In order to pick up the rhythm of the forex markets, it’s essential to understand their dynamics and know what triggers the movements. ActivTrades trading markets is the ultimate solution where you’ll find all the trading instruments to get you started.

The Forex market generates billions of dollars in transactions every day. The dollar(USD) is the most dominant currency, and the value of transactions is three times more than the euros(EUR).

Central banks hold fx reserves to enable transactions, and governments buy/sell forex to maintain the exchange rate at a particular level.

This discussion explores ActivTrades trading instruments, financial markets, best trading instruments for beginners, forex, and stock trading, among other topics. Keep reading.

| ActivTrades Trading Instruments ActivTrades Trading Accounts ActivTrades Full Review | ActivTrades Trading Platforms ActivTrades Education Section ActivTrades Services |

Currency Pairs At ActivTrades

Currency pairs are the most widely traded and most popular asset classes throughout the world.

What makes them popular? Because exchange rates of currency pairs are very volatile and can fluctuate very easily, this is what makes them so attractive.

The ActivTrades forex market offers you multiple opportunities to benefit from the price movements.

The platform is reliable and offers adequate leverage and narrowest spreads for both beginners and experienced traders. ActivTrades offers all these and more options for the ultimate trading experience.

ActivTrades Market Trading Information

At ActivTrades financial markets, you can access a number of stocks and ETFs, including securities of major companies.

Whenever you invest stocks, you can easily trade, own a certain percentage of the company, and get rewarded in dividends.

Leverage

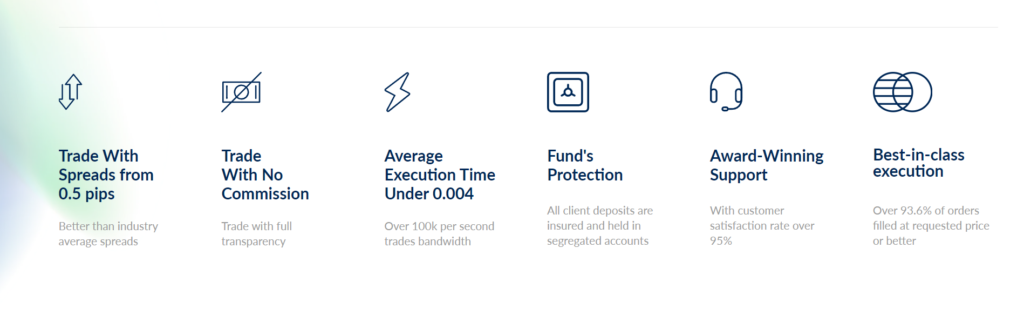

Leverages allow you to open positions that are higher than your investments. You can open positions at ActivTrades with a leverage ratio of 1:2000 and a margin of 50%. Because of the margin requirement, you can make a deal of up to €10,000 of your equity.

Spreads

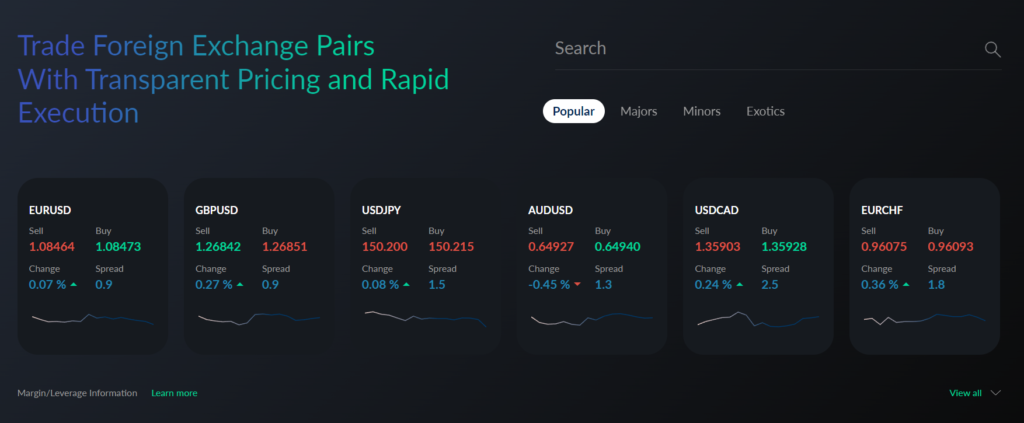

At ActivTrades forex and stock trading, fixed spreads are an advantage for any investor. This means you can trade for a small commission each time you open a new position. The spread is determined by calculating the difference between the ASK price and BID price.

ActivTrades determines the ASK PRICE, whereas the market estimates the BID Price.

The ASK PRICE is the amount ActivTrade is willing to sell the base currency against the quoted currency. For example, the USD is the base currency for the USD/EUR trading pair, whereas the EUR is the quoted currency.

On the other hand, the BID price is the amount buyers are willing to buy the base currency against the quoted currency.

It’s important to note that you may not trade some currency pairs and investing commodities in certain areas.

Although not typical, spreads may differ when the market is characterized by rapidly changing trading conditions. As such, spreads may change during non-trading periods.

If you choose to trade in such circumstances, ActivTrades will list those spreads.

Commissions

Commissions are paid or charged for trading positions that are open beyond the day. It also depends on the direction of the position.

It’s important to note that commissions may vary depending on the market conditions as well as liquidity.

Here is an illustration of the commissions at ActivTrades

| Exchanges | Commissions |

| EUROPE except London | 0.05% of the total transaction value for a €1 minimum commission.or 0.01% of the total transaction value for a €5 minimum commission. |

| London | 0.10% of the total transaction value for £1 minimum commission. |

| New York, Including International ADRs as well as ETFs | US$0.02 per share for US$1 minimum commission. |

Commodity Trading

ActivTrades trades in a wide variety of commodity CFDs, metals, grains, softs, and energies. Unlike the Future contracts, the investing CFDs have less stringent requirements for margins. For example, the spreads commence from 0.005 points on gas.

ActivTrades FX CFDs

CFDs are financial instruments that are an agreement between two parties to settle the difference between the opening and closing prices. CFDs are a type of over-the-counter instrument.

The term “over-the-counter” (OTC) is used because transactions in these instruments are conducted directly between parties.

In contrast, the term “derivative” means that the price of CFDs depends on the price of the underlying assets.

The underlying assets are currencies, stocks, indices, commodities, increasingly popular cryptocurrencies, and more. It is worth noting that when we buy EUR / USD or gold, it does not involve the actual purchase of the currency or precious metal, and we will not own it.

ActivTrades Expiration of Assets

With ActivTrades, traders can also enter into futures contracts when they plan to buy or sell assets over a specified period of time. Generally, futures contracts expire within 90 days.

Trading rates at CFDs normally fluctuate consistently during the trading period. As such, market factors may influence the trading rates.

If you wish to keep your trades open, you can use the automatic scrolling of exchange-traded futures during the expiration date of the futures contracts.

ActivTrades Forward CFDs are based on those contracts that will expire on a future date. Therefore, you’ll not pay overnight financing costs or everyday adjustments to your position. Already, the base Futures costs account for this factor.

After expiry, the open positions are automatically closed. If you wish to proceed with trading, you must open a new position.

ActivTrades Forex and Stock Market Frequently Asked Questions

What is Forex?

Forex is the short name for the Foreign exchange market or FX and is a global market where currencies of various countries are traded against each other.

The FX market investors stake in fluctuations in the relative value of currencies in certain currency pairs.

What currencies can I trade at ActivTrades?

At ActivTrades, you can trade a majority of currency pairs such as EUR/USD, USD/CAD, USD/JPY, and GBP/USD.

You can also trade small currency pairs such as EUR/GBP, CHF/JPY, USD/TRY, and GBP/ZAR.

Are there currency pairs I can’t trade at ActivTrades?

Quite often, it’s not possible to cover a wide market in its entirety. Sometimes rules and regulations of certain countries may prevent the trading of particular currency pairs. For instance, the Vietnamese dong or Iraqi dinar.

Are there any trading fees at ActivTrades?

Normally, you’ll not be charged for transactions in your account. The profits you earn come from the difference between buying and selling rates or the spread.

Nonetheless, if you leave open positions beyond the day, there may be applicable charges, such as the scrolling fee.

What is the difference between long/short positions?

For long or buy positions, your gains will be from an increase in the exchange rate of a particular currency.

For the short or sell positions, the gains will be from the decrease in the exchange rate of a particular currency.

What is the trading time in the ActivTrades FX market?

The Forex markets start at 22.00GMT on Sunday and close at 22.00 GMT on Friday when the US market closes.

There is a general saying that the Forex market never sleeps because forex trading takes place around the clock, Monday through Friday.

It’s important to note that some assets may have limited trading times depending on the particular securities exchange. Other restrictions may apply depending on the nature of the underlying assets.

ActivTrades Trading Instruments

Conclusion

In trading fundamentals forex, the above terms are essential for beginners and professionals to master. The ActivTrades investment instruments offer investors an opportunity to venture into forex trading and stake cash. However, if you are new, you can start with a demo account because transactions in the FX market are speculative.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts