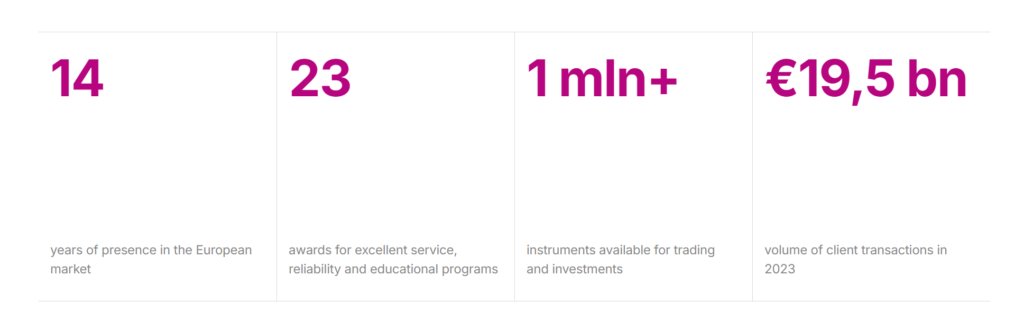

Earn Broker is an investment firm founded in 2011 and consistently upholds its commitment to rigorous regulatory standards and excellent customer service, earning multiple accolades including Best Broker of the Year in 2014 and Leading CFDs Broker in 2017.

With a license from a respected financial authority (Cyprus Securities and Exchanges Commission, CySEC), the broker adheres to strict financial regulations ensuring client protection and transparency. Their trading services offer advantageous leverage options, favorable trading conditions, access to a wide range of global markets, and state-of-the-art analysis tools from Acuity, making them a reliable choice for diversified trading strategies.

Moreover, their sophisticated risk management options and customized alert systems further assist traders in maximizing their investment opportunities. There’s more to discover about Earn Broker, their extensive offerings and tools that can enhance your trading experiences.

Background Information 🔍

Earn Broker was founded in 2011, marking its entry into the competitive online brokerage industry. From its inception, the company focused on adhering to strict compliance regulations, making sure that it operated within the legal frameworks of its licensing jurisdiction. This commitment to regulatory compliance has underpinned its operations, building trust among its clientele.

The company’s history is marked by significant milestones, including receiving multiple awards that highlight its service excellence and operational integrity. Remarkably, Earn Broker was named Best Broker of the Year in 2014, a mere five years after its formation, signaling its rapid rise to prominence within the industry. This early recognition was followed by accolades such as Best CFDs Broker Europe in 2017, showcasing its expertise in offering complex financial instruments.

These awards reflect the broker’s continuous commitment to maintaining high standards in customer service and operational efficiency. Additionally, the recognitions serve as a sign of its robust compliance framework, which ensures adherence to the evolving landscape of financial regulations. By integrating these principles, Earn Broker has solidified its reputation as a reliable and competent player in the online brokerage arena.

Earn Broker Licensing Details 🔒

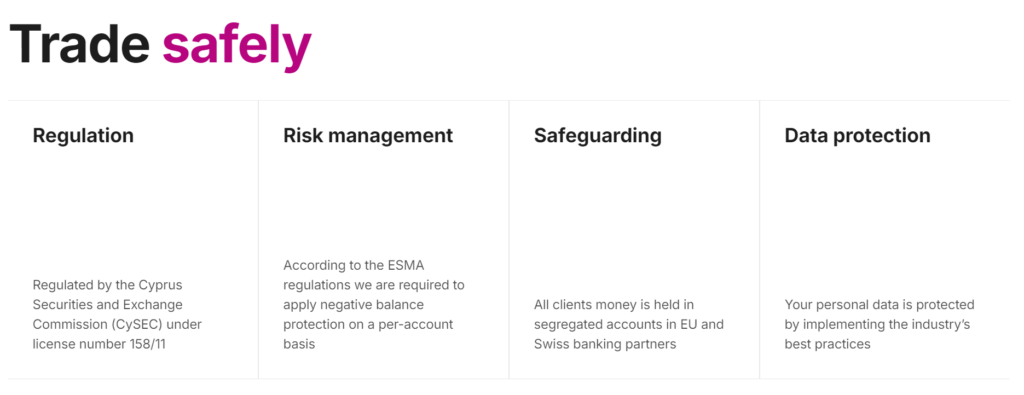

Brand Earn operated by Top Markets Solutions Ltd is a Cyprus Investment Firm (CIF) regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 158/11 and compliant with MIFID II.

These licensing details reflect the broker’s adherence to stringent regulatory requirements set forth by Cyprus Securities and Exchanges Commission (CySEC). This guarantees that they meet the high standards expected in financial markets, safeguarding both the integrity of the trading environment and trader assets.

Earn Broker Regulation Compliance

Earn Broker prioritizes adhering to a robust framework of financial regulations, ensuring that all business practices not only meet but often exceed industry standards. This commitment serves to protect clients and maintain the integrity of the financial markets. Earn Broker’s approach to regulation compliance revolves around several key areas:

🔴 The broker is diligent in following the regulations set by financial authorities, ensuring that all trading activities are conducted in a lawful manner.

🔴 Earn Broker adopts best practices and standards that are recognized globally, enhancing the safety and reliability of its services.

🔴 They deploy multiple layers of security and risk management protocols to safeguard clients’ investments and personal information.

🔴 The company maintains open communication with its clients, providing clear and accessible information on trading conditions, fees, and the risks associated with trading activities.

Earn Broker CFD Trading Services

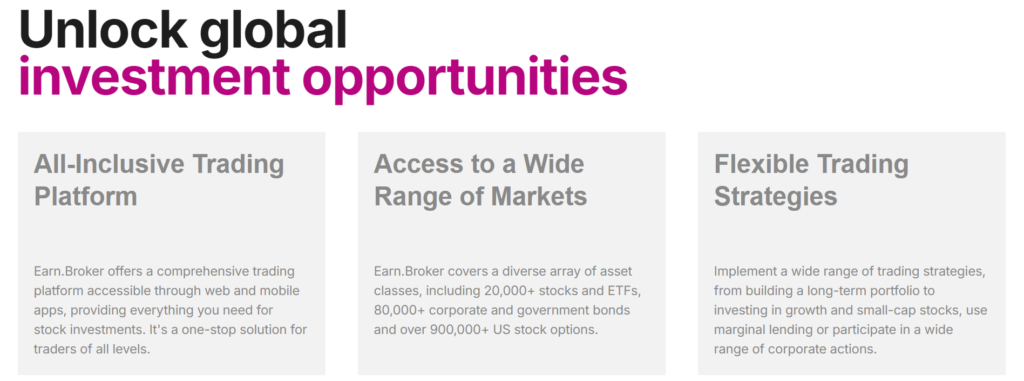

Earn Broker offers a comprehensive CFD trading service, empowering traders to maximize their trading potential. With CFDs (Contracts for Difference), traders can leverage their investments, access a wide array of markets without the need to own the underlying assets, and profit from both market uptrends and downtrends. It is noteworthy that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Traders who choose Earn Broker benefit from seamless trading technology provided by a licensed and award-winning partner. Here are some key features of their service:

