The US Dollar is still strong, while the commodity currencies are weak and the Bank of Japan still needs to defend the Japanese Yen.

The ongoing stock market bear market, which saw the benchmark S&P 500 Index and the NASDAQ 100 end the week at close to 2-year lows and exhibiting bearish momentum, dominated the news last week.

As Russia conducted a mock referendum on the issue of annexation in some of the occupied territories, attention has once again been drawn to the conflict in Ukraine.

The new Truss administration’s announcement of a mini budget, which included a proposal to implement the largest tax cuts since World War Two, made headlines in the UK over the past week.

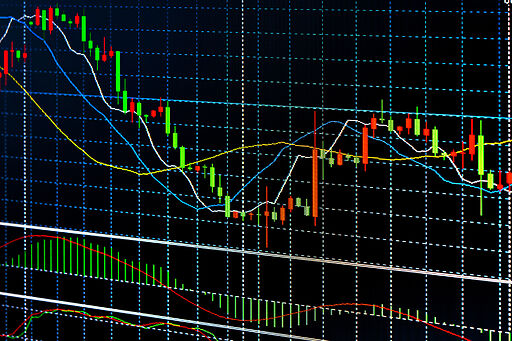

Therefore, it is a good idea to start the week by taking a broad view of what is happening in the market as a whole and how such developments are influenced by macroeconomic fundamentals, technical considerations, and market sentiment.

The market is currently experiencing some very strong trends that can be quickly and profitably exploited.

Fundamental Technical Analysis

Last week, the British pound, the euro, and the dollar all displayed relative strength on the forex market. The AUD, NZD, and CAD were the three weakest currencies.

Here is what to expect this week.

U.S. Dollar Index

The Dollar is still strong against some currencies, but it has lost ground to the British Pound and the Euro, which are rebounding after significant declines. The Dollar therefore still has a lot of strength, though not all of it is consistent.

A recent bearish inflection level confluent with 110.00 may have formed a new support level for the market.

Over the week, it might be wise to refrain from trading or to limit one’s attention to long positions in the US dollar. The strongest, longest-lasting bullish trend in the Forex market is currently occurring in the most significant currency.

GBP/USD

GBP/USD support levels should be closely watched, and the level of 1.10000 might act as a magnet. The idea is that tense circumstances will lead to more downward price action and a test of this mark may tempt bearish traders.

To use downward momentum as a potential launching pad for the currency pair, bullish traders may want to see a slight erosion from the GBP/current USD’s higher weekly range.

As long as economic clarity in the US and UK remains elusive, it seems likely that the GBP/USD will discover it needs to find equilibrium in a new price range. The GBP/USD may be trading in a range between 1.08500 and 1.13100 levels in the near future.

NZD/USD

Since the coronavirus panic of May 2020, the NZD/USD currency pair printed a fairly large bearish candlestick last week, which caused the pair to trade at its lowest level ever.

The price is still within the range of $0.5450 to $0.5600, which could be very supportive as it served as a strong inflection point in 2020, so the technical picture is not entirely bearish despite the bearish overall outlook.

It’s interesting to note that despite the NZD’s relatively high interest rate, it is still on the verge of hitting new record lows. It is obvious that this currency is weak.

USD/JPY

This week, it’s important to keep an eye on this currency pair as the US Dollar continues to gain strength while losing ground to the British Pound and the Euro. The price chart below demonstrates the strong long-term bullish trend that this pair is in.

The Bank of Japan has intervened at this level to halt any further advances, which is a problem for bulls because it does not want the price to rise above the 145 handle. But it appears that the price will attempt to rise this week, raising the question of whether the Bank of Japan can do so if they choose to.

EUR/USD

On Friday, the EUR/USD pair reached 0.9853 before dropping. It reaches a low of roughly 0.9790, well below the 38.2% retracement of the 1.0197/0.9535 slide.

Technical readings indicate that the EUR/USD has only just started to recover from extremely oversold conditions. The RSI is at 29, but the indicators are mostly flat and continue to be at extreme levels.

In the meantime, the 20 SMA continues to run parallel to a descending trend line that originates from this year’s high of 1.1494 and maintains its firmly bearish slope far above the current level. In the coming days, the trend line will act as resistance at about 1.0070.

Other Upcoming Market News

Given the number of significant data releases scheduled this week compared to the previous week’s lack of any, the markets are likely to experience continued high levels of volatility. The releases due this week include:

- US Non-Farm Employment Change, Unemployment Rate, Average Hourly Earnings

- US ADP Non-Farm Employment Change Forecast

- Swiss CPI (inflation)

- US ISM Services PMI data

- US ISM Manufacturing PMI data

- RBA Cash Rate & Rate Statement

- RBNZ Official Cash Rate & Rate Statement

- US JOLTS Job Openings

- OPEC Meetings

- Canadian Unemployment Rate & Employment Change

Otherwise, in Germany and Australia markets will be closed on Monday, October 3rd for a public holiday while in China, the entire week is a public holiday.

US ISM Manufacturing PMI Data

The ISM manufacturing index, which is due later today, is unlikely to dampen the growing confidence about the US economy, which has been fueled by good economic data revealed in recent weeks. While projections suggest a slowdown to 52.1 in September from 52.8 in August, this should be supported by improved supply chains, while new orders should remain positive.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts