Traders brace for a significant event as Federal Reserve Chairman Jerome Powell prepares to deliver a closely-watched speech. The investment community is on high alert, with the forex and commodities markets reflecting a cautious sentiment. Here’s what’s happening in the financial sphere as market participants await key economic insights.

Preamble to Powell’s Address

Dollar’s Dominance Amid Economic Optimism

Despite a turbulent economic environment, market trends have shown a persistent allure towards the US dollar, buoyed by recent better-than-expected macroeconomic data. Just last week, the Consumer Price Index (CPI) delivered a surprise with figures surpassing forecasts, further cementing the dollar’s supremacy while casting doubt on the urgency for interest rate cuts.

The Forex Front

EUR/USD Steadies but Shadows Loom

EUR/USD maintains its grip above the 1.0600 threshold early Tuesday in Europe after plunging to five-month nadirs. The pair finds temporary reprieve in the wake of muted US Treasury bond yields, although signs of recovery are tempered by the resurgent dollar, fueled by risk-off investor behaviors. Traders are now fixating on Germany’s ZEW survey outcomes and the potential ripples from Powell’s impending discourse.

EURUSD Daily Chart

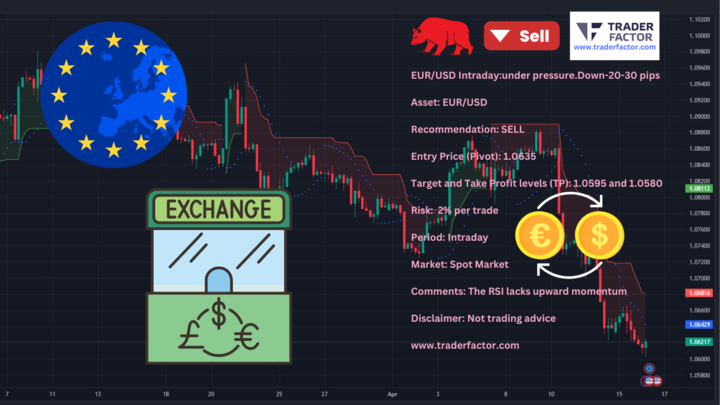

EURUSD Intraday Update

In the latest developments, the EUR/USD asset is experiencing downward pressure, with a decrease of 20-30 pips. Analysts are recommending a SELL position for traders eyeing potential opportunities in this volatile market.

Here are the key details for this trade:

- Asset: EUR/USD

- Entry Price (Pivot): 1.0635

- Target and Take Profit levels (TP): 1.0595 and 1.0580

- Risk: 2% per trade

- Period: Intraday

- Market: Spot Market

Notably, the Relative Strength Index (RSI) indicates a lack of upward momentum, signaling a potential downward trend in the near term. Traders are advised to carefully consider these factors before making their trading decisions.

Sterling Stalls Despite Attempted Rally

GBP/USD’s efforts to commandeer a significant foothold above 1.2500 have been thwarted by a broad-based hegemony of the US dollar following the release of upbeat US retail sales figures. This burgeoning dollar rally renders sterling’s gains lackluster, as the aura of a robust US economy casts long shadows over its peer currencies.

Here are the specifics for this trade opportunity:

- Asset: GBP/USD

- Entry Price (Pivot): 1.2465

- Target and Take Profit levels (TP): 1.2400 and 1.2375

- Risk: 2% per trade

- Period: Intraday

- Market: Spot Market

The GBP/USD asset is observed to be in a phase of consolidation, with a decline ranging between 35-60 pips. Traders are being advised to consider a SELL position based on market analysis and trends.

Glittering Expectations for Gold

Will Gold Breach the $2,400 Benchmark?

Gold holds below the crucial $2,400 barrier as investors retreat to safer assets, despite the easing of Middle Eastern tensions and a consolidated rebound driven by hopes of dovish turns in Fed policy. The precious metal girds itself for another surge, backed by promising technical indicators, yet the looming shadow of Powell’s speech and robust US economic data play into investors’ calculations.

Asia Reflects Worry, Weighing on Gold

The Asian markets mirror a distinctly somber mood, with traders contemplating the possibility of delayed rate cuts by the Fed in light of substantial US Retail Sales announcements. These forecasts show increased probabilities for static interest rates well into the latter part of the year, strengthening the dollar narrative while undermining equities.

Looking Through a Macro Lens

China’s Mixed Economic Signals

Compounding the global unease are signals from China, where despite exceeding GDP growth expectations for the first quarter, reports indicate a disheartening performance in March’s retail sales and industrial output. China’s property market continues its struggle, translating into a persistently rattled investor sentiment that inadvertently fans the flames of USD appreciation.

Fed Perspectives Lean Hawkish

San Francisco Fed President Mary Daly has been vocal in her hawkish stance, warning against rash policy actions where none are warranted. Her rhetoric has contributed to an already bulwarked dollar.

The Resilient Shine of Gold

Gold prices, curiously resilient in the face of a reinvigorated US dollar, draw strength from a pullback in Treasury yields. Market participants appear unphased by subdued geopolitical tensions, with buying interest in Gold remaining steadfast.

Final Thoughts Before the Cogent Address

The financial landscape hinges on Powell’s communication, with traders hanging on to every potential hint of direction for monetary policy. All eyes are fixed on his speech, which has the power to either solidify the existing market sentiments or upend expectations. For now, market trends exhibit a guarded approach, with the dollar’s potency unabating and gold’s allure undiminished. The question on everyone’s mind remains – will Powell’s remarks chart a new course, or confirm the solid groundwork of a resilient US economy? Only time, and the coming address, will tell.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial Analyst and News Editor with qualifications in accounting and economics. She has over 20 years of banking and accounting experience, during which she has gained extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts