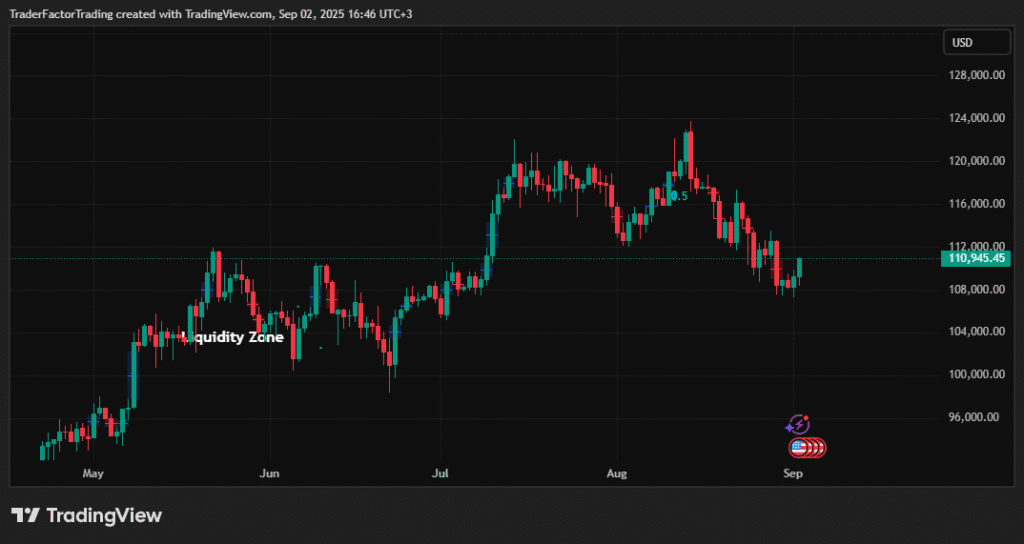

The Bitcoin price USD is currently trading around $108,400 to $108,700 across major exchanges in live trading sessions, struggling to move above the $110,000 resistance level. A review of BTCUSD live data and BTCUSD tradingview charts points to bearish signals after breaching key support levels. Trading volume for Bitcoin price live is up by 25% over the past 24 hours, reflecting increased market activity. Analysts reviewing the latest Bitcoin news today live and past BTCUSD news note that machine learning models suggest a possible Bitcoin price prediction of $101,500 by the end of September. However, some expert forecasts for the Bitcoin price in 2025 remain bullish, projecting potential highs around $124,340. This current phase of the market is marked by volatility and uncertainty, with the Bitcoin price navigating between important moving averages.

Table of Contents

ToggleCurrent Price Action and Market Performance

The Bitcoin price remains volatile around the $110,000 mark on multiple platforms, as shown by BTCUSD live chart — tradingview and other analytical tools. According to CoinMarketCap, the Bitcoin price USD is $108,709; Coinbase reports $108,439, and Robinhood reports $108,310. These minor variations in the Bitcoin price live reflect competitive spreads between exchanges. Despite negative signals, the Bitcoin price managed a modest 1.62% gain in the past 24 hours. The elevated trading volume signals constant attention from both retail and institutional actors, highlighting persistent interest in BTCUSD live movements.

Technical Analysis Shows Bearish Signals

Moving Average Analysis

Technical reviews of the Bitcoin price using BTCUSD tradingview and other tools indicate that Bitcoin trades between its 50-day and 200-day exponential moving averages. This setup creates a zone of uncertainty as traders try to forecast the next move. The breach of support levels, as seen in BTCUSD live chart — tradingview, has led many technical analysts to a more cautious stance. If downward pressure continues, the Bitcoin price live could edge closer to the $100,000 range. Market volatility remains elevated, yet some traders monitor these movements on BTCUSD tradingview for potential entries at more favorable levels.

Support and Resistance Levels

At present, the $110,000 area is serving as a clear resistance for upward Bitcoin price moves. Support zones, earlier visible in BTCUSD live chart — tradingview, have started to weaken, hinting at further correction. Technical experts in BTCUSD news highlight $100,000 as the next strong support if declines persist. Traders continue to check Bitcoin news today live for any fresh developments that could shift current sentiment. These levels remain central as trading decisions depend heavily on support and resistance dynamics.

Fundamental Market Drivers

Trading Volume and Activity

Bitcoin price live data highlights a 25% surge in 24-hour trading volume, now above $64 billion across major platforms. High volume is evident in both institutional and retail segments. This rise usually brings more pronounced moves, as seen recently in the Bitcoin price USD charts. Algorithmic trading and market makers contribute to fluctuations, often visible in BTCUSD live numbers and BTCUSD tradingview trends. A notable uptick in Ethereum price and Solana price may also influence trading sentiment, as cross-asset activity grows.

Market Sentiment and Predictions

Most machine learning forecasts anticipate a Bitcoin price prediction average of $101,500 by the end of September, indicating a 7.89% potential drop from the current Bitcoin price USD. Nevertheless, long-term Bitcoin price in 2025 projections remain split, with some analysts referencing a target around $124,340. Diverging viewpoints in BTCUSD news and Bitcoin News price updates reflect overall uncertainty in the crypto market. While some expect further weakness in September, others are watchful for a stronger recovery in the months ahead.

September Market Outlook

Historical September Performance

Looking at historical data and Bitcoin news today live, September has often proven difficult for Bitcoin, with many traders referring to it as “Red September.” Recent BTCUSD live extracts confirm that this volatility is in line with prior years. Often, this period brings profit-taking and higher swings, especially after summer activity. Despite the negative tilt, traders continue to seek clues in Bitcoin news price feeds and other resources for early signs of a turnaround or deeper retracement.

Risk Factors and Considerations

Several variables may influence the direction of the Bitcoin price live in the coming weeks and months. Regulatory issues, macroeconomic conditions, and shifts in institutional engagement all play a role. Interest rates and policy decisions could sway the appetite for risk assets such as BTCUSD live and Ethereum price. Whale movements and changes in the Solana price also affect overall sentiment. For those tracking Bitcoin price prediction, sound risk management remains crucial in an unpredictable landscape.

Bitcoin faces technical resistance at $110,000 and possible support at $100,000. The latest BTCUSD news signals active trading, with technical and sentiment indicators mixed. As September progresses, traders and analysts are focused on BTCUSD live, Bitcoin price USD updates, and projections for the Bitcoin price in 2025. Monitoring the Bitcoin price live and related Bitcoin news today live will be key for anyone navigating this evolving market.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.