The launch of China’s DeepSeek AI has sent shockwaves through global tech markets, challenging the dominance of established AI leaders. Introduced as a cost-efficient alternative to U.S. AI models like ChatGPT, DeepSeek was developed for a fraction of the usual investment. This disruptive innovation immediately unsettled investor confidence, leading to sharp declines in major AI-related stocks. Nvidia, for example, faced a staggering market-cap loss of nearly $600 billion, while Alphabet and other tech giants also experienced notable drops.

Table of Contents

ToggleAI Stock News: DeepSeek’s Impact

China’s DeepSeek, a cutting-edge AI startup, has introduced a revolutionary, cost-efficient AI model designed to rival U.S. leaders like OpenAI’s ChatGPT. Unlike the high development costs often associated with Western AI, DeepSeek was reportedly developed for under $6 million. This stark contrast has sparked significant concerns within the tech industry about the sustainability of the hefty financial investments required by U.S. companies to create AI technologies. DeepSeek’s breakthrough not only highlights China’s increasing competitiveness in the AI space but also raises questions about future innovation and market dynamics in the global AI sector.

Stock Market Fallout

The unveiling of China’s DeepSeek AI has reverberated across financial markets, shaking investor confidence in leading AI and technology companies. The impact, concentrated within AI-related stocks, has resulted in significant losses for some of the most prominent players in the tech industry. Below are the key elements that outline the fallout.

Nvidia’s Unprecedented Losses

Nvidia, a trailblazer in AI hardware and software solutions, bore the brunt of the market reaction. Its shares plummeted by a staggering 17% in a single trading day, wiping out $593 billion in market value. This marks the largest one-day loss in history for any publicly listed company. Analysts attribute the drop to fears that DeepSeek’s cost-efficient technology may reduce demand for high-end AI chips, which have been a linchpin of Nvidia’s explosive growth in recent years.

Broadcom and Other Chipmakers Feel the Heat

Broadcom, another major player in the semiconductor market, saw its stock tumble by 17.4%. The panic spread across the sector, with notable selloffs in shares of AMD and Micron as well. These declines highlight growing concerns over the future profitability of chipmakers, many of which rely on Western AI firms’ continued investment in advanced, expensive hardware.

Major Declines for Alphabet and Meta

The tech-heavyweights weren’t spared either. Alphabet, Google’s parent company, suffered a 4.2% drop, reflecting investor fears about the potential disruption DeepSeek poses to the AI landscape. Meta also experienced sharp losses as skepticism mounted over its high spending on AI projects and the sustainability of its strategy in a changing global market environment.

Energy Sector Fallout and Reduced Demand Projections

Interestingly, the ripple effects extended into the energy sector, impacting companies like Vistra and GE Vernova. With energy consumption increasing rapidly for AI data centers, concerns arose that DeepSeek’s reported efficiency could translate to a reduction in demand for AI infrastructure energy needs. This led to a selloff as investors recalibrated future growth expectations for energy providers linked to AI advancements.

Analyst Reactions and Industry Implications

Market analysts are divided on the long-term implications of DeepSeek’s entry. Some view the losses as a temporary overreaction, arguing that U.S. companies still hold the edge in innovation and established ecosystems. It could be a dip opportunity for buyers. However, others believe the staggering declines signal a foundational shift in the industry, pushing firms to rethink their strategies and cost structures in light of DeepSeek’s lean development model.

The fallout from DeepSeek’s introduction underscores the tech industry’s fragility when faced with disruptive challenges. It serves as a wake-up call, prompting both companies and investors to reevaluate the underlying assumptions driving AI growth and spending today.

Market Indices: Is This a Dip Opportunity?

The unveiling of DeepSeek has had a ripple effect on major U.S. market indices. Its unexpected entry into the AI landscape has prompted widespread shifts in investment behavior, leading to fluctuating outcomes across key indices. Below is a detailed breakdown of the market movements and their implications.

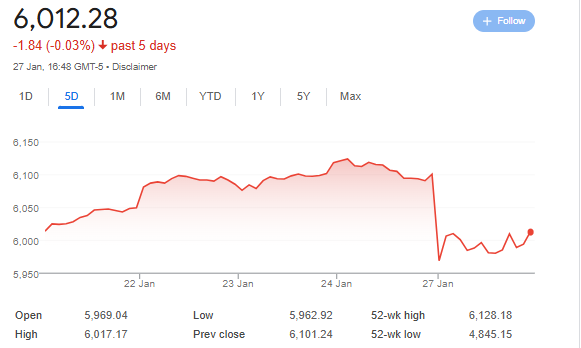

Nasdaq Faces Sharp Decline

The tech-centric Nasdaq Composite saw a dramatic drop of 3.1%, reflecting the vulnerability of the technology sector to disruptive events. The decline was driven by significant selloffs in major AI-related stocks, including Nvidia, Alphabet, and Meta. Investors rapidly pulled out of high-risk tech stocks, concerned about DeepSeek’s potential to erode market dominance and profitability for U.S.-based companies in the AI space.

S&P 500 Shows Modest Decline

The S&P 500, which encompasses a broader range of industries, fell by 1.5%. While tech stocks played a central role in this decline, weakness in other sectors, such as energy and semiconductors, also contributed. Companies tied to AI infrastructure and related services faced mounting skepticism from investors, creating a ripple effect that extended beyond the technology sector into industries reliant on AI’s continued expansion.

Dow Jones Defies the Trend

Amid the turbulence, the Dow Jones Industrial Average rose slightly, signaling a flight to safety by investors. Unlike the Nasdaq and S&P 500, the Dow is less reliant on tech-heavy stocks and includes more diversified, stable companies. This allowed it to remain resilient, as capital moved from higher-risk sectors like technology into more traditional, “blue-chip” stocks in an attempt to preserve value.

Investor Behavior Amid Uncertainty

The mixed performance of the indices reveals a shift in investor sentiment. High-growth tech stocks, typically seen as market leaders, faced a stark reassessment in the wake of DeepSeek’s low-cost innovation. Many investors turned to safer assets, such as dividend-paying companies and sectors with historically lower volatility, leading to a divergence between tech-heavy and diversified indices.

Broader Implications for Financial Markets

The contrasting behavior of the U.S. indices reveals deeper uncertainties about the future of AI investments. While the Nasdaq and S&P 500 reflected immediate concerns about the unsustainable spending patterns by U.S. tech giants, the relative steadiness of the Dow suggests that many investors believe the disruption may remain confined to the tech sector.

AI Crypto Stocks Crash Due to DeepSeek Launch

The launch of DeepSeek had a significant impact on AI-related cryptocurrencies, triggering a wave of selloffs. Below are some notable examples:

Fetch.ai (FET)

Fetch.ai, a blockchain project focused on decentralized AI solutions, saw its token decline by 12% following the DeepSeek announcement. Investors were concerned about how DeepSeek’s cost-effective and centralized AI capabilities might overshadow Fetch.ai’s decentralized offerings, leading to reduced confidence in its growth outlook.

SingularityNET (AGIX)

SingularityNET, a platform enabling the creation, sharing, and monetization of AI services on a blockchain, experienced a steep drop of 14% in its token value. DeepSeek’s entry into the AI space raised questions about the scalability and competitive edge of decentralized AI platforms like SingularityNET.

Ocean Protocol (OCEAN)

Ocean Protocol, which focuses on data sharing and AI-powered analytics via blockchain technology, faced a 10% dip in its token price. Investors were wary of the growing interest in centralized AI solutions like DeepSeek that might render some decentralized data-sharing models less attractive.

Artificial Liquid Intelligence (ALI)

ALI, a token linked to projects exploring AI-driven innovations in creating metaverse environments and virtual influencers, recorded a loss of nearly 9%. The buzz around DeepSeek redirected attention from speculative AI crypto projects, impacting ALI’s perceived future potential.

Numeraire (NMR)

Numeraire, a token supporting machine-learning models on a decentralized hedge fund platform, dropped by 11%. The increased skepticism surrounding AI-backed crypto stocks post-DeepSeek made Numeraire particularly vulnerable, as investors reprioritized less speculative AI investments.

Global Ripple Effects

DeepSeek’s debut had repercussions far beyond U.S. markets, causing ripples in global financial markets. Japanese technology stocks, alongside European tech companies, saw declines as the deepening selloff extended worldwide. Investors in many international markets voiced concerns about whether DeepSeek’s cost-efficient AI strategy could potentially undermine the competitive edge of Western technology leaders, leading to a broader global reassessment of AI investments.

Investor Sentiment

The emergence of DeepSeek has left analysts and investors divided. Some view the sharp market reaction as an overcorrection, while others see it as a sign of genuine and far-reaching industry challenges. For many, DeepSeek represents a call to action for U.S. and global tech firms to rethink their AI development strategies. The ability of DeepSeek to deliver powerful AI at minimal cost has prompted questions about innovation and spending efficiency, leaving the business community to consider whether the traditional model of high-cost AI development is sustainable.

What is DeepSeek Chinese AI Chatbot?

DeepSeek is a breakthrough development in the world of artificial intelligence, emerging as a Chinese competitor to leading AI chatbots such as OpenAI’s ChatGPT. Developed by a Chinese startup, DeepSeek aims to challenge the dominance of U.S.-based AI models by providing a cost-efficient yet equally powerful alternative. Its creation required a reported investment of less than $6 million—significantly lower than the billions spent on similar U.S. AI technologies—making it a standout in terms of development efficiency.

Purpose and Features

The primary goal of DeepSeek ai Chat is to cater to user needs through innovative AI-driven interactions. Like ChatGPT, it functions as a conversational AI model, capable of understanding and generating human-like text. Users can interact with DeepSeek for various purposes, such as asking questions, composing content, or solving problems. What makes DeepSeek particularly noteworthy is its cost-effectiveness without compromising on performance. The chatbot demonstrates efficiency both in resource utilization and response accuracy, presenting itself as a serious alternative to Western models.

How DeepSeek is Threatening OpenAI’s ChatGPT

When compared to ChatGPT, DeepSeek AI app sets itself apart through its focus on accessibility and cost management. While ChatGPT has benefited from massive financial backing and advanced AI infrastructure, DeepSeek relies on streamlined development methods to achieve similar results. Both chatbots share common capabilities like language understanding, conversational fluency, and application in fields ranging from customer support to education. However, DeepSeek’s model efficiency raises questions about the resource-dependency of traditional AI systems, potentially prompting a shift in the industry’s approach to AI development.

DeepSeek AI Price

DeepSeek AI stands out in the competitive field of artificial intelligence due to its remarkably low development cost, reportedly under $6 million. This figure is a stark contrast to the billions of dollars invested by industry leaders like OpenAI in creating models such as ChatGPT. The cost-efficiency of DeepSeek demonstrates an alternative approach to AI development, where innovation can thrive without the need for massive financial resources. This pricing model not only challenges the spending norms of U.S.-based tech giants but also sets a precedent for more resource-optimized AI projects in the future. By achieving high performance at a fraction of the cost, DeepSeek has sparked discussions about the sustainability of current AI investment strategies and the potential for broader global participation in advancing artificial intelligence.

Significance in the AI Landscape

DeepSeek’s introduction signals a pivotal moment in the competitive AI space. Its emergence not only highlights China’s growing influence in advanced technologies but also challenges the prevailing notion that innovation requires exorbitant spending. By producing a comparable model at a fraction of the cost, DeepSeek underscores the potential of resource-optimized AI development. Furthermore, it has catalyzed a reevaluation of spending patterns and strategies among global AI giants, ushering in discussions about the future trajectory of AI advancements.

With DeepSeek now positioned as a viable rival to existing AI leaders, its influence extends beyond technological innovation, touching on global market dynamics and sparking debates about sustainable development in artificial intelligence.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.