The EUR/USD market has experienced a reaction with the euro (EUR) declining against the US dollar (USD). The exchange rate currently stands at 1.0667, reflecting a decrease of 0.0061 or 0.57%.

The market reaction to the EUR/USD pair is influenced by the recent decision of the European Central Bank (ECB) to raise interest rates by 25 basis points.

Meanwhile following the release of the U.S PPI and Retail Sales data, the GBP/USD exchange rate currently stands at 1.2407, indicating a decrease of 0.0081 or 0.64%.

In addition, the price of gold is hovering around 1900 reaching a high of 1912.80 and a low of 1906.86.

Table of Contents

ToggleEuropean Central Bank Raises Interest Rates Amid Inflation Concerns

The European Central Bank (ECB) has announced a decision to increase its key interest rates by 25 basis points in response to rising inflation concerns. The move reflects the ECB’s commitment to address high inflation levels and maintain price stability in the euro area.

Inflation Projections

According to the ECB’s September staff macroeconomic projections, average inflation for the euro area is expected to reach 5.6% in 2023, followed by 3.2% in 2024 and 2.1% in 2025. This upward revision is primarily driven by higher energy prices. Despite some indicators showing signs of easing, underlying price pressures remain elevated. Excluding energy and food, inflation is projected to average 5.1% in 2023, 2.9% in 2024, and 2.2% in 2025.

Impact on Economic Growth

The tightening of financing conditions has dampened demand and had a significant impact on the economy. As a result, the ECB has revised its economic growth projections. The euro area is now expected to expand by 0.7% in 2023, followed by growth rates of 1.0% in 2024 and 1.5% in 2025.

Aims and Duration of Interest Rate Increase

The decision to raise interest rates aims to contribute to a timely return of inflation to the ECB’s target of 2%. The Governing Council emphasizes that the interest rate levels reached will need to be maintained for a sufficient duration to have a substantial impact on inflation. Future decisions will continue to be data-dependent, taking into account the inflation outlook, economic and financial data, and the strength of monetary policy transmission.

New Interest Rate Levels

Effective from September 20, 2023, the interest rates on the main refinancing operations, marginal lending facility, and deposit facility will be increased to 4.50%, 4.75%, and 4.00% respectively.

Monetary Policy Programs

The ECB’s Asset Purchase Programme (APP) portfolio is gradually declining as part of its monetary policy measures. However, the reinvestment of principal payments from maturing securities purchased under the Pandemic Emergency Purchase Programme (PEPP) will continue until at least the end of 2024. The roll-off of the PEPP portfolio will be managed to ensure an appropriate monetary policy stance.

Commitment to Price Stability

The ECB remains committed to fulfilling its price stability mandate and is prepared to adjust its instruments to achieve the 2% inflation target over the medium term. The availability of the Transmission Protection Instrument further enhances the ECB’s efforts to counter market dynamics that could disrupt monetary policy transmission across the euro area.

Future Insights

The President of the ECB (Legarde) will provide further insights into the decision during a press conference later today, offering additional details and explanations regarding the interest rate increase and the ECB’s outlook for the euro area.

Producer Price Indexes Increase in August 2023

The U.S. Bureau of Labor Statistics has released the latest data on the Producer Price Indexes (PPI) for August 2023. The report highlights significant increases in final demand prices and provides insights into specific sectors of the economy.

| Metric | August 2023 Increase |

|---|---|

| Producer Price Index for Final Demand | +0.7% |

| Largest increase in final demand prices since June 2022 | – |

| Producer Price Index for Final Demand Goods | +2.0% |

| Producer Price Index for Final Demand Services | +0.2% |

| Producer Price Index for Final Demand (Excl. Foods, Energy, and Trade Services) | +0.3% |

| Prices for final demand (Excl. Foods, Energy, and Trade Services) rose by 3.0% over 12 months | – |

1. Overall Increase in Final Demand Prices

The Producer Price Index for final demand increased by 0.7 percent in August, seasonally adjusted, following a 0.4 percent rise in July. This represents the largest increase in final demand prices since June 2022, when it rose by 0.9 percent. Over the 12 months ending in August, the index for final demand rose by 1.6 percent on an unadjusted basis.

2. Contribution of Goods and Services

In August, 80 percent of the rise in final demand prices was driven by a considerable 2.0-percent jump in the index for final demand goods. Prices for final demand services, on the other hand, saw a more modest increase of 0.2 percent.

3. Final Demand Excluding Foods, Energy, and Trade Services

The index for final demand, excluding foods, energy, and trade services, experienced a 0.3 percent increase in August, which aligns with the growth observed in July. Looking at the 12-month period ending in August, prices for final demand (excluding foods, energy, and trade services) increased by 3.0 percent. This marks the largest advance since the 3.4 percent increase recorded for the 12 months ending in April.

These findings indicate that the overall PPI is witnessing upward pressure, with prices for goods playing a significant role in driving the increase.

The Producer Price Index provides crucial insights into inflationary pressures within the economy, offering valuable information for businesses, policymakers, traders, and investors. By closely monitoring the PPI data and its components, market participants can make more informed decisions regarding trading strategies and investments.

August 2023 U.S. Retail and Food Services Sales Show Positive Growth

According to the advance estimates released by the U.S. Census Bureau, retail and food services sales in August 2023 experienced positive growth. These estimates, adjusted for seasonal variation and holiday and trading-day differences, reveal key insights into the state of the retail industry.

| Metric | August 2023 Sales |

|---|---|

| Overall Sales Performance | $697.6 billion |

| Monthly Growth (from July 2023) | +0.6% |

| Yearly Growth (from August 2022) | +2.5% |

| Three-Month Comparison | +2.2% |

| Retail Trade Sales Growth (from July 2023) | +0.6% |

| Retail Trade Sales Growth (from August 2022) | +1.6% |

| Gasoline Stations Sales Growth (from August 2022) | -10.3% |

| Food Services and Drinking Places Sales Growth (from August 2022) | +8.5% |

1. Overall Sales Performance

The advance estimates indicate that retail and food services sales for August 2023 reached $697.6 billion, representing a 0.6 percent increase (±0.5 percent) compared to the previous month. Additionally, sales were 2.5 percent higher (±0.7 percent) than in August 2022.

2. Three-Month Comparison

Examining the data over a three-month period from June 2023 to August 2023, total sales increased by 2.2 percent (±0.4 percent) compared to the same period a year ago. The initially reported change in sales from June 2023 to July 2023 was revised from a 0.7 percent increase (±0.5 percent) to a 0.5 percent increase (±0.2 percent).

3. Sector Performance

In terms of specific sectors, retail trade sales rose by 0.6 percent (±0.5 percent) from July 2023, showing a 1.6 percent increase (±0.5 percent) compared to the previous year. However, gasoline stations experienced a decline of 10.3 percent (±1.1 percent) in sales from the previous year. On the other hand, food services and drinking places saw a notable increase of 8.5 percent (±2.3 percent) compared to August 2022.

These figures indicate overall positive growth in the retail and food services sector, suggesting consumer confidence and spending power. As the economy continues to recover, businesses can leverage this information to make informed decisions regarding their operations and strategies.

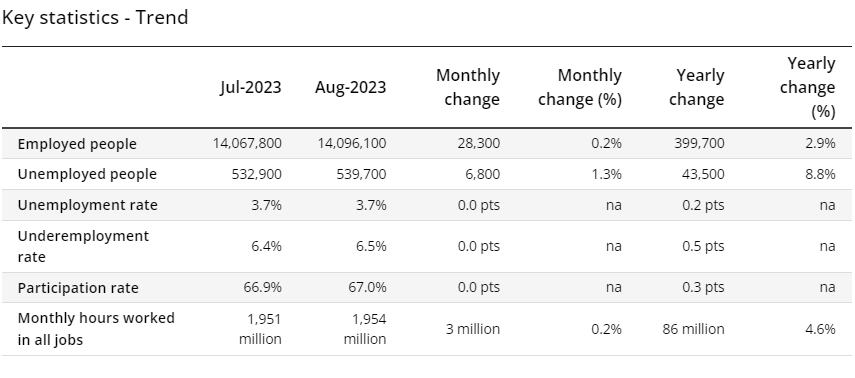

Australian Job Market Witnesses Strong Recovery in August

The Australian job market has made a remarkable comeback in August, displaying resilience and a significant bounce-back from previous challenges. The latest report from the Australian Bureau of Statistics (ABS) reveals impressive growth and positive indicators, surpassing expectations and providing a much-needed boost to the nation’s economy.

Surging Employment in August

In August 2023, Australia experienced a substantial increase in employment, with an impressive addition of 64,900 jobs to the workforce. This surge can be attributed to several factors, including the easing of COVID-19 restrictions, increased consumer spending, and a renewed sense of optimism across various industries.

Positive Indicators and Statistics

According to the ABS’s Labour Market Insights report, the employment rate for individuals in the working age population (15-64) reached 66.7%, showcasing a strong participation rate of 77.4%. These statistics indicate a growing confidence among both job seekers and businesses, fostering a positive environment for further economic growth.

Building upon Previous Months’ Successes

The recent rebound in the job market builds upon the successes witnessed in the preceding months. In June, net employment rose by an impressive 32,600, following a substantial surge in May. This consistent growth demonstrates the adaptability and strength of Australia’s job market in the face of challenging circumstances.

Pressure on the Reserve Bank of Australia (RBA)

The significant improvement in employment numbers has put pressure on the Reserve Bank of Australia (RBA) to review its monetary policies. With the increasing demand for skilled workers and a rise in job vacancies, economists believe that the labor market may have reached a turning point, indicating a departure from the tightness observed in previous months.

Industry-specific Demand and Skills

While the overall job market recovery is encouraging, it is essential to acknowledge that certain industries and sectors are experiencing higher demand for specific skill sets. According to recruitment agency Hays, adapting to these changing market dynamics and acquiring relevant skills will be crucial for job seekers looking to make the most of the recovering job market.

Importance of Monitoring and Strategic Planning

While the recovery in the job market is undoubtedly positive, it is crucial to remain cautious. Economic conditions can fluctuate, and ongoing monitoring and strategic planning will be necessary to sustain this positive momentum.

Australia’s job market has shown remarkable resilience and growth in August, setting the stage for a brighter future. The employment figures have exceeded expectations, providing hope and a sense of positivity. With the right strategies in place and a focus on adaptability, Australia’s job market has the potential to not only recover but thrive in the coming months.

AUDUSD Market Reaction

The AUD/USD market has experienced a notable reaction in response to the strong Australian labor market report. The Australian dollar (AUD) has held its gains above 0.6400 and even tested 0.6450 following the release of the report, which showed significant job growth. This positive news has had an impact on the AUD/USD exchange rate.

Disclaimer

The information provided in this article is based on publicly available sources and should not be considered financial advice. It is always recommended to conduct thorough research and consult with a professional before making any investment decisions.