The US Dollar has been left treading water in the face of positive economic developments, as investors remain wary.

Market sentiment is elevated on expectations that a soft landing for America’s economy may be possible – yet this hasn’t helped lift the USD from its current trading rut against currencies such as AUD/USD and gold prices. Will robust Treasury yields compel insight into higher support levels?

Let’s look at how DXY index movements can offer clues to answer these questions.

Dollar Index Analysis- DXY

The DXY index has struggled to break through resistance as of late, and is now approaching the lower end of its range. Support at current lows may keep it afloat for a while longer before eventually dropping off towards April 2022’s low point; however price action could be capped by existing peaks or the 55-day & 100-day moving averages which are both near these highs.

Dollar Performance Post Jobs Report

This week so far, the US Dollar has continued to drift as high beta risk assets have seen modest gains. The positive news of 253k non-farm jobs added in April and an unemployment rate at its lowest level since 1969 weren’t enough to buoy the dollar’s weakened state.

Major equity indices around Asia Pacific are mostly higher following Wall Street’s strong close on Friday with Japan being a rare exception after returning from holiday yesterday into negative territory.

Treasury yields across all maturities remain relatively unchanged for now although short ends ticked upwards last session when two-year bonds showed resilience by reclaiming 3.92% during last month’s brief visit twards 3/56%.

Oil prices continue their streak over $71 bbl while gold remains comfortably above $2K/ounce despite today’s generally flat markets ahead of this week’s North American cash session opening later tonight local time.

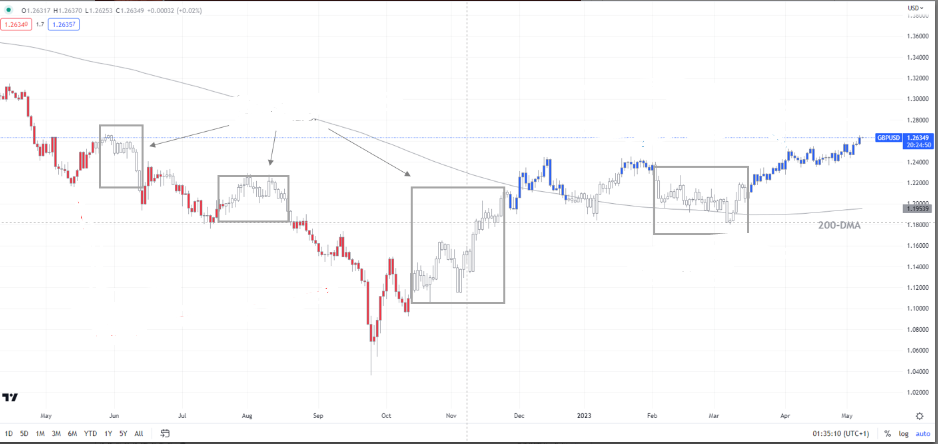

Pound Performance Ahead Of BOE Rate Decision

Last week, the British pound surged to a one-year high against its American counterpart as investors anticipate an imminent rate hike from the Bank of England. April’s US jobs data may have been encouraging but was overshadowed by revisions to prior months which kept market expectations for future Fed cuts intact.

Meanwhile in the UK, price pressures remain elevated with inflation recently reaching 10.1% — near record highs last seen nearly 40 years ago! The BOE is widely expected to lift rates 25 basis points this Thursday and such action could potentially push GBP/USD even higher if it were combined with hawkish rhetoric on further hikes in store down the line.

Crude Oil Price Remains Constant

Last week, crude oil faced intense pressure before closing higher due to strong US jobs data. With the unemployment rate hitting a 50-year low of 3.4%, traders’ sentiment was boosted further with promising domestic Golden Week travel numbers from China.

The positive news lifted WTI futures back up above $71 and speculation grew that OPEC+ might impose additional production cuts at their upcoming Vienna meeting in June – however concerns over waning gasoline refining profits remain on the horizon as RBOB crack spread positions come under severe strain despite soft energy inventory levels last week.

Meanwhile OVX index volatility has since declined signalling comfortable market pricing conditions while price spreads between front two contracts reflect overall balance within this sector for now.

Markets Ahead

Equity markets posted mixed performance this week, with S&P 500 falling 0.8%, Nasdaq rising 0.1% and FTSE 100 declining 1.2%. Japan’s Golden Week holiday saw the Hang Seng index jump by an impressive 0.8%.

Earnings season revealed strong outperformance of actual EPS relative to analyst expectations for many companies in the S&P 500 – 79% reported above estimates; a significantly higher rate than their 10-year average per FactSet data release last Friday (Apr 30).

This Week In Focus

Amongst key upcoming events stateside, consumer price index (CPI) and producer price index (PPI) reports will be released Wednesday through Thursday respectively followed up next Monday with Empire Manufacturing numbers;

Australia will also bring out its annual budget Tuesday night accompanied by speculation that liquified natural gas exports may see increases in taxations.

Also expected this week is the BOE Rate decision that could impact the currency.

The Australian dollar has been volatile, as the US dollar weakens and domestic data is mixed. Gold remains a safe haven asset, despite reacting unpredictably to US jobs data. The US banking sector is under stress, posing a risk to the overall multi-week uptrend of US equities.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial Analyst and News Editor with qualifications in accounting and economics. She has over 20 years of banking and accounting experience, during which she has gained extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts