Job Openings in June

According to the latest Job Openings and Labor Turnover Survey (JOLTS) by the US Bureau of Labor Statistics (BLS), there were 9.58 million job openings on the last business day of June. This figure is slightly lower than the market forecast of 9.62 million and follows May’s 9.82 million openings.

Decrease in Hires and Total Separations

The BLS also reported a decrease in hires (5.9 million) and total separations (5.6 million) over the month. Within separations, quits decreased to 3.8 million, while layoffs and discharges remained relatively unchanged at 1.5 million.

Market Reaction and US Dollar Index

The market reacted to this data by causing a modest retreat in the US Dollar Index (DXY), which had reached a multi-week high of 102.43. As of now, DXY is still up 0.35% on the day at 102.22.

Gradual Deceleration in Labor Demand

A decline in job vacancies and workforce reductions both signify a gradual deceleration in labor demand, aligning with the Federal Reserve’s desired outcome. Notably, companies continue to retain employees, indicating that the unemployment rate is unlikely to surge in the foreseeable future.

Importance for the Federal Reserve

The JOLTS report holds significant importance for the Federal Reserve as it considers its next moves after implementing a total of 5.25 percentage points in interest rate hikes since March 2022.

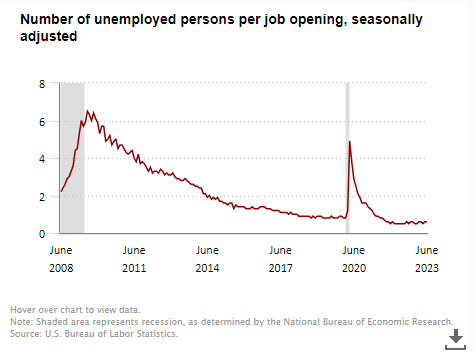

Decrease in Job Openings Compared to Prior Year

In June, job openings witnessed a noteworthy decrease of nearly 1.4 million, or 12.6%, compared to the same period in the prior year. According to data from the Labor Department, there are now approximately 1.6 job vacancies for every available worker.

Sector-Specific Job Openings

While healthcare, social assistance, and state and local government (excluding education) observed increased job openings, transportation, warehousing, utilities, and state and local government education experienced declines.

Manufacturing Sector in Contraction

Another report emphasizes that the manufacturing sector, which encountered reduced job vacancies and hires in June, remains in contraction as of July. The ISM Manufacturing Index’s reading of 46.4 reflects the proportion of companies reporting contraction, with a level below 50 indicating contraction.

Shift from Goods to Services Consumption

Although the decline in manufacturing employment may not have a significant impact on overall payrolls, the ISM report sheds light on a shift from goods to services consumption in the ongoing recovery from the Covid pandemic.

Upcoming Reports for Economic Outlook

Analysts will look to several upcoming reports throughout the week, including the ADP private sector employment release on Wednesday, weekly jobless claims on Thursday, and the crucial nonfarm payrolls report on Friday, to acquire a comprehensive economic outlook. It is anticipated that the July jobs report will indicate growth of 200,000, slightly lower than June’s 209,000, with the unemployment rate remaining stable at 3.6%.

Source:

Footnotes

The JOLTS report, or Job Openings and Labor Turnover Survey, provides valuable insights into the US labor market and is closely monitored by traders and investors. Here are the answers to 10 frequently asked questions about the JOLTS report:

What is the JOLTS report?

The JOLTS report is a monthly survey conducted by the US Bureau of Labor Statistics (BLS) that measures job openings, hires, separations, and other labor market indicators. It provides a comprehensive view of the state of employment in the US.

When is the JOLTS report released?

The JOLTS report is typically released on the first business day of each month. Traders and investors eagerly await its release as it provides fresh data on the state of the labor market.

How often is the JOLTS report released?

The JOLTS report is released on a monthly basis, allowing traders to track changes and trends in the labor market over time.

What is the significance of the JOLTS report for traders and investors?

The JOLTS report is a key indicator for traders and investors as it provides valuable information about the health of the economy and the labor market. It helps gauge the strength of job creation and labor demand, which can have a significant impact on currency values.

How does the JOLTS report impact currency markets?

The JOLTS report can influence currency markets in several ways. If the report shows a significant increase in job openings, it may indicate a strong economy, leading to increased investor confidence and potentially strengthening the currency. Conversely, if the report reveals a decline in job openings, it can signal economic weakness and lead to a weakening currency.

What kind of data is included in the JOLTS report?

The JOLTS report contains data on job openings, hires, separations, and the quit rate. It provides details on the industries with the highest job openings, the number of workers hired and leaving jobs voluntarily, and other valuable labor market information.

How does the JOLTS report differ from other economic indicators such as the gross domestic product (GDP)?

While the GDP measures the overall economic output of a country, the JOLTS report focuses specifically on the labor market. It provides more granular data on job openings, hires, and separations, offering insights into the dynamics of the job market.

What should traders be looking for in the JOLTS report?

Traders should pay attention to the overall trend in job openings, as well as the levels of hiring and separations. Additionally, analyzing sector-specific data can provide valuable insights into the strength of different industries and their potential impact on the economy.

How does the JOLTS report affect the stock market?

The JOLTS report can influence the stock market by affecting investor sentiment. Positive job market data can boost investor confidence, leading to increased stock market activity. Conversely, negative job market data can lead to a decline in investor confidence and potentially impact stock prices.

Can the JOLTS report be used to predict future economic trends?

While the JOLTS report provides valuable information about the current state of the labor market, it is not a definitive predictor of future economic trends. Traders and investors should consider other economic indicators and factors when making predictions about the future direction of the economy.

Are there any historical trends or patterns from past JOLTS reports that traders can analyze for insights?

Traders can analyze historical trends and patterns from past JOLTS reports to gain insights into the labor market’s behavior over time. By examining trends in job openings, hires, quits, and layoffs, traders can identify recurring patterns and make more informed decisions.

What are the key factors that can influence the JOLTS report and its impact on currency markets?

Several key factors can influence the JOLTS report and its impact on currency markets. Factors such as economic policies, interest rates, business confidence, and global events can all play a role in shaping the labor market and subsequently impacting the JOLTS report’s data.

How can traders interpret the JOLTS report in conjunction with other economic data for a comprehensive analysis?

Traders can interpret the JOLTS report in conjunction with other economic data to gain a more comprehensive analysis of the labor market and its potential impact on the economy. By considering indicators such as GDP, inflation rates, consumer spending, and manufacturing data, traders can form a more complete picture of the overall economic landscape.

Are there any experts or analysts who provide predictions or forecasts for the JOLTS report, and how accurate are these predictions historically?

Yes, there are experts and analysts who provide predictions and forecasts for the JOLTS report. These predictions are based on various factors and methodologies, including statistical models and economic analysis. While these predictions can provide valuable insights, it’s important to note that they may not always accurately predict the exact outcome of the report due to the inherent volatility and complexity of the labor market. Traders should use these predictions as one of many tools in their decision-making process.

What are the potential implications for currency markets if the JOLTS report deviates significantly from expectations?

If the JOLTS report deviates significantly from expectations, it can have a significant impact on currency markets. A positive surprise, such as a higher-than-expected number of job openings or hires, can strengthen the currency as it reflects a healthier labor market. Conversely, a negative surprise, such as lower-than-expected job openings or hires, can weaken the currency as it indicates potential economic weakness. Traders should closely monitor deviations from expectations to identify potential trading opportunities.

Read these next:

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Forex Breakout Strategy: A Guide for Profitable Trading

Forex Consolidation Breakout Strategies for Traders

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial News Editor with extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts SEO Editor