In the bustling world of financial markets, all eyes are set on a series of pivotal events and data releases that are expected to stir significant volatility across various trading instruments. From the highly anticipated Federal Reserve’s Federal Open Market Committee (FOMC) meeting to crucial employment and manufacturing data, traders are on high alert, gauging potential impacts on currency pairs, commodities, and equities.

Table of Contents

ToggleAnticipating the Fed’s Next Move

EUR/USD Under Pressure Amid Fed Speculations

The currency market remains tense as the EUR/USD pair trades near the 1.0650 level, weighed down by a stronger US Dollar and investor caution ahead of the Fed’s policy announcements. The Dollar’s recent ascent, fueled by a rebound in US Treasury yields, has left traders speculating on the Federal Reserve’s next steps amidst expectations of sustained high interest rates.

EURUSD Daily Chart

Market Sentiment Awaits FOMC Outcome

Investors across the globe are holding their breath, eagerly awaiting the outcome of the FOMC meeting. The consensus leans towards the Fed holding the Federal Funds Rate steady, yet the subsequent policy statement and Chair Jerome Powell’s press conference are expected to shed light on the future interest rate path. With rate cut expectations for later in the year being reevaluated, the market’s direction hangs in the balance.

Key Economic Data in the Spotlight

A Hefty Dose of Data

Today’s economic calendar is packed with notable releases that are keeping traders on their toes:

- ADP Non-Farm Employment Change: A precursor to the Bureau of Labor Statistics’ (BLS) employment report, this data provides insights into private-sector job growth, offering clues about the overall health of the American labor market.

- Final Manufacturing PMI & ISM Manufacturing PMI: These indices offer a snapshot of the manufacturing sector’s health, influencing sentiment surrounding industrial activity and economic resilience.

- JOLTS Job Openings: The Job Openings and Labor Turnover Survey (JOLTS) sheds light on labor market dynamics, including job vacancies, offering a deeper understanding of employment trends.

- ISM Manufacturing Prices: This indicator gauges price levels for goods in the manufacturing sector, contributing to inflation expectations.

Amid these reports, the spotlight remains firmly on the Federal Reserve, with traders eagerly awaiting the FOMC’s statement and Chair Jerome Powell’s subsequent press conference.

Impact on Commodities and Equities

- Gold prices have stabilized in anticipation of the Fed’s decision, having recently dipped to a four-week low. The direction of US monetary policy, as indicated by the FOMC, will play a crucial role in shaping gold market dynamics in the weeks ahead.

- Equities and Bonds: Investors in stock and bond markets are also bracing for impact, with equity futures indicating a cautious stance ahead of the critical announcements. Bond yields, particularly sensitive to inflation expectations and interest rate trajectories, will react to any shifts signaled by the Fed.

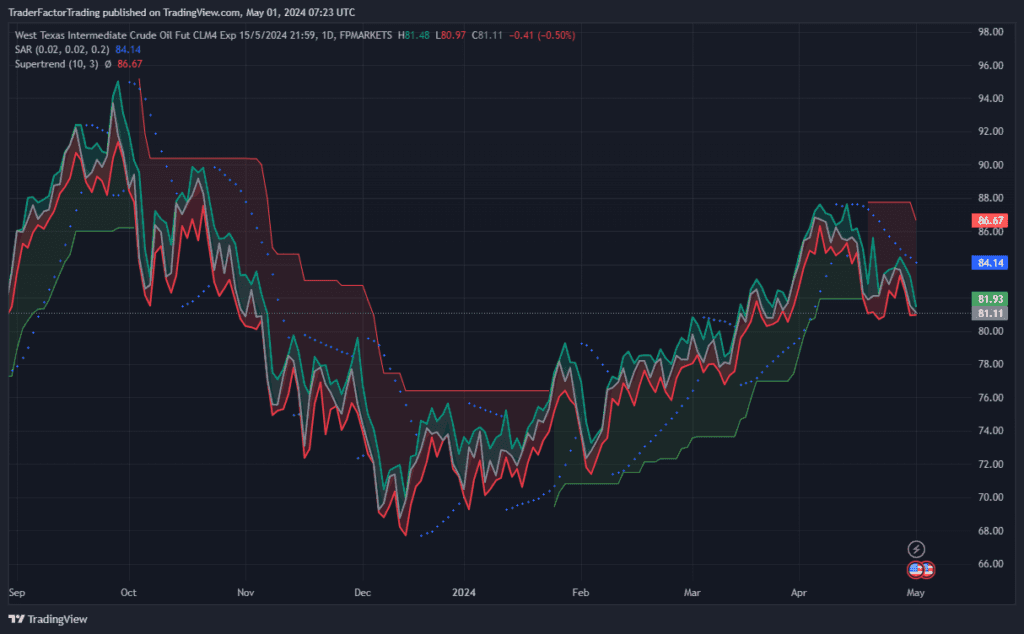

Meanwhile, WTI crude oil faces pressure from unexpected inventory builds and geopolitical developments, prompting a reassessment of oil market dynamics.

Trading Recommendations

Opportunities in Currency and Commodity Markets

Given the anticipated volatility, traders might find opportunities in the currency and commodity markets. For EUR/USD, buying positions around the 1.0690 pivot point with a target of 1.0823 could capitalize on economic data surprises. Conversely, a SELL signal for Crude Oil (WTI) around the 82.91 resistance level with a target of 80.680 offers an attractive risk/reward scenario amidst market fluctuations.

WTI(Crude Oil) Chart

Looking Ahead

The financial markets stand on the precipice of significant movements as traders worldwide tune in to the Fed’s verdict and closely monitor key economic indicators. With potential for unexpected turns, staying informed and agile in trading approaches will be paramount for navigating the waves of market volatility.

As the global financial community awaits these developments, the outcomes of these events are poised to define market sentiment in the weeks to come, highlighting the ever-present interplay between monetary policy, economic data, and trading strategies.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.