This week, financial markets brace for a series of pivotal data releases and central bank insights that could reshape the landscape for traders and investors alike. With the spotlight on Federal Reserve Chair Jerome Powell and critical U.S. inflation data, market participants are on high alert for cues that could drive currency, gold, and broader market movements.

Table of Contents

ToggleEUR/USD Analysis: A Struggle for Direction Amid Policy Standstill, Powell Speech Awaited

The EUR/USD pair has seen a mix of fluctuations, primarily buoyed above the 1.0800 mark as the U.S. Dollar grapples with finding demand amidst a modestly improving risk mood. The ongoing monetary policy pause by central banks, due to stubbornly high inflation and tight employment sectors, leaves major currency pairs searching for a clear direction.

Upcoming U.S. Consumer Price Index (CPI) data for April is eagerly awaited by investors for potential market shifts, even though the Federal Reserve places more emphasis on the Personal Consumption Expenditures (PCE) Price Index. Despite a soft tone against its major counterparts, the U.S. Dollar’s movements appear contained for now.

EURUSD Chart

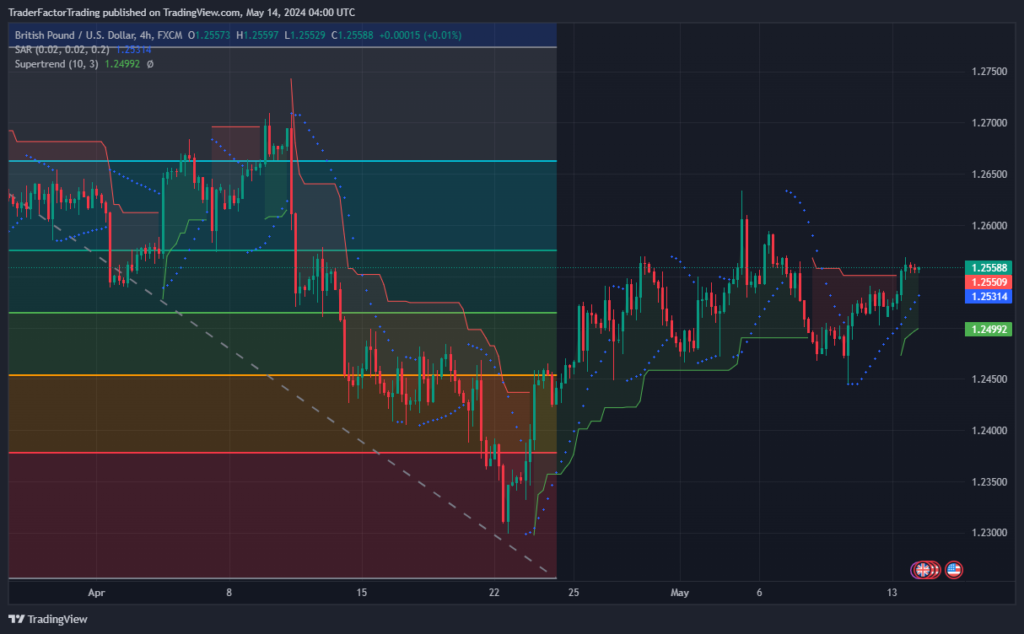

GBP/USD Rebounds: BoE’s Dovish Stance and USD Weakness

GBP/USD finds new vigor, advancing to four-day highs near the 1.2560 mark, driven by an upbeat mood in the risk arena. Following a tumultuous week, the pair stabilizes above 1.2500, spurred by the Bank of England’s dovish policy statement and subsequent USD sell-off due to disappointing U.S. data.

GBPUSD Chart

Gold’s Retreat Below $2,350: A Hawkish Fed Perspective

Gold prices take a step back, trading below $2,350 in a corrective move after last week’s surge. Hawkish Fed remarks and speculation around delayed easing plans place pressure on gold, although economic uncertainties and geopolitical tensions could offer support to the precious metal.

XAUUSD Chart

The Japanese Yen’s Dilemma: Inflation Concerns and Policy Normalization

The Japanese Yen faces further declines, with USD/JPY pushing past the 156.00 threshold. Market watchers are cautious as Japan grapples with inflation, largely attributed to a weakening Yen without the support of wage-driven price pressures.

Key Market Events and Their Potential Impact

| Day | Economic Events | Impact on Currencies |

|---|---|---|

| Monday | A quiet start to the week with little market-moving news. | – |

| Tuesday | – UK’s Claimant Count Change – U.S. PPI data – Fed Chair Powell’s speech | – GBP/USD may see volatility. – Potential impact on USD and gold prices. |

| Wednesday | – Australian Wage Price Index – U.S. CPI – Empire State Manufacturing Index – Retail Sales data | – Influence on AUD and USD. – Potential effects on corresponding currency pairs and gold prices. |

| Thursday | – Australia’s Employment and Unemployment Rate – Eurozone’s ECB Financial Stability Review – U.S. Unemployment Claims – Industrial Production | – Possible sway in AUD markets. – Dollar trajectory could be affected. |

| Friday | – China’s Retail Sales and Industrial Production – Speech by FOMC Member Waller | – Movements in AUD and USD due to economic interdependencies and policy insights. |

Monday

A quiet start to the week offers little in terms of market-moving news.

Tuesday

Attention turns to the UK’s Claimant Count Change and U.S. PPI data, alongside Fed Chair Powell’s speech. These events could significantly influence GBP/USD dynamics and broader market sentiment toward the U.S. Dollar and gold.

Wednesday

The Australian Wage Price Index and U.S. CPI, Empire State Manufacturing Index, and Retail Sales data take center stage. Expectations are high for these releases to impact the AUD and USD, along with their corresponding currency pairs and gold prices.

Thursday

Australia’s Employment and Unemployment Rate, alongside Eurozone’s ECB Financial Stability Review, could sway AUD markets. Meanwhile, U.S. data including Unemployment Claims and Industrial Production are set to affect the Dollar’s trajectory.

Friday

China’s Retail Sales and Industrial Production, coupled with a speech by FOMC Member Waller, may influence AUD and USD movements due to the economic interdependencies and policy insights.

Conclusion

With a week packed with critical economic data and policy speeches, traders and investors should stay vigilant. The outcomes of these events could offer fresh directions for the EUR/USD, GBP/USD, gold prices, and the broader financial markets. Engaging with these developments is key to navigating the week’s trading landscape effectively.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.