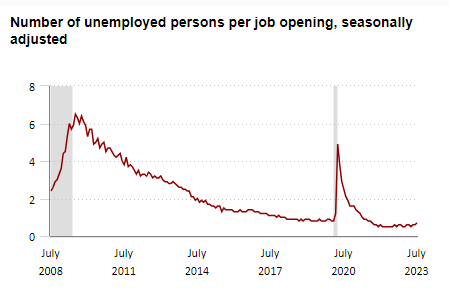

According to the latest Job Openings and Labor Turnover Survey (JOLTS) report released by the U.S. Bureau of Labor Statistics, the number of job openings edged down to 8,827,000(p) in July 2023. This indicates a slight decline compared to the previous month.

The report also revealed important rates related to job openings, hires, and total separations. In July 2023, the job openings rate stood at 5.3%(p), while the hires rate remained stable at 3.7%(p). Similarly, the total separations rate was recorded at 3.5%(p).

Digging deeper into the data, it becomes apparent that the quits rate, which measures the number of employees voluntarily leaving their jobs, was reported at 2.3%(p) in July 2023.

On the other hand, the layoffs/discharges rate, which represents involuntary job terminations initiated by employers, stood at 1.0%(p).

These numbers provide valuable insights into the overall state of the labor market. While job openings experienced a slight decline, reflecting potential challenges in certain sectors, the hires rate remained steady.

The total separations rate, which includes both voluntary and involuntary job separations, indicates some movement in the labor market.

The JOLTS report is an essential tool for policymakers and businesses alike, helping them make informed decisions based on real-time labor market conditions.

Table of Contents

ToggleConsumer Confidence Plummets in August, Sending the Dollar Index Downward

According to recent data from the Conference Board, consumer confidence in the US experienced a sharp decline in August. The Consumer Confidence Index dropped significantly to 106.1, down from the revised July figure of 114.0.

This decrease in consumer sentiment is having a noticeable impact on the market, particularly on the US Dollar Index, which has fallen below the key level of 104.00.

The Decline in Consumer Confidence

The Consumer Confidence Index serves as an important indicator of consumer sentiment in the US. In August, this index plummeted to 106.1, signaling a significant drop in consumer confidence compared to the revised figure of 114.0 in July.

The Present Situation Index, which measures consumers’ assessment of current economic conditions, also experienced a notable decline from 153.0 to 114.8.

Further, the Consumer Expectations Index, which gauges consumers’ short-term outlook for income, business, and labor market conditions, slid to 80.2 from its previous reading of 88.

Impact on the Market

The decline in consumer confidence is not limited to its psychological impact on individuals but also affects the financial markets. One notable consequence is the downward movement of the US Dollar Index.

The US Dollar Index, which measures the value of the dollar against a basket of major currencies, has fallen below the crucial level of 104.00 in response to the weakening consumer sentiment.

Broader Implications

The significant decline in consumer confidence raises concerns about the health of the US economy as a whole. Consumer spending plays a vital role in driving economic growth, and a drop in consumer confidence could lead to reduced spending and a slowdown in economic activity.

Weakened consumer sentiment may impact business decisions, hiring plans, and investment strategies of companies, potentially affecting employment rates and market stability.

The JOLTS Report and Its Importance for Traders

The Job Openings and Labor Turnover Survey (JOLTS) report, released by the U.S. Bureau of Labor Statistics, provides valuable insights into the state of the labor market. It offers comprehensive data on job openings, hires, total separations, quits rate, and layoffs/discharges rate.

While the JOLTS report is significant for policymakers and businesses, it also holds great importance for traders.

Released monthly, the JOLTS report collects data on job openings, hires, total separations, quits rate, and layoffs/discharges rate. These statistics provide crucial information about the current state of the labor market, including employment trends and dynamics.

Overview of its purpose and scope

The primary purpose of the JOLTS report is to offer a more detailed view of the labor market beyond traditional employment figures.

It helps policymakers, analysts, and businesses gain a broader understanding of job openings, hires, and separations, enabling them to make informed decisions based on real-time labor market conditions.

Components of the JOLTS Report

Job Openings

- Job openings refer to positions that are available for immediate hire. The JOLTS report measures job openings by collecting data from employers on their current vacancies.

- Vacancies can provide insights into the demand for labor in various industries. Traders can analyze this information to identify potential investment opportunities in sectors experiencing growth or expansion.

Hires

- Hires represent the number of employees who were newly hired during a specific period. The JOLTS report captures data on hires by collecting information from employers about their recent hiring activities.

- The figures can indicate the level of business activity and expansion within different industries. Traders can use this data to assess the overall health of sectors and make investment decisions accordingly.

Total Separations

- Total separations encompass both voluntary and involuntary job terminations. This category includes quits, layoffs, discharges, retirements, and other forms of employment termination.

- The data provides insights into the overall movement within the labor market. By understanding the reasons behind job separations, traders can gain a better understanding of employment trends and potential impacts on specific sectors.

Quits Rate

- The quits rate measures the number of employees who voluntarily leave their jobs. It is calculated by dividing the number of quits by the total employment.

- It reflects employee confidence in the labor market. A higher quits rate suggests that individuals are more willing to leave their current jobs, possibly indicating favorable opportunities elsewhere.

- Traders can monitor this rate to gauge shifts in job market sentiment and its potential impact on specific industries.

Layoffs/Discharges Rate

- The layoffs/discharges rate represents the number of employees who experience involuntary job terminations initiated by employers. It is calculated by dividing the number of layoffs/discharges by total employment.

- In addition, it can provide insights into the stability of businesses and specific sectors. Traders can assess this rate to identify potential risks associated with industries experiencing higher rates of job terminations.

Importance of the JOLTS Report for Traders

Labor Market Insights

Understanding the health of the job market is crucial for traders. The JOLTS report offers insights into employment trends, such as the level of job openings and hires. By monitoring these indicators, traders can identify shifts in demand for labor and adjust their trading strategies accordingly.

Economic Growth Indicators

Job openings are closely linked to economic expansion. When businesses have more job openings, it often indicates growth and increased business activity. Traders can use JOLTS data to assess the overall economic climate and anticipate potential trends that may impact their investments.

Market Sentiment and Investor Confidence

The labor market has a significant influence on investor sentiment. Positive labor market data, such as high job openings and low layoffs rates, can boost investor confidence in the economy. Traders can leverage JOLTS figures to gauge market sentiment and adjust their trading strategies accordingly.

Sector-specific Analysis

By examining job openings and hires within specific industries, traders can gain sector-specific insights. The JOLTS report provides data for various sectors, enabling traders to identify investment opportunities in industries experiencing growth or potential risks in sectors with declining job openings or hires.

Utilizing the JOLTS Report for Trading Strategies

Short-term Trading Opportunities

Reacting to immediate market movements based on JOLTS data can be a key strategy for traders. For example, if the JOLTS report shows a significant increase in job openings in a particular sector, it may indicate growing demand and potential price movements in related stocks.

Traders can use this information to capitalize on short-term trading opportunities by buying or selling stocks based on the emerging trends.

Incorporating JOLTS figures into short-term trading strategies can also involve monitoring the quits rate and layoffs/discharges rate. A high quits rate may suggest a strong labor market and increased consumer confidence, potentially leading to higher stock prices in certain industries.

Conversely, a spike in the layoffs/discharges rate may indicate economic uncertainty and could prompt traders to adjust their positions or consider short-selling opportunities.

Long-term Investment Considerations

While the JOLTS report provides valuable insights for short-term trading, it is equally important for long-term investment considerations. Traders can use the data to assess the long-term impact of labor market trends on their investments.

For instance, if the JOLTS report consistently shows a rise in job openings and low separations in a specific sector, it could indicate sustained growth potential. Traders may choose to invest in companies within that sector with a long-term perspective.

Incorporating JOLTS data into investment decisions can also involve analyzing the quits rate. A high quits rate may imply a tight labor market and increased competition for talent. This can drive up wages and potentially impact profit margins for companies.

Traders considering long-term investments need to closely monitor these dynamics to evaluate the potential risks and rewards associated with their investment choices.

Remember, the JOLTS report is just one of many tools available to traders, and it should be used in conjunction with other fundamental and technical analysis methods to build a well-rounded trading strategy.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.