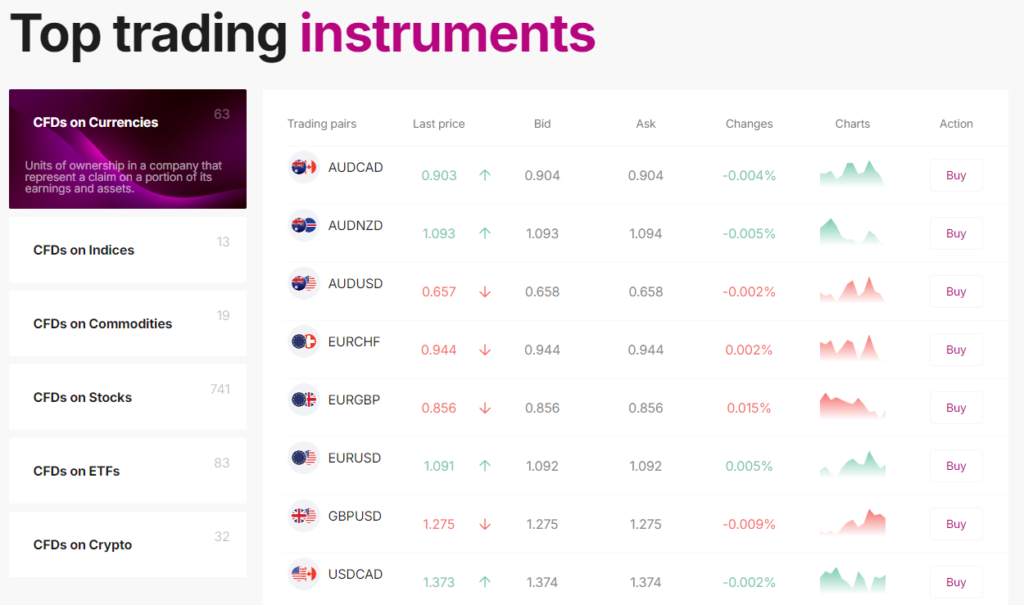

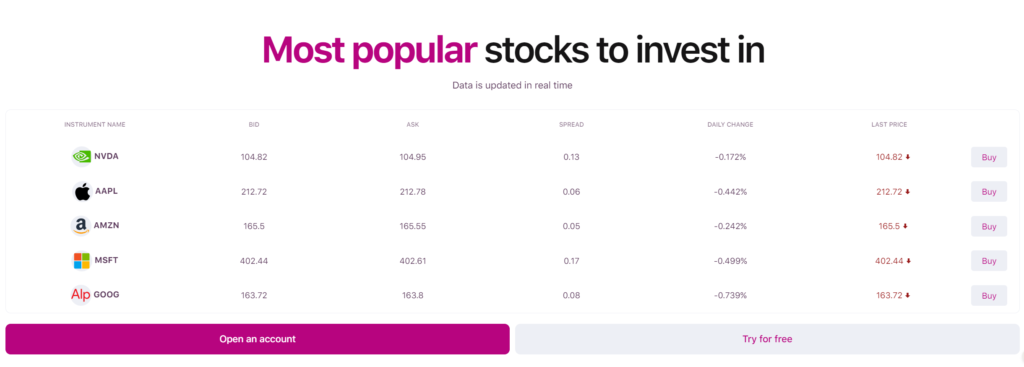

Trading Instruments

Earn Forex Broker offers traders access to over 900 trading instruments, allowing them to explore an extensive range of markets and assets.

| Instrument Type | Examples |

| CFDs on Currencies | EURUSD, EURGBP, USDJPY, NZDUSD, EURCAD |

| CFDs on Indices | FRA40, UK100, NIKKEI, US30, US500 |

| CFDs on Commodities | XAGEUR, XAUEUR, XALUSD, COFFEE, WTI |

| CFDs on Shares | NVDA, AAPL, AMZN, MSFT, GOOG |

| CFDs on ETFs | SPY, TQQQ, TLT, SOXX, GLD |

| CFDs on Cryptocurrencies | BTCUSD, ETHUSD, BNBUSD, SOLUSD, XRPUSD |

Earn Brokerage Opportunities

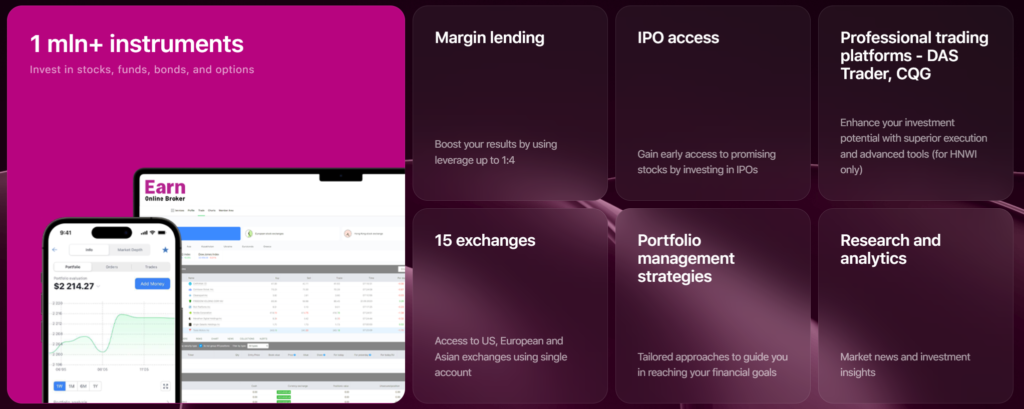

Earn Broker offers a complete range of brokerage opportunities that cater to diverse investor needs. These include margin lending benefits which enhance purchasing power, access to IPO investments for early stock buying opportunities, and professional trading platforms that guarantee efficient market execution. Additionally, clients have access to global exchanges and can benefit from tailored portfolio management strategies to optimize their investment outcomes. Clients can trade over 1+ mln securities, including stocks, ETFs, bonds and options on 15 world exchanges and OTC.

- Margin Lending Benefits

Margin lending allows traders to leverage their capital up to a ratio of up to 1:4, enhancing their purchasing power in the market. This financial tool offers distinct advantages, essential for expanding trading strategies. By borrowing funds from a broker, traders can invest in a wider array of assets than their capital would normally permit.

Key benefits of margin lending include:

✅ It amplifies trading results, allowing traders to gain more exposure to the market with less upfront capital. This can considerably increase profit potential on successful trades, but also could magnify losses if the market goes opposite to the trade.

✅ Margin accounts are equipped with mechanisms to prevent excessive losses, such as margin calls, which require traders to add funds or close positions when their account value falls below a certain threshold.

✅ By using borrowed funds, traders can afford to hold a deeply diversified portfolio.

✅Margin lending facilitates a range of strategies, including short selling and pattern day trading, giving traders flexibility to adjust their tactics based on market conditions.

These features combine to provide substantial trading advantages, making margin lending an option for those looking to expand their investment capabilities.

- IPO Investment Access

Building on the advantages of margin lending, Earn Broker’s IPO investment access offers investors early entry into high-potential stocks, enhancing portfolio growth opportunities. This investment access is critical for engaging with IPO opportunities, which often present a notable potential for financial growth. By securing shares at IPO prices, investors can participate in the stock market’s early trading stages, where initial price surges can result in substantial gains. However specific stocks can experience significant downturns during first days and weeks after initial public offering, thus rigorous due diligence of the investments before participation in IPO is a must for investors.

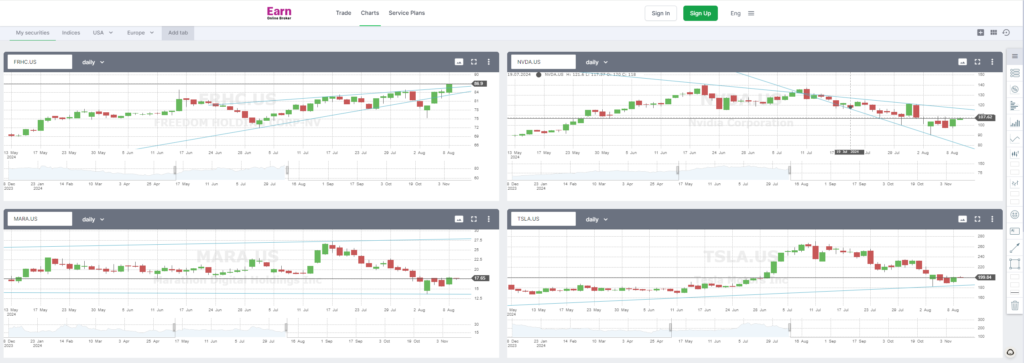

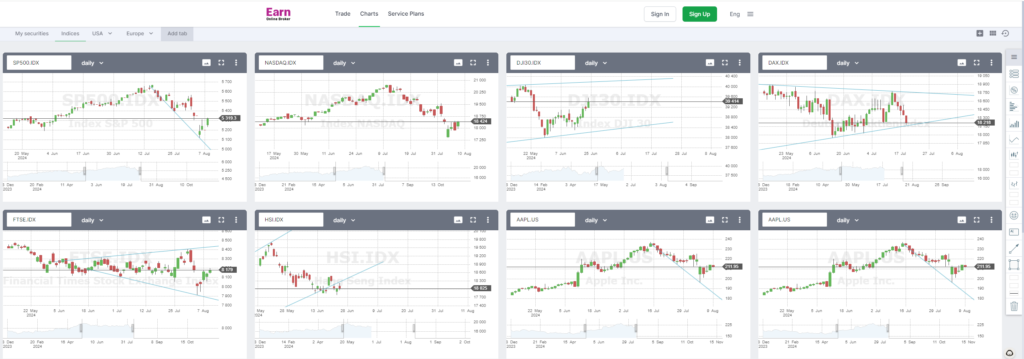

- Professional Trading Platforms

Earn Broker is equipped with professional trading platforms (proprietary Earn.Broker and professional DAS Trader) that offer investors advanced tools and superior execution capabilities essential for maximizing investment outcomes. These platforms are designed to elevate trading efficiency through streamlined processes and real-time data, enabling traders to make quick, informed decisions. Platform customization allows users to tailor their trading environment to suit their individual strategies and preferences, enhancing their overall trading experience.

Here are several key features offered by professional trading platforms:

🔵 These platforms provide a range of analytical tools that help traders identify trends, forecast market movements, and make data-driven decisions. This includes access to historical data, charting capabilities, and various analytical indicators.

🔵 Advanced risk management options are integral, allowing traders to set stop-loss orders, take profit levels, and monitor their risk exposure to manage potential losses effectively.

🔵Traders can test and develop their trading strategies using historical data and simulation features, ensuring strategies are optimized before execution.

🔵Traders can set up custom alerts based on specific market conditions, ensuring they never miss critical trading opportunities.

- Global Exchange Access

Earn Broker frequently expands its clients’ trading opportunities by providing access to global exchanges across the US, Europe, and Asia. This global market access enables traders to engage in a variety of international markets, offering substantial investment opportunities and a broad range of asset diversity. Through its sophisticated trading platforms, Earn Broker facilitates seamless trading in diverse assets including equities, bonds, funds and options on these global exchanges.

The inclusion of multiple international exchanges not only broadens the scope for asset choices but also enhances trading advantages. Traders can capitalize on different market phases and regional economic cycles, optimizing their strategies according to global economic trends. Moreover, the ability to trade across different time zones increases the opportunities for traders to participate in market movements around the clock, thereby potentially increasing their profitability.

Asset diversity is particularly vital in hedging against market volatility. By providing access to a wide array of assets from various global markets, Earn Broker allows its clients to diversify their portfolios effectively.

- Portfolio Management Strategies

Access to global exchanges not only diversifies investment options but also sets the stage for portfolio management strategies that cater to individual financial goals and risk tolerances. Brokers like Earn Broker provide advanced platforms that facilitate a range of investment strategies, enabling both seasoned and novice investors to tailor their asset allocation to fit their specific needs. This strategic approach enhances portfolio diversification and wealth preservation, essential for long-term financial stability.

Here’s how Earn Broker supports effective portfolio management:

🟡They offer tools that help investors assess and manage risk, ensuring that each investment aligns with their overall risk tolerance.

🟡Investors can adjust their portfolios in response to market changes and personal circumstances, optimizing their investment outcomes.

🟡Strategies emphasize not just growth but also protecting the value of the existing assets against market volatilities.

🟡Access to a wide range of assets across global markets enables a broad spread of investments, reducing potential risks and improving returns.

These strategies are essential to achieving a balanced and resilient investment portfolio.

Table of Contents

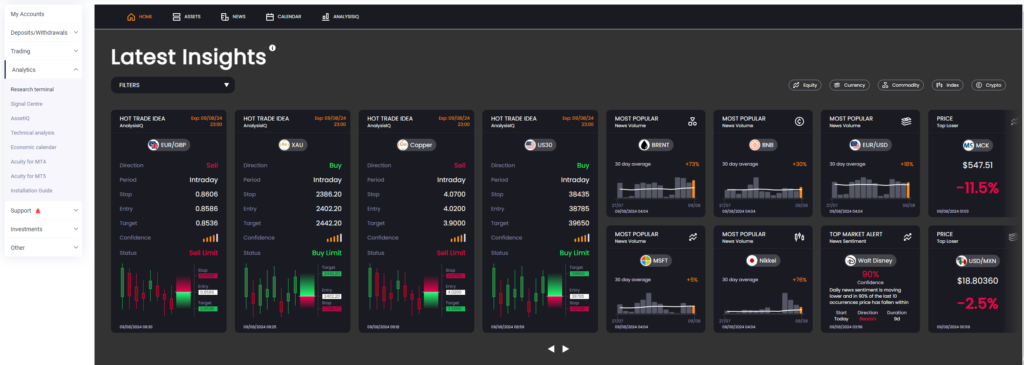

ToggleEarn Broker Advanced Trading Features 💻📊

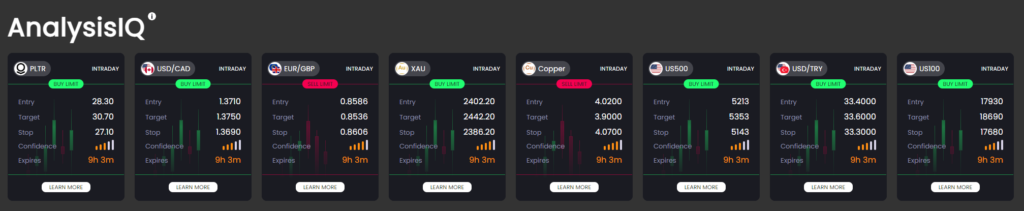

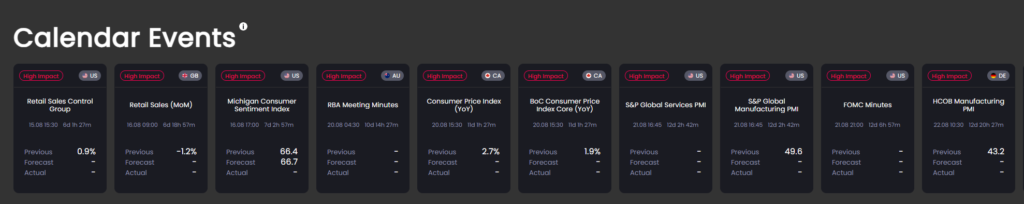

Advanced trading features greatly enhance a trader’s ability to analyze markets, execute trades, and manage risk effectively.

Technical Analysis

At the core of these features is technical analysis, which utilizes historical data and statistical models to forecast future market trends and price movements. This analytical tool is essential for traders to identify potentially profitable trading opportunities and to tailor their trading strategies accordingly.

Risk Management

Risk management is another vital aspect that advanced trading features support. By implementing stop-loss orders and setting risk-reward ratios, traders can minimize potential losses and optimize their investment returns. These tools are key in maintaining portfolio health, especially in volatile markets.

Moreover, understanding trading psychology plays a significant role in successful trading. Advanced features often include sentiment indicators and behavioral analytics, which help traders gauge market sentiment and make more informed decisions. These insights are crucial in developing robust trading strategies that can adapt to changing market conditions.

Furthermore, these advanced trading features allow for a deep exploration of market trends, enabling traders to detect shifts and movements that might not be visible without sophisticated analytical tools. By leveraging these features, traders can enhance their market predictions and refine their approaches to better align with current and forecasted market behaviors.

Earn Broker Platform Accessibility

Earn Broker allows traders to explore the vast capabilities of advanced trading features through their trading platform. The accessibility of Earn Broker’s trading platform impacts the effectiveness and efficiency of trading operations.

Here are key aspects of Earn Broker’s trading platform:

🟣Mobile Trading: Enables traders to execute and monitor trades from anywhere, making sure that they are not tied to a desktop setup.

🟣Cross-Platform Functionality: Allows seamless shifts between devices and operating systems, improving the trading experience without interruptions or data discrepancies.

🟣 User-Friendly Interface: Essential for traders, a simple and intuitive interface ensures that users can navigate and utilize the platform’s features without unnecessary complexity.

🟣Real-Time Updates: Critical for making informed decisions, timely updates and alerts provide traders with the necessary information to react promptly to market changes.

Earn MetaTrader5 (MT5) Platform

Earn Broker’s trading platform includes the MT5 platform, developed by MetaQuotes. This platformis renowned for its extensive trading capabilities and versatility across various markets. It offers advanced technical analysis tools, supports automated trading systems known as Expert Advisors, and provides options for copy trading. These features collectively enhance the trading experience by facilitating efficient market analysis, execution, and management.

Features

Earn’s MT5 platform enhances trading capabilities with its extensive suite of multi-asset functionalities and advanced technical tools. It’s designed to serve both novice and experienced traders who require robust and flexible trading tools, in-depth market analysis capabilities, and sophisticated account management features. The platform supports a variety of investment strategies and includes features critical for thorough risk assessment.

Key features of the Earn’s MT5 Platform include:

🔷Advanced Trading Tools: MT5 offers a broad array of trading tools that empower traders to execute complex trading strategies. Tools such as technical indicators, graphic objects, and detailed charting capabilities allow for thorough market analysis.

🔷In-depth Market Analysis: Equipped with advanced analytical tools, MT5 provides traders with the insights needed to make informed decisions. This includes access to real-time market data, news, and historical data analysis.

🔷Enhanced Account Management: The platform facilitates efficient account management, allowing users to monitor their investments accurately and adjust their strategies swiftly.

🔷Rigorous Risk Assessment: MT5 includes features like stop-loss orders and margin monitoring to help traders manage and mitigate risks effectively, ensuring they can safeguard their investments against market volatility.

Benefits

Building upon the advanced features of Earn’s MT5 platform, traders benefit greatly from its capabilities, which optimize trading efficiency and potential profitability. The MT5 platform offers a wide range of trading benefits and investment advantages that are tailored to enhance user experience and increase profit opportunities. Its sophisticated risk management tools allow traders to set stop-loss and take-profit orders effectively, minimizing potential losses while maximizing gains.

Furthermore, Earn’s MT5’s all-encompassing customer support system ensures traders receive assistance whenever needed, promoting a dependable trading environment. The platform’s advanced technical tools enable detailed market analysis, helping traders make informed decisions based on real-time data and historical trends. This level of analysis supports strategic trading, leveraging various market conditions to exploit potential profit opportunities.

Earn’s MT4 Platform

Earn’s MT4 platform, known for its robust features, enhances trading by offering extensive charting tools, cross-device accessibility, and backtesting capabilities. It’s designed to cater to both novice and experienced traders by providing a user-friendly interface and a variety of technical analysis tools. These attributes guarantee that traders can execute trades efficiently and with precision, across multiple devices.

Features

While MT4 is renowned for its user-friendly interface, it also boasts extensive charting tools that cater to both novice and experienced traders. The platform integrates various elements essential for effective trading, supporting multiple account types and ensuring adaptable trading conditions. MT4’s architecture allows for in-depth market insights, which are vital for making informed trading decisions.

Here are several core features that highlight its capabilities:

🔶Risk Management: MT4 provides advanced risk management tools, including stop-loss orders and real-time margin monitoring, which help traders manage their exposure and safeguard investments.

🔶Trading Tools: The platform includes an array of trading tools such as technical indicators, graphical objects, and expert advisors, facilitating a wide range of trading strategies.

🔶Market Insights: Traders have access to real-time market data and news, allowing them to analyze market trends and volatility for better positioning.

🔶Trading Conditions: MT4 supports various trading conditions, tailored to different trading styles and risk appetites, from scalping to long-term investing.

These features collectively enhance the trading experience on MT4, making it a versatile choice for those looking to trade under diverse market conditions and with different risk management strategies.

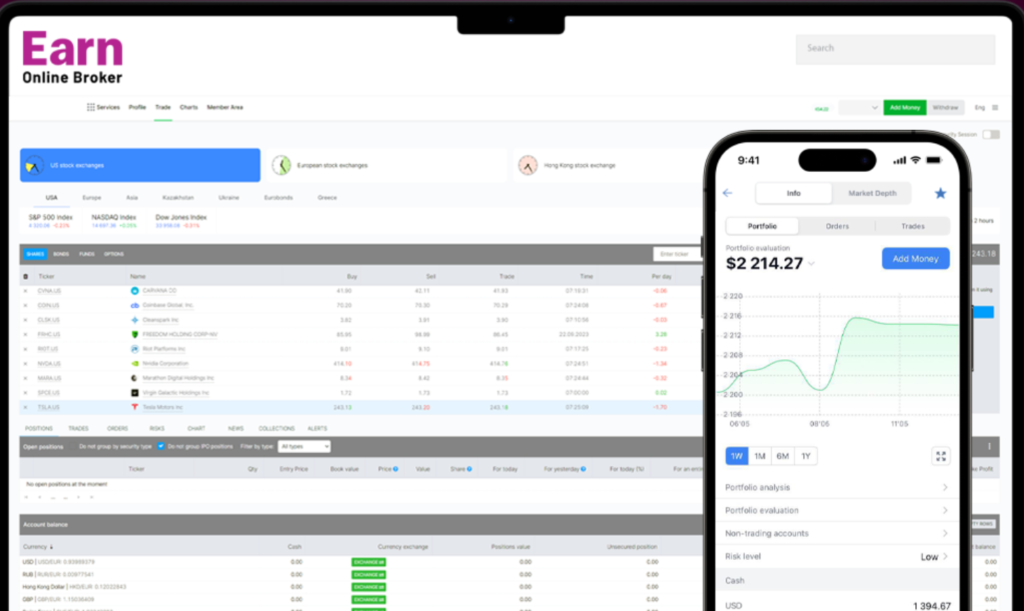

Earn Broker Platform

Earn Broker provides investors with the Earn.Broker App which is equipped with a range of features designed to enhance the experience for users when accessing world stock exchanges. It offers advanced tools for market analysis, transaction execution, and portfolio management, ensuring that investors can operate efficiently and effectively. This app supports a broad spectrum of asset classes, appealing to both novice and experienced investors.

It’s important to note that the Earn.Broker app is available for Apple devices via the iOS App Store and Google Play (Android).

Features

Earn.Broker app stands out with its extensive suite of features designed to enhance the trading experience for users across different asset classes. It integrates a range of functionalities essential for dynamic trading environments.

Here are the core features:

🔹Trading Tools: The app provides advanced trading tools that allow users to execute trades efficiently. Features such as one-click trading and automated strategies streamline the trading process, making it more intuitive and less time-consuming.

🔹Market Analysis: Users gain access to real-time market data and analysis tools. These features help traders make informed decisions by providing insights into market trends, price movements, and potential opportunities.

🔹Account Management: The app includes robust account management tools. Traders can monitor their portfolios, check balances, and view historical trading data all in one place, ensuring they stay on top of their financial activities.

🔹Risk Management: With built-in risk management tools, the app helps users manage and mitigate risks effectively. Features like stop-loss orders and real-time alerts enable traders to protect their investments from significant losses.

Additionally, Earn.Broker app is backed by 24/5 customer support, ensuring users have assistance whenever needed, further enhancing the trading experience.

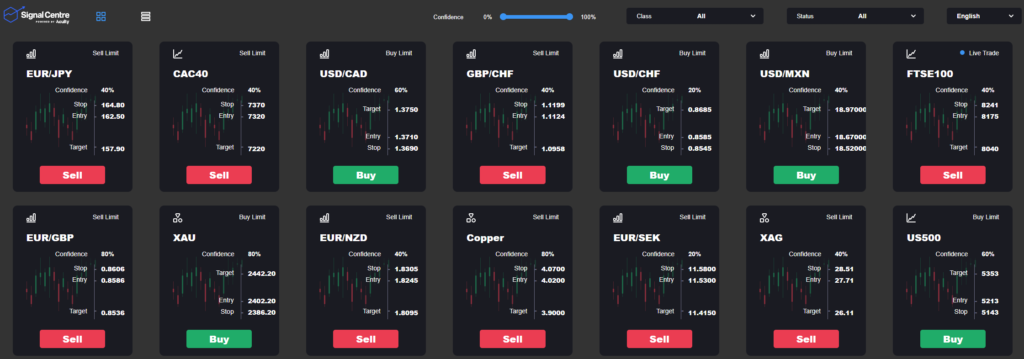

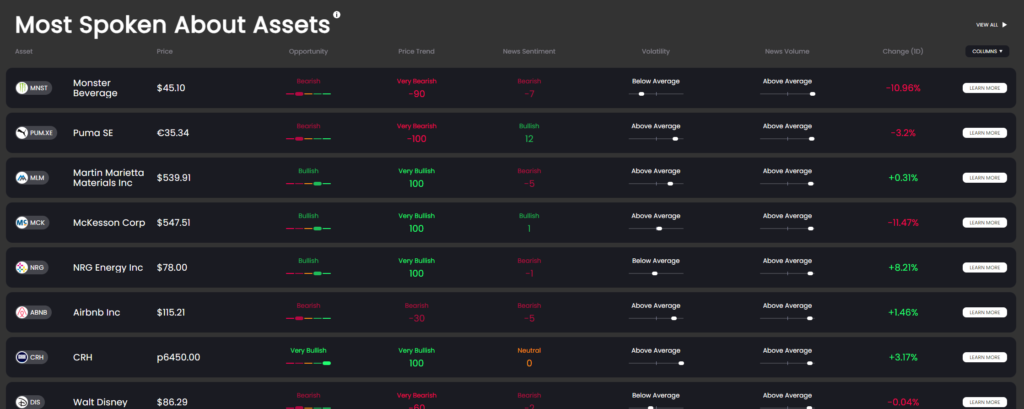

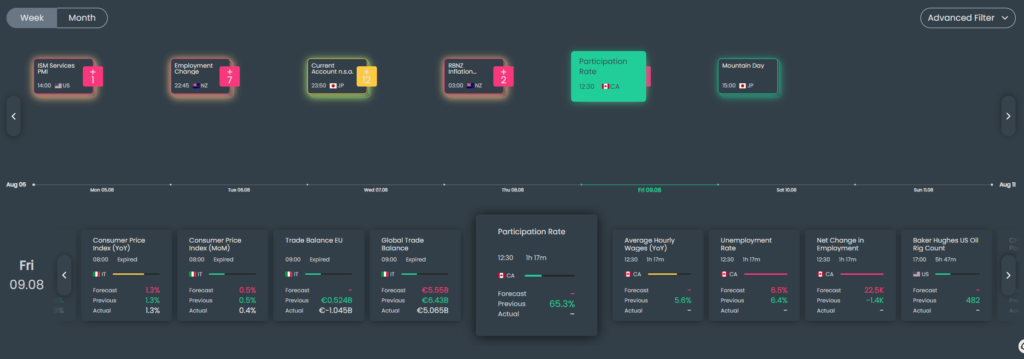

Earn Broker Comprehensive Analytics Tools

Advanced analysis tools at Earn Broker empower traders to make informed decisions by providing detailed insights into market trends and performance metrics. These tools are critical for thorough market analysis, shaping effective trading strategies, and enhancing risk management. They also offer valuable investment insights and facilitate portfolio optimization.

Here’s an overview of the key capabilities provided by the analysis tools:

| Feature | Description | Importance |

| Market Analysis | In-depth exploration of market trends | Essential for timing trades |

| Risk Management | Tools to limit and control exposure | Protects against volatility |

| Portfolio Insight | Analyzes and suggests improvements | Optimizes asset allocation |

By integrating these tools into their daily trading activities, users at Earn Broker can better manage their investments and refine their trading approaches.

The comprehensive analysis suite is designed to streamline the decision-making process, enabling traders to execute trades more confidently. With these advanced tools, Earn Broker remains a competitive choice for those seeking to enhance their trading performance through informed, data-driven strategies.

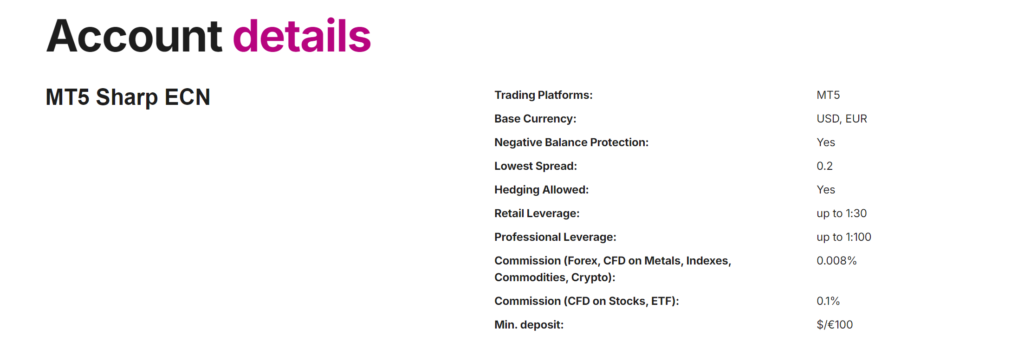

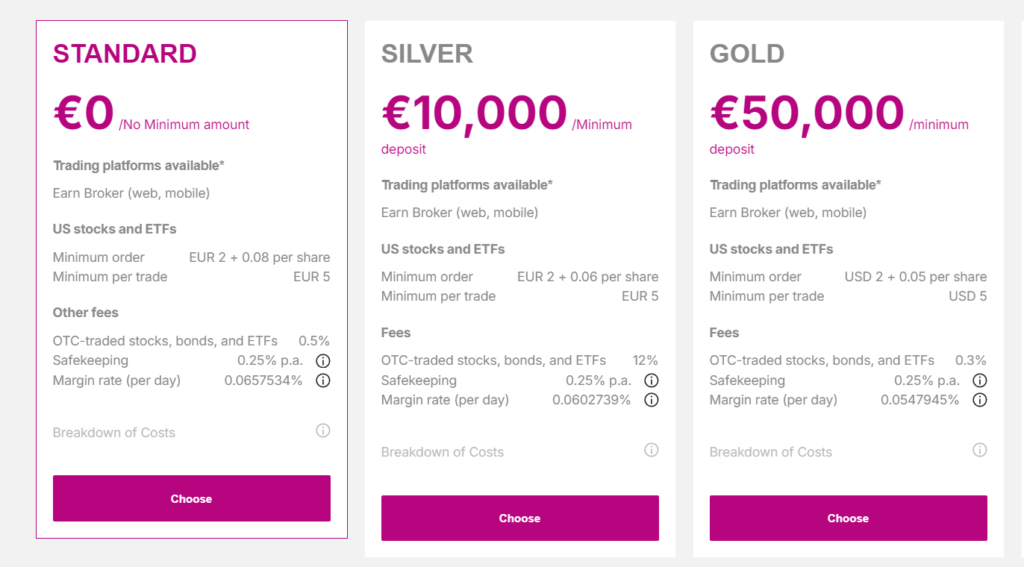

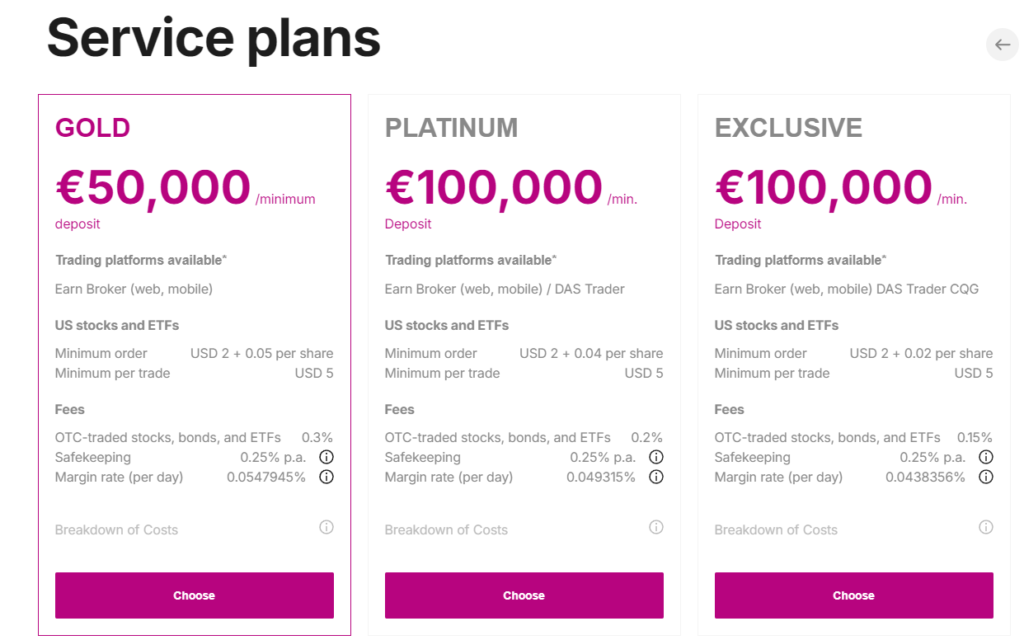

Earn Broker Account Types

Several account types are available at Earn Broker, catering to different trading preferences and experience levels. Each type offers unique trading options and account benefits, facilitating an effective account comparison and customization for users.

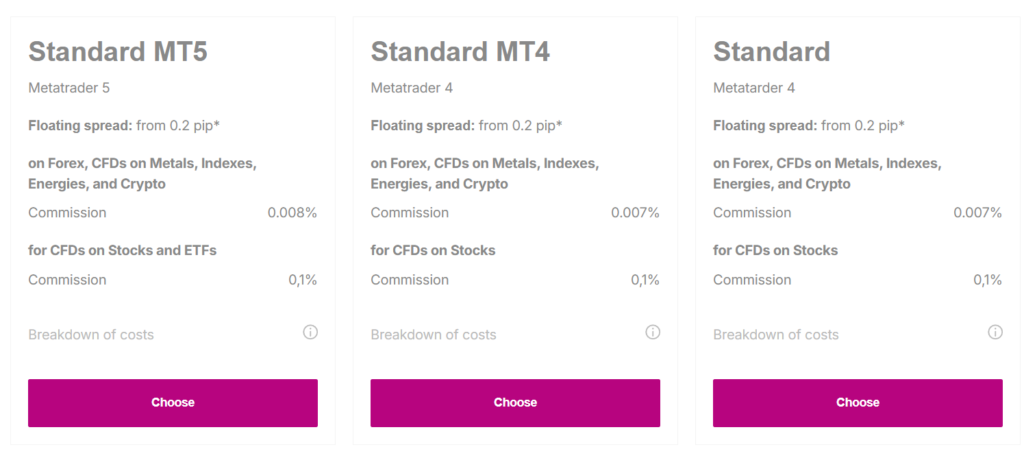

MT5 Sharp ECN

The MT5 Sharp ECN account provides investors with an extensive selection of instruments across the platform. This account features transparent pricing through commissions, eliminating additional markups on spreads. Traders benefit from Market Execution, which ensures a seamless trading experience with no re-quotes or extra prompts during order confirmation.

- Extensive selection including Forex, Indices, Commodities, Stocks, ETFs, and Cryptocurrencies.

- Market Execution for precise trading without re-quotes.

- Transparent pricing through commissions.

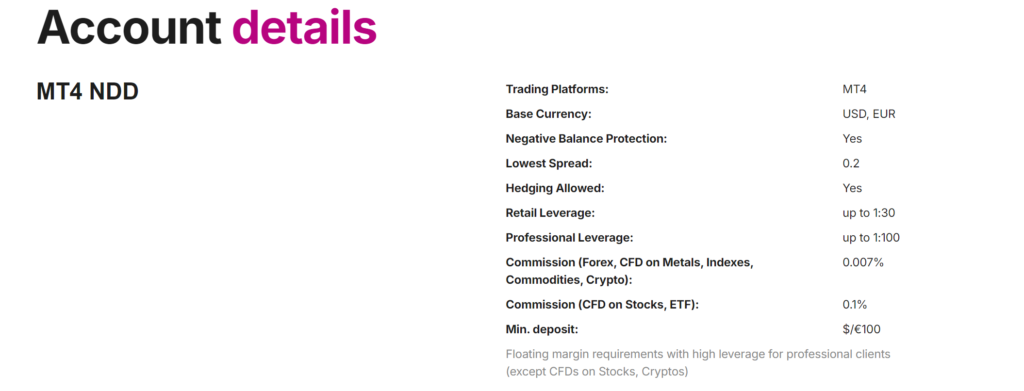

MT4 NDD (No Dealing Desk)

The MT4 NDD account offers traders direct access to the market without dealing desk intervention. This results in faster execution speeds and potentially tighter spreads compared to traditional accounts.

- Wide range including Forex, Indices, Commodities, and more.

- No Dealing Desk for direct market access.

- Competitive spreads due to direct market access.

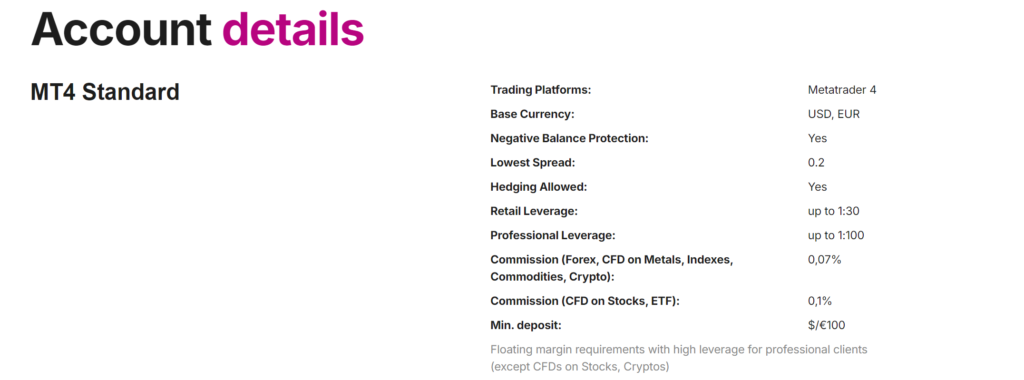

MT4 Standard

The MT4 Standard account is designed for traders who prefer a traditional trading experience. This account offers quality executions and live support, making it suitable for both beginners and experienced traders.

- Broad range including Forex, Indices, Commodities, and others.

- Standard execution with reliable performance.

- Live support for all trading-related queries.

ERC (Poland) for Experienced Retail Clients

The ERC account is specifically tailored for experienced retail clients from Poland. Permanent residents of Poland can apply to receive the status of Experienced Retail Clients (ERC) and be entitled to lower margin requirements for some instrument classes.

In order for clients to obtain this status, they must fulfill certain criteria. This account offers advanced trading features and conditions that cater to seasoned traders.

Demo Account for Practicing

The Demo Account allows new traders to practice trading without risking real money. It is an excellent way for beginners to get accustomed to the trading platform and develop their strategies before committing actual funds.

- Practice and learn without financial risk.

- Simulated trading environment with real-time data.

Each account type at Earn Broker is designed to provide traders with the tools and conditions they need to trade effectively according to their experience and preferences.

Trading Conditions

Earn Broker offers transparent and favorable trading conditions to ensure that traders have a seamless and efficient experience. Here is an overview of their trading conditions, focusing on costs and charges, margin requirements, and deposits and withdrawals.

Costs and Charges

Earn Forex Broker follows a transparent pricing model, and all costs and charges are clearly outlined for traders.

- Spreads vary depending on the account type and instrument being traded. They can be as low as 0.0 pips on major currency pairs.

- Depending on the account type (e.g., MT5 Sharp ECN), traders may incur commission charges instead of markups on spreads.

- Overnight positions may be subject to swap rates, which are interest rates applied to leveraged positions held overnight.

- A fee may be charged if an account remains inactive for a specified period. To avoid this fee, traders can ensure regular activity within their accounts by placing trades even if they are small. Also, they can keep positions open within a certain period and identify new trading opportunities.

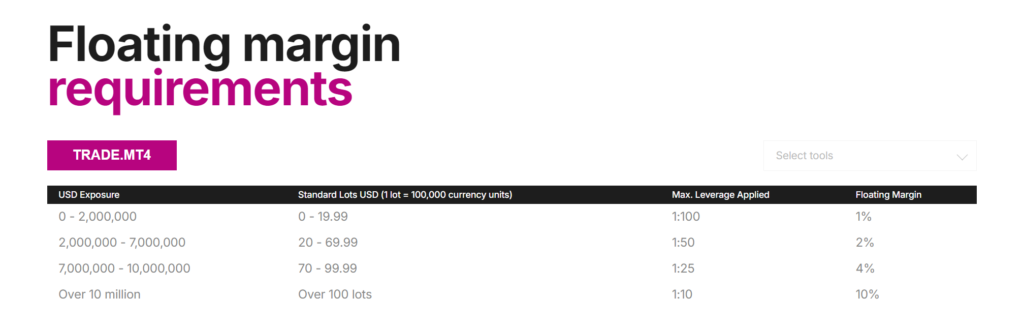

Margin Requirements

Margin requirements determine the amount of capital that traders need to maintain in their accounts to open and maintain positions.

- Leverage ratios vary by instrument and account type. For instance, major currency pairs might offer leverage up to 1:30, while stocks might have lower leverage options.

- The initial margin requirement is the minimum amount required to open a new position.

- The maintenance margin is the minimum amount that must be maintained to keep a position open. If the account balance falls below this level, a margin call may occur.

- Margin call and stop-out levels are specific thresholds at which the broker may request additional funds or close positions to prevent further losses.

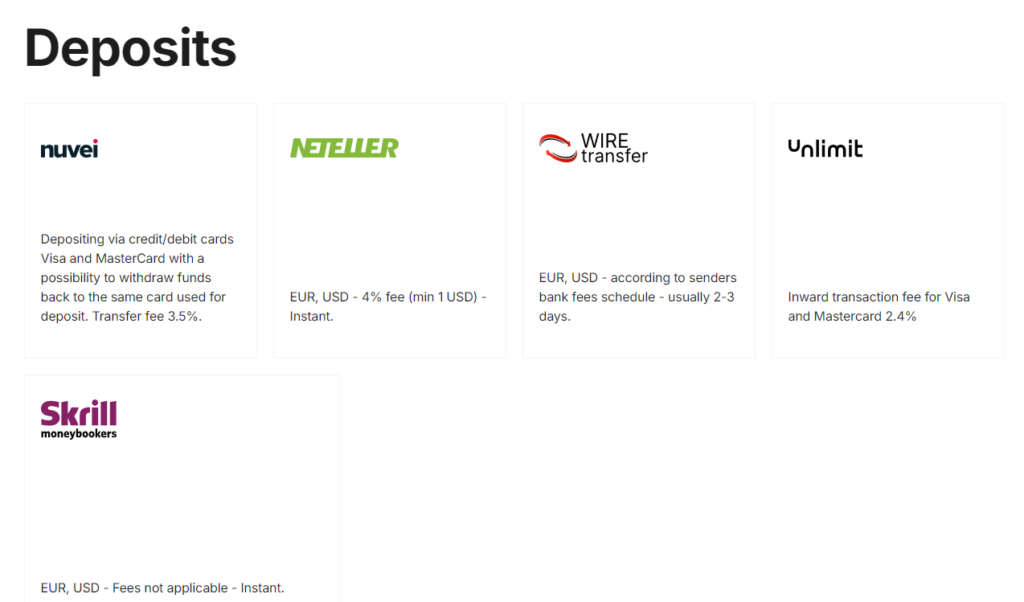

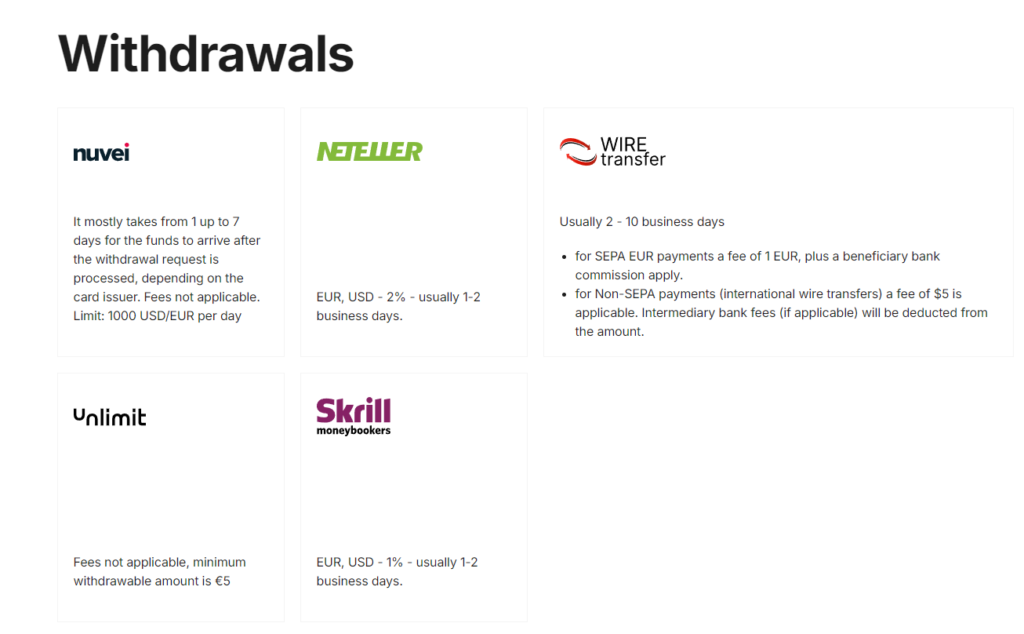

Deposits and Withdrawals

Depositing and withdrawing funds with Earn Broker is designed to be straightforward and secure.

- Traders can fund their accounts using various methods, including bank transfers and payments with credit/debit cards and popular e-wallets such as Skrill and Neteller.

- Similar to deposit options, withdrawals can be processed via bank transfers, credit/debit cards, and e-wallets.

- Deposits and withdrawals with bank transfer are usually processed within 3 business days.

- The broker strives to keep fees minimal. However, some payment providers may charge transaction fees, which are passed on to the clients.

Earn Broker’s trading conditions are designed to provide clarity and support to traders, ensuring they understand the costs, margins, and processes involved in managing their trading accounts effectively.

Earn Broker Leverage Options

Building on its robust trading conditions, Earn Broker also offers leverage options that empower traders to amplify their market positions. Through leveraged trading, clients can significantly enhance their exposure to various financial markets with a relatively small amount of invested capital. This capability is vital for maximizing potential returns, yet it comes with increased risk levels that necessitate effective risk management strategies.

Here are the key aspects of Earn Broker’s leverage options:

- The broker provides varying leverage ratios, which can reach up to 1:30 for major currency pairs. This allows traders to select a level of leverage that matches their trading style and risk tolerance.

- By utilizing leverage, traders can open larger positions than what their initial capital would allow, amplifying potential gains from small price movements. It is noteworthy that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- Tools and educational resources are available to help traders comprehend and manage the risks associated with leveraged trading.

- The platform supports various leverage strategies, enabling traders to customize their approach based on their market analysis, trading goals, and risk appetite.

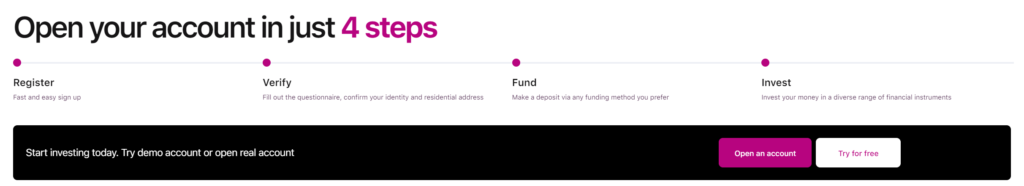

Earn Broker Account Opening Process

Starting your trading journey with Earn Broker is a streamlined and efficient process. Here’s a step-by-step guide to help you get started:

- The first step to begin trading is registering on the platform. Prospective clients need to provide basic personal information, such as their name, email address, and phone number, as well as to complete their economic profile.

- After registering, the account verification step is crucial. Users must submit documents to prove their identity and residency. This step ensures compliance with regulatory standards and enhances the security of your account.

- Once your account is verified, you can explore various funding options. Earn Broker supports multiple methods, including Bank Transfers, Credit Cards and E-Wallets.

- If you are new to trading, Earn Broker offers a demo account. This feature allows users to practice trading without financial risk, helping them familiarize themselves with trading dynamics before committing to real funds.

Earn Broker Customer Service 📞🤝

Earn Broker’s commitment to customer satisfaction is evident through its exceptional customer service. Customer support is readily available to assist you throughout the entire process, from account setup to active trading. You can reach out through multiple channels:

- Live Chat

- Phone

This ensures that any issues or queries are resolved swiftly.

Earn Broker Awards 🏆

Earn Broker has consistently garnered industry recognition, securing multiple awards over the years that underscore its market leadership and service quality. Particularly, the broker was named Best Broker in 2014 and received accolades for the Top Affiliate Program and Customer Service Excellence in 2015. Additionally, the broker stood out as the Leading CFD broker in 2017, highlighting its expertise and robust offerings in the CFD sector.

Conclusion

Earn Broker excels in regulatory compliance, outstanding customer service, and innovative trading tools. With CySEC licensing, it offers advantageous leverage, favorable trading conditions, and sophisticated risk management. Their advanced features enhance market analysis and trade execution. It is noteworthy that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.