OANDA, founded in 1996, has become a trusted name in forex trading, delivering services in 196 countries. It’s renowned for its robust regulatory compliance, holding licenses from top-tier authorities. The platform offers a complete set of tools, including the OANDA Trade platform and MetaTrader 4, detailed forex calculators, and competitive leverage options. Traders can choose between standard and premium accounts, with no minimum deposit, making it accessible for newcomers and seasoned traders alike. Customer support is available 24/7, ensuring assistance is always at hand. Their commitment to transparency and trader education sets them apart, promising more insights as one explores deeper into their offerings.

Table of Contents

ToggleOANDA Company Overview

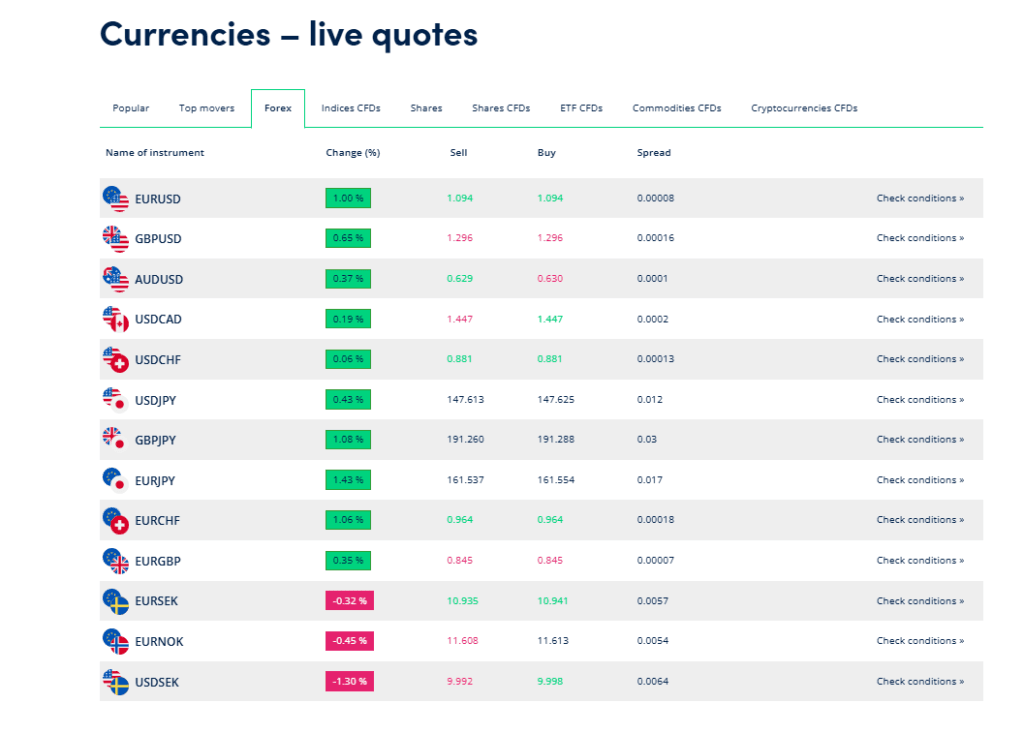

OANDA operates globally, offering trading services in 196 countries. Over the years, it garnered a positive reputation among users, reflected in its OANDA review Trustpilot scores. Traders frequently highlight its reliable regulation and competitive forex spreads. As a well-regulated broker, OANDA adheres to strict guidelines, enhancing traders’ trust and security. It’s regulated by several Tier-1 jurisdictions, guaranteeing a high level of oversight.

Potential traders will find OANDA’s broker minimum deposit appealing as it allows newcomers to enter the forex market without a significant initial investment. This accessibility is praised in many OANDA forex reviews, which often point out the platform’s user-friendly nature and the transparency of its fee structure.

Speaking of costs, OANDA’s forex spreads are competitive, which is important for traders looking to maximize their returns on each trade.

Regulatory Compliance and Safety

OANDA’s dedication to regulatory compliance and safety is evident as it holds licenses from multiple top-tier regulators globally. This robust regulatory framework makes it a safe choice, particularly for beginners wondering if OANDA is good for them. The broker’s establishment across various jurisdictions guarantees adherence to stringent financial standards, providing a secure trading environment.

For new traders, OANDA’s forex demo account is a significant asset, allowing them to practice trading without financial risk. This feature, combined with regulation in top-tier jurisdictions, reflects OANDA’s commitment to user safety and education.

Furthermore, OANDA’s status as a prop firm highlights its capability to manage substantial trading volumes and maintain liquidity, essential for executing large trades efficiently and securely.

OANDA Trading Platforms and Tools

While OANDA provides a variety of trading platforms, its flagship platform, OANDA Trade, stands out for its robust functionality and user-friendly interface. Traders can access a detailed oanda forex calculator, making it simple to plan and execute trades efficiently. The platform supports a wide range of oanda forex pairs, catering to traders looking for major, minor, or exotic options.

OANDA’s transparency in pricing is evident in its detailed disclosure of oanda forex fees, safeguarding traders from being surprised by hidden costs. Additionally, the platform facilitates trading across global markets by providing information on oanda forex market hours, which assists in strategizing entries and exits during peak liquidity times.

Moreover, OANDA offers competitive oanda forex leverage options, enabling traders to amplify their trading positions in the forex market. This feature is particularly valuable for those looking to maximize potential returns, while also considering the increased risk involved.

OANDA’s trading tools are designed to enhance the trading experience, providing users with valuable insights and assisting in decision-making processes. The integration of advanced charting tools and real-time data feeds ensures that OANDA’s clients are well-prepared to tackle the dynamic forex market.

OANDA Mobile

The OANDA Mobile app ensures that you never miss an opportunity by allowing you to trade on the go. It provides superfast execution and institutional-grade pricing directly from your smartphone.

The app is available for both iOS and Android devices, offering seamless access to your accounts and the ability to trade CFDs across various asset classes, including forex, commodities, indices, and cryptocurrencies. The app’s intuitive design allows for quick navigation and easy access to real-time market data, keeping you informed and in control at all times.

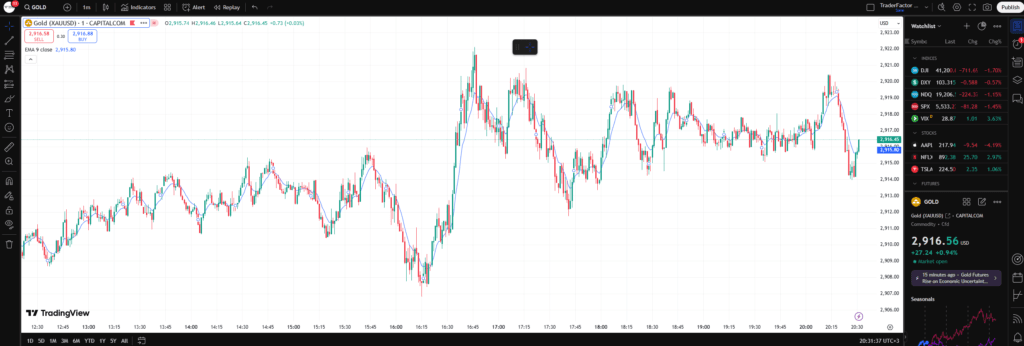

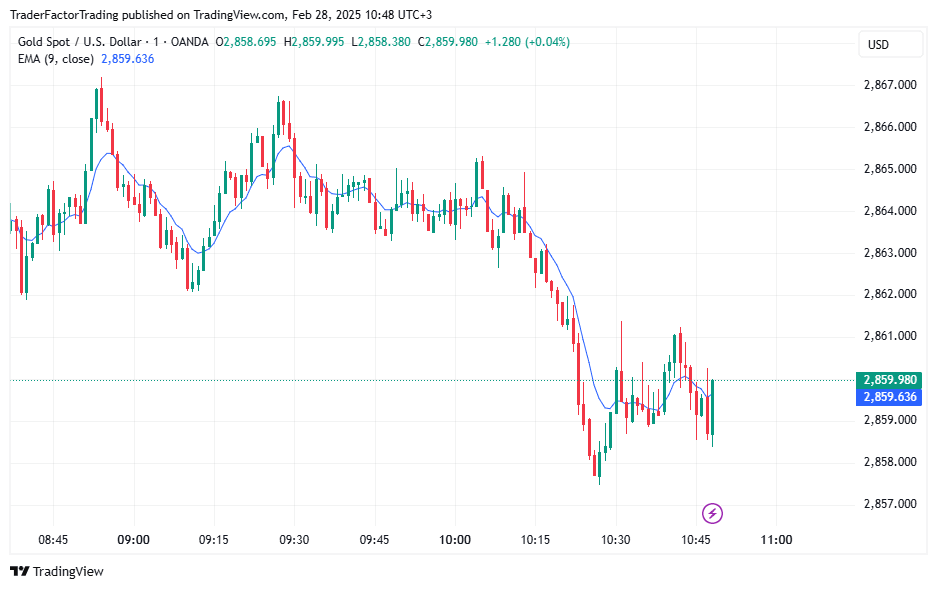

TradingView

OANDA integrates seamlessly with TradingView, allowing traders to execute trades directly from the TradingView interface. This integration provides access to TradingView’s extensive charting tools and social trading community, giving traders a unique blend of technical analysis capabilities and the insights of a global trading community.

By choosing OANDA as your preferred broker on TradingView, you can enjoy the benefits of tight spreads and fast execution, making it a powerful combination for traders who rely on detailed charting and collaborative trading strategies.

MetaTrader 5

MetaTrader 5 (MT5) is one of OANDA’s premier platforms, offering advanced trading capabilities and a suite of sophisticated tools. With MT5, traders gain access to powerful charting options, technical analysis tools, and automated trading features. OANDA enhances the MT5 experience with its best-in-class bridging technology and tier one bank pricing, delivering a superior trading environment.

Traders can also benefit from free custom risk management tools and proprietary indicators. The platform supports inbuilt signal alerts and copy trading, powered by the latest NLP technology, providing a comprehensive solution for both novice and experienced traders.

Depth of Market

OANDA’s Depth of Market feature provides traders with a clear view of market liquidity, showing the range of available prices and the volume of buy and sell orders at each price level.

This feature is critical for traders seeking to understand the supply and demand dynamics of the market, allowing them to make informed trading decisions. By using Depth of Market, traders can optimize their entry and exit strategies, ensuring they execute trades at the most favorable prices.

Technical Analysis

OANDA offers robust technical analysis tools that empower traders to make informed decisions by providing real-time market data and insights.

With features powered by AutoChartist, traders can easily identify patterns, trends, and key market levels, allowing them to optimize their trading strategies and enhance their market understanding.

MetaTrader Premium Tools

OANDA’s MetaTrader platform is enhanced with a suite of premium tools designed to elevate the trading experience. These tools include custom risk management EAs and proprietary indicators, providing traders with advanced capabilities for automated trading and strategic decision-making.

The platform’s integration of these tools ensures that traders have access to cutting-edge technology for improved performance.

VPS Partners

For traders seeking enhanced reliability and performance, OANDA partners with leading VPS providers.

These partnerships offer traders the benefit of running trading algorithms and strategies continuously, without interruptions due to local power failures or internet connectivity issues, ensuring that they can execute trades with greater efficiency and stability.

Learning Resources

OANDA is committed to supporting traders with comprehensive learning resources that cater to all levels of expertise. From webinars and video tutorials to detailed articles and guides, OANDA provides a wealth of educational content designed to enhance traders’ knowledge and skills.

These resources are invaluable for traders looking to deepen their understanding of market dynamics and refine their trading strategies.

Account Types and Specifications

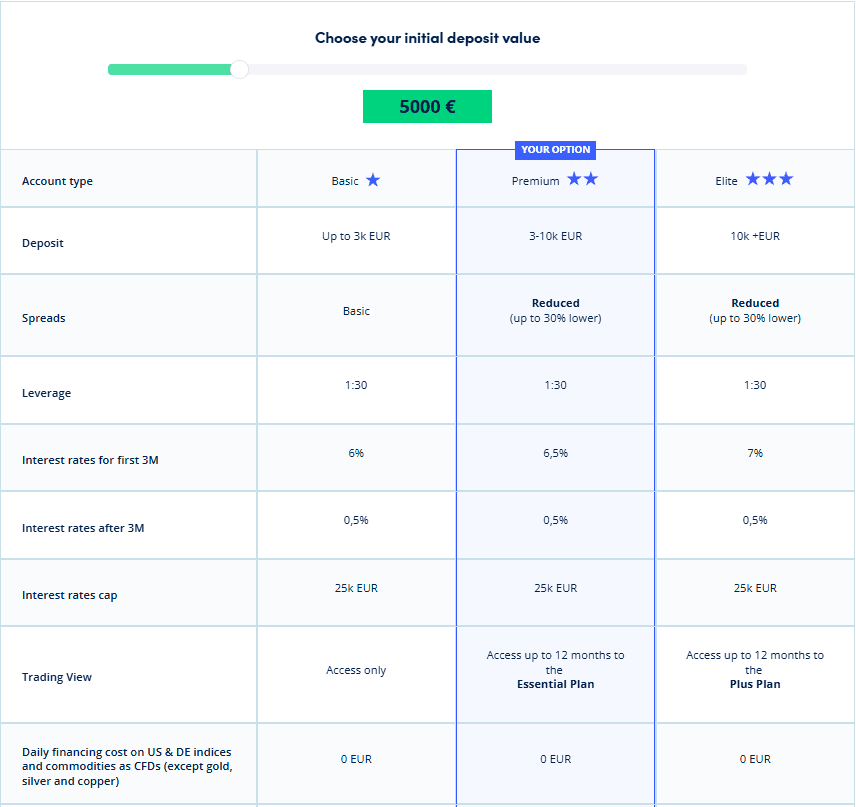

What types of trading accounts does OANDA offer? OANDA provides a variety of account options to cater to different trading preferences and needs. The primary oanda account types include Standard and Premium accounts, each designed with unique oanda account features and benefits to enhance a trader’s experience.

The Standard account is suited for casual and novice traders, offering access to all trading instruments without a commission, relying instead on OANDA’s spread. This account type is popular for its simplicity and ease of use, making it an excellent starting point for those new to forex and CFD trading.

OANDA Premium Trader account

The OANDA Premium Trader account is specifically designed for high-volume traders who seek enhanced benefits and services. This account offers a suite of exclusive features aimed at optimizing the trading experience. Traders can enjoy premium spreads or volume rebates, which provide cost-saving opportunities for those with large trading volumes. Additionally, the Premium Trader account includes a dedicated relationship manager who prioritizes client requests, ensuring personalized service and attention.

Other perks of the Premium Trader account include free access to a Virtual Private Server (VPS), enhancing trading reliability and performance by allowing continuous operation of trading algorithms without interruption.

Traders also benefit from professional market analysis reports, providing valuable insights into market trends and opportunities. The account requires a deposit of $10,000 within 30 days or maintaining this balance to unlock these premium features. With 24/5 customer service and priority service queues, the OANDA Premium Trader account is ideal for those looking to elevate their trading capabilities with tailored support and advanced resources.

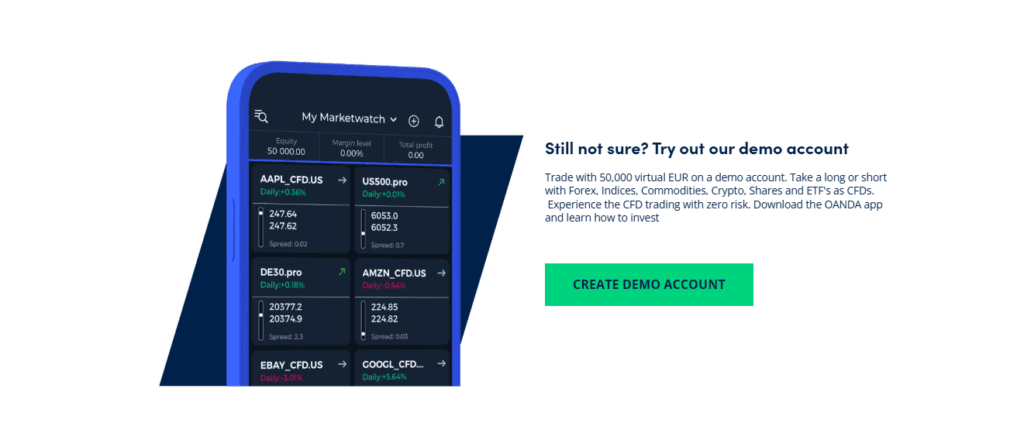

OANDA Demo Account

Additionally, OANDA offers a demo account feature, allowing traders to practice their skills in a risk-free environment. This is particularly useful for applying theoretical knowledge gained from the educational materials in practical, real-world trading scenarios without the worry of losing capital.

This combination of theoretical and practical learning tools guarantees that OANDA’s clients are well-prepared to navigate the complexities of the financial markets.

Commissions and Fees

Understanding the structure of commissions and fees at OANDA is crucial for traders looking to manage their trading costs effectively. This OANDA forex broker review reveals that OANDA offers competitive pricing structures tailored to cater to various trading styles and volumes. The OANDA forex commission model is particularly notable for its transparency, allowing traders to see potential trading costs upfront.

OANDA broker fees are structured primarily around spread pricing, which can vary depending on market conditions and account types. For more active traders, OANDA provides an option for core pricing plus commission, which typically offers lower spreads in exchange for a fixed commission per trade. This setup is ideal for high-volume traders who prefer cost predictability.

Moreover, the OANDA forex minimum deposit is remarkably accessible, making it easier for new traders to enter the market without a significant financial outlay. Traders can start with a relatively small amount, yet have access to all trading tools and opportunities.

For existing users, managing accounts is streamlined through the OANDA login portal, where they can monitor their commission and fee structure, adjust their trading leverage, and fund or withdraw from their accounts efficiently. This system ensures that traders can keep overhead costs low while maximizing potential returns.

Mobile Trading Features

In today’s fast-paced financial markets, effective mobile trading capabilities are essential. OANDA understands this need and offers robust mobile trading solutions through its apps, ensuring traders can manage and execute trades anytime, anywhere. The apps are designed with both novice and experienced traders in mind, offering an array of tools and features that streamline the trading process.

Here’s a quick overview of what OANDA’s mobile platforms offer:

- Both the OANDA Trade mobile app and the MetaTrader 4 app feature intuitive interfaces that make navigation and trading straightforward.

- The Trade app includes 33 technical indicators and 13 drawing tools, allowing for thorough market analysis on the go.

- Traders receive up-to-the-minute market news and analysis, ensuring they are well-informed to make timely decisions.

- Users can customize their dashboard and set up notifications for market events or price movements, enhancing their trading efficiency.

Deposit and Withdrawal Options

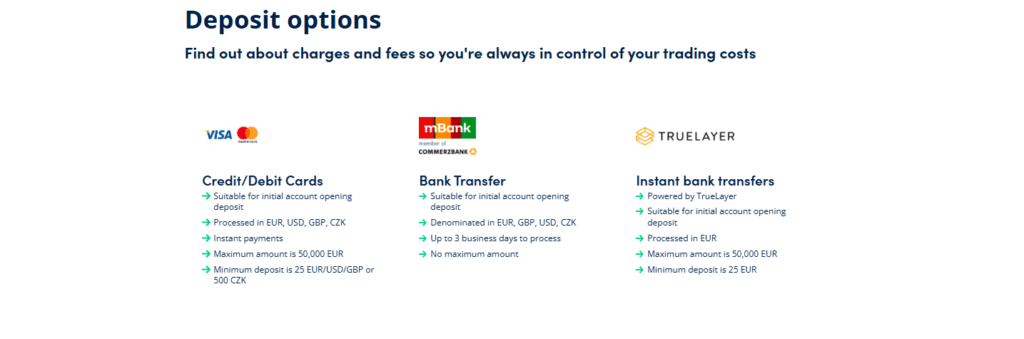

OANDA offers a diverse range of deposit and withdrawal options.

Deposits

OANDA provides a range of flexible options for funding your trading account, ensuring convenience and accessibility for traders worldwide. You can deposit funds using credit and debit cards from major providers like MasterCard and Visa, with transactions typically reflecting in your account within one business day. Additionally, OANDA accepts bank transfers, including through WISE, offering a reliable way to fund your account, though processing times may vary depending on the institution.

For those preferring digital payment solutions, OANDA supports deposits via popular e-wallets such as Skrill and Neteller, enabling swift and secure transactions. Furthermore, clients in certain regions, including South East Asia, Latin America, and Africa, have the benefit of using local online or mobile bank transfers and e-wallet methods tailored to their specific countries.

Withdrawals

The withdrawal process at OANDA is designed to be straightforward, adhering to a hierarchy rule to ensure funds are returned to their original source. If you deposit using multiple methods, withdrawals must be made in a specific order: first to debit cards, then credit cards, and finally via bank transfer. This ensures compliance with financial regulations and enhances security.

OANDA allows withdrawals back to credit and debit cards from MasterCard and Visa, as well as direct transfers to your bank account, including through WISE. Additionally, funds can be withdrawn via e-wallets such as Skrill and Neteller, providing a variety of options to suit individual preferences. In select African regions, local withdrawal methods are also available, adding another layer of convenience for regional clients.

Customer Support Services

Efficiently addressing customer inquiries, OANDA provides robust support through various channels. Recognized for its commitment to accessible, high-quality service, the company guarantees that both novice and experienced traders can find helpful guidance whenever needed. This focus on inclusive support is a cornerstone of their customer service strategy.

Key features of OANDA’s customer support include:

- Customers can access support any time through live chat, email, or phone, making sure help is always at hand.

- Catering to a global audience, OANDA offers assistance in several major languages, which enhances user experience and accessibility.

- For more personalized service, certain account types come with dedicated managers, providing tailored advice and quick issue resolution.

- An in-depth FAQ section, along with detailed articles on platform navigation and trading strategies, helps users self-serve many common questions and issues.

Educational Resources

Building on its strong customer support, OANDA also offers a wide array of educational resources designed to enhance the trading skills of both novice and experienced investors. They’ve established a thorough learning center that includes a variety of formats to suit different learning styles. For beginners, there are simple tutorials and webinars that cover the basics of trading and risk management. More experienced traders can explore in-depth articles and market analysis that examine intricate trading strategies and economic theories.

OANDA doesn’t stop at static resources. They host live sessions where traders can interact directly with market experts and receive real-time answers to their questions. These sessions often include live market analysis and commentary, providing valuable insights into market dynamics.

Market and Product Access

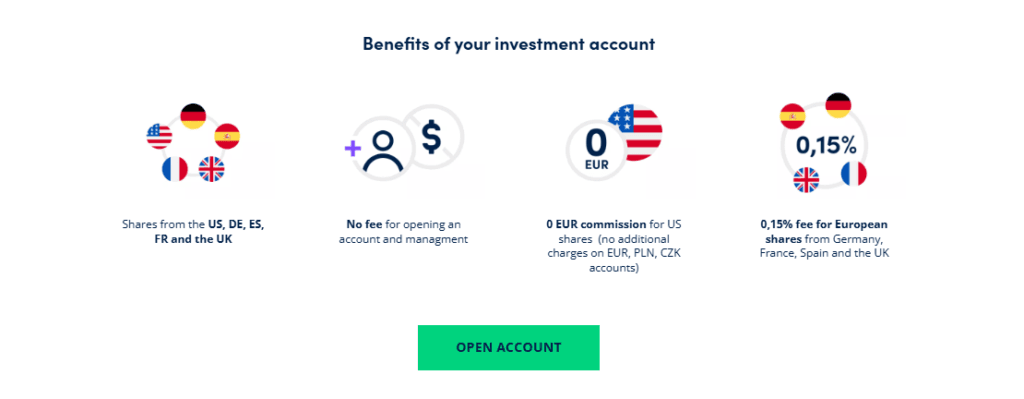

OANDA provides its clients with wide access to a diverse range of markets and products, ensuring they can engage in various trading opportunities worldwide.

With a setup designed to cater to both seasoned traders and those new to the financial markets, OANDA maintains a competitive edge by offering extensive market access across multiple asset classes.

Here are key highlights of OANDA’s market and product access:

Forex Trading

OANDA offers a comprehensive suite of currency pairs, providing traders with access to over 70 pairs including major, minor, and exotic currencies.

This vast selection allows traders to capitalize on global market movements and currency fluctuations, making it possible to implement diverse trading strategies that cater to both short-term and long-term market views.

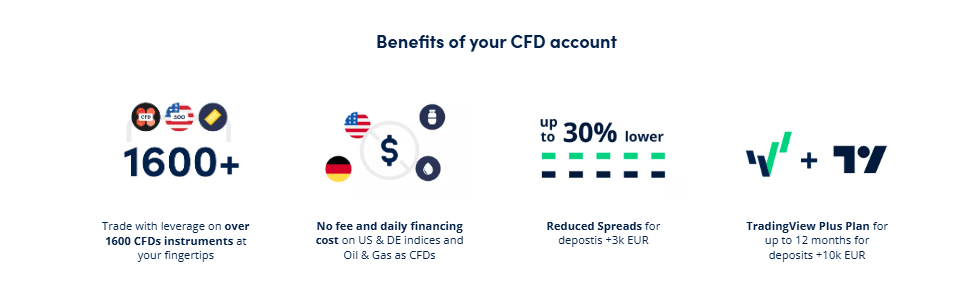

CFD Trading

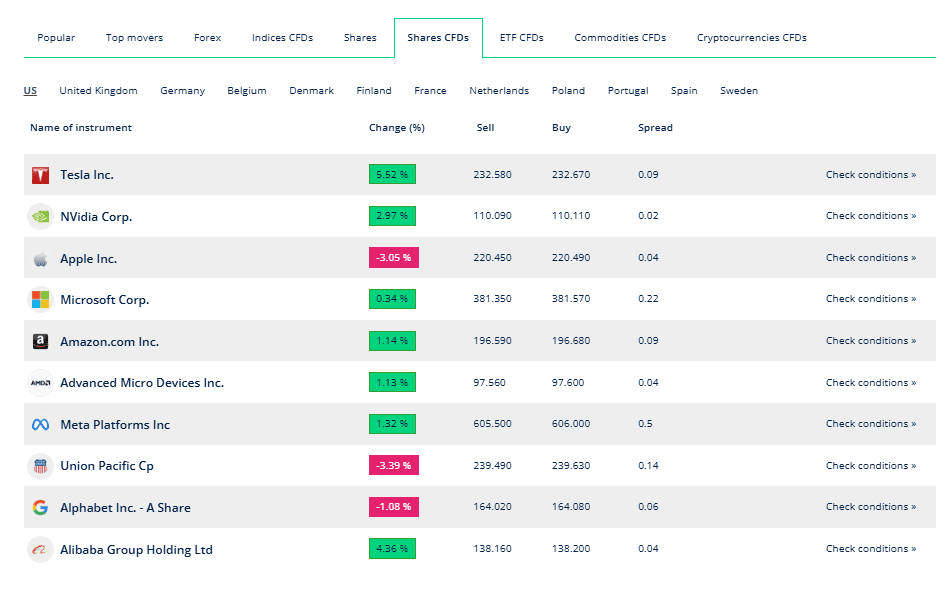

With OANDA, traders can engage in CFD trading on a wide array of assets including indices, commodities, bonds, and precious metals. This variety enables clients to diversify their investment portfolios and hedge against market volatility.

By offering CFDs on such diverse markets, OANDA allows traders to speculate on price movements without needing to own the actual underlying assets, thus providing flexibility and leverage options.

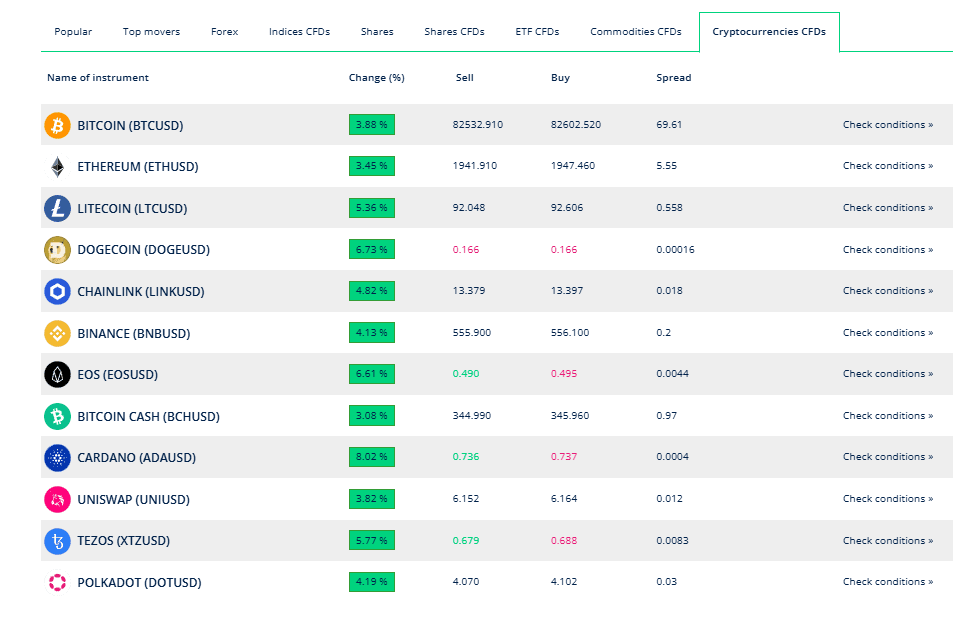

Cryptocurrency

OANDA provides access to popular cryptocurrency CFDs, allowing traders to speculate on the price movements of leading digital currencies like Bitcoin, Ethereum, and Litecoin.

This approach enables traders to enter the dynamic world of cryptocurrencies without the need to own or store the digital assets themselves. With competitive spreads and the ability to trade on both rising and falling markets, OANDA’s cryptocurrency offerings present exciting opportunities for speculative trading.

Unique Markets

Depending on the client’s region, OANDA offers access to unique markets such as options and innovative financial instruments designed to meet specific market needs. These tailored offerings allow traders to explore specialized investment opportunities that align with regional economic trends and demands. By providing access to these unique markets, OANDA enhances its clients’ ability to diversify and adapt their trading strategies to capitalize on niche sectors and emerging market trends.

How to Open an Account with OANDA

Opening an account with OANDA is a straightforward process designed to get you trading quickly and efficiently. Here’s a step-by-step guide to help you through the process:

Step 1: Visit the OANDA Website

Start by navigating to the OANDA website where you’ll find the “Create Account” button prominently displayed. Clicking on this button will begin the account registration process.

Step 2: Select the Account Type

OANDA offers various account types tailored to different trading needs, including demo accounts for practice and live accounts for actual trading. Choose the account type that best aligns with your trading goals.

Step 3: Complete the Registration Form

You’ll need to fill out an online registration form with your personal details such as name, email address, and contact information. Be sure to enter accurate information to avoid any issues later on.

Step 4: Verify Your Identity

To comply with regulatory requirements, OANDA will ask you to verify your identity. This typically involves submitting a government-issued ID and proof of address, such as a utility bill or bank statement.

Step 5: Fund Your Account

Once your account is verified, you can proceed to fund it using one of the available payment methods. OANDA offers various funding options, including bank transfers and credit/debit cards, ensuring you can choose the most convenient method for you.

Tips for a Smooth Account Opening Process

- Have your identification documents ready before starting the registration to expedite the verification process.

- Ensure all entered information matches your official documents to avoid delays in account approval.

- Take advantage of OANDA’s educational resources and trading tools available on the platform to enhance your trading experience.

Frequently Asked Questions

How Can I Participate in Oanda’s Elite Trader Program?

To join the Elite Trader program, you’ll need to trade actively and frequently. Check their website for specific trading volume requirements and benefits like rebates. It’s designed for high-volume traders seeking additional perks.

Does OANDA Offer Partnership Opportunities or Affiliate Programs?

Yes, you can explore partnership opportunities or affiliate programs, which often include commission-based earnings for referring new traders. Check their website for detailed information on how to apply and the associated benefits.

Are There Any Specific Tools for Risk Management Provided by Oanda?

You’ll find specific risk management tools like stop-loss orders, margin alerts, and customizable leverage settings to help manage your trading risks effectively. These features aim to safeguard your investments from excessive losses.

Can I Access Historical Trading Performance Statistics on Oanda?

You can access historical trading performance statistics on OANDA through their platform. They offer detailed reports and tools to analyze past trading activities, helping you refine strategies and improve future trading decisions.

Is OANDA a trustworthy broker?

Yes, OANDA is considered a trustworthy broker, with over 25 years of experience and regulation in eight jurisdictions.

Does OANDA pay out?

Yes, OANDA processes payouts efficiently, ensuring traders receive funds through supported withdrawal methods.

How much money do you need to start trading with OANDA?

You can start trading with OANDA with as little as $1, as there is no minimum deposit requirement.

Why can’t I withdraw from OANDA?

Withdrawal issues may occur due to verification requirements or banking details discrepancies, which can be resolved by contacting OANDA’s support.

How long does OANDA take to pay out?

OANDA typically processes withdrawals within one to five business days, depending on the payment method used.

Is my money safe with OANDA?

Yes, your money is safe with OANDA as they follow strict regulatory standards and segregate client funds from company funds.

Does OANDA charge a monthly fee?

No, OANDA does not charge a monthly fee for maintaining an account, though other fees may apply based on trading activity.

What is the minimum balance in OANDA?

OANDA does not impose a minimum balance requirement on trading accounts, allowing flexibility for all traders.

Is OANDA Broker good for beginners?

Yes, OANDA is suitable for beginners, offering user-friendly platforms, educational resources, and a demo account to practice trading.

How long does it take to get approved for OANDA?

Account approval with OANDA typically takes a few hours to one business day, depending on the completeness of submitted documents.

Conclusion

As you consider your trading options, OANDA stands out with its all-encompassing platforms and extensive market access. Offering competitive fees and strong regulatory safeguards, it’s tailored for both new and seasoned traders. Remember, with options like MetaTrader 4 and OANDA Trade, you’re equipped to navigate the markets effectively. Whether it’s forex or CFDs, OANDA’s versatile tools and dedicated support guarantee a seamless trading journey. Get started, and see how OANDA can meet your trading needs.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.