On Thursday, Tesla (TSLA) investors felt a jolt of pain as the stock plummeted 9.75%, its lowest point since January.

The electric vehicle giant saw gross margins dip below 20% for the first time in nearly three years and profit slip to $2.5 billion from last year’s impressive $3.3 billion figure – causing analysts on Wall Street to take drastic action by lowering estimates amid deepening concerns over margin pressure.

Tesla has taken drastic measures to revitalize its sales in 2020, slashing prices six times over the course of the year – including two cuts just this month.

Faced with a challenging market situation, they are doing all they can to maintain their strong foothold in electric vehicle production.

Despite the drop in Tesla’s net income by $700 million year-over-year, they still managed to exceed expectations with a total revenue of $23.33 billion and adjusted earnings per share of $0.85 both slightly under Street estimates but higher than expected results nonetheless.

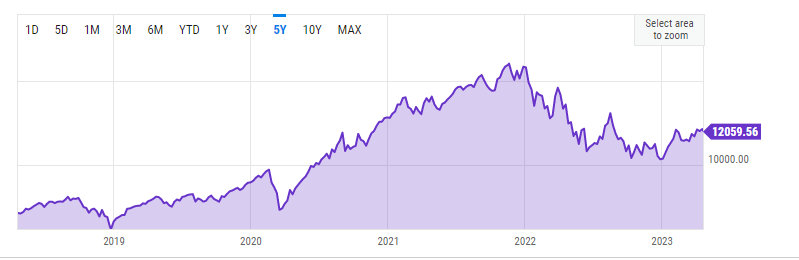

Tesla (TSLA)

Ark Invest’s TSLA Price Target

With its latest purchase of Tesla stock, Ark Invest has raised their price target and expectations for the company. They envision a future where TSLA prices soar to $2,000 by 2027 – an increase from last year’s outlook – and sales span between 10-20 million vehicles annually.

Additionally, Ark Invest foresees immense revenue potential stemming from self-driving technology. Despite this optimism however, previous forecasts made by Ark have been overly ambitious in terms of EV adoption thus far; only time will tell if these grandiose predictions concerning autonomous driving come true!

Wall Street Rally

The stock market rally took a step back on Thursday as investors assessed mixed earnings reports and worrying economic data. Tesla was especially hard-hit, with CEO Elon Musk indicating he’s ready to let profit margins drop significantly in light of the company’s recent price cuts.

Now might be an ideal time for skittish shareholders to take some chips off the table while TSLA is still being worked on.

The Ark Invest team has kept faith in Tesla stock, recently purchasing a whopping 256K shares. Believing it can reach lofty heights of $2K by 2027, they remain ‘super bulls’ on the automaker’s potential for success!

On Friday, some of the biggest names in both businesses and manufacturing announced their latest earnings.

Las Vegas Sands (LVS) flashed a buy signal after reporting theirs while Iridium (IRDM), Lam Research (LRCX), Freeport-McMoRan(FCX), SLB, Procter & Gamble (PG) and HCA Healthcare all reported numbers that suggest now might be an ideal time to invest.

What’s more! LVS is on IBD Leaderboard; LRCX is part of IBD Big Cap 20; FCX stock ,SLB as well as P&G are near buy points with HCA holding firm at its own respective zone.

Dow Jones Futures

Investing in the Dow Jones can be a tricky endeavor with market futures fluctuating frequently. Pre-market activity for the stock index today saw it lose ground versus fair value, while both S&P 500 and Nasdaq 100 futures experienced gains.

Nonetheless, traders should keep in mind that overnight action does not necessarily carry through to regular trading hours when assessing their investment strategies.

Exchange-traded Funds

Some of the most popular growth ETFs experienced a mixed Thursday on Wall Street, as FFTY dipped 0.8% and BOUT slid 0.1%. However, tech-safe havens proved resilient with IGV giving up just 0.008%, while SMH crept up by a slender margin thanks to its exposure to major semiconductor producers such as LRCX stock.

Meanwhile ARKK fell sharply by 3.8%, influenced in part no doubt by Tesla’s tumultuous track record – however this did not deter Cathie Wood from investing over $40 million across Ark Invest’s expanding portfolio of ETFs buying an impressive 256k shares in one day!

The markets experienced a day of ups and downs, with the SPDR S&P Metals & Mining ETF (XME) falling 1.5% and Global X U.S. Infrastructure Development ETF (PAVE) advancing slightly by 0.2%. ]

In contrast, energy stocks took a hit as the Energy Select SPDR ETF dropped to 0.9%, while health sector funds also declined when Health Care Select Sector SPDR Fund sank 0 .4%.

However, homebuilders bucked this trend with their success on Wednesday carrying over into today; shares in the Homebuilder’s fund rose.

Wall Street Rally

Thursday’s stock market was largely bearish, with the three major indexes losing significant value. Leaders in the tech industry like Lam Research and Tesla fared quite differently; while one performed solidly against a downward trend, the other experienced its worst day of trading yet.

Additionally, crude oil prices saw an abrupt drop of 2.4%, indicating further economic uncertainty as investors remain wary about fiscal conditions to come despite decreasing yields on 10-year treasury bonds by 5 basis points to 3.55%.

Stocks To Buy

Las Vegas Sands soared past expectations in the first quarter, powered by a Macau boom as restrictions due to Covid eased. While LVS stock jumped 3.7%, Wynn Resorts and MGM struggled to keep their momentum going while Melco Resort made its own impressive breakout performance.

In Q1, Iridium posted impressive growth with a 300% rise in earnings-per-share and revenue topping estimates. Coupled with this news, IRDM stock skyrocketed 11%, briefly pushing past the 65.51 flat base buy point as listed on MarketSmith.

This triggered further attention to short term levels that have been broken by the company; however investors need to be aware of potential pullbacks given its history of quickly surging up then dropping back down again into new consolidations near highs.

After some disappointing news about Lam Research, investors were relieved to find out that Taiwan Semiconductor didn’t reduce their capital spending.

This resulted in an impressive rally from the company’s shares and even managed to break a previously established downward trendline. LRCX stock is now within buying range of its 548.95 flat-base buy point!

Market Rally Analysis

After a day of wavering, the stock market’s rally held steady Thursday. The Nasdaq 100 came dangerously close to pushing below its 21-day line and failing the 12,000 benchmark – but for now maintained both levels.

Meanwhile, the S&P 500 and Dow Jones not only stayed above their respective 21-day lines but also remain locked in between their record highs from this year so far and each index’ 50-day moving average.

Thursday was a day of widespread selling across the stock market, with Tesla playing an influential role as its losses weighed on both the S&P 500 and Nasdaq Composite.

Despite some successes among homebuilders led by D.R. Horton’s impressive earnings figures, shares in gaming companies such as Las Vegas Sands and medical products were not enough to offset broader declines caused by Tesla and worries about impending recessionary signs looming overhead.

Way Forward

Despite the indexes hovering at a steady level, there has been substantial volatility in individual stocks and sectors. Those that give off buy signals may be worth looking into, but to avoid potential losses it’s best not to make any bold moves with your investments – play it safe instead!

As earnings season approaches next week with mega caps reporting first, investors must prepare for what could turn out as an unpredictable ride full of changes in direction by day or even hour.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial Analyst and News Editor with qualifications in accounting and economics. She has over 20 years of banking and accounting experience, during which she has gained extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts