🌧️ Inclement Weather Dampens UK Retail Sales, but Online Shopping Soars! 🛒💻

💥💻 Consumers prefer online shopping.

🛍️🌧️Wet weather causes grocery stores to record reduced sales in both clothing and food categories.

📊💸 Fluctuations in sales can have broader implications for the country’s economic recovery and consumer spending.

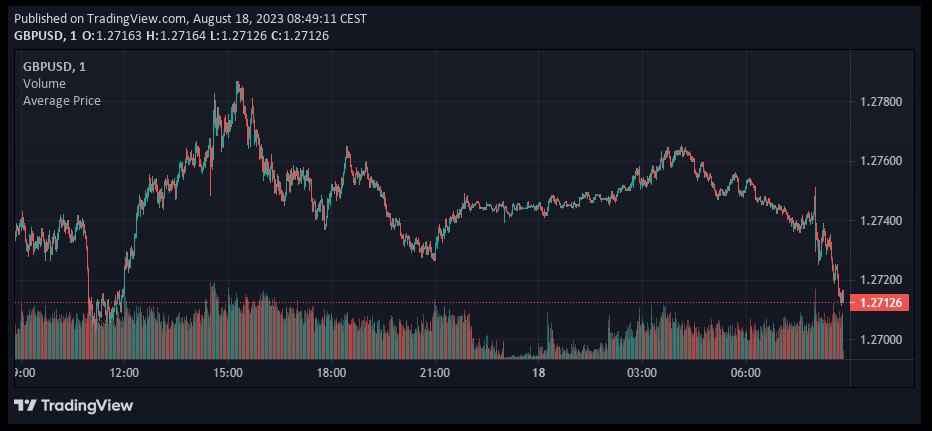

💷💰 The disappointing retail sales data has also influenced currency pairs GBP/USD and EUR/GBP.

The retail industry in the United Kingdom experienced a significant decline in sales during the month of July, with a decrease of 1.2%. This unexpected drop has been attributed to the unusually wet weather conditions that prevailed throughout the month.

The high levels of rainfall, particularly in the North West region, had a negative impact on footfall and subsequently affected retail sales. However, amidst this decline, online sales witnessed a surge, reaching their highest proportion of total retail sales since February 2022, accounting for 27.4% in July.

This increase in online sales can be attributed to the presence of increased promotional activities in the digital space.

Impact of Wet Weather on Retail Sales

July saw above-average rainfall across the country, with the North West region experiencing particularly heavy downpours. The wet weather conditions proved to be detrimental for businesses, as it deterred customers from venturing out and resulted in decreased footfall in brick-and-mortar stores.

With fewer people visiting physical retail outlets, the overall retail sales figures were adversely affected.

Online Sales Surge Amidst Decline

While brick-and-mortar stores faced challenges due to the wet weather, online sales thrived during this period. Online purchases accounted for a significant portion of total retail sales, reaching a record high of 27.4% in July.

The surge in online sales can be attributed to the increased promotional activities conducted by retailers in the digital space.

As consumers opted for the convenience and safety of online shopping, retailers strategically offered attractive discounts and promotions to capture this growing market segment.

Grocery Stores Experience Reduced Sales

Grocery stores, which typically see a steady flow of customers, reported a decline in both clothing and food sales during this period. The combination of rain and rising prices contributed to this downward trend.

As consumers opted to stay at home due to the inclement weather, there was a decrease in demand for non-essential items such as clothing. Additionally, rising food prices also impacted sales, further adding to the challenges faced by supermarkets.

Significance of Retail Sales Figures

Retail sales figures hold great importance as they are reflective of household consumption, which forms a significant part of the UK economy. Consumer spending plays a crucial role in driving economic growth, and therefore, any fluctuations in retail sales can have broader implications for the overall health of the economy.

The disappointing retail sales data raises concerns about the strength of consumer spending and its impact on the country’s economic recovery.

Currency Impact

The GBP/USD currency pair has been affected by the disappointing retail sales data, struggling to establish a clear direction. The decline in retail sales adds to the uncertainty surrounding the British pound’s performance against the US dollar.

Similarly, the EUR/GBP currency pair has experienced a recovery from a five-week low, supported by the disappointing UK retail sales data. Positive economic data from the European Union and Germany have alleviated concerns of a recession in the region, boosting the value of the euro against the pound.

Upcoming Factors to Watch

Moving forward, market participants will be closely monitoring upcoming EU inflation readings, remarks from the European Central Bank’s Lane, and the Jackson Hole Symposium.

These factors could significantly impact the direction of the EUR/GBP currency pair. Additionally, cautious market sentiment, along with positive factors influencing the euro, has contributed to the bid higher movement of the EUR/GBP, reaching an intraday high near 0.8545 in London.

Summary

The retail industry in the UK experienced a decline in sales during July, primarily due to wet weather conditions that negatively impacted footfall. However, online sales surged to their highest proportion of total retail sales since February 2022. Supermarkets reported reduced sales in clothing and food due to a combination of rain and rising prices.

The disappointing retail sales data has affected currency pairs such as GBP/USD and EUR/GBP. While the GBP/USD struggles to establish a clear direction, the EUR/GBP has seen a recovery supported by the weak retail sales data and positive economic data from the EU and Germany.

How Retail Sales Can Impact The Currency Market, (GBPUSD And EURGBP)

How do retail sales impact the currency market?

Retail sales data is a crucial economic indicator that reflects consumer spending patterns. Strong retail sales indicate a healthy economy, which can positively impact a country’s currency. On the other hand, weak retail sales may signify a slowdown or contraction, potentially leading to currency depreciation.

How can declining retail sales affect GBP/USD?

When retail sales in the UK decline, it suggests reduced consumer demand and economic weakness. This can lead investors to sell the pound (GBP) and buy the US dollar (USD), causing a depreciation of the GBP/USD exchange rate. For example, if UK retail sales unexpectedly drop, traders may sell GBP/USD, resulting in a decrease in the exchange rate.

What if retail sales in the UK exceed expectations?

If retail sales in the UK surpass expectations, it indicates robust consumer spending and economic strength. This positive sentiment can attract investors, leading to an increase in demand for the pound (GBP) and potentially strengthening the GBP/USD exchange rate. For instance, if UK retail sales data shows substantial growth, traders might buy GBP/USD, causing the exchange rate to rise.

How does weak retail sales impact EUR/GBP?

Weak retail sales in the UK can signal economic concerns and dampen investor sentiment towards the pound (GBP). Consequently, investors may sell GBP and seek alternative currencies like the euro (EUR), leading to an appreciation of the EUR/GBP exchange rate. Suppose UK retail sales disappoint, causing traders to sell GBP/USD and buy EUR/GBP. In that case, the exchange rate could increase.

Can strong retail sales in the UK benefit EUR/GBP?

Strong retail sales in the UK demonstrate a thriving consumer market, which may lead investors to favor the pound (GBP) over the euro (EUR). This shift in investor sentiment can cause the EUR/GBP exchange rate to depreciate. For example, if UK retail sales data shows impressive growth and traders believe it will strengthen GBP relative to EUR, they may sell EUR/GBP, resulting in a decrease in the exchange rate.

Are there any other factors that influence GBP/USD and EUR/GBP apart from retail sales?

Yes, currency exchange rates are influenced by various factors, including interest rate differentials, political events, economic indicators (such as GDP, inflation, and employment), market sentiment, and geopolitical developments. These factors collectively determine the supply and demand for currencies, impacting their exchange rates.

Can unexpected retail sales figures cause volatility in GBP/USD and EUR/GBP?

Yes, unexpected retail sales data can trigger significant reactions in currency markets, leading to increased volatility in GBP/USD and EUR/GBP. If the released figures deviate significantly from market expectations, traders may swiftly adjust their positions, resulting in rapid buying or selling of currencies and heightened market volatility.

How quickly do currency markets react to retail sales data?

Currency markets are highly reactive to important economic data releases, including retail sales figures. Traders monitor such data closely and react swiftly to new information, adjusting their positions accordingly. The immediate response to retail sales data can impact currency exchange rates within seconds or minutes after the announcement.

Do retail sales have a long-term impact on currency markets?

Retail sales data, along with other economic indicators, provides insights into a country’s economic trajectory. While short-term fluctuations in currency exchange rates can occur due to retail sales data, the long-term impact depends on broader economic trends, monetary policy decisions, and market sentiment towards a particular currency.

How can retail sales data impact trading strategies in GBP/USD and EUR/GBP?

Retail sales data can influence traders’ decisions and trading strategies in GBP/USD and EUR/GBP. If retail sales data aligns with a trader’s bullish or bearish outlook for a currency, they may adjust their positions accordingly. For instance, if strong UK retail sales are anticipated, traders might buy GBP/USD, expecting the exchange rate to rise. Conversely, weak retail sales could prompt traders to sell GBP/USD or buy EUR/GBP, anticipating a decrease in the exchange rate.

Read These Next;

Exploring Forex Factory: An Invaluable Resource for Traders

The Best Time to Trade Forex: Maximizing Profit Potential

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Forex Breakout Strategy: A Guide for Profitable Trading

Forex Consolidation Breakout Strategies for Traders

Master Forex Flag Pattern Strategy for Profit

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Phyllis Wangui is a Financial News Editor with extensive knowledge of the forex, stock news, stock market, forex analysis, cryptos and foreign exchange industries. Phyllis is an avid commentator on these topics and loves to share her insights with others through financial publications and social media platforms.

View all posts SEO Editor