Cryptocurrency traders are closely monitoring the movements of Bitcoin against the US dollar (BTC/USD). Despite a recent push above $65,000, Bitcoin’s price is encountering hurdles that could potentially lead to another downturn. With recent developments and market analyses, the current intraday trading outlook suggests a prevailing downside, urging traders to consider a cautious approach.

Table of Contents

ToggleResistance and Support Levels

Bitcoin has been unable to secure a stable position above the $68,000 mark, leading to a period of consolidation. Market analysts speculate that if this trend continues, we might see BTC’s value retract towards the $63,400 support zone. This comes after Bitcoin’s attempt to surpass new heights, reaching an all-time high of $69,218, only to experience a sharp decline to $59,150. Since then, Bitcoin has managed to recover somewhat, climbing back above the $65,000 threshold. However, the recovery appears to be under threat as selling pressure mounts above the $67,500 level.

Bitcoin Price: Trading Insights for BTC/USD

For traders eyeing the BTC/USD pair, the current recommendation leans towards a SELL strategy. The entry price or pivot point is identified at 66,910, which currently serves as a resistance level. This suggests that while there is potential for further recovery, Bitcoin still faces significant obstacles on its path to higher prices in the immediate term.

BTCUSD Daily Chart

Technical Analysis

The technical configuration for Bitcoin indicates a negative outlook. Notably, the Relative Strength Index (RSI), a key indicator of market momentum, is below its neutrality area at 50. This underlines the bearish sentiment surrounding Bitcoin in the intraday trading period.

Risk Management

As with any trading decision, risk management remains paramount. It is advised to limit exposure to 1% per trade to safeguard against unforeseen market movements. The cryptocurrency market is known for its swift and dramatic price swings, making cautious risk assessment essential.

EUR/USD and AUD/USD Pairs Present Lucrative Opportunities Amidst Volatility Ahead of ECB Press Conference

The EUR/USD currency pair is showcasing a promising upward trend, offering traders potential gains. The Euro is currently stabilizing at approximately 1.0900 against the US Dollar during the European trading session, maintaining a position at six-week highs. Market experts are advocating for a BUY position on the EUR/USD, suggesting an entry point at 1.0880.

The envisioned targets for this trade are set at 1.0915 and 1.0930, respectively, forecasting an uplift of 20-30 pips. Despite the RSI presenting mixed to bullish signals, it is recommended that traders proceed with caution due to the inherent volatility of the forex market. This intraday analysis highlights the fluid nature of the spot market, where astute strategic planning can turn minor price movements into significant profit opportunities.

EURUSD Daily Chart

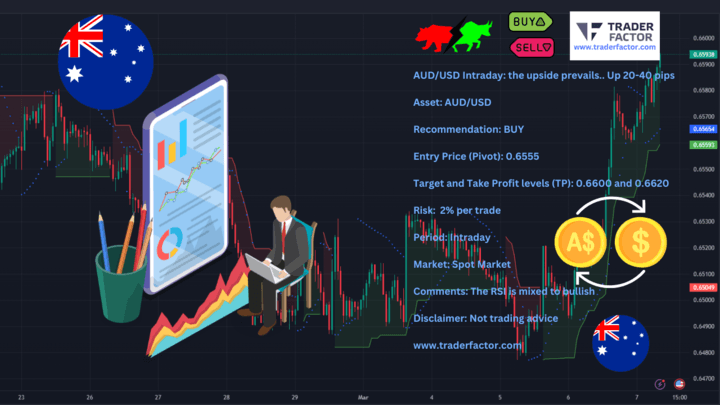

AUDUSD Daily Chart

Parallelly, the AUD/USD pair is drawing trader interest with its optimistic outlook. Recommended as a BUY, the entry price is pegged at 0.6555, with take profit levels ambitiously positioned at 0.6600 and 0.6620, predicting a potential increase of 20-40 pips. Similar to the EUR/USD scenario, the RSI for the AUD/USD indicates a mixed to bullish market sentiment, supporting the positive trading outlook. Nonetheless, the unpredictable fluctuations of the forex market call for a prudent approach.

AUD/USD Daily Chart

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.