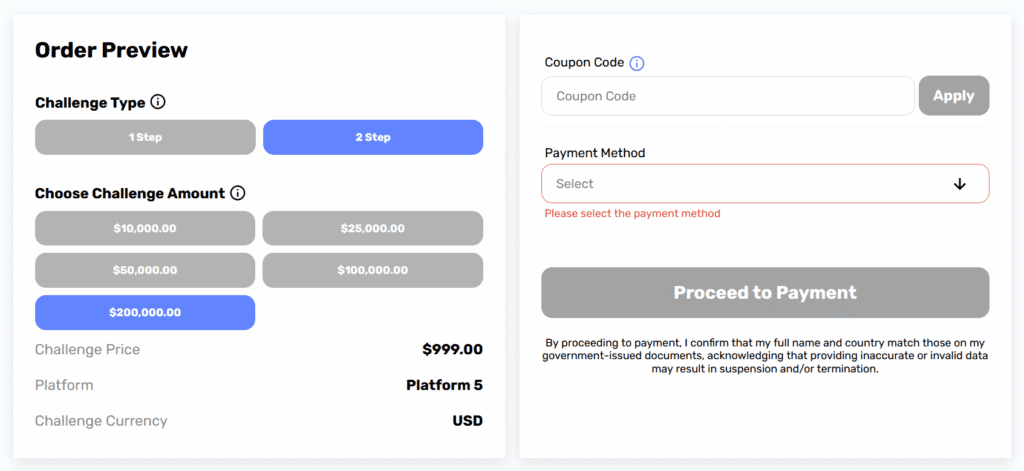

Two-step challenges offer the most affordable pricing structure overall. You can start with $10,000 accounts for only $99. Additionally, these challenges provide gradual skill development opportunities.

One-step challenges cost more but offer faster account access. The lowest one-step price begins at $149 total. Furthermore, these challenges require higher profit targets initially.

Complete Pricing Structure Overview

Bullwaves Prime pricing scales logically with account sizes offered. Smaller accounts require lower upfront investments from traders. However, larger accounts offer greater profit potential over time.

The $10,000 two-step challenge costs $99 as mentioned. Meanwhile, the $25,000 two-step challenge costs $199 total. Additionally, the $50,000 version requires $299 upfront.

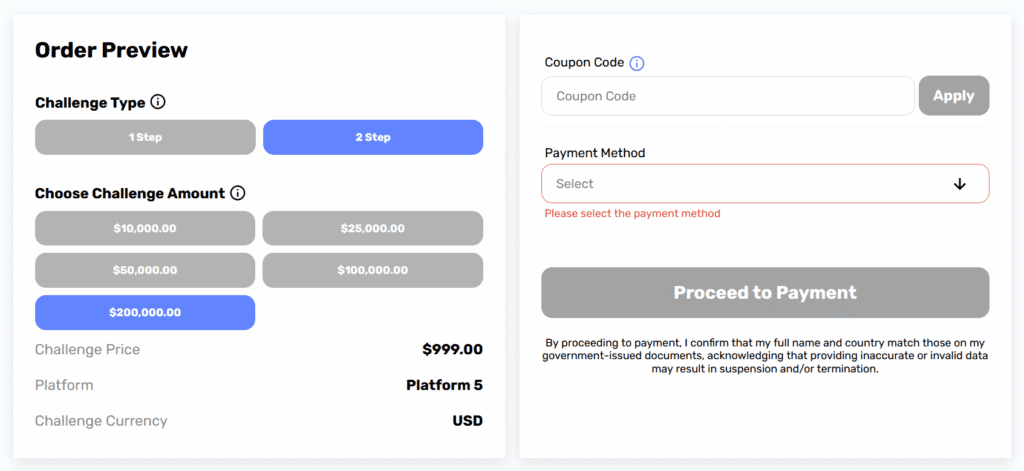

Higher-tier accounts include $100,000 and $200,000 options available. The $100,000 two-step challenge costs $549 per account. Moreover, the largest $200,000 challenge requires $999 investment.

One-Step Challenge Pricing Details

One-step challenges cost more due to their streamlined structure. The $10,000 one-step challenge costs $149 per account. Next, the $25,000 version requires $299 total investment.

Mid-range options include $50,000 accounts at $399 each. The $100,000 one-step challenge costs $599 per account. Finally, the $200,000 challenge requires $1,199 total investment.

These higher prices reflect the faster path to funding. You complete only one phase instead of two. Therefore, the pricing premium provides time value benefits.

Bullwaves Prime Prop Firm Trading Conditions

Bullwaves Prime offers specific trading conditions that you need to understand. These conditions affect how you trade daily. Therefore, let’s examine each important aspect thoroughly.

Leverage and Margin Requirements

Bullwaves Prime provides leverage up to 1:50 across all accounts. This means you control larger positions with smaller capital. However, you must use leverage responsibly to manage risk effectively.

The 1:50 leverage applies to all account sizes consistently. Whether you choose $10,000 or $200,000 accounts, leverage remains the same. Moreover, this standard approach simplifies your trading calculations.

Contract sizing varies per instrument and requires careful consideration. You should check specific requirements before executing any trades. Additionally, different assets may have varying margin requirements.

Weekend and Overnight Holdings

You can hold trades over the weekend without restrictions. This flexibility allows for longer-term trading strategies. Furthermore, weekend holding doesn’t incur additional penalties or fees.

Overnight holding is also permitted across all trading instruments. Your positions remain open until you decide to close them. However, you should monitor market gaps that may occur.

Crypto trading during weekends is available on funded accounts. This provides continuous trading opportunities throughout the week. Nevertheless, weekend crypto volatility may present additional risks.

News Trading Rules and Restrictions

News trading has specific restrictions that you must follow carefully. You cannot open or close positions during certain timeframes. Specifically, trading is prohibited a few minutes before news releases.

High-impact economic announcements trigger these trading restrictions automatically. Therefore, you should plan your trading around major news releases. Additionally, check economic calendars to avoid violations.

Risk Management Parameters

Daily drawdown limits are strictly enforced across all challenges. For 1-step challenges, the daily limit is 4% maximum. Meanwhile, 2-step challenges allow 5% daily drawdown limits.

Maximum total drawdown limits also apply to all accounts. Both challenge types enforce 8-10% total drawdown limits respectively. Exceeding these limits results in immediate account termination.

Use of Expert Advisors

You can use Expert Advisors during challenge phases only. However, EAs are prohibited on funded accounts entirely. This restriction ensures discretionary trading skills remain paramount.

Execution and Slippage Conditions

Bullwaves Prime provides real market liquidity for all trades. This ensures professional-grade execution quality consistently across platforms. However, slippage may occur during high volatility periods.

The firm uses MetaTrader 5 as their primary platform. MT5 offers advanced execution capabilities and order management tools. Furthermore, mobile compatibility ensures trading flexibility anywhere.

Raw spreads start from 0.0 pips on major pairs. This competitive pricing structure benefits active traders significantly. Nevertheless, commission charges may apply to certain accounts.

Bullwaves Prime Prop Firm Payment Processes

Bullwaves Prime handles payments through structured profit-sharing arrangements. Understanding these processes helps you plan your trading income. Therefore, let’s examine how payments work at this prop firm.

Profit Split Structure

Bullwaves Prime offers up to 80% profit split on funded accounts. This means you keep most of your trading profits. However, the exact percentage may vary based on your account size.

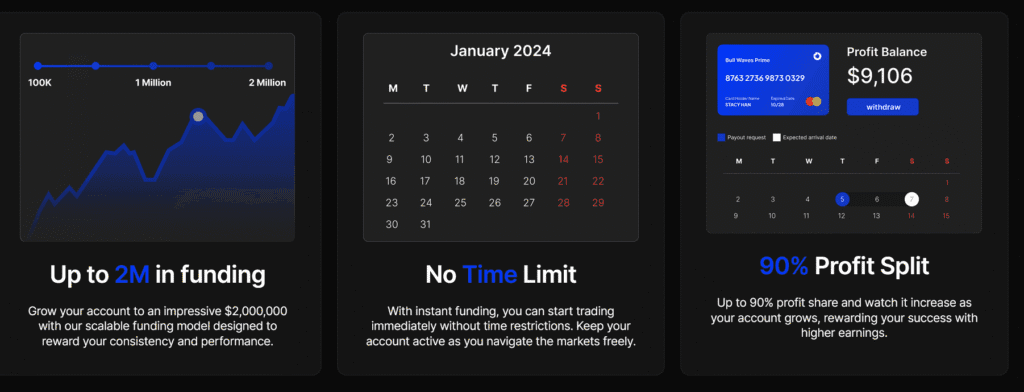

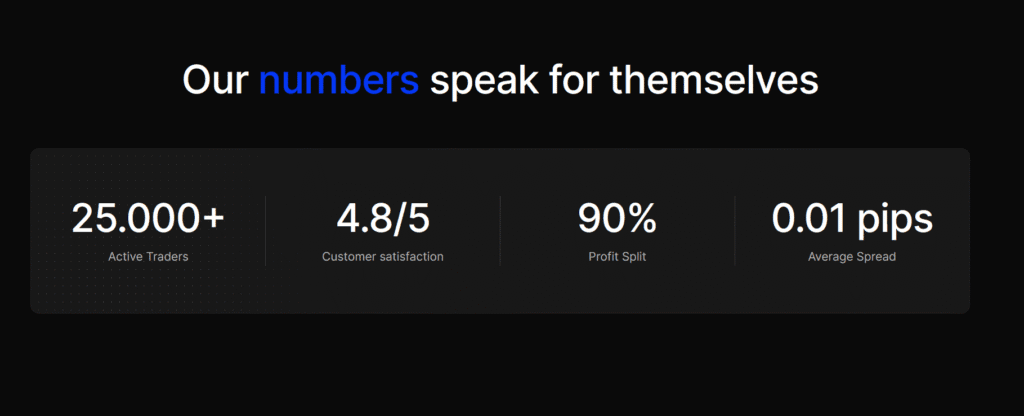

The profit split increases as your account grows over time. Initially, you receive 80% of your generated profits consistently. Furthermore, some traders may qualify for up to 90% splits.

No profit targets exist during the funded trading stage. You earn based solely on your actual trading performance. Moreover, there’s no pressure to hit specific monthly goals.

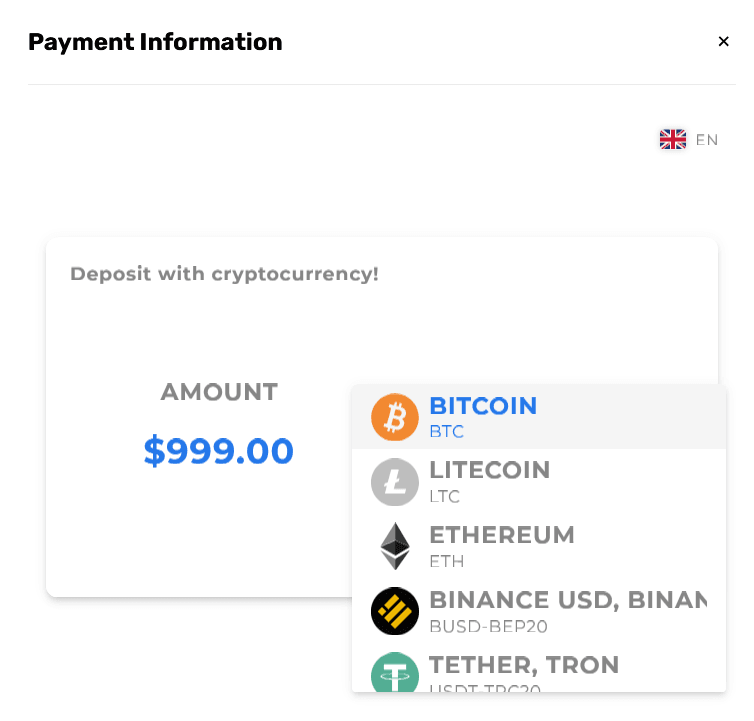

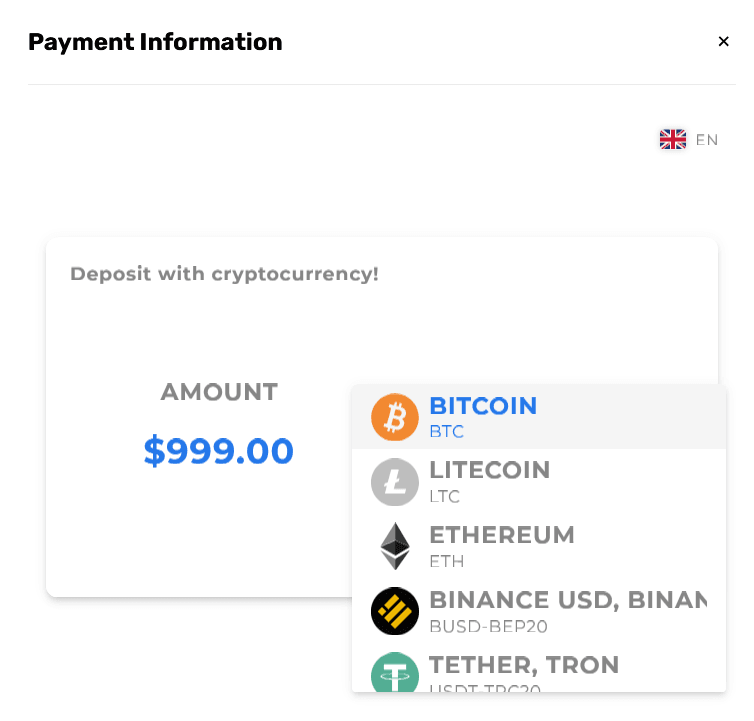

Payment Processing Methods

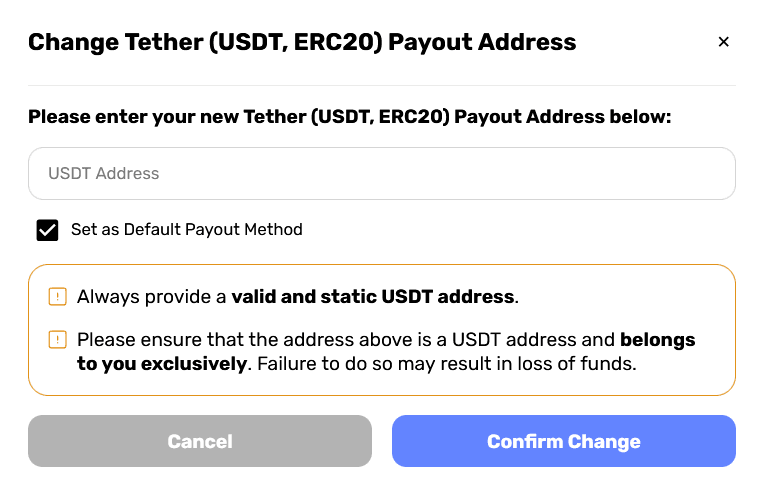

Bullwaves Prime processes payouts through two main methods primarily. Bank wire transfers and USDT-ERC20 cryptocurrency payments are available. Therefore, you can choose your preferred payment option.

Bank wire transfers incur a flat $30 fee per transaction. This fee applies regardless of your withdrawal amount size. However, crypto payments through USDT have no additional fees.

The minimum withdrawal amount is set at $50 across methods. This low threshold makes payouts accessible for smaller accounts. Additionally, you can request withdrawals regularly once eligible.

Payout Schedule and Timing

Your first payout becomes eligible 15 calendar days after trading. This waiting period applies to both 1-step and 2-step challenges. Furthermore, you must complete at least 10 active trading days.

Subsequent payouts follow a bi-weekly schedule after the first one. You can request withdrawals every 15 calendar days consistently. However, all positions must be closed before requesting payouts.

The payout processing timeline takes 2-5 full business days typically. Bullwaves Prime reviews each request before processing it completely. Nevertheless, they aim to process payments as quickly as possible.

Are Payments Instant?

The review process takes 2-5 business days for completion. However, this timeframe ensures security and compliance with regulations.

The firm reserves 24 hours to verify payout details. This security measure prevents errors and protects your funds. Moreover, it helps confirm all withdrawal information is correct.

Processing times may vary depending on your chosen method. Bank wires typically take longer than cryptocurrency transfers. Therefore, crypto payments often arrive faster than traditional methods.

Profit Split Limitations

The profit split reaches its limit at 6% gains. This calculation uses your account’s starting balance as reference. Therefore, gains beyond 6% don’t qualify for additional splits.

For example, a $100,000 account caps profits at $6,000. You receive 80% of this amount as your share. Furthermore, this limit resets after each successful payout.

This 6% rule maintains program longevity and trader relationships. It prevents high-risk gambling behaviors that could harm accounts. Additionally, it encourages consistent trading approaches over time.

Payment Setup Process

You should complete payout information as soon as possible. This prevents delays when you’re ready to withdraw funds. Furthermore, having details ready speeds up the entire process.

For crypto payouts, add your USDT ERC-20 wallet address. This information must be accurate to avoid payment issues. However, you can update details through their support system.

Bank wire transfers require completing a detailed information form. This includes your banking details and personal identification information. Additionally, ensure all information matches your account registration details.

KYC Requirements for Funded Traders

Before receiving your first payout, you must complete KYC verification. This Know Your Customer process verifies your identity completely. Furthermore, it’s required by financial regulations and compliance standards.

The KYC process requires a photo ID or passport copy. You also need proof of address documentation like bills. Moreover, bank statements can serve as address verification.

Your funded account activates within 48 business hours after completion. This includes both challenge completion and successful KYC verification. Therefore, complete KYC promptly to avoid unnecessary delays.

Trading Day Requirements

You must complete 10 active trading days before requesting payouts. These days count when you open at least one position. Furthermore, positions don’t need to close the same day.

Active trading days demonstrate consistent engagement with the markets. This requirement applies to both challenge phases and payouts. Moreover, it ensures you’re actively managing your trading account.

If you hit profit targets before 10 days, continue trading. The challenge won’t pass until you meet this requirement. Therefore, plan your trading schedule to accommodate this rule.

Position Management During Payouts

All positions must be closed before requesting any payout. Open trades prevent withdrawal requests from being processed successfully. However, you can continue trading after submitting payout requests. Nevertheless, maintain proper risk management to avoid rule violations.

Security and Verification Measures

Bullwaves Prime implements security measures to protect your payments. They verify all withdrawal details before processing any requests. Furthermore, suspicious activity triggers additional review procedures automatically.

The 24-hour verification period allows thorough security checks. This prevents fraudulent withdrawals and protects legitimate traders. Moreover, it ensures compliance with international financial regulations.

Contact support immediately if you encounter payout issues. Their team can help resolve problems and answer questions. Additionally, they provide guidance on completing required documentation properly.

Bullwaves Prime Prop Firm Scaling Program

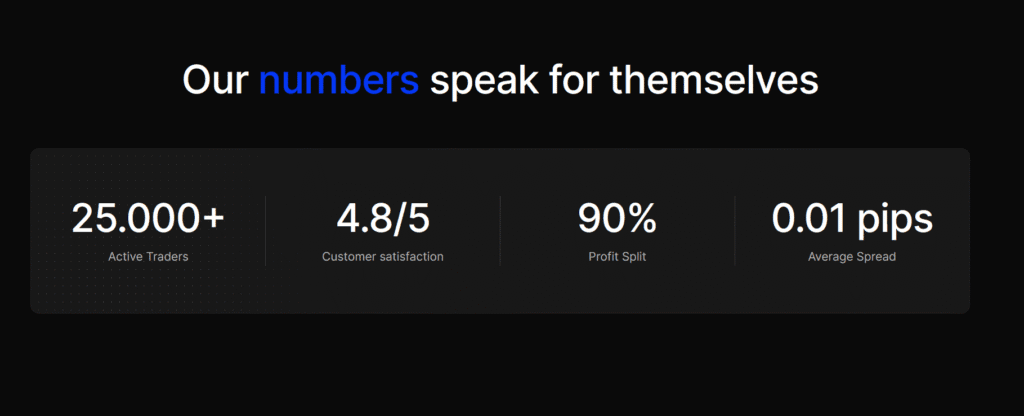

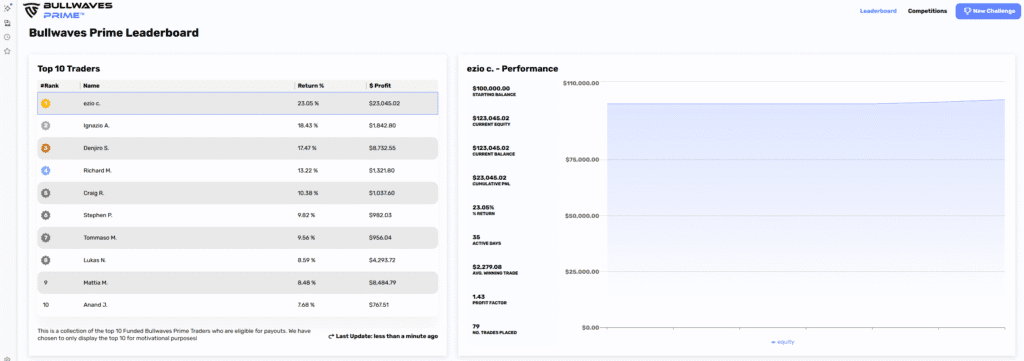

The maximum funded capital reaches $2,000,000 across all accounts. This allows substantial earning potential for successful traders. However, you must demonstrate consistent performance to reach these levels.

Account scaling depends on your trading performance and consistency. Successful traders can grow their funding over time gradually. Furthermore, larger accounts offer greater profit potential significantly.

The maximum single payout could reach $120,000 theoretically. This comes from 6% profit on two $200,000 accounts. Therefore, scaling provides substantial income opportunities for skilled traders.

Bullwaves Prime Prop Firm Customer Support

Bullwaves Prime provides comprehensive customer support through multiple channels effectively. You can access live chat support directly from their website. Additionally, email support is available. Their customer support team operates with quick response times consistently.

Honest Bullwaves Prime review covering challenges, trading conditions, fees, and more. Everything you need to know before joining this prop firm.

Furthermore, the live chat feature offers instant trader assistance. The support staff understands prop trading challenges and provides relevant solutions. You can expect knowledgeable responses to technical and account-related questions. Moreover, their multilingual support accommodates traders from different regions worldwide.

Bullwaves Prime Prop Firm Platforms

Bullwaves Prime utilizes MetaTrader 5 as their primary trading platform. This industry-standard platform provides advanced trading capabilities consistently. Therefore, you get access to professional-grade tools and features.

MetaTrader 5 Platform Features

MetaTrader 5 offers sophisticated charting tools for technical analysis. You can customize charts with various indicators and timeframes. Additionally, the platform supports algorithmic trading through Expert Advisors.

The platform includes advanced order management capabilities that enhance execution. You can set multiple order types including pending orders. Furthermore, partial fills and order modifications work seamlessly.

MT5 provides comprehensive market depth information for better decisions. You can see real-time bid and ask prices clearly. Moreover, the economic calendar integration helps track important events.

Mobile Trading Compatibility

Bullwaves Prime ensures full mobile compatibility through MT5 apps. You can trade from your smartphone or tablet anywhere. Additionally, mobile apps maintain all desktop platform functionality.

The mobile platform syncs with your desktop account automatically. Your charts, indicators, and settings transfer between devices seamlessly. Furthermore, push notifications keep you updated on market movements.

Mobile execution quality matches desktop performance standards consistently. You experience the same fast order processing speeds. Therefore, location doesn’t limit your trading effectiveness.

Advanced Trading Tools

MetaTrader 5 includes professional-grade analytical tools for market analysis. You can access over 80 technical indicators for strategy development. Additionally, custom indicators can be added through the marketplace.

The platform supports multiple chart types including candlesticks and bars. You can analyze price action across various timeframes simultaneously. Moreover, drawing tools help identify key support and resistance levels.

Automated trading capabilities allow you to run Expert Advisors. However, EAs are only permitted during challenge phases. Furthermore, the platform includes backtesting features for strategy validation.

Real Market Execution Quality

Bullwaves Prime provides real market liquidity through their platform. You experience institutional-grade execution quality during all trading sessions. Additionally, there’s no dealing desk intervention in trades.

Order execution happens in milliseconds during normal market conditions. You benefit from minimal slippage on most trades. Furthermore, the platform handles high-frequency order processing effectively.

Market depth shows real liquidity at different price levels. You can see actual market conditions before placing orders. Therefore, you make more informed trading decisions consistently.

Bullwaves Prime Prop Firm Fees and Commissions

Bullwaves Prime maintains a transparent fee structure across all accounts. Understanding these costs helps you calculate your trading profitability. Therefore, let’s examine each fee component in detail.

Spread Costs and Pricing

Bullwaves Prime offers raw spreads starting from 0.0 pips. This competitive pricing applies to major forex pairs primarily. However, spreads vary depending on market conditions and liquidity.

Major currency pairs show the tightest spread conditions. EUR/USD and GBP/USD frequently display zero pip spreads. Additionally, other major pairs maintain consistently low spreads.

Spread costs fluctuate throughout different trading sessions significantly. London and New York overlaps provide optimal pricing conditions. Furthermore, economic events may temporarily widen spreads above normal.

Minor and exotic pairs typically have higher spreads. These instruments show less liquidity than major pairs. Moreover, spread costs increase during off-peak trading hours.

Commission Structure

Bullwaves Prime does not charge trading commissions on most accounts. This means you only pay the spread cost. However, specific account types may have different arrangements.

The absence of commissions reduces your overall trading costs. You don’t pay separate fees for opening positions. Therefore, the spread represents your primary transaction cost.

Some asset classes may have different commission structures. Check specific instrument details before trading them actively. Additionally, crypto trading may have unique fee arrangements.

Swap Fees and Overnight Charges

Swap fees apply to positions held overnight consistently. These charges reflect interest rate differentials between currencies. However, you can avoid them by closing trades daily.

Positive swap rates mean you receive payments overnight. Negative swap rates result in charges to accounts. Furthermore, swap calculations occur at 00:00 server time.

The exact swap rates vary by currency pair. You can check current rates within the platform. Moreover, these rates change based on central bank policies.

Wednesday swaps are typically tripled to account for weekends. This means higher overnight costs on Tuesday nights. Therefore, plan position management around these charges accordingly.

Account Maintenance Fees

Bullwaves Prime does not charge monthly account maintenance fees. Your funded account remains active without recurring costs. However, inactivity for 30 days triggers account suspension.

Challenge accounts also have no monthly maintenance charges. You pay only the initial challenge fee upfront. Moreover, there are no hidden costs during evaluation.

The absence of maintenance fees reduces your operational costs. You keep more of your trading profits. Therefore, focus on trading rather than fee management.

Bullwaves Prime Prop Firm Trader Education

Bullwaves Prime supports your development with key educational resources. You can find helpful trader education materials to improve skills. The firm provides access to performance reports for feedback. These learning tools help you refine your trading strategies.

You can also join a collaborative community of traders. This environment helps you grow professionally and share insights. The focus is on practical resources for your trading journey. Therefore, you have support to enhance your market understanding.

How to Open a Bullwaves Prime Prop Firm Account

Opening a Bullwaves Prime account involves a straightforward process. You can complete the entire setup in minutes. First, you need to understand the basic requirements.

Account Opening Requirements

You must be at least 18 years old to register. Additionally, you need valid identification documents for verification. Furthermore, a stable internet connection ensures smooth account creation.

Bullwaves Prime accepts traders from most countries worldwide. However, some regions face restrictions due to regulations. Therefore, check your country’s eligibility before starting the process.

Step 1: Click Here To Register

Navigate and click on the “Sign up” button prominently displayed. This takes you to the account creation page.

You’ll see the registration form with required fields. The page loads quickly and displays clearly. Moreover, the interface remains user-friendly throughout the process.

Step 2: Choose Your Account Type

Bullwaves Prime offers different account options for traders. You can select between various account sizes available. Additionally, different evaluation structures suit different trading styles.

Consider your budget and trading experience when choosing. Smaller accounts require less initial investment upfront. However, larger accounts offer greater profit potential over time.

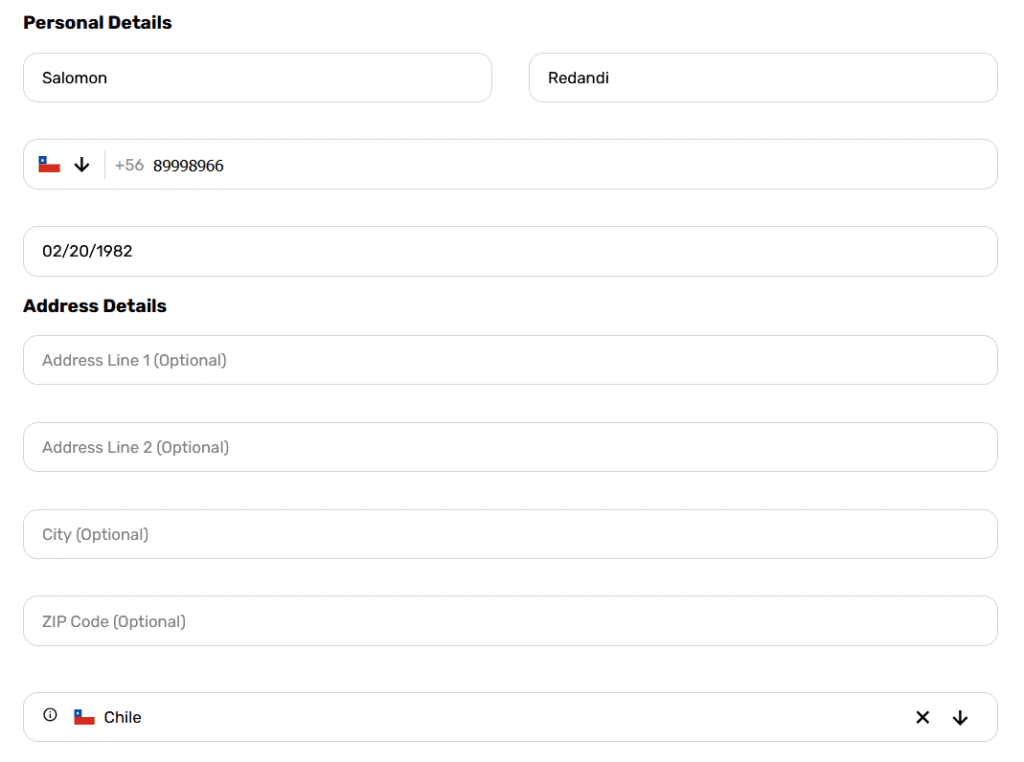

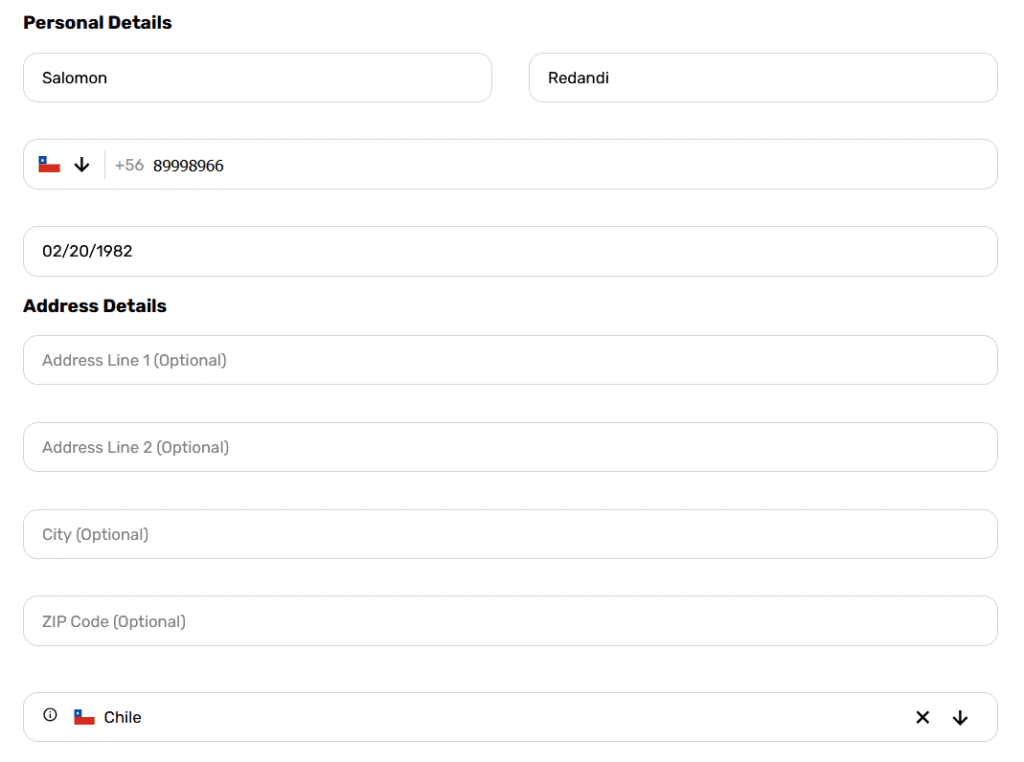

Step 3: Complete Personal Information

Fill out your personal details accurately in all fields. This includes your full name as shown on documents. Additionally, provide your current residential address completely.

Your email address must be active and accessible daily. You’ll receive important account notifications through this email. Furthermore, choose a strong password for account security.

Step 4: Select Payment Method

Bullwaves Prime accepts credit cards and cryptocurrency payments. Choose the method that works best for you. Additionally, ensure your payment method has sufficient funds.

Credit card payments process instantly in most cases. Cryptocurrency payments may take a few minutes longer. However, both methods are secure and reliable consistently.

Step 5: Complete the Payment Process

Enter your payment information carefully in the provided fields. Double-check all details before submitting the payment request. Furthermore, keep your payment confirmation for future reference.

The system processes payments automatically once you submit them. You’ll receive a confirmation email within minutes typically. Moreover, any payment issues trigger immediate notifications.

Step 6: Receive Account Credentials

Check your email for login credentials after payment confirmation. These arrive within 10 minutes of successful payment. Additionally, check your spam folder if necessary.

The email contains your MT5 login details specifically. You also receive dashboard access information simultaneously. Furthermore, the email includes important next steps.

Step 7: Access Your Dashboard

Log into the Bullwaves Prime dashboard using provided credentials. This shows your account status and trading information. Additionally, you can monitor your progress here.

The dashboard displays all important account metrics clearly. You can track your trading performance over time. Moreover, payout requests are processed through this interface.

Step 8: Download MetaTrader 5

Download MT5 from the official MetaTrader website directly. Install the software on your computer or device. Additionally, mobile apps are available for smartphones.

Use the login credentials provided in your email. Connect to the Bullwaves Prime server specifically. Furthermore, ensure your internet connection remains stable throughout.

Step 9: Complete KYC Verification

Submit required identification documents for account verification. This includes a valid passport or driver’s license. Additionally, provide proof of address documentation.

Upload clear photos of all required documents completely. Ensure all information is visible and legible clearly. Moreover, documents must be current and unexpired.

Step 10: Start Trading

Begin trading once your account is fully activated. Follow all trading rules and guidelines carefully. Additionally, monitor your progress through the dashboard regularly.

Frequently Asked Questions

Is Bullwaves Prime prop legit?

Yes, Bullwaves Prime is a legitimate proprietary trading firm. It is powered by a regulated broker. This connection adds a layer of transparency and security. The firm provides real market liquidity on the MT5 platform. They have clear rules and a structured payout process. Thousands of active traders use their platform successfully. This demonstrates their credibility in the industry.

What is the profit split in Bullwaves?

Bullwaves Prime offers a generous profit split for successful traders. You can earn up to an 80% profit share on your earnings. In some cases, this can increase to as high as 90%. This split applies to profits generated on your funded account. The structure is designed to reward consistent and skilled traders. It is one of the most competitive splits in the industry.

What are the rules for a funded account in Bullwaves?

Funded accounts have specific rules you must follow. You need to manage risk within set drawdown limits. The daily drawdown is typically 4-5% depending on your challenge. The maximum total drawdown is between 8-10%. You must also trade for a minimum of 10 days before a payout. Certain trading strategies like arbitrage and martingale are prohibited. Following these rules is essential to maintain your funded account.

Can you withdraw money from Bullwaves?

Yes, you can withdraw money from Bullwaves Prime. Payouts are processed after you meet the trading requirements. Your first payout is eligible 15 days after your first trade. You must also complete 10 active trading days. Subsequent payouts are available every 15 days. Withdrawals are processed via bank wire or USDT-ERC20. The minimum withdrawal amount is $50.

How to get a Bullwaves funded account?

To get a funded account, you must pass an evaluation challenge. First, you choose an account size and challenge type. Then, you complete the payment for the one-time fee. After that, you receive your login credentials for the challenge. You must trade and meet the specified profit target. You also need to stay within the drawdown rules. Once you pass the challenge, you receive your funded account.

Does Bullwaves have instant funding accounts?

Bullwaves Prime does not offer instant funding accounts. Their model requires traders to first prove their skills. You must successfully complete either a 1-step or 2-step challenge. This evaluation process ensures that only skilled traders manage firm capital. While funding is not instant, the process is straightforward. Passing the challenge grants you access to a funded account.

Are prop firm challenges worth it?

Prop firm challenges can be very worthwhile for skilled traders. They offer access to large amounts of trading capital. The fee is small compared to the account size you manage. This allows you to earn significant income without risking your own money. Challenges also provide a structured environment to prove your abilities. For traders who can manage risk, they are a great opportunity.

How long is a Bullwaves prop firm challenge?

Bullwaves Prime prop firm challenges have no time limits. You can take as long as you need to reach the profit target. This flexibility removes the pressure of deadlines. It allows you to trade according to your own strategy and pace. You can wait for the best market conditions to place trades. The focus is on your trading skill, not on speed.

Which are the best prop firm challenges?

The best prop firm challenge depends on your trading style. Bullwaves Prime offers both 1-step and 2-step challenges. The 1-step challenge has a higher profit target but is faster. It is suitable for confident and experienced traders. The 2-step challenge has lower profit targets split into two phases. It is great for traders who prefer a more gradual evaluation. Both offer excellent conditions and clear rules.

Conclusion

Bullwaves Prime presents compelling trading opportunities for skilled traders. This prop firm offers competitive pricing and clear trading rules. You can access significant capital with a small upfront fee. Their profit splits are generous, reaching up to 90%. Flexible conditions, like no time limits, support various strategies. The use of MT5 ensures professional-grade execution. For traders seeking legitimate funded accounts, Bullwaves Prime stands out. It provides a solid foundation for building a trading career. This firm offers a balanced and valuable proposition for traders worldwide.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.