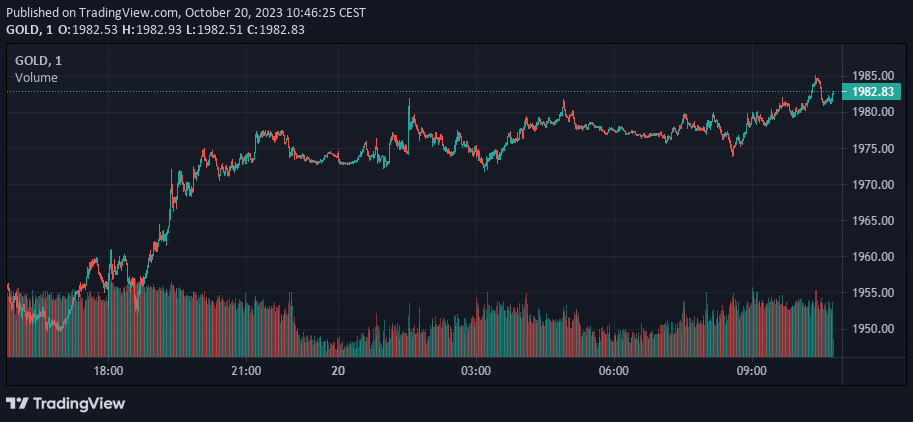

On Friday, the price of Gold (XAU/USD) ascended to a three-month peak, nearing the $1,985 mark. This rise is largely attributed to the global rush for safe investments, spurred by growing geopolitical uncertainties in the Middle East.

XAU/USD Daily Chart

Aside from these tensions, the increasing belief that the Federal Reserve will maintain interest rates steady for the second consecutive time in November also played a role in pushing the non-yielding gold higher. This marks the fourth consecutive day of gains and the fifth positive day out of the last five. The retreat of US Treasury bond yields further supports this upward trend.

Factors Influencing the Gold Price

The yield on the key 10-year US government bond receded from a new 16-year high reached on Thursday, but it remains near the 5% mark. This, coupled with the overbought Relative Strength Index (RSI) on hourly charts, suggests that bullish traders should proceed with caution when planning for any further rise in the US Dollar-denominated commodity.

However, the metal appears set to record substantial gains for the second week in a row. Traders are now awaiting comments from influential FOMC members for short-term opportunities as the week concludes.

Daily Market Movers

Fears that the conflict between Israel and Hamas could extend to other Middle Eastern countries, impacting the global economy, continue to boost the safe-haven appeal of gold. Israeli forces carried out airstrikes on the Gaza Strip on Thursday, bringing the prospect of a comprehensive invasion of the Hamas-controlled region closer.

In addition to this, the Israeli military amassed troops and equipment near the Gaza border, while Israeli missiles also hit targets in Lebanon and Syria. Egypt has also been directly affected by the escalation in the conflict, with Israel repeatedly bombing the Rafah border crossing between Egypt and Gaza.

UK Retail Sales Report: September 2023

The retail sector in the UK experienced some significant changes in September 2023. Retail sales volumes witnessed a decline of 0.9% following a marginal increase of 0.4% in August 2023.

Sector-Wise Performance

| Sector | Change |

|---|---|

| Non-Food Stores | -1.9% |

| Non-Store Retailing (Online) | -2.2% |

| Food Stores | +0.2% |

| Automotive Fuel Sales | +0.8% |

Non-food stores and non-store retailing (online retailers) were the primary contributors to the decline, with decreases of 1.9% and 2.2% respectively. However, there were sectors that showed resilience. Food stores saw a modest rise in sales volumes by 0.2% in September 2023, and automotive fuel sales volumes also increased by 0.8%.

Impact on Currency Market

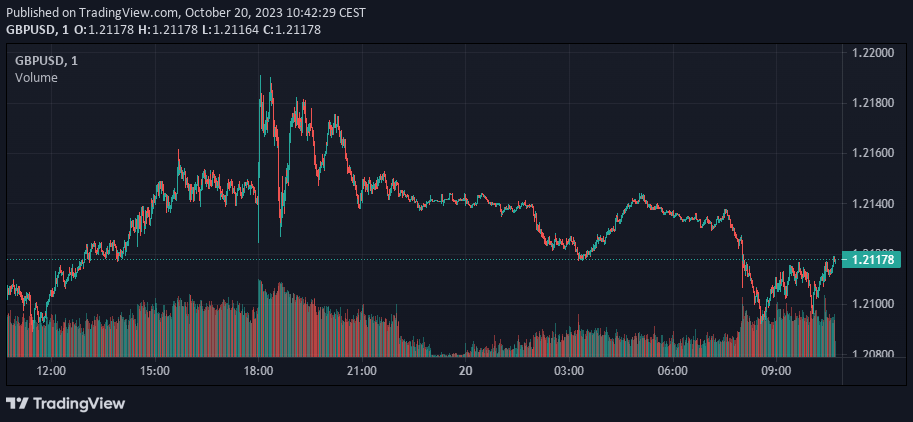

The less than stellar UK retail sales data had repercussions on the GBP/USD, resulting in extended losses for the currency pair. This was further intensified by rising geopolitical tensions in the Middle East, strengthening the US Dollar and putting pressure on GBP/USD. Technical analysis suggests potential further losses towards 1.2050 and 1.2000.

GBP/USD Daily Chart

EUR/USD Update

The EUR/USD also witnessed fluctuations due to various factors. On Thursday, the EUR/USD saw an uptick, aiming for its strongest daily close in more than a week. This happened in spite of prevalent market risk aversion, and was propelled by a softening US dollar.

Nevertheless, the pair struggled to maintain its position above the 1.0600 mark, implying that it may face further challenges on its upward trajectory.

EUR/USD Daily Chart

Germany’s Producer Price Index for September is expected to decline, and the ECB meeting next week is likely to maintain key rates. These events might put pressure on the EUR.

Upcoming Trends

US economic data have presented a mixed picture, with a decrease in initial jobless claims but an increase in continuing claims. Federal Reserve Chair Jerome Powell has indicated a preference for keeping rates unchanged in the near future.

In conclusion, the retail landscape in the UK in September 2023 was marked by a general decrease in sales volumes, with only a few sectors showing growth. The retail data affected the GBP/USD, contributing to its losses. The ongoing geopolitical and macroeconomic events will continue to influence the retail and financial landscapes.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.