Gold prices experienced volatility this week, marking key movements between $2,880 and $2,940. A drop below $2,900 highlighted selling pressure in the market. Technical indicators point toward short-term consolidation, while global economic factors add complexity. Investors are watching key levels that may define the price trend.

Table of Contents

ToggleTechnical Overview of Gold Prices

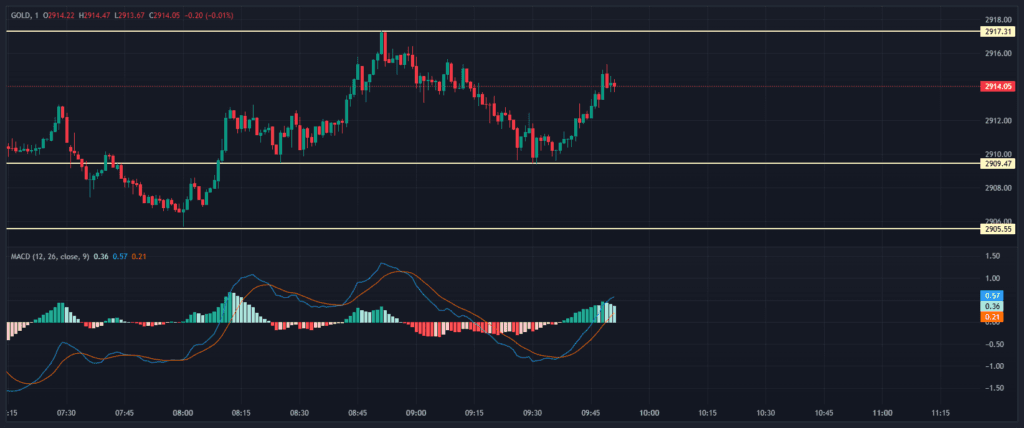

Gold’s price dipped below $2,900 on Tuesday, reinforcing bearish pressure in the market. The $2,880 support level is crucial; a breach here could intensify selling. Conversely, resistance at $2,940 acts as a pivotal barrier to any upward momentum. A bearish engulfing candlestick pattern further underscores short-term selling potential, often reflecting a shift in trader sentiment.

Additionally, the RSI dropping below 70 indicates weakening bullish momentum, suggesting reduced buying strength at current levels. If prices manage to push past $2,940 resistance, it could open the door for gains toward $3,000. However, sustained momentum would be necessary to maintain such a breakout and test higher levels.

Dollar Performance and Impact

The dollar index recently declined, approaching a two-month low, driven by weak U.S. consumer confidence and a drop in Treasury yields. Typically, a softer dollar supports gold by making it less expensive for foreign buyers. However, gold’s recent price slip highlights constraints in its immediate responsiveness, possibly due to market caution ahead of key economic signals. Inflation remains a central focus for merchants and policymakers alike, influencing currency sentiment and gold’s appeal as a hedge.

The Federal Reserve’s monetary stance, tied closely to inflation, adds complexity as markets await the PCE index release this Friday, a critical metric for gauging inflation trends. Jobs data further complicates the picture, with labor market strength providing cues on wage pressures and consumer spending. Tariff negotiations also remain in the backdrop, as any shifts in global trade policies could alter economic stability and dollar flows. Together, these intertwined factors contribute to a fluid landscape, where the dollar and gold react dynamically to the changing economic and geopolitical narratives.

Broader Economic Sentiments

Economic concerns, including persistent inflation and unresolved tariff uncertainties, continue to weigh heavily on the gold market. Inflation erodes purchasing power while simultaneously enhancing gold’s attraction as a safe-haven asset. Meanwhile, ongoing tariff discussions create additional economic unpredictability, prompting investors to tread carefully amid the unclear trajectory of global growth. Policy directions from central banks, particularly the Federal Reserve and the European Central Bank, further heighten market caution, with their decisions carrying significant implications for interest rates and economic stability.

Adding to the complexity, the euro’s recent strength against the dollar introduces a competing dynamic, as a stronger euro can diminish gold’s relative value for European buyers. Despite these headwinds, gold remains a trusted hedge for investors navigating financial turbulence, underscoring its enduring role in portfolio strategies. Looking ahead, heightened market volatility is expected to play a pivotal role in shaping gold price trends, as investors respond swiftly to evolving economic signals and geopolitical developments.

Outlook and Key Levels to Watch

Gold will likely consolidate or retest key technical levels. Support remains critical around $2,880, acting as the first defense. Resistance at $2,940 could test upward momentum. A breach of either level could set the next directional trend.

Gold’s near-term path remains influenced by technical and fundamental factors. Close attention to $2,880 support and $2,940 resistance will be essential. Uncertainties around the dollar and global economy demand careful investor watch.

Read Next

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance