Eightcap is a globally recognized Forex and CFD broker, lauded for its commitment to delivering excellence in trading services. Offering competitive low spreads and access to advanced platforms like MetaTrader 4, MetaTrader 5, and TradingView. Eightcap caters to the needs of both beginner and seasoned traders. Its innovative tools, including FlashTrader for swift order execution and Capitalise.ai for code-free strategy automation, amplify trading efficiency. EightCap Broker Review:

Known for its transparency and exceptional customer support, the broker provides a reliable environment for market engagement. With accolades such as industry awards and consistently high reviews, Eightcap continues to solidify its position as a trusted trading partner. Below is a balanced review of Eightcap based on its key features, strengths, and areas for improvement.

Table of Contents

ToggleEightCap’s Regulation and Safety

Eightcap is licensed and regulated by reputable financial authorities, ensuring adherence to international regulatory standards. With licenses from these prominent entities, Eightcap upholds its commitment to providing a secure, regulated, and trustworthy environment for global trading activities.

The broker operates with transparency and accountability across multiple jurisdictions, including:

- Australian Securities and Investments Commission (ASIC) – Regulation in Australia under license number 391441.

- Financial Conduct Authority (FCA) – Authorized in the United Kingdom under FRN 921296.

- Securities Commission of the Bahamas (SCB) – Compliance in the Bahamas under license number SIA-F220.

- Cyprus Securities and Exchange Commission (CySEC) – Authorised within the European Economic Area (EEA).

- Seychelles Financial Services Authority (SYC) – Eightcap International Ltd (registration number 8427413-1) is regulated by the Seychelles Financial Services Authority (FSA SD100)

EightCap Trading Platforms and Tools

Eightcap offers a comprehensive suite of cutting-edge trading platforms and tools designed to meet the diverse needs of modern traders. Below is an overview of the platforms and tools provided by Eightcap, along with their features and benefits.

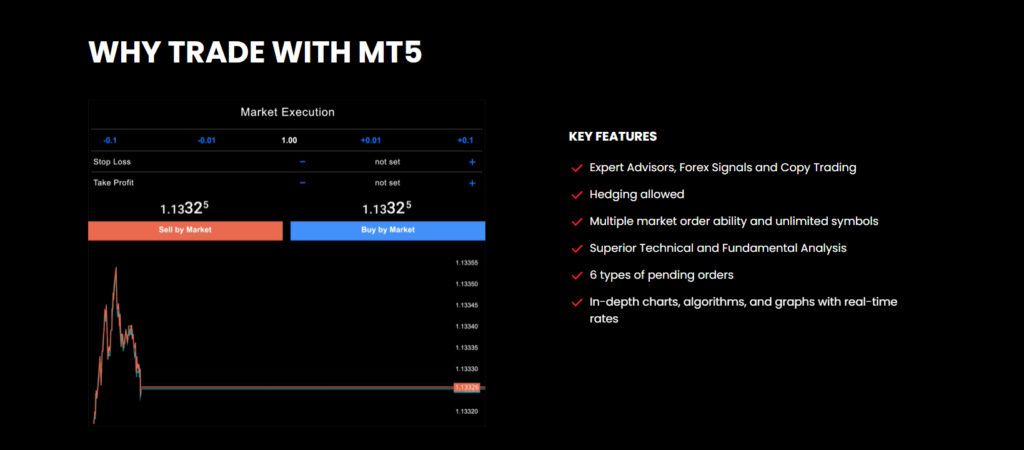

MetaTrader 5

MetaTrader 5 (MT5) is a powerful and versatile trading platform designed for advanced trading strategies. It features enhanced charting capabilities, multiple timeframes, and a wide range of analytical tools. MT5 also supports extensive trading automation through Expert Advisors (EAs) and offers access to a broader range of asset classes, including Forex, CFDs, and more. With faster processing and advanced risk management options, MetaTrader 5 is ideal for experienced traders looking to refine their strategies.

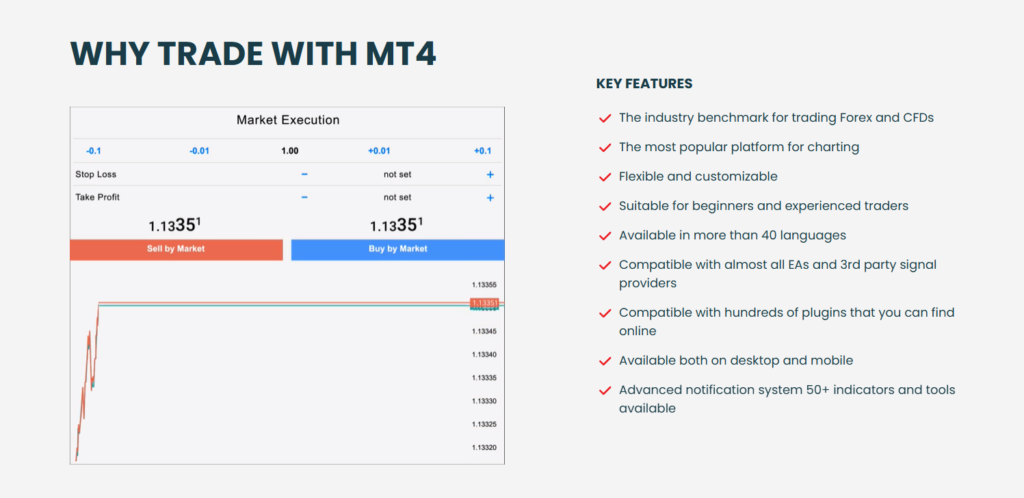

MetaTrader 4

MetaTrader 4 (MT4) remains a trusted platform for traders worldwide due to its intuitive interface and robust capabilities. With customizable charts, technical indicators, and support for automated trading via Expert Advisors, MT4 empowers both novice and seasoned traders. Its widespread adoption ensures seamless access to resources, tools, and expert advice for optimizing trading operations.

TradingView

TradingView integration enables traders to execute trades directly from its advanced charting tools. The platform offers a social trading aspect, allowing users to share insights and strategies with a global community of traders. TradingView is known for its in-depth market analysis capabilities and user-friendly interface, making it a popular choice for technical analysts.

MT4 Live/Demo WebTrader

The MT4 Live and Demo WebTrader offers traders flexibility and convenience by allowing access to the trading platform directly through a web browser. With no software download required, traders can efficiently manage their trades, analyze markets, and execute positions while on the go. The demo version is especially useful for beginners seeking to develop and practice their trading skills risk-free.

MT5 Live WebTrader

Designed for traders who prefer advanced capabilities without the need for software installation, the MT5 Live WebTrader delivers the sophistication of MetaTrader 5 within a browser-based format. Users gain access to advanced analytical tools, trading automation, and multi-asset trading while benefiting from seamless real-time execution.

MT5 Demo WebTrader

The MT5 Demo WebTrader is perfect for traders aiming to explore the advanced features of MetaTrader 5 in a risk-free environment. This browser-based platform offers the same high-quality tools and functionalities of the live version, making it ideal for testing new strategies or gaining confidence in trading.

Other Tools

AI-powered Economic Calendar

The AI-powered Economic Calendar from Eightcap provides traders with comprehensive insights into macroeconomic events and their historical market impact. By synthesizing big data and sentiment analysis, this tool simplifies market decisions, helping traders anticipate movements effectively. Ideal for both day traders and swing traders, the economic calendar bridges the gap between data and actionable insights.

Capitalise.ai

Capitalise.ai offers a code-free solution for creating, testing, and automating trading strategies in plain language. This innovative tool empowers traders by simplifying complex algorithmic trading processes, giving them the ability to refine strategies with ease. It is especially valuable for traders who wish to automate trading without needing technical or programming expertise.

FlashTrader

FlashTrader is a specialized tool designed to streamline order execution. With the ability to calculate position sizes, set stops and limits, and execute trades rapidly, FlashTrader is tailored for traders who prioritize speed and precision in fast-moving markets. Its user-friendly interface ensures minimal effort for efficient, multi-tasking trade management.

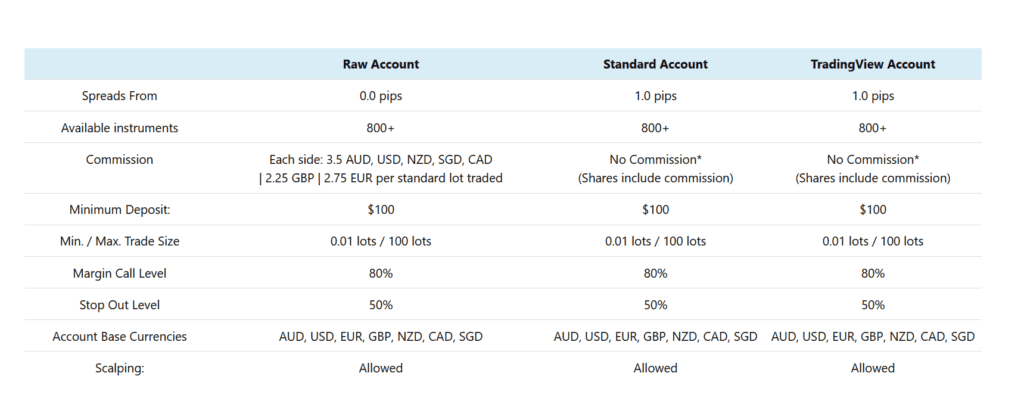

EightCap Account Types and Fees

Eightcap provides traders with three distinct account types, each tailored to meet varied trading preferences and expertise levels. By offering transparent fee structures and flexible trading conditions, Eightcap ensures an inclusive and reliable trading experience. Below is an overview of the available accounts and associated fees.

Raw Account

The Raw Account is ideal for traders focused on forex CFDs or high-frequency strategies requiring optimal pricing. The Raw Account provides institutional-grade pricing, appealing to experienced traders and scalpers who demand tight spreads and efficient execution.

Key features include:

- Spreads: Starting as low as 0.0 pips.

- Commission: $3.50 per side per standard lot traded (or equivalent in other currencies).

- Minimum Deposit: $100, ensuring accessibility for most traders.

- Minimum/Maximum Trade Size: 0.01 lots to 100 lots.

- Margin Call Level: 80%.

- Stop-Out Level: 50%.

Standard Account

The Standard Account serves as a straightforward, commission-free option for beginner and intermediate traders. This account type is well-suited for those looking for simplicity and cost-effective trading without worrying about commission fees.

Key features include:

- Spreads: Starting from 1.0 pips.

- Commission: No commission on trades (except for shares, which include additional charges).

- Minimum Deposit: $100, making it accessible for newer traders.

- Minimum/Maximum Trade Size: 0.01 lots to 100 lots.

- Margin Call Level: 80%.

- Stop-Out Level: 50%.

TradingView Account

For traders seeking sophisticated charting tools and a professional trading experience, the TradingView Account offers advanced functionality alongside Eightcap’s competitive conditions. This account connects users to the world’s largest trading network, providing proprietary charting, Pine Script language access, webinars, and custom indicators for a dynamic trading approach.

Key features include:

- Spreads: Starting from 1.0 pips.

- Commission: No commission on trades (except for shares).

- Minimum Deposit: $100.

- Minimum/Maximum Trade Size: 0.01 lots to 100 lots.

- Margin Call Level: 80%.

- Stop-Out Level: 50%.

Additional Conditions and Features

- Account Base Currencies: Available in AUD, USD, EUR, GBP, NZD, CAD, and SGD.

- Scalping and Algorithmic Trading: Fully supported on all account types, offering flexibility for diverse strategies.

- Demo Accounts: Traders can also explore risk-free demo accounts to practice strategies or test platform features.

EightCap Instruments and Markets

Eightcap offers an extensive range of over 800 CFDs, providing traders with access to a diverse selection of instruments across key financial markets. Its lineup includes forex, indices, commodities, shares, and a standout offering of over 250 cryptocurrency CFDs.

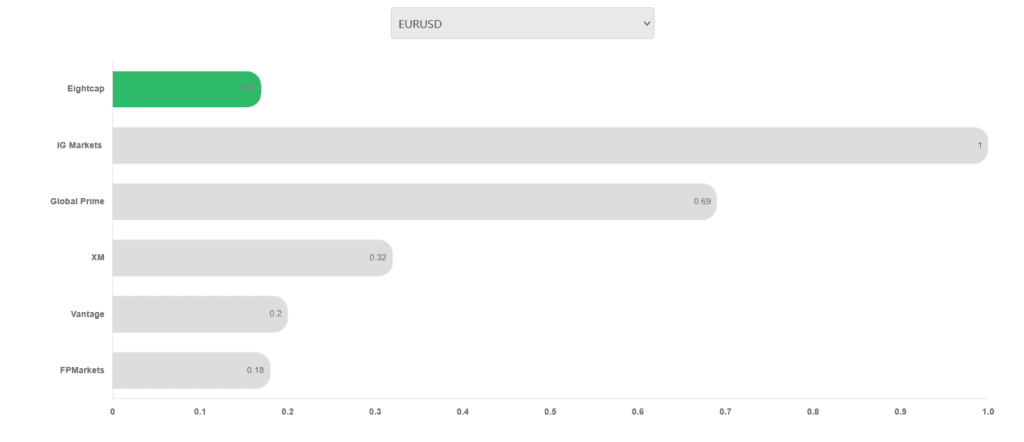

Forex

With 56 currency pairs, Eightcap ensures ample opportunities for those trading the forex market. Major, minor, and exotic pairs are all available, catering to traders with different levels of expertise and strategic preferences. This makes Eightcap a solid choice for forex enthusiasts who value low-latency execution and competitive spreads.

Indices

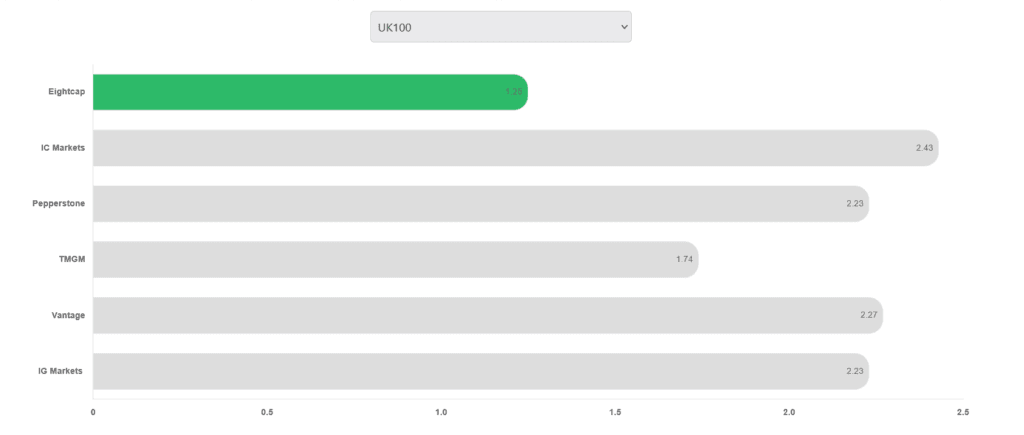

Traders looking to capitalize on global market fluctuations can access major indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 40. These index CFDs are ideal for diversifying trading approaches and allow traders to speculate on the performance of entire markets rather than individual assets.

Commodities

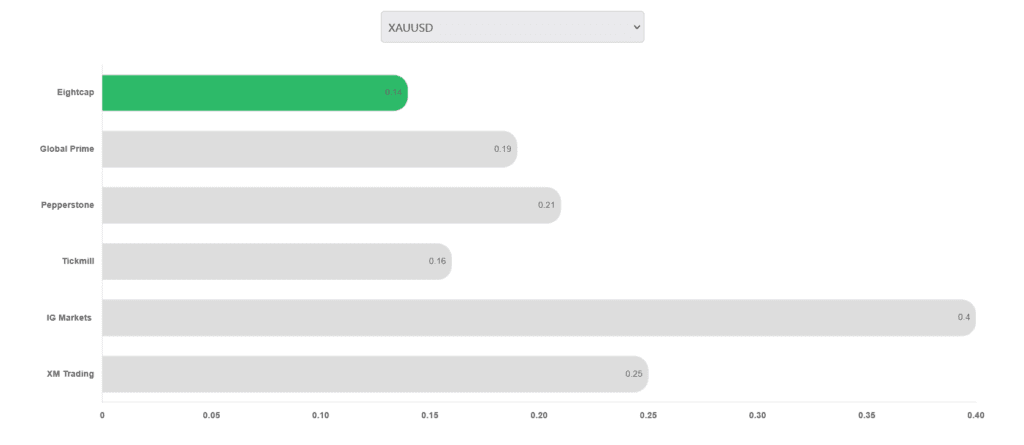

Commodities trading options include gold, silver, crude oil, and natural gas. These instruments provide a hedge against market uncertainty or can complement broader trading strategies for those looking to tap into energy and precious metals markets.

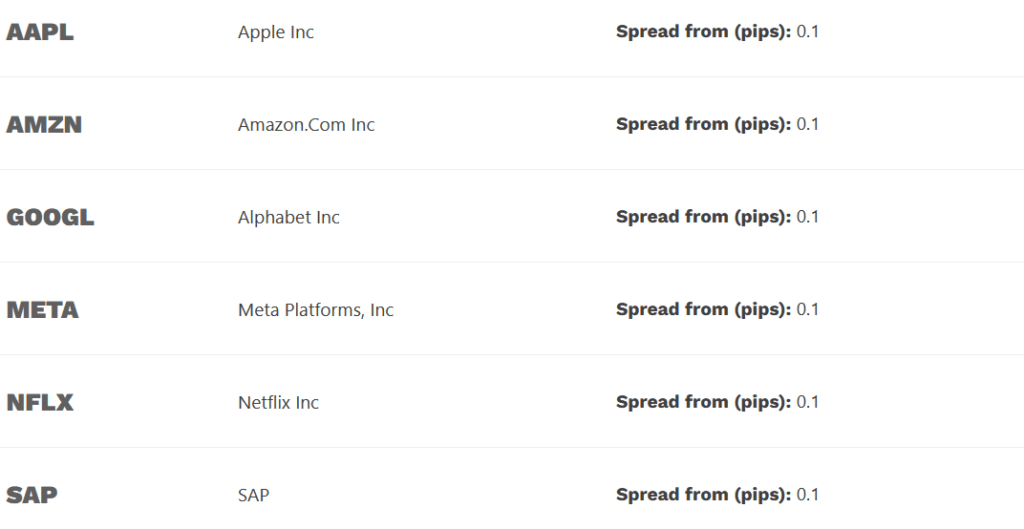

Shares

The platform provides CFDs on individual shares from globally recognized companies. This allows traders to speculate on the price movement of top-performing stocks in industries like technology, banking, and retail. However, as these are CFDs, traders are not purchasing the actual shares, which is an important distinction for those seeking ownership.

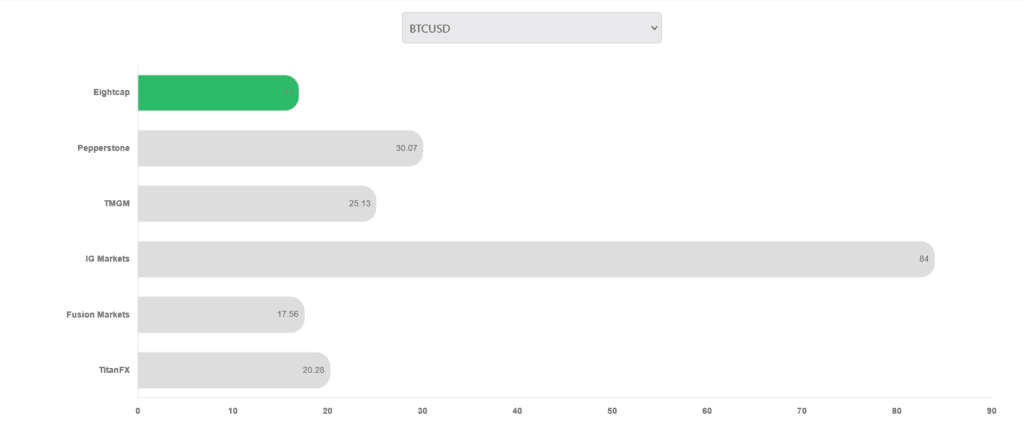

Cryptocurrencies

Eightcap truly excels in its cryptocurrency offering, boasting over 250 cryptocurrency CFDs. This makes it one of the most extensive selections in the industry. Popular assets like Bitcoin, Ethereum, and Litecoin are included, alongside a broad range of altcoins. Whether it’s long-established coins or newly emerging tokens, the variety empowers traders to explore various crypto markets with ease. For traders focused on the highly dynamic and volatile crypto space, this extensive offering is a significant advantage.

EightCap Leverage

Eightcap offers flexible leverage options designed to accommodate a wide range of trading strategies and risk tolerances. With maximum leverage reaching up to 500:1, traders can amplify their market exposure significantly, providing opportunities for both substantial returns and potential risks.

Leverage levels at Eightcap vary depending on the asset class being traded. This tiered approach ensures that traders operate within leverage parameters suited to the characteristics of each asset class.

- Forex: Maximum leverage of 500:1 allows traders to control large positions with relatively small capital outlays, making forex trading highly accessible and potentially profitable.

- Commodities and Indices: Moderated leverage levels are provided to account for the unique volatility and trading conditions of these markets, offering a balance between opportunity and risk.

- Shares and Cryptocurrencies: Leverage is comparatively lower for these instruments to mitigate risks associated with their inherent price volatility and market dynamics.

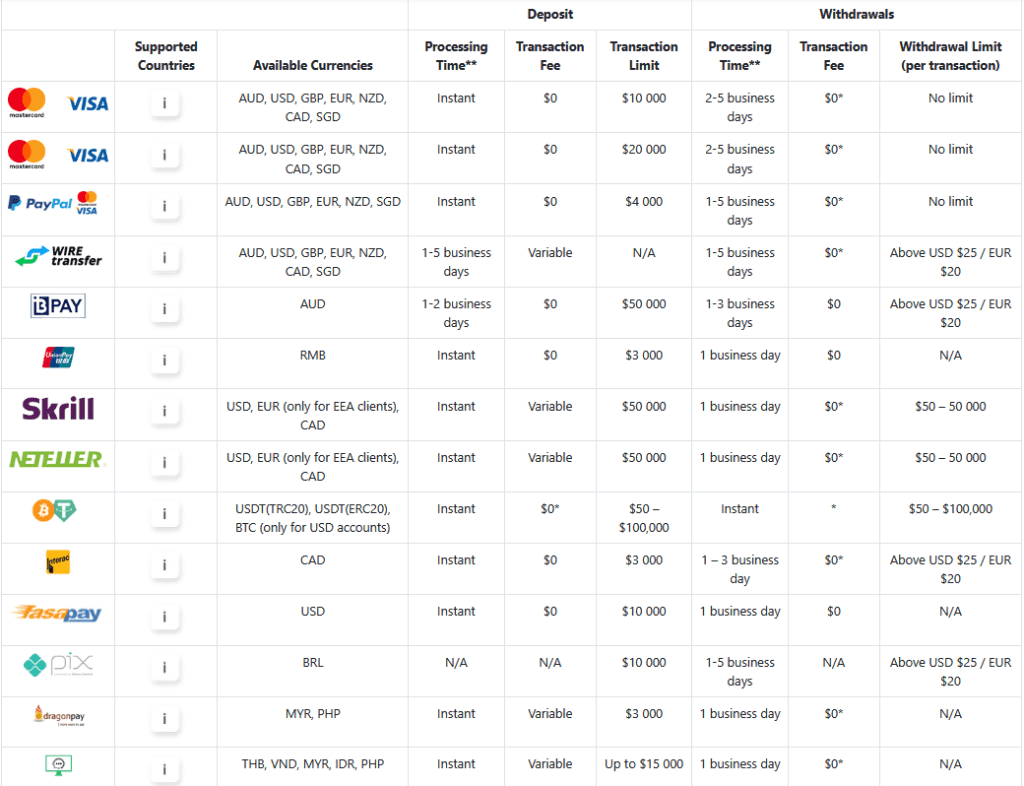

EightCap Deposits and Withdrawals

Eightcap provides a convenient and flexible payments system, accommodating a variety of deposit and withdrawal methods to cater to a global clientele. The platform supports widely used payment options, including credit and debit cards, bank transfers, Skrill, Neteller, PayPal, and even cryptocurrency payments in certain regions. This diverse range ensures that traders have accessible and convenient options suited to their specific needs.

Deposit Process

Deposits at Eightcap are designed with accessibility in mind, featuring a low minimum deposit requirement of $100. This entry-level amount is ideal for beginner traders testing the waters and experienced traders looking for a cost-efficient broker. The funding process is streamlined and straightforward, with deposits processed almost instantly through most payment methods. This efficiency minimizes downtime, allowing traders to quickly begin trading on account setup.

Withdrawal Process

Eightcap stands out with its policy of free withdrawals, a significant advantage compared to competitors who impose fees on transactions. However, while withdrawals are cost-free, the processing times for fund transfers can be inconsistent. Some users have reported delays and dissatisfaction with vague communication from the finance team during these periods. This could be an area for improvement to align Eightcap’s withdrawal process with its industry-leading deposit experience.

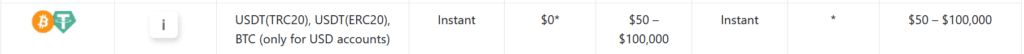

Cryptocurrency Payment Option

The availability of cryptocurrency payments in select regions is particularly appealing to modern, tech-savvy traders who value fast and secure transactions.

This payment option complements the platform’s strong emphasis on cryptocurrency trading, creating a seamless ecosystem for crypto-focused clients.

EightCap Educational Resources and Research Tools

Eightcap demonstrates its commitment to trader education and empowerment through its educational platform, Eightcap Labs. The platform offers nearly 300 articles, eBooks, and informative videos covering a wide spectrum of trading topics. These resources guide traders from foundational concepts like forex basics to more complex subjects such as technical analysis and risk management. Whether you’re a beginner trying to understand market dynamics or a seasoned trader perfecting advanced strategies, Eightcap Labs offers valuable insights.

Webinars and Tutorials

Supplementing its library of self-paced materials, Eightcap provides webinars and tutorials designed to enhance learning through interaction. These live and recorded sessions cater to a range of skill levels, introducing traders to practical tips, market insights, and expert perspectives. While effective, the frequency and variety of webinars may fall short compared to the richer offerings of top-tier brokers such as IG or Saxo, who provide specialized, in-depth training sessions.

Research Tools

Eightcap also equips traders with useful research tools to support informed trading decisions. Acuity’s AI-powered economic calendar is one of its standout offerings, providing real-time insights into major market events. Additionally, daily trade ideas present actionable opportunities, helping traders identify potential market moves. While valuable, these tools are not as exhaustive as the research suites offered by higher-tier brokers. Competitors frequently integrate extensive backtesting tools, advanced charting systems, and proprietary market analytics, giving them an edge for data-driven traders.

Customer Support

Support is available 24/7 via live chat, email, and phone, with multilingual options in 10 languages. Users generally report fast responses for general inquiries, often under a minute via live chat, and dedicated account managers enhance the experience. However, some traders have noted delays in resolving complex issues, like leverage changes or withdrawals, and occasional complaints about unresponsive email support.

Pros and Cons of EightCap

The Pros and Cons section helps you get a clear understanding of Eightcap’s strengths and weaknesses. It’s designed to guide you in deciding whether the platform aligns with your trading goals and preferences.

Pros

- Regulated by ASIC, FCA, and CySEC for high security.

- Competitive spreads (from 0.0 pips on Raw account) and low fees.

- Extensive crypto CFD offering (250+).

- Advanced tools like Capitalise.ai, FlashTrader, and TradingView integration.

- No withdrawal or inactivity fees.

Cons

- Limited market range (no real stocks or ETFs).

- The $100 minimum deposit may limit some retail traders.

Conclusion

Eightcap offers a well-rounded platform with diverse account types, extensive cryptocurrency trading options, and flexible deposit methods that cater to a variety of traders. However, issues like inconsistent withdrawal processing and limited educational resources could impact your overall experience. If you’re a crypto or forex trader, the platform’s strengths may outweigh its downsides. Take the time to evaluate your trading goals and priorities to decide if Eightcap provides the right balance of features and functionality for your trading needs.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.