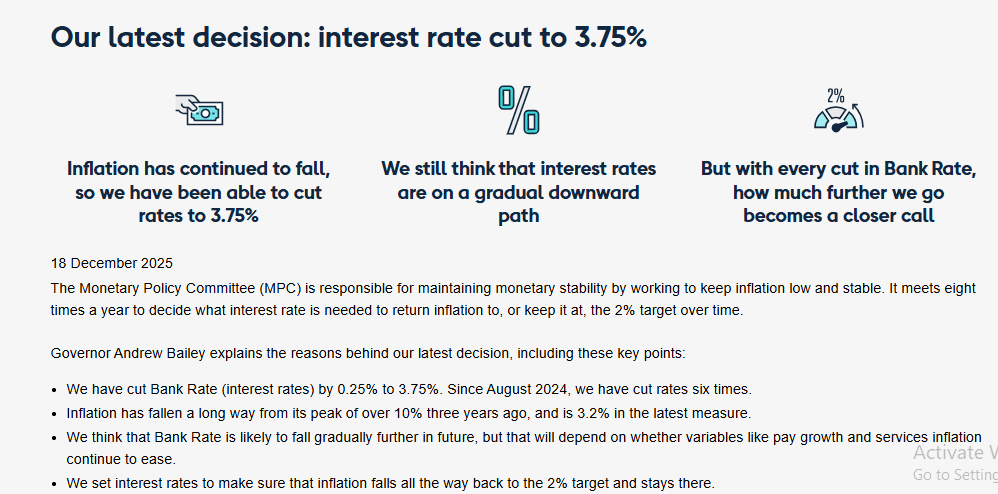

The Bank of England (BoE) is expected to announce a reduction in its base interest rate today, marking its fourth cut of 2025. Analysts widely predict a decrease from 4% to 3.75%, the lowest level since early 2023. This decision comes as inflation slows to 3.2%, unemployment rises, and economic growth stagnates. The Monetary Policy Committee (MPC) remains divided, but a majority is anticipated to favor the cut, reflecting the need for monetary easing to support the economy.

Table of Contents

ToggleInflation Trends and Economic Context

Inflation Eases but Remains Elevated

The latest inflation data, showing a drop to 3.2% in November from 3.6% in October, has strengthened the case for a rate cut. This decline, driven by easing food prices, suggests that the cost-of-living squeeze is beginning to ease. However, inflation remains well above the BoE’s 2% target and is the highest among G7 nations. Domestic factors, such as last year’s tax increases on employers, have contributed to the persistence of price pressures.

Economic Growth Stalls

The UK economy contracted by 0.1% in the three months to October, reflecting a broader slowdown. Business investment has been subdued, with many firms delaying projects amid economic uncertainty. The weak GDP figures highlight the challenges facing policymakers as they attempt to balance inflation control with the need to stimulate growth.

Labor Market and Monetary Policy Dynamics

Rising Unemployment and Slowing Wage Growth

Unemployment has reached its highest level since 2021, while wage growth has slowed significantly. These labor market trends indicate weakening demand and reduced consumer spending power, which could further dampen economic activity. The BoE is likely to view these developments as justification for monetary easing to support the labor market and broader economy.

Divisions Within the Monetary Policy Committee

The MPC, which narrowly voted 5-4 to hold rates in November, is expected to shift its stance today. Governor Andrew Bailey, who previously advocated for caution, is likely to support a rate cut, tipping the balance in favor of easing. Analysts suggest that the decision may still be contentious, with some members concerned about inflationary risks and others prioritizing economic support.

Implications for Borrowers and Savers

Interest Rates Cut Impact on Mortgage Holders

A rate cut would reduce borrowing costs for households, particularly those with variable-rate mortgages. Approximately 500,000 homeowners with tracker mortgages could see their monthly payments decrease by an average of £29, while those on standard variable rates might save around £14 per month. Fixed-rate mortgage holders, however, are unlikely to see immediate benefits.

Challenges for Savers

While borrowers may benefit from lower rates, savers are likely to face reduced returns on deposits. The average rate on easy-access savings accounts, currently at 2.56%, could decline further if banks adjust their offerings in response to the BoE’s decision. This dynamic underscores the trade-offs inherent in monetary policy adjustments.

Outlook for 2026

Limited Scope for Further Cuts

Looking ahead, the BoE is expected to adopt a cautious approach to further rate reductions. While some analysts anticipate one or two additional cuts in 2026, persistent inflation in the services sector and external economic uncertainties could limit the scope for aggressive easing. The MPC’s decisions will likely hinge on evolving data, including wage trends, business investment, and global economic conditions.

External and Domestic Risks

External factors, such as geopolitical tensions and global economic trends, could influence the BoE’s policy trajectory. Domestically, the impact of recent fiscal measures, including the removal of green levies from power bills, will also play a role in shaping the economic outlook. Policymakers will need to carefully navigate these complexities to achieve their dual mandate of price stability and economic growth.

Conclusion

The anticipated rate cut reflects the BoE’s response to a challenging economic environment characterized by slowing inflation, rising unemployment, and stagnant growth. While today’s decision may provide short-term relief for borrowers and businesses, the path forward remains uncertain. Policymakers face the difficult task of balancing economic support with inflation management, and the effectiveness of their actions will depend on how the economy evolves in the coming months.

Frequently Asked Questions

Is the Bank of England going to cut interest rates?

Yes, the Bank of England is expected to cut its base rate from 4% to 3.75% during its interest rate decision today. This move aligns with the BoE cut rate forecast, driven by slowing inflation and rising unemployment.

What date is the next Fed interest rate decision?

The next Federal Reserve interest rate decision is scheduled for January 29, 2026. Stay updated with Fed rate cut news for further developments.

How much is the new rate cut?

The Bank of England is predicted to lower its base rate by 0.25 percentage points, bringing it down to 3.75%. This would mark the fourth cut in the BoE cut rate history for 2025.

What time is the UK interest rate decision?

The Bank of England interest rate decision is expected at 12:00 PM GMT today. This review is part of the Bank of England base rate next review schedule.

Will mortgage rates ever get down to 3% again?

It is unlikely that mortgage rates will return to 3% soon, given the current economic conditions and the Bank of England base rate history. However, further BoE cut rate predictions could influence future trends.

Will mortgage rates go down with a rate cut?

Yes, a Bank of England interest rate cut typically leads to lower mortgage rates, especially for variable and tracker mortgages. However, fixed-rate deals depend on broader market conditions and BoE cut rate forecasts.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.