FxPro is a globally recognized forex and CFD broker, offering more than 2,100 tradable instruments across various asset classes. Established in 2006, the platform supports a wide range of tools and technologies for traders of all experience levels. With robust regulatory oversight and a strong emphasis on trading efficiency, FxPro has gained a solid reputation.

This review examines its regulatory status, account offerings, trading platforms, products, customer services, and fees to provide potential users with an informed decision-making guide.

Table of Contents

ToggleFxPro Regulation

FxPro upholds rigorous regulatory standards to prioritize transparency and client trust. The broker operates under several reputable regulatory licenses, reflecting its global presence. These frameworks ensure a secure trading environment while adhering to regional compliance requirements. This multi-jurisdictional oversight highlights FxPro’s commitment to a transparent trading environment.

Trade responsibly. Trading CFDs involves risk of loss.

- CySEC: FxPro Financial Services Ltd is regulated by the Cyprus Securities and Exchange Commission.

- FCA: FxPro UK Limited is regulated by the Financial Conduct Authority in the UK.

- SCB: FxPro Global Markets Ltd is regulated by the Bahamas Securities Commission.

- FSCM: Prime Ash Capital Limited is licensed by the Financial Services Commission of Mauritius.

- KNN: FxPro Global Markets LLC is registered in Costa Rica.

- LCA: FxPro Global Markets LTD operates from Saint Lucia.

FxPro Spreads, Fees, and Commissions

FxPro offers competitive spreads starting from 0.0 pips on Raw+ accounts, with slightly wider spreads on Standard MT4/5 accounts. Their transparent fee structure, including manageable non-trading costs like inactivity and withdrawal fees, ensures clarity for all traders.

Spreads

FxPro provides competitive spreads tailored to different account types, ensuring flexibility for traders. On the Raw+ account, spreads for major currency pairs like EUR/USD start as low as 0.0 pips, making it an appealing choice for scalpers and high-frequency traders. Meanwhile, the Standard MT4/5 account offers slightly wider spreads, suitable for beginners or those seeking a simplified fee structure without commissions. By offering account-specific spreads, FxPro caters to a broad spectrum of trading preferences, maintaining market competitiveness and transparency.

Commissions

For the Raw+ account, FxPro applies commissions alongside its zero-spread offerings. This setup ensures precision and fairness, particularly valuable for professional traders who prioritize highly accurate trade costs. Such commission structures cater well to those looking for transparency in transactions and cost predictability. The Standard and Elite MT4/5 accounts do not charge standard trade commissions, relying solely on spreads, which makes them more suitable for traders who prefer straightforward fees without extra calculations.

Trade responsibly. Trading CFDs involves risk of loss.

Non-Trading Fees

FxPro also incurs non-trading fees, which include charges such as inactivity fees and withdrawal costs. These fees are transparently communicated, ensuring clients are well-informed to manage their accounts effectively. While such costs are standard among brokers, FxPro’s approach ensures these fees remain reasonable and do not heavily impact the trading experience. Combined with their competitive spreads and commissions, these manageable non-trading fees contribute to FxPro’s reputation for offering accessible and efficient trading conditions.

FxPro Account Types

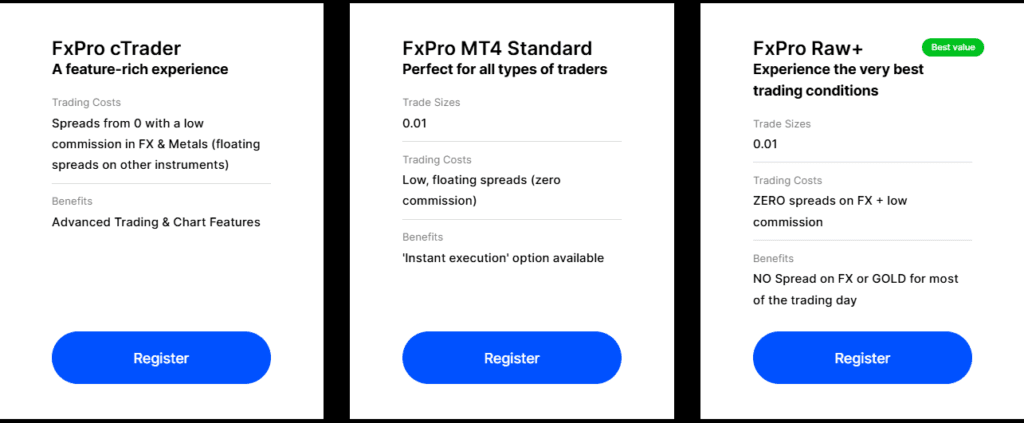

FxPro offers three distinct account types, each designed to meet the specific needs of various trader profiles. From beginners seeking simplicity to professionals requiring advanced tools, the account types deliver tailored trading experiences.

Trade responsibly. Trading CFDs involves risk of loss.

Below is a detailed breakdown of the options available.

Standard MT4/5

The Standard MT4/5 account is an excellent choice for beginner traders or those preferring simplicity. It provides stable spreads, a user-friendly interface, and access to all essential trading tools. Supporting both the MetaTrader 4 and 5 platforms, it ensures ease of navigation for new users. The Standard account is ideal for traders prioritizing reliability and straightforward trading conditions, as it focuses on accessibility without overwhelming users with advanced features.

Raw+ MT4/5

The Raw+ MT4/5 account is tailored for experienced traders who demand precision and cost-efficiency. It features razor-thin spreads starting from zero pips, combined with a transparent commission structure for added clarity. This account type caters to those who rely on quick market execution and require access to ultra-low-cost trading conditions. By leveraging the advanced tools of MT4/5, Raw+ ensures seamless performance for strategy-driven and active traders.

Elite MT4/5

The Elite MT4/5 account brings premium trading to the forefront, combining the best features of Raw+ with added incentives. Traders benefit from exclusive rebates, elevated service levels, and access to VIP perks for a personalized experience. Designed for high-volume professionals, Elite enhances trading advantages with its cost-effective model and top-tier support. The Elite account underscores FxPro’s commitment to serving the needs of the most demanding market participants.

How to Open Your Account

Opening an FxPro account is streamlined and user-friendly. The entire process is quick, with verification usually completed within 24 hours.

- Click here “Register.”

- Complete the form with your personal information.

- Upload proof of identity and address for verification.

- Select your preferred account type and funding method.

- Once verified, start trading through your chosen platform.

Trade responsibly. Trading CFDs involves risk of loss.

FxPro Trading Platforms

FxPro offers a diverse range of trading platforms, each equipped with advanced tools, robust functionality, and user-friendly designs.

FxPro Mobile App

The FxPro Mobile App is designed for traders who require flexibility and efficiency in their trading experience. It allows users to access real-time market data, manage accounts, and execute trades from anywhere. The app includes advanced analytical tools, such as charting features and technical indicators, to enhance decision-making. Its user-friendly interface ensures seamless navigation, while secure login methods prioritize safety. This makes it ideal for both active and casual traders seeking convenience.

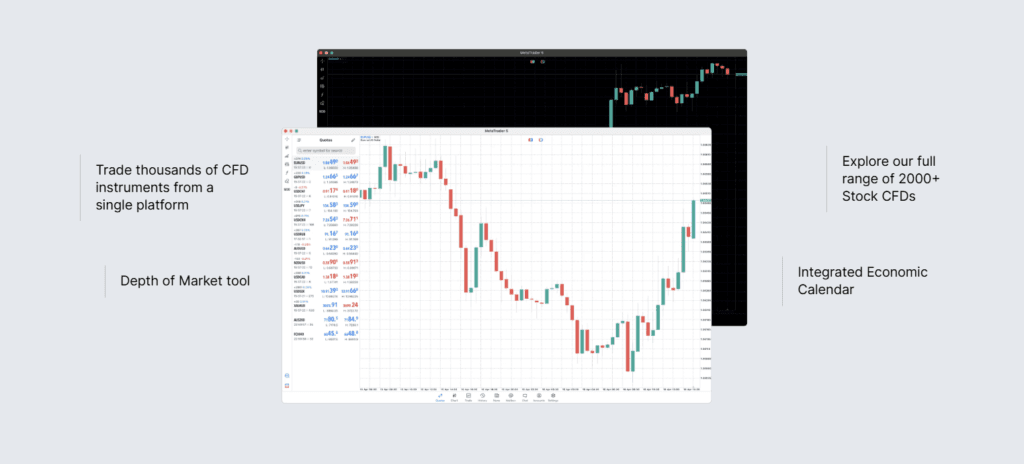

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a widely favored platform among forex traders due to its proven reliability and dynamic features. It allows for customizable charting, enabling traders to adapt visual data to their strategies. Expert advisors offer automated trading solutions, while low-latency order execution ensures accuracy, even in fast-moving markets. MT4’s user-friendly interface is paired with robust analytical tools, making it versatile and suitable for traders at all skill levels.

Trade responsibly. Trading CFDs involves risk of loss.

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) builds on the solid foundation of its predecessor while introducing new capabilities. It supports additional asset classes, making it appealing for traders exploring diversified markets. With enhanced timeframes and advanced technical indicators, MT5 provides deeper insights into market trends. Its economic calendar feature helps users track key events that impact trading, and support for algorithmic trading caters to tech-savvy users. This adaptability ensures MT5 meets various trading requirements.

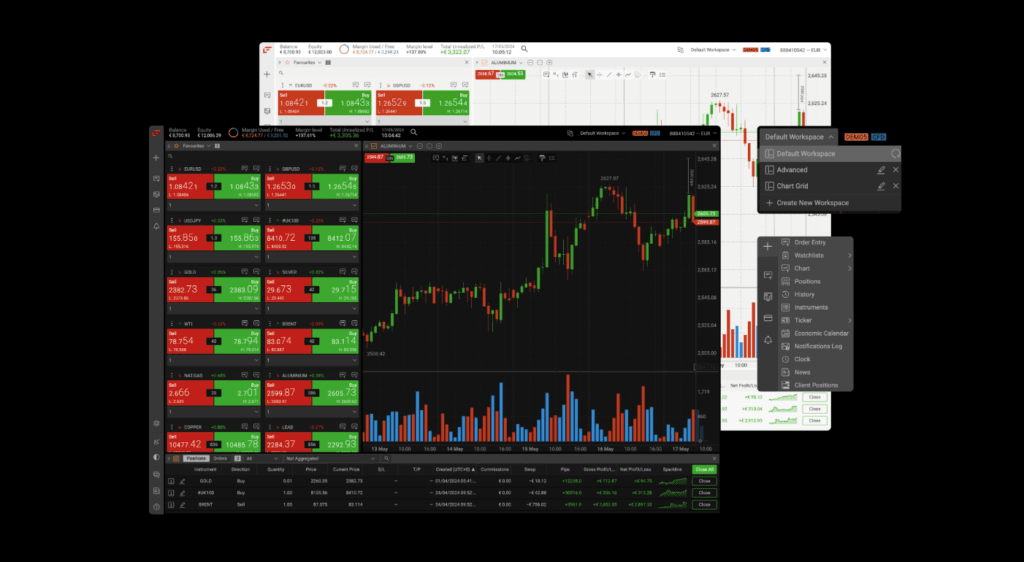

cTrader

cTrader is tailored for traders who value precision and advanced functionality, particularly within algorithmic trading and customization. Offering a clean design and straightforward interface, cTrader enhances usability while offering access to detailed market depth information. Its automation features, through cTrader Automate, allow users to deploy and optimize trading algorithms effortlessly. The inclusion of multiple order types and risk management tools ensures this platform appeals to both manual and automated trading strategies.

FxPro WebTrader

FxPro WebTrader is an online trading solution that delivers seamless accessibility without requiring downloads or installations. It’s compatible with multiple devices, offering traders the freedom to execute trades anywhere via a browser. The platform features essential technical analysis tools, including charts and indicators, while ensuring smooth navigation. Order execution is reliable, maintaining speed and efficiency. WebTrader’s simplicity makes it a reliable choice for those seeking a straightforward trading interface.

Trade responsibly. Trading CFDs involves risk of loss.

FxPro Products

FxPro offers traders access to a vast range of over 2,100 CFDs, spread across multiple asset classes. This variety enables users to diversify their portfolios while maintaining risk management. Below is a detailed look at each product category supported on the platform.

Forex Pairs

FxPro provides a comprehensive selection of forex pairs, including majors, minors, and exotic currencies. This vast range gives traders the flexibility to capitalize on global currency fluctuations and explore varied strategies. Forex trading on FxPro is supported by low spreads, fast order execution, and powerful technical analysis tools, ensuring efficient and precise trading conditions.

Shares

With access to global stock markets, FxPro allows trading in CFDs on leading company shares. Traders can speculate on the rise or fall of shares without owning the underlying asset. This enables participation in corporate earnings seasons and market trends, while trading conditions emphasize transparency and competitive pricing.

Trade responsibly. Trading CFDs involves risk of loss.

Cryptocurrencies

FxPro supports CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This allows traders to explore the volatility and growth opportunities within the crypto market. Without owning digital wallets, users can trade with leveraged positions and reliable execution speed, making it an attractive option for crypto enthusiasts.

Indices

Indices CFDs on FxPro cover major market benchmarks, such as the S&P 500, FTSE 100, and Nikkei 225. Trading indices enables users to speculate on the movement of broader market trends instead of single assets. These products offer exposure to economic developments across regional and global markets, supported by cost-effective spreads.

Metals

Precious metals, including gold, silver, and platinum, are among FxPro’s tradable assets. Often viewed as safe havens during economic uncertainty, metals offer traders a way to hedge against inflation and diversify portfolios. FxPro’s platform allows for low-margin trades in metal CFDs, fostering efficient access to the commodity market.

Energy

Energy products feature prominently on FxPro, with CFDs available on crude oil, natural gas, and other energy resources. These volatile markets provide significant opportunities to speculate on international supply-demand trends, geopolitical events, and emerging energy market dynamics. Low spreads and quick trade executions add efficiency to energy trading.

ETFs

Exchange Traded Funds (ETFs) allow traders to diversify within a single product by tracking a collection of assets. FxPro’s ETF CFDs cover sectors like technology, healthcare, and financials. This diversity empowers traders to balance risk across industries and regions with accessible trading conditions.

Trade responsibly. Trading CFDs involves risk of loss.

Futures

FxPro also supports futures CFDs, enabling users to trade on the expected future pricing of select asset classes. This includes commodity, index, and financial futures. Futures CFDs offer exposure to scheduled global market movements and trends often linked to macroeconomic developments, giving traders additional flexibility in their strategies.

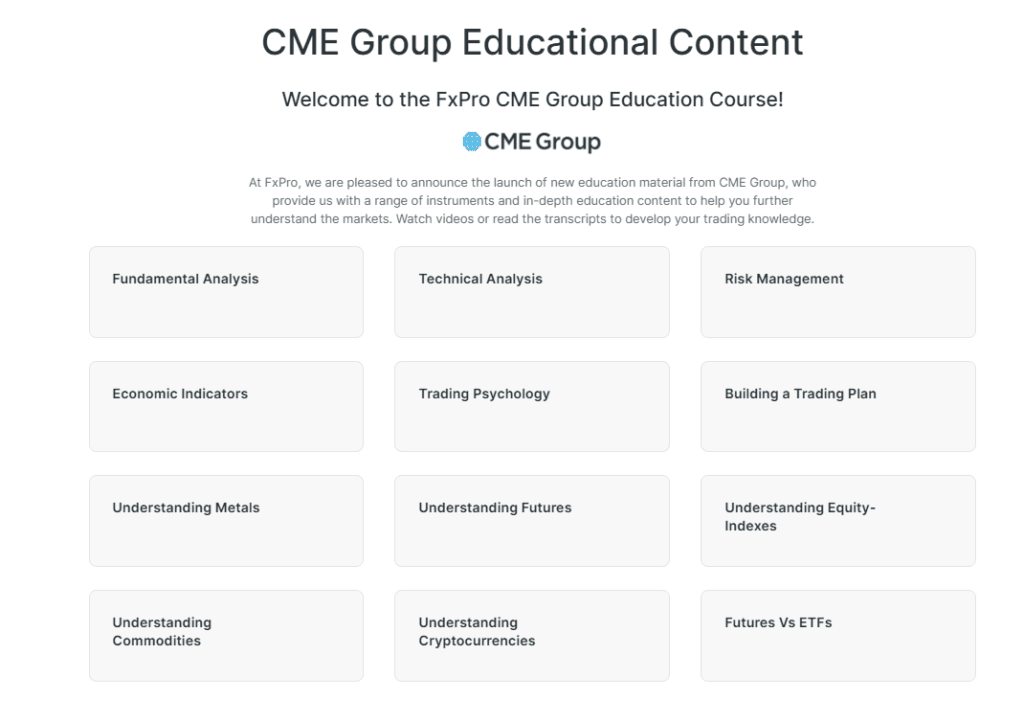

FxPro Education Section

FxPro’s educational offerings are anchored by their comprehensive Knowledge Hub, packed with informative articles on trading basics, fundamental analysis, technical analysis, and more. These resources are designed to introduce beginners to core market concepts while offering deeper insights for experienced traders, helping them refine strategies and stay informed about market trends.

Additionally, FxPro hosts webinars featuring industry experts who share valuable knowledge on market dynamics, trading strategies, and practical tips. These interactive sessions allow participants to ask questions and engage directly with professionals, making them a valuable tool for enhancing trading skills. Together, FxPro’s resources create a robust learning platform for traders of all levels.

FxPro Customer Support

FxPro offers 24/5 multilingual customer service, accessible through live chat, email, and phone. The team is knowledgeable and prompt, assisting with account setup, troubleshooting platforms, and clarifying fees. This ensures traders receive the support they need to focus on their strategies without disruption.

Trade responsibly. Trading CFDs involves risk of loss.

FxPro Markets Pros and Cons

Pros:

- Over 2,100 CFD instruments spanning diverse classes, including forex and crypto.

- Low stop-limit levels from 0 pips on cTrader and 1 pip on MT4/5.

- Lightning-fast trade execution within 12 milliseconds.

- Negative balance protection to minimize unexpected losses.

- Award-winning technology and 24/5 multilingual customer support.

Cons:

- The fee structure may appear complex to new traders.

- Access to exclusive account features may require higher deposit thresholds.

Conclusion

FxPro delivers a robust, regulated trading environment with diverse instruments and top-notch platforms. Its competitive fees, fast execution, and user-oriented features make it a strong contender for traders worldwide. While advanced accounts offer added perks, FxPro retains accessibility for beginners. The blend of technology and safety ensures an attractive trading experience for retail and professional users alike.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.