In a market brimming with anticipation, traders and investors alike set their sights on the upcoming U.S. Producer Price Index (PPI) data and a speech by Federal Reserve Chairman Jerome Powell. These events are poised to shape market sentiment and could potentially sway the direction of major currencies and commodities in the near term.

GBP/USD Reaction to UK Jobs Data

Economic Indicators from the UK

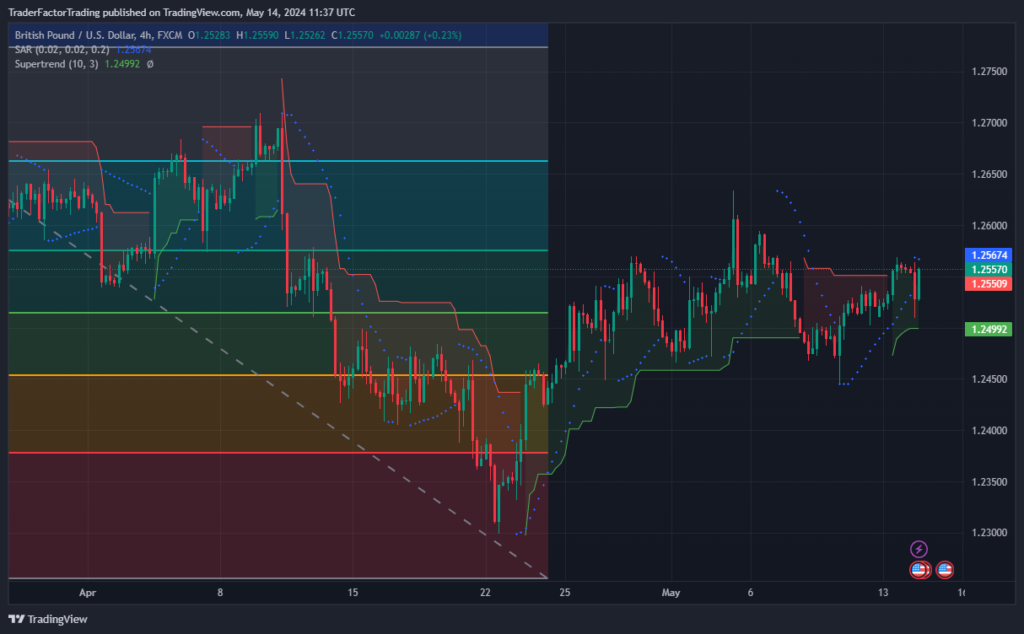

The GBP/USD pair experienced a slight downturn, falling below the 1.2550 mark in the European session on Tuesday. This movement came in the wake of the latest jobs data from the UK, which revealed a slight increase in the Unemployment Rate to 4.3% for the three months ending in March, aligning with forecasts but failing to invigorate demand for the Pound Sterling.

GBPUSD Chart

Despite the unemployment rate’s minor uptick, the Average Earnings Including Bonus remained steady at a 5.7% annual increase, surpassing market expectations of 5.3%. However, this mixed bag of data did little to bolster the Pound Sterling against its counterparts.

Awaiting US Data and Powell’s Speech

With the U.S. set to release its Producer Price Index (PPI) for April and Federal Reserve Chairman Jerome Powell scheduled to speak, the GBP/USD pair hovers in a narrow band around 1.2550. Traders are keenly awaiting these developments, which could significantly impact the USD’s performance against a backdrop of global economic uncertainties.

EUR/USD and German Sentiment Data

EUR/USD remains steady near the 1.0800 level following upbeat ZEW sentiment data from Germany. Despite this positive development, the pair has entered a consolidation phase as the market awaits further cues from the U.S., particularly the upcoming producer inflation data and remarks from Fed Chairman Powell.

EURUSD Chart

Gold and Currency Market Trends

Gold Price Dynamics

The gold price shows signs of a rebound amidst the US Dollar’s consolidation. However, the precious metal’s gains may be capped as investors adopt a cautious stance ahead of critical US inflation data releases. The upcoming PPI data and Powell’s speech are particularly in focus, with implications for the Federal Reserve’s monetary policy trajectory and, by extension, gold’s investment appeal.

XAUUSD Chart

USD/JPY Eyes on Inflation and Economic Data

The USD/JPY pair has climbed to 156.50, with market participants eyeing the forthcoming U.S. inflation data and Japan’s Q1 GDP report. These indicators will provide valuable insights into the economic strength of Japan and the potential timing of rate adjustments by the Federal Reserve, influencing currency valuations and investor strategies.

Conclusion

As the financial world turns its gaze toward the United States for the release of pivotal economic data and insights from one of its leading monetary policy figures, market volatility is expected. Traders and investors are advised to stay abreast of these developments, which promise to offer significant clues about the future direction of global financial markets.

How PPI Data Can Impact The Currency

PPI stands for Producer Price Index, which is an economic indicator that measures the average changes in selling prices received by domestic producers for their output. It’s a critical factor in the assessment of inflation, as it reflects the prices at the producer level before those goods and services reach consumers.

When it comes to currencies, the PPI can have a significant impact:

- Inflation Indication: Since PPI tracks the price changes from the perspective of the seller or producer, a rise in PPI is often considered an early indicator of inflation. If producers are paying more for their inputs or are able to charge more for their products, these costs are likely to be passed on to consumers, leading to higher consumer prices.

- Monetary Policy Influence: Central banks closely monitor PPI as part of their role in managing monetary policy. An increasing PPI might prompt a central bank to raise interest rates to cool down inflationary pressures. Conversely, a falling PPI might indicate deflationary pressures, possibly leading to lower interest rates. Changes in interest rates can affect the value of a country’s currency since higher interest rates provide higher returns on investments denominated in that currency, making it more attractive to foreign investors.

- Exchange Rates: The above factors can influence exchange rates. A currency might strengthen if its country’s PPI rises and leads to higher interest rates or is seen as a sign of a healthy economy. Alternatively, if the PPI indicates deflation or economic slowdown, it might lead to a weaker currency as investors seek better returns elsewhere.

- International Trade Competitiveness: Changes in the PPI can also affect a country’s trade balance. For instance, if a country’s PPI rises faster than those of its trade partners, its exports might become more expensive and less competitive abroad, potentially leading to a trade deficit which can impact the value of its currency negatively.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts