Gold prices recently soared past the $3300 mark, a critical threshold. This surge highlights gold’s enduring appeal as a safe-haven asset amidst heightened economic and geopolitical challenges. Key factors like credit downgrades and a weakening US dollar have driven demand. Market analysts are closely assessing the implications of this increase, reflecting on whether it signals prolonged growth or temporary volatility.

- 🟢 Gold breaks $3300, boosting confidence.

- 📈 RSI near 70; upside potential.

- 🛠 $3250, $3200 as key supports.

- 🔄 50-day, 200-day averages crossover.

- 📊 Consolidation likely at $3300-$3350.

Table of Contents

ToggleTechnical Analysis

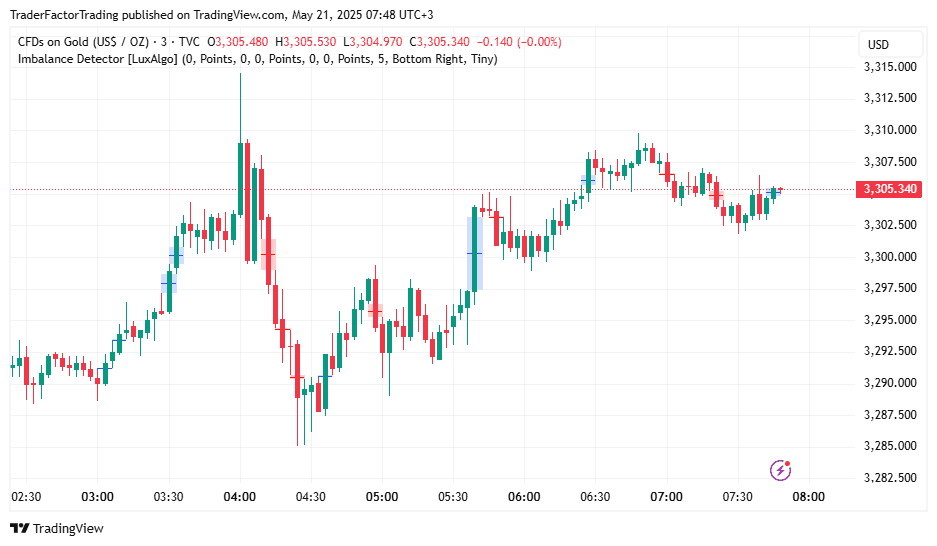

From a technical perspective, gold’s breach of the $3300 level is significant. Historically, prices above this threshold have acted as a key resistance point. Sustained movement above $3250 and a strong volume break at $3300 signal a bullish trend. This pattern suggests renewed market confidence and room for upward growth.

Momentum indicators, such as the Relative Strength Index (RSI), show gold entering overbought territory. However, current RSI values near 70 are not excessively high, indicating potential for further upside. Traders should monitor closely for signs of correction or consolidation at these levels.

Long-term moving averages also display a positive outlook. Both the 50-day and 200-day moving averages have formed a crossover, traditionally viewed as a bullish signal. Additionally, the widening gap between the two averages reflects growing upward momentum.

Given the current market condition, analysts predict consolidation near the $3300-$3350 range before the next leg higher. Key support levels to watch include $3250 and $3200, which may serve as a base if prices pull back.

Reasons Behind the Price Surge

Economic Factors Driving Demand

The recent downgrade of the US government’s credit rating by Moody’s cast a shadow over investor confidence. Lower ratings often signal increased risk, reducing the appeal of traditional safe assets like US Treasury bonds. Consequently, investors turned to gold, boosting its price significantly.

Simultaneously, the US dollar’s dip has made gold more attractive to international buyers. A softer dollar reduces the metal’s cost in other currencies, spurring demand.

Geopolitical Tensions and Market Sentiments

Ongoing geopolitical conflicts have also amplified risk aversion in markets. With conflicts in Eastern Europe and the Middle East showing no immediate resolution, gold has emerged as the go-to hedge against uncertainty. Such crises underline gold’s utility, especially during protracted instability, reinforcing its standing as a protective asset.

Additionally, changes in central bank policies globally are influencing the metal’s value. Recent rate cuts by central banks, including the People’s Bank of China, have increased the appeal of non-yielding assets like gold. The easing monetary environment suggests support for sustained demand.

Market Outlook and Future Considerations

Investor Strategies and Portfolio Diversification

With gold reaching new heights, many investors are reevaluating their portfolio allocations. It is increasingly viewed as both a hedge against inflation and a tool for diversification. Higher prices could encourage central banks to increase their gold holdings, further tightening supply.

However, some analysts caution against excessive optimism. Any improvement in geopolitical or economic stability might weaken demand. For now, gold remains resilient, supported by strong fundamentals and macroeconomic trends.

Challenges that May Impact Prices

Despite the optimism, uncertainty lingers. A sudden recovery in the US dollar or aggressive rate hikes by central banks could exert downward pressure. These factors underscore the need for vigilance, especially for those entering at high price levels.

Conclusion

Despite the surge, investors should remain cautious, watching for potential pullbacks or shifts in sentiment. Analysts agree that gold’s safe-haven status makes it a reliable asset in turbulent times, reinforcing its long-term allure.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.