FundedFast Prop Firm has garnered attention in 2025 as a popular choice among traders seeking funded trading opportunities. By providing diverse account sizes and flexible challenges, the firm appeals to a wide range of traders. This review examines FundedFast Prop Firm’s features, trading conditions, payment processes, and more. Readers will gain comprehensive insights to make informed decisions about whether FundedFast aligns with their needs. Enjoy this FundedFast Review!

With a focus on transparency and convenience, FundedFast Prop Firm delivers specific account funding options that cater to different skill levels. This article explores its challenges, platforms, and trading rules to paint a detailed picture of its offerings.

FundedFast Prop Firm Overview

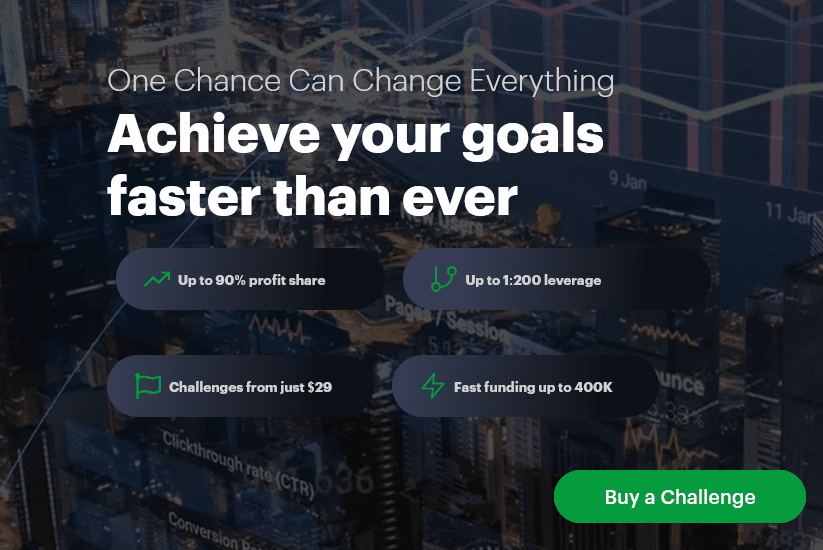

FundedFast Prop Firm is a proprietary trading firm designed for traders who aim to access funded accounts after successfully completing specific challenges. It enables traders to trade firm capital instead of risking personal funds. With account sizes ranging from $3,000 to $400,000, FundedFast addresses both beginners and experienced traders alike.

One defining feature of FundedFast Prop Firm is the absence of time limits for completing its challenges. This approach eliminates pressure for traders, allowing them to demonstrate their skills at their own pace. By offering clear guidelines and extensive funding options, FundedFast seeks to maintain its appeal in a competitive industry.

FundedFast Prop Firm Challenges

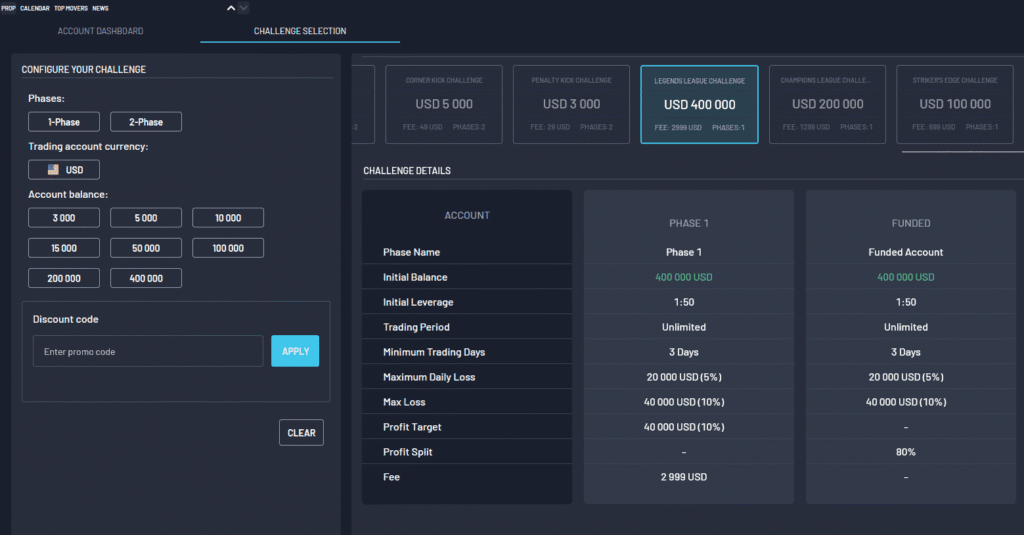

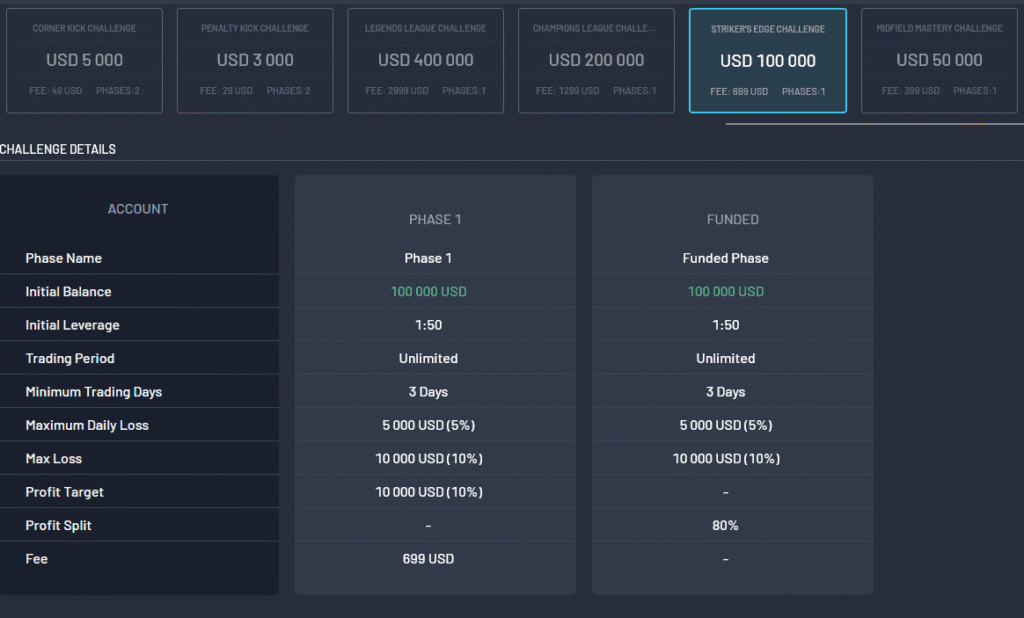

The challenges offered by FundedFast Prop Firm are meticulously designed to evaluate traders’ skills and discipline without the added pressure of strict time limits. These challenges aim to strike a balance between flexibility and robust performance testing, catering to traders with varying levels of expertise. Participants can choose between a one-phase challenge, optimized for those who prefer a streamlined path, and a two-phase challenge, crafted for traders who thrive on consistency and gradual progression.

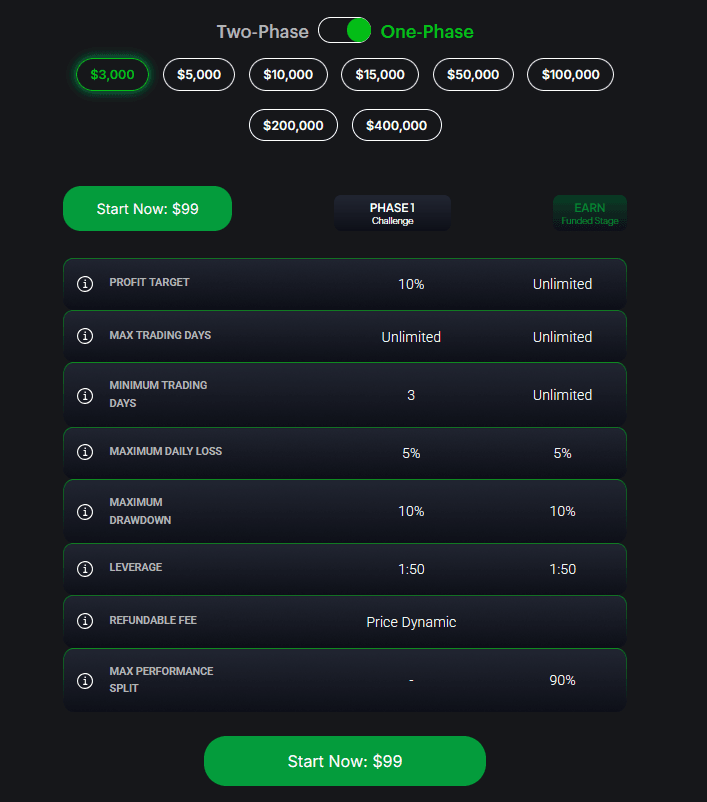

The One-Phase Challenge

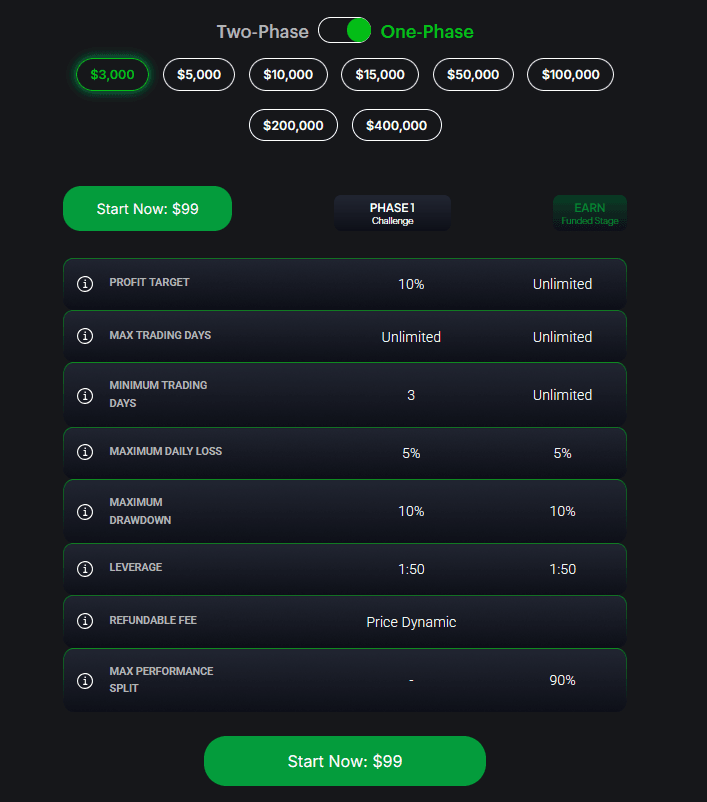

The one-phase challenge is tailored for traders who wish to quickly secure a funded account. It offers a straightforward approach, requiring participants to achieve a 10% profit target. With no time constraints, traders can progress at their own pace, ensuring that external pressures do not affect their performance. This flexibility makes it ideal for individuals who prioritize autonomy.

To maintain risk control, the challenge enforces a maximum daily loss limit of 5% and a maximum overall drawdown of 10%. These rules are in place to encourage disciplined trading without compromising the account’s longevity. All traders are required to trade for a minimum of three days to qualify, ensuring a fair assessment of their trading style and strategies.

Key Details of the One-Phase Challenge

| Category | Details |

| Profit Target | 10% |

| Time Limit | Unlimited |

| Minimum Trading Days | 3 |

| Max Daily Loss | 5% of account balance |

| Max Overall Drawdown | 10% of account balance |

| Leverage | Up to 1:50 |

Prices for One-Phase Challenges

| Account Size | Price (USD) |

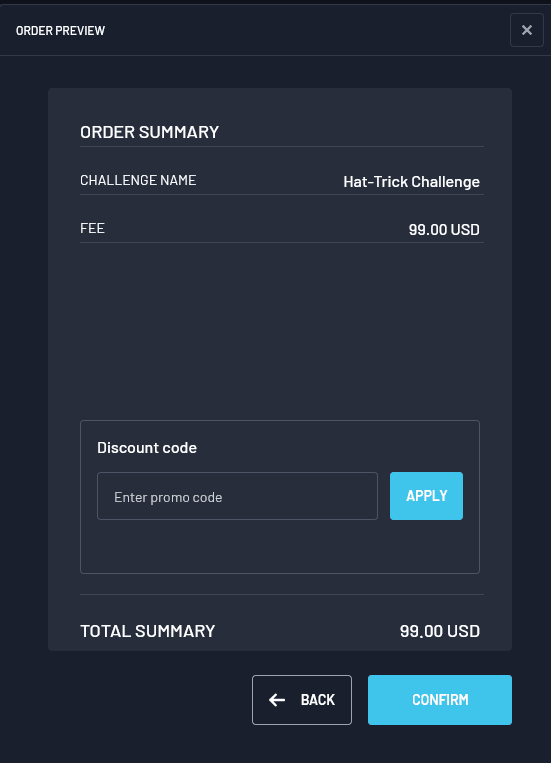

| $3,000 | $99 |

| $5,000 | $109 |

| $10,000 | $119 |

| $15,000 | $299 |

| $50,000 | $399 |

| $100,000 | $699 |

| $200,000 | $1,299 |

| $400,000 | $2,999 |

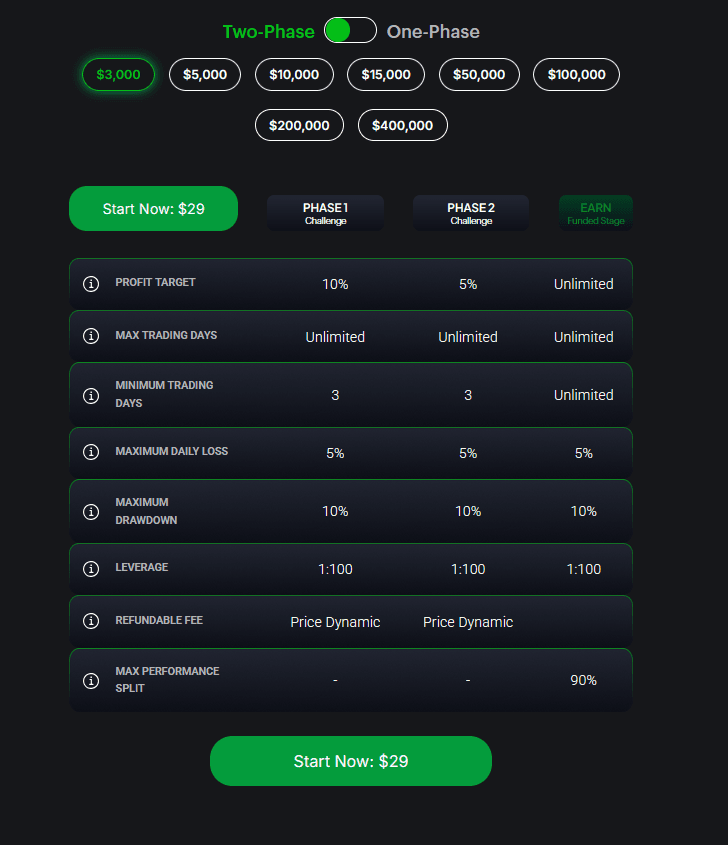

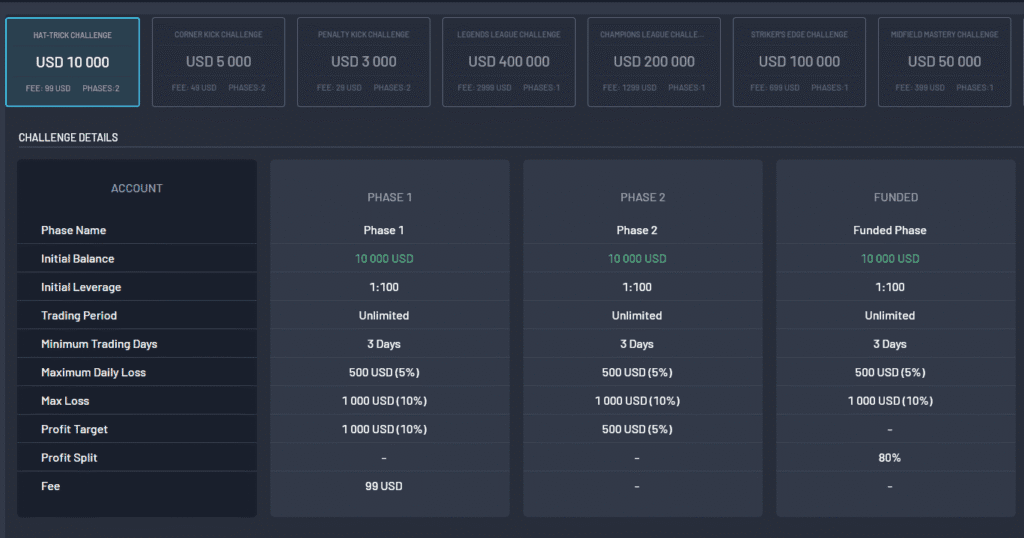

The Two-Phase Challenge

The two-phase challenge is structured for traders who thrive on steady progression and emphasize consistent performance. It introduces an additional layer of evaluation to verify trading skills over time. This approach is well-suited for traders who prefer a methodical path towards securing a funded account.

Phase 1

Phase 1 mirrors the one-phase challenge with a 10% profit target. Traders must uphold risk management rules, including a 5% daily loss limit and a 10% overall drawdown cap. Like the one-phase challenge, there are no time restrictions, allowing traders to execute their strategies deliberately.

Phase 2

Phase 2 reduces the profit target to 5%, offering a less intensive requirement compared to Phase 1. However, the same risk management rules apply, ensuring traders maintain consistent discipline. This stage tests the ability to replicate success under continued scrutiny, reinforcing long-term trading habits.

Key Details of the Two-Phase Challenge

| Category | Phase 1 | Phase 2 |

| Profit Target | 10% | 5% |

| Time Limit | Unlimited | Unlimited |

| Minimum Days | 3 | 3 |

| Max Daily Loss | 5% of balance | 5% of balance |

| Max Drawdown | 10% of balance | 10% of balance |

| Leverage | Up to 1:100 | Up to 1:100 |

Prices for Two-Phase Challenges

| Account Size | Price (USD) |

| $3,000 | $29 |

| $5,000 | $49 |

| $10,000 | $99 |

| $15,000 | $119 |

| $50,000 | $299 |

| $100,000 | $499 |

| $200,000 | $799 |

| $400,000 | $1,799 |

Table of Contents

ToggleComparison and Suitability

The one-phase challenge is ideal for traders who prefer concise goals and quick access to funded accounts. It eliminates the need for prolonged commitment while maintaining strict performance benchmarks.

The two-phase challenge, on the other hand, is built for traders seeking a more comprehensive evaluation. The gradual progression across two phases emphasizes consistency, making it suitable for those who value long-term sustainability over immediate results.

Both challenges uphold FundedFast Prop Firm’s core standards of promoting discipline and flexibility, offering traders a fair means to demonstrate their skills while managing risk effectively.

FundedFast Prop Firm Trading Conditions

FundedFast Prop Firm sets clear trading conditions suited to various trading strategies. Standard leverage of Up to 1:50 for One-Phase and 1:100 on Two-Phase, giving traders ample margin to execute their trades effectively.

Traders with FundedFast have the freedom to hold positions over weekends, a feature often unavailable at other firms. Additionally, the absence of mandatory stop-loss rules allows traders to manage their positions autonomously. These trading conditions reflect an understanding of trader needs, promoting flexibility and adaptability in trades.

FundedFast Prop Firm Payment Processes

FundedFast Prop Firm handles payments through a straightforward and transparent process. Traders must pay a refundable challenge fee, which is returned once they successfully complete all the challenge requirements.

At the funded stage, payouts are processed efficiently, and traders receive up to a 80% profit split. Payment methods include major platforms such as bank transfers or digital wallets, ensuring convenience.

Traders also have the option to purchase an ‘Add-On’ during checkout, which can increase the profit share to 90%. By focusing on simplicity, FundedFast maintains smooth and hassle-free payment operations.

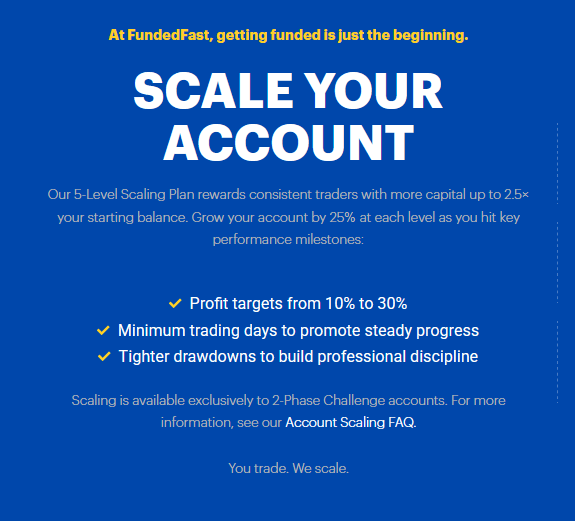

FundedFast Scaling Program

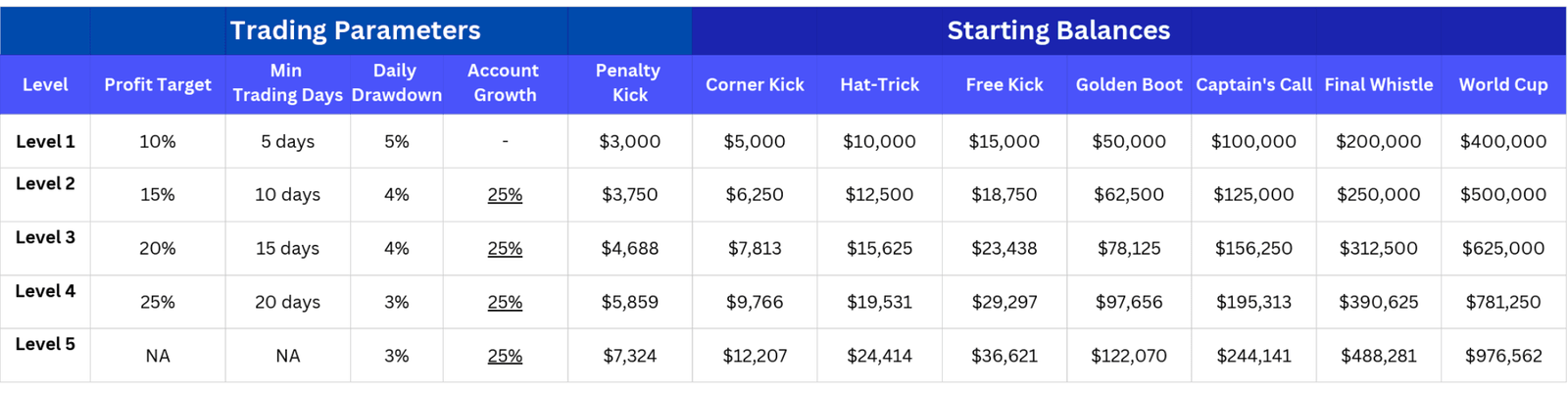

The FundedFast Scaling Program is an initiative designed to reward traders who demonstrate consistency, discipline, and sustained profitability. The program offers a structured approach to account growth, gradually increasing the capital available to traders as they meet specific performance milestones. This allows traders to grow their earning potential while maintaining disciplined risk management.

How the Scaling Program Works

The Scaling Program is designed to encourage top performers to advance through multiple levels. At each level, traders are required to achieve a specified profit target while adhering to the firm’s risk management rules.

Successful traders can access progressively larger account sizes, increasing their capital and revenue opportunities. The program ensures that growth is tied to performance, making it ideal for traders committed to their long-term development.

Scaling Levels and Metrics

The Scaling Program consists of five levels, each with its own requirements and benefits. Key metrics include profit targets, minimum trading days, and drawdown limits, as shown in the table below:

Benefits of the Scaling Program

The Scaling Program provides several benefits to traders, including:

- Structured Growth: Traders can steadily increase their funding and earning potential as they meet performance milestones.

- Enhanced Capital Opportunities: Large account sizes provide more flexibility and the ability to scale trading strategies effectively.

- Encouragement of Best Practices: Risk management rules and performance criteria ensure traders build strong habits that are critical for long-term success.

FundedFast Prop Firm Customer Support

Customer support plays a significant role in FundedFast Prop Firm’s operations. The firm provides assistance through live chat, email, and a dedicated support portal. These channels help traders resolve queries about challenges, accounts, and trading rules.

FundedFast now has a Discord channel, providing a space for traders to connect, share insights, and discuss strategies. Though still small, the community is steadily growing, offering an opportunity for members to engage with like-minded individuals. Join the conversation and become part of the FundedFast community here.

FundedFast Prop Firm Licensing, Trust, and Community

FundedFast Prop Firm emphasizes reliability through transparent rules and clearly defined funding opportunities. As the firm operates solely within a simulated demo environment, with no real-money trading or client fund management, financial licensing and regulation are not required. Nonetheless, FundedFast remains committed to transparency, helping traders fully understand how the model works.

While historically focused on individual trader performance, FundedFast is actively building a sense of community. A small but growing trader network is emerging, supported by initiatives such as a dedicated Discord server, where participants can engage, exchange strategies, and support each other throughout their trading journeys.

FundedFast Prop Firm Funding Options

FundedFast Prop Firm offers diverse funding options tailored to traders of all levels. Accounts range from $3,000 to an impressive $400,000, with entry fees adjusted accordingly. These scalable options ensure accessibility while accommodating ambitious traders targeting larger accounts.

Its graduated funding structure allows traders to begin with smaller accounts and progress to larger ones as their confidence and skills develop. This flexibility reinforces FundedFast’s broad appeal across the trading community.

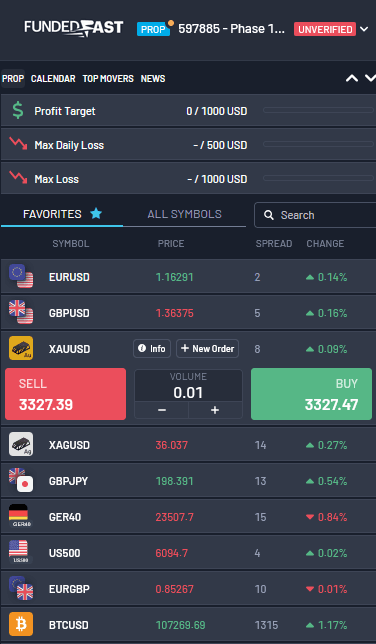

FundedFast Prop Firm Asset Availability

FundedFast Prop Firm supports trading across various asset classes, including forex, commodities, indices, and cryptocurrencies. This variety enables traders to diversify their portfolios and avoid dependency on singular asset types.

The availability of multiple asset options means traders can adapt their strategies based on market trends. By catering to broader trading preferences, FundedFast gains relevance among diverse trader groups.

FundedFast Prop Firm Platforms

FundedFast Prop Firm operates on industry-standard trading platforms, offering tools and resources that meet professional standards. The platform provides features such as charting tools, indicators, and access to real-time data, ensuring that traders can execute informed decisions.

Ease of access through web, desktop, or mobile platforms ensures that FundedFast remains user-friendly. This accessibility enables traders to trade seamlessly, whether at home or on the go.

FundedFast Prop Firm Trading Rules

Trading rules at FundedFast Prop Firm focus on maintaining discipline while granting flexibility. The 5% daily loss limit and 10% maximum drawdown aim to curb risk, encouraging traders to use careful money management techniques.

The flexibility of unlimited time frames allows traders to bypass external pressures, focusing instead on consistent performance. These rules strike a balance between risk management and functional autonomy.

FundedFast Prop Firm Fees and Commissions

FundedFast Prop Firm charges a challenge fee based on the chosen account size. This fee is refundable, provided traders successfully meet challenge requirements. For instance, a $3,000 account costs $99 for the one-phase challenge or $29 in the two-phase challenge. Larger accounts, such as $400,000, incur higher fees, reaching $2,999 and $1,799 for the respective challenges.

No additional commissions outside of standard spreads are noted, ensuring cost transparency for traders during challenge or funded stages.

FundedFast Prop Firm Trader Education

FundedFast offers an extensive trading course tailored to meet the needs of traders in the Brazilian market. This course is designed to provide both beginners and intermediate traders with the knowledge and skills required to navigate the complexities of trading. With a focus on practical strategies and risk management, the program equips participants with the tools needed to enhance their trading confidence and performance. The firm plans on introducing more educational content for all trades in the future.

Frequently Asked Questions

What is FundedFast Prop Firm?

FundedFast Prop Firm is a proprietary trading firm that provides traders access to funded accounts after completing specific trading challenges. It allows traders to use firm capital for trading without risking their own money.

What types of challenges does FundedFast Prop Firm offer?

FundedFast Prop Firm offers two types of challenges: the one-phase challenge and the two-phase challenge. These are designed to test traders’ skills, discipline, and consistency while maintaining flexibility with unlimited time to complete them.

What are the core rules for the challenges?

The key rules include a maximum daily loss of 5% and an overall drawdown limit of 10%. Additionally, traders must achieve a profit target of 10% in the one-phase challenge and 10% and 5% in the two-phase challenge phases.

What happens if I fail a challenge?

If a trader violates the maximum loss rules or does not achieve the profit target, the challenge is considered a failure. Traders can retake the challenge by purchasing a new account or restarting under applicable terms.

Are the challenge fees refundable?

Yes, the challenge fees are refundable once traders successfully complete all challenge requirements and secure a funded account, provided they meet the platform’s terms and conditions.

What trading platforms does FundedFast Prop Firm use?

FundedFast Prop Firm supports Match-Trader which is an industry-standard platform. This platform provides advanced trading tools, real-time market data, and user-friendly interfaces.1

What leverage is offered on FundedFast accounts?

The leverage offered by FundedFast Prop Firm is up to 1:50 for One-Phase and 1:100 for Two-Phase. This allows traders sufficient margin to execute their strategies effectively.

How are payouts handled at FundedFast Prop Firm?

Once traders reach the funded stage, FundedFast Prop Firm offers competitive profit splits of up to 80%.Traders also have the option to purchase an ‘Add-On’ during checkout, which can increase the profit share to 90%. Payouts are processed efficiently through secure methods like bank transfers or digital wallets.

What fees are associated with FundedFast Prop Firm?

Traders pay a challenge fee that varies according to the chosen account size. This fee is refunded upon successful completion of the challenge, and no additional commissions outside of standard spreads are charged.

Does FundedFast Prop Firm offer educational resources?

FundedFast Prop Firm does not currently provide structured educational programs or mentoring. Traders are expected to possess adequate knowledge and skills before attempting the challenges.

What is a prop firm?

A prop firm, or proprietary trading firm, allows traders to trade using the company’s capital instead of their own. Traders usually need to complete a prop firm challenge free of rule violations to secure funding. Some of the best prop firms offer flexibility and competitive funding options.

How much does a 100K funded account cost?

The cost of a 100K funded account varies between prop firms. For the cheapest prop firm, fees can range from a few hundred to over a thousand dollars depending on the firm’s structure and whether a prop firm challenge is involved. These fees are often refundable upon successful completion of the challenge.

Which prop firm pays the best?

The best prop firm funding models usually offer profit splits of 80% to 90% for successful traders. Firms like these aim to match traders with generous payout opportunities while ensuring compliance with their risk rules. Researching the best prop firms based on payout structures can help traders make an informed decision.

What are the risks of prop firms?

The risks of prop firms include losing the challenge fee if the terms are not met or violations occur. Additionally, passing the best prop firm challenge typically requires discipline and skill, and a mismatch between trading objectives and firm requirements can lead to challenges. It’s crucial to review conditions carefully to manage these risks effectively.

What are prop firm challenges?

A prop firm challenge is an evaluation process where traders must meet specific profit targets and risk limits to qualify for a funded account. Challenges test a trader’s ability to maintain discipline and consistency, with some of the best prop firm challenges offering unlimited time or flexible terms. Completing a challenge is often the first step to accessing the firm’s capital.

How hard is it to pass a prop firm challenge?

Passing a prop firm challenge can be difficult, with only a small percentage of traders succeeding. Estimates suggest that less than 20% of participants pass challenges from the best prop firms due to strict rules on profit targets and risk management. However, choosing a prop firm match with realistic goals can improve the chances of success.

How to get funded by a prop firm?

To get funded, traders typically need to complete a prop firm challenge free of significant rule violations. Focus on trading within set profit targets and risk limits and adhere to the firm’s guidelines. Some of the best prop funding programs also offer instant funding options for qualified traders without challenges.

Which prop firm gives daily payouts?

Some prop firms offer daily payouts to funded traders, but this varies based on the firm’s policies. The best prop firm funding options provide frequent payout schedules, ensuring traders can easily access their earnings. Reviewing payout terms is vital to identify a suitable match for specific needs.

What is an instant funding prop firm?

An instant funding prop firm provides traders with immediate access to capital without requiring a traditional challenge. Unlike standard challenge-based funding, these programs often come with higher fees in exchange for skipping the evaluation process. They are popular among experienced traders seeking direct access to the best prop firm funding schemes.

Conclusion FundedFast Review

FundedFast Prop Firm offers a unique trading opportunity through customizable funding challenges and flexible rules. By addressing traders’ needs for autonomy and scalability, the firm has positioned itself as a viable option for aspiring professionals. However, potential participants should weigh the lack of regulation and community resources against its offerings.

This review highlights the various aspects of FundedFast Prop Firm without bias, allowing readers to make an independent and informed choice based on their trading goals.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.