Trading Central was founded in 1999 in Paris, France, by former financial services professionals, aimed to address the demand for reliable investment research. The company introduced its pattern recognition solution, Recognia, in the early 2000s, followed by the launch of the first technical analysis system, Technical Insight, on broker websites in 2003.

Since then, Trading Central has continually expanded its suite of trading tools and products. Trading Central stands as a prominent financial research and analysis firm, offering investment insights and technical analysis across various financial markets for online broker services.

Its range of products includes:

- automated analysis tools,

- pattern recognition software,

- technical and fundamental analysis,

- user-centric approach, and

- 24/7 coverage across 85+ markets.

In today’s competitive markets, having an edge is crucial for traders. Whether it’s identifying emerging trends ahead of others or leveraging robust analytical tools, gaining an advantage over the competition can be game-changing.

Trading Central aims to provide such an advantage, employing both AI analytics and human expertise to offer professional-grade insights to its users.

Here is a comprehensive review of Trading Central. Keep reading.

Access Trading Central for free by opening a real trading account with one of the following trusted forex brokers: OneRoyal

Trading Central Solutions

Trading Central (TC) provides award-winning investment solutions that online brokers can seamlessly integrate into their existing services. These solutions encompass a wide array of tools, trading features, and analysis capabilities that brokers can offer to their clients as premium services.

The offerings include:

- Automated analytics

- 24/7 expert advisors

- Real-time economic releases, and more

The organization has established partnerships with over 180 brokers in more than 50 countries, including well-known entities like eToro, UFX, Markets.com, and Orbex. While the specific features available may vary among brokers, the benefits for retail traders are evident – customizable trading tools empower investors to execute advanced trading strategies with confidence.

Furthermore, Trading Central provides a range of educational services covering topics such as risk management, timing trades, and opportunity validation.

It is important to note that Trading Central does not directly sell its services to retail investors. Instead, online brokers pay to integrate the firm’s tools and features into their offerings. Therefore, investors interested in accessing Trading Central’s resources will need to sign up with a supporting broker.

Tools and Resources Offered by Trading Central

Specific Services

Trading Central’s commitment to providing valuable insights and analysis in a user-friendly format underscores its position as a leading provider of investment strategies and technical analysis tools for traders across various financial markets.

Here’s a detailed breakdown of the specific services and features available:

Charting Tools

Trading Central provides a versatile set of charting tools, including line charts, bar charts, and candlestick charts, enabling traders to visualize market data effectively.

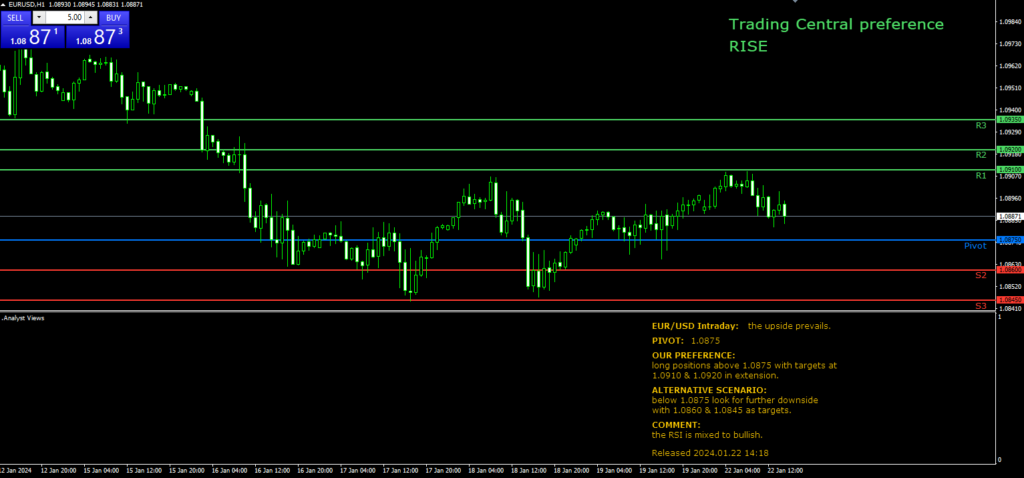

Trend Analysis

Traders can benefit from Trading Central’s trend analysis tools, aiding them in identifying market trends and assessing their strength to make informed trading decisions.

Pattern Recognition

The platform’s pattern recognition tools efficiently identify key chart patterns such as Head and Shoulders, Double Tops, Triangles, and more, enabling traders to anticipate potential market movements.

Features Available to Online Brokers

These features collectively underline Trading Central’s commitment to empowering traders with valuable insights, analysis, and tools, ultimately aiding them in making well-informed and strategic trading decisions across diverse financial markets.

Let us have a look at these features:

Fundamental Insight

Trading Central’s Fundamental Insight empowers investors to interpret complex financial data effortlessly, offering crucial insights in a digestible manner.

Expert Analysts (EAs)

A team of expert analysts provides valuable trade ideas, technical and fundamental analysis, and real-time market commentaries, serving as reliable resources for traders.

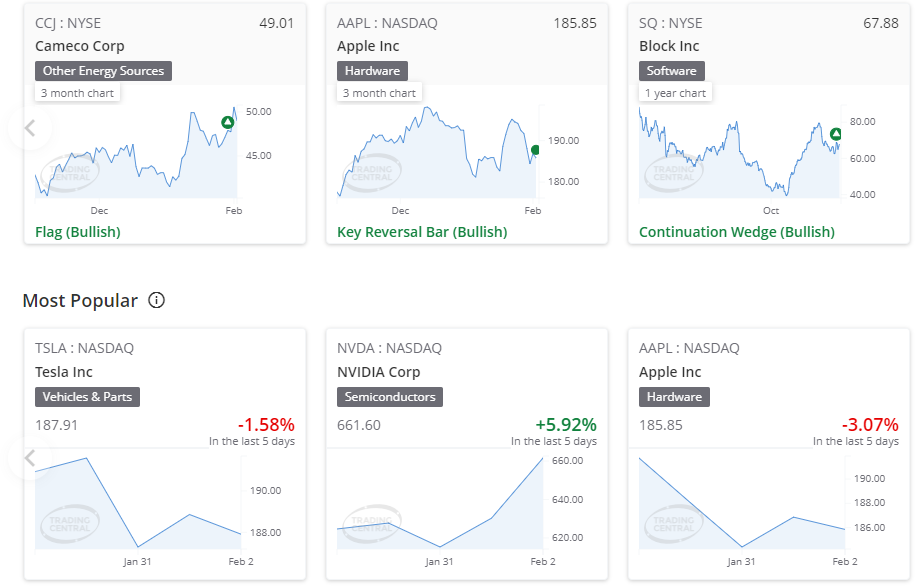

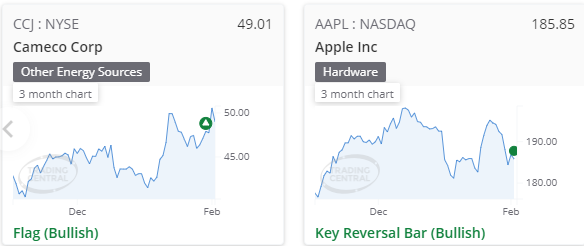

Featured Ideas Tool

This tool presents meticulously researched trading ideas backed by robust algorithms and insights from industry trading experts, providing real-time market scans and detailed breakdowns of each idea.

Technical Indicators

A range of technical indicators and charts are offered, which can be integrated into popular trading platforms with ease, enhancing the overall technical analysis experience.

Interactive Economic Calendar

The interactive Economic Calendar provides a comprehensive overview of key economic events and their potential impact on the markets, assisting traders in making timely and informed decisions.

Strategy Builder

The Strategy Builder feature of Trading Central is a versatile tool catering to both novice and seasoned traders. It empowers users to craft personalized analysis and trading strategies based on specific parameters and market conditions, allowing them to define risk tolerance, timeframes, technical indicators, and other relevant criteria.

Additionally, traders can leverage the tool to backtest their strategies using historical data, enabling them to evaluate performance and refine their strategies before deploying them in live trading scenarios.

Economic Insight Tool

The Economic Insight Tool is another fundamental offering of Trading Central, delivering comprehensive economic analysis and insights to users.

Covering a broad spectrum of economic indicators such as GDP growth, inflation rates, employment data, central bank decisions, and other macroeconomic factors, this tool equips traders with the latest economic developments and trends, facilitating strategic decision-making through easily digestible formats like charts, graphs, and written analysis.

Trading Central enables accessibiity to valuable news and sentiment analysis through different channels:

- Expert Analysts (EAs): A global team of market research analysts furnishes financial market blog posts, video content, and educational tutorials, often accessible directly within the user’s broker’s educational webpage.

- MetaTrader Research Solutions: This enhanced offering allows plugin indicators and premium tools to be seamlessly embedded directly on the MT4 and MT5 platforms, providing access to free signals, indicators, and featured ideas without extensive download requirements.

- Market Buzz: Leveraging language algorithms, Market Buzz compiles the latest news articles, email mentions, or webpage posts into a concise data overview, monitoring a vast array of news publications and types of events across various asset classes, making it an ideal resource for quick performance recapitulation.

Exploring Trading Central’s Coverage

Trading Central has established partnerships with over 180 brokers across more than 50 countries, including well-known entities such as eToro, UFX, Markets.com, and Orbex. While the specific features accessible may differ among brokers, the overarching benefit for retail traders lies in the fully customizable tools that instil confidence in executing advanced trading strategies.

Additionally, Trading Central offers a diverse array of educational services covering topics like risk management, trade timing, and opportunity validation, further emphasizing its commitment to empowering independent traders.

The platform’s comprehensive coverage spans an extensive network of 89 global markets, providing analysis for over 75,000 instruments, including 35,000 stocks, 330 forex pairs, 50 indices, select crypto coins, and 60 commodities. Notably, analysis is available for recognized markets and assets such as the US30, NASDAQ 100, XAUUSD, and BTC, showcasing the breadth of Trading Central’s asset coverage.

By amalgamating analyst insights with automated analytics, Trading Central provides Forex traders with a holistic approach that transcends traditional market analysis. This comprehensive approach equips investors with up-to-date information, enabling them to evaluate opportunities and mitigate risks across diverse global markets effectively.

Benefits of Trading Central

The benefits of utilizing Trading Central are substantial and cater to both novice and experienced traders:

Automated Analysis Tools

By offering powerful automated analysis tools, Trading Central eliminates the need for manual market analysis, allowing traders to make timely and well-informed decisions. The automated nature of these tools ensures that traders can quickly respond to price fluctuations and capitalize on opportunities without delay.

Trading Opportunity Screening

Trading Central’s pattern recognition software and algorithms aid traders in identifying trends and market opportunities, allowing them to recognize important chart patterns promptly. This capability enhances traders’ ability to anticipate potential market reversals or continuation signals, thereby improving the accuracy of their trades.

Technical and Fundamental Analysis

The platform empowers traders to conduct both technical and fundamental analysis, providing a comprehensive understanding of market dynamics. This combination of analysis methodologies enables traders to make well-rounded and informed decisions by studying price action, market trends, financial statements, and economic indicators.

User-Focused Approach

Trading Central places a strong emphasis on understanding the needs of its users, continuously developing tailored services to cater to diverse trader requirements. By prioritizing the user experience, Trading Central ensures a seamless and intuitive trading environment, making it an attractive choice for traders of all experience levels.

All-Day Coverage

Trading Central offers 24-hour coverage across a wide range of markets, including stocks, Forex pairs, ETFs, and indices. This comprehensive coverage allows traders to stay on top of market developments regardless of their geographical location or time zone.

Cons of Trading Central

While Trading Central offers numerous benefits, it’s essential to consider the following aspects:

Profits Not Guaranteed

It’s important to remember that tools and indicators are not a guarantee of generating profits. The outcome of trades will depend on how well traders combine the information provided by Trading Central with their own knowledge and personal analysis.

Access Via Registered Brokers Only

Trading Central tools can only be accessed via supported brokerages, and services cannot be accessed individually as part of trading research or knowledge-building exercises. Traders must sign up with a licensed broker to utilize the company’s tools.

Aimed at Professional Traders

Some tools and services offered by Trading Central may not be suitable for inexperienced investors. Previous trading knowledge and education in the financial markets may still be required to effectively implement premium tools. The advanced research and automated analytical tools may feel overwhelming to novice intraday traders.

Data Reliability and Timeliness

The firm indeed provides a wide range of products aimed at empowering users with professional-grade insights. It’s worth noting that Trading Central’s combination of automated technology and human expertise enables the delivery of high-quality analysis, catering to the diverse needs of traders and investors.

When considering the reliability and timeliness of the data provided by Trading Central, it’s important to recognize the following points:

Automated Analysis Tools

The use of automated analysis tools suggests that Trading Central’s data can be delivered promptly and efficiently, allowing users to stay abreast of market developments in real time.

Human Expertise

The incorporation of human expertise signifies that Trading Central’s insights are not solely reliant on algorithmic outputs but also benefit from the knowledge and experience of financial professionals. This blend of automation and human insight can contribute to the reliability and accuracy of the information provided.

Market Coverage

With coverage across 85+ markets and 24/7 availability, Trading Central aims to ensure that users have access to timely and comprehensive data to support their investment decisions.

It’s also essential to consider that while Trading Central strives to provide accurate and timely insights, market conditions can change rapidly. Therefore, users should apply their own judgment and additional research to make well-informed decisions.

FAQs

- Is Trading Central free to use?

No, Trading Central is not directly accessible to individual traders. It is offered through brokerage partners as an add-on service. Traders need to check with their broker for pricing and account requirements.

- Is Trading Central suitable for beginners?

Trading Central caters to all experience levels, but it is more suited to intermediate-advanced users given its technical focus.

- Can I download Trading Central’s charts and indicators?

Yes, Trading Central allows its technical tools like charts, indicators, and trading signals to be downloaded and integrated with platforms like MT4 and MT5.

- Does Trading Central publish trade setup alerts?

Yes, its Featured Ideas tool constantly scans markets for validated patterns and publishes timely trade alerts on emerging opportunities.

Access Trading Central for free by opening a real trading account with one of the following trusted forex brokers: OneRoyal

Conclusion

Trading Central is not directly accessible to individual traders for free. It operates as a service exclusively available through brokerage partners, where the cost of using its tools, instruments, or research and analysis platform varies between brokers. Users are advised to consult with their specific broker for pricing and account requirements regarding access to Trading Central.

While Trading Central caters to all experience levels, it is more suited to intermediate and advanced users due to its technical focus. The platform offers various features designed to support experienced investors in bridging the gap between independent trading and institutional prowess. Through the utilization of advanced research and automated analytical tools, Trading Central aims to provide valuable insights and opportunities typically reserved for institutional investors.

Additionally, Trading Central allows its technical tools like charts, indicators, and trading signals to be downloaded and integrated with platforms such as MT4 and MT5. It also publishes trade setup alerts through its Featured Ideas tool, which scans markets for validated patterns and provides timely trade alerts on emerging opportunities.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts