The EUR/USD pair has been showing limited fluctuations, maintaining stability around 1.0550 during the European session on Thursday. This stagnation is attributed to a wary market atmosphere and anticipation of upcoming US data releases and Federal Reserve Chairman Powell’s speech.

EURUSD Daily Chart

Previously, the EUR/USD pair witnessed a downward trend, closing with losses due to the rise in US Treasury bond yields and a risk-averse market mood. This environment bolstered the strength of the US Dollar, placing downward pressure on the pair.

Market Cautiousness Ahead of Powell’s Speech

Thursday has begun on a relatively quiet note, allowing EUR/USD to consolidate its losses. However, the slight drop in US stock index futures suggests that investors continue to tread cautiously.

Later today, Federal Reserve Chairman Jerome Powell is scheduled to deliver a statement at the Economic Club of New York, providing valuable insights into future policy directions.

The Impact of Powell’s Stance on Dollar’s Strength

Should Powell take a more dovish approach, emphasizing the tightening conditions in the bond market and indicating potential halts in policy adjustments, we could see the US Dollar under some pressure. However, if Powell maintains a data-dependent stance and leaves room for an additional rate increase before the year ends, the US Dollar is likely to hold its ground.

Over the month, the EUR has been consolidating at lower levels against the USD, with experts keeping a close eye on this highly traded currency pair.

Risks and Opportunities: A Bearish Outlook for EUR/USD

A significant risk that could drive the pair closer to parity is escalating geopolitical tensions in the Middle East. While the conflict between Hamas and Israel is predicted to remain contained, a wider regional conflict could lead to rising energy prices and weaken the EUR. This shift from neutral to bearish reflects the recognition of this risk.

On a more optimistic note for the EUR, there are indications of economic growth in China improving towards year-end. This development could potentially offset another downside risk that has been burdening the EUR over the summer.

Weekly Jobless Claims and Other Economic Updates

This Thursday’s economic calendar kicks off at 12:30 GMT with the release of the weekly Jobless Claims. Initial Claims are projected to rise slightly from 209,000 to 212,000, while Continuing Claims are anticipated to increase from 1,702,000 to 1,710,000.

Simultaneously, we’ll see the unveiling of the monthly Philadelphia Fed Manufacturing Survey for October. Despite expecting a continued contraction in the region’s manufacturing activity, it is predicted to be less severe than September’s, moving from -13.5 to -6.6.

At 14:00 GMT, the real estate market will be in focus with the release of September’s Existing Home Sales data. The sales are projected to decline from 4.04 million units to 3.89 million.

Powell’s Speech and Fed Speakers’ Lineup

Attention will shift towards US Fed Chairman Jerome Powell around 16:00 GMT as he is scheduled to address the New York Economic Club.

The day will also feature several speeches by other Federal Reserve officials. Chicago Fed President Austan Goolsbee is set to speak at 17:20 GMT, followed by Atlanta Fed President Raphael Bostic around 20:00 GMT. Philadelphia Fed President Patrick Harker will take the stage at 21:30 GMT, and Dallas Fed President Lorie Logan will conclude the day’s speakers at 23:00 GMT.

Market Movements and Interest Rate Expectations

Equities are experiencing a downturn following Elon Musk’s statement during a Tesla earnings call about rising rates impacting demand. In addition, Chinese real-estate giant Country Garden defaulted on a USD bond payment. Asian equities have fallen over 2%, European equities are down around 0.50%, and US Futures have dropped by a quarter percentage point.

According to the CME Group’s FedWatch Tool, there is a 97.1% probability that the Federal Reserve will maintain the current interest rates in its November meeting.

Bond Market Turbulence

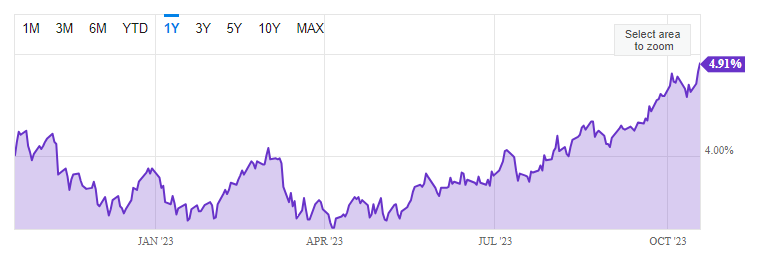

The bond market is witnessing fluctuations as the benchmark 10-year US Treasury yield climbs to 4.91%. This rise comes in response to unexpected large-scale bond sales from China and Japan, which totaled $118 billion for September alone.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial Analyst and News Editor with qualifications in accounting and economics. She has over 20 years of banking and accounting experience, during which she has gained extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts