Bitcoin remains a focal point in financial discussions in June 2025. Holding above the $100,000 mark, its performance sparks both optimism and caution. Analysts suggest potential for further growth, influenced by institutional interest and macroeconomic trends. Yet, volatility remains a major consideration. Predictions of reaching $110,000 or even $125,000 drive investor curiosity. Meanwhile, global economic factors and regulatory developments shape the cryptocurrency’s trajectory. This blend of circumstances underscores Bitcoin’s resilience amid varied market forces. Below, we explore its current standings, market factors, and projections for the near future.

Table of Contents

ToggleTechnical Analysis

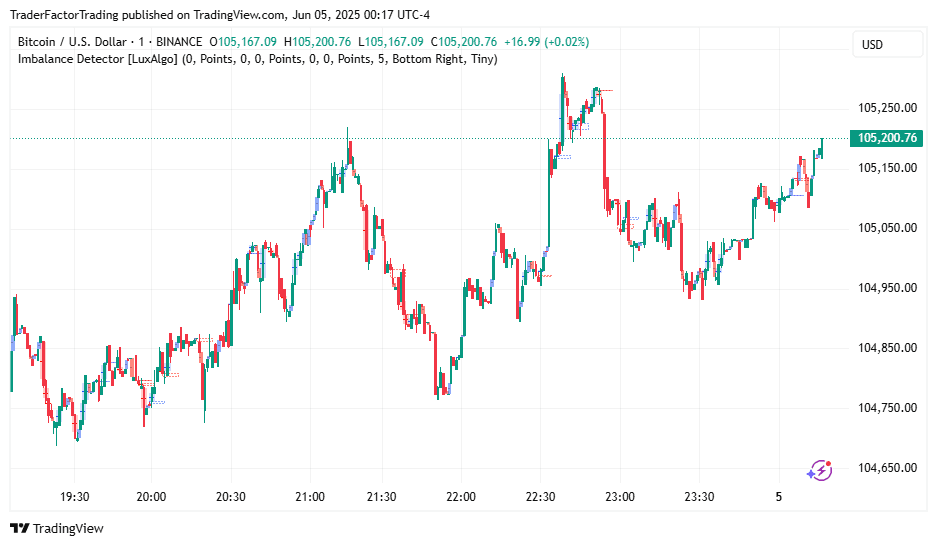

The nearest support level is around $100,000, which has historically acted as a strong psychological barrier, attracting buyers during dips. On the upside, the next resistance level is at $110,000, and breaking this could signal further bullish momentum. If the price remains above the 50-day and 200-day moving averages, it indicates a bullish trend, while a drop below these averages could suggest weakness. The Relative Strength Index (RSI) is another key indicator; if it is above 70, Bitcoin might be overbought, signaling a potential pullback, while an RSI below 30 could indicate oversold conditions and a buying opportunity. Additionally, increasing trading volume near $105,214 suggests strong market interest, whereas declining volume could point to weakening momentum.

Market Trends

Bitcoin’s stability above $100,000 underscores its enduring appeal. Institutional investors maintain their interest, signaling long-term confidence. Notable macroeconomic conditions, such as interest rate shifts, influence market sentiment. June 2025, in particular, has seen consistent trading activity supporting the cryptocurrency’s capitalization. While price fluctuations are frequent, the broader trajectory points to sustained growth. This reflects increasing adoption trends. Regulators, however, remain watchful, which could restrict upward momentum. Some analysts advise caution, given the ongoing impact of policy shifts.

Bitcoin Predictions and Sentiment Analysis

Investor sentiment remains cautiously optimistic despite inherent market risks. Analysts forecast a potential price increase to $110,000 this month. Predictions of reaching $125,000 also gain traction in bullish circles. Driving this outlook is Bitcoin’s ability to weather economic headwinds. Factors like institutional flows and robust liquidity support these ambitious projections. However, skeptics highlight market overvaluation as a possible hurdle. Such contrasting views create a dynamic debate within the investment community this June.

Regulatory and External Considerations

Global economic developments continue to influence Bitcoin’s price. Regulations are a particularly critical factor worth monitoring. Countries in Asia and Europe are considering stricter rules for crypto transactions. These could tighten capital inflows and dampen speculative activity. Conversely, positive legislative shifts could enhance market confidence. Additionally, inflation concerns and central bank actions remain central drivers. These could either fuel Bitcoin’s upward trend or create headwinds. Monitoring these factors is vital for understanding the asset’s future.

Outlook for Investors

Investors are urged to evaluate recent developments carefully. The cryptocurrency market remains volatile and sensitive to external shocks. Bitcoin’s ability to sustain its current levels reflects strong fundamentals. Still, price corrections cannot be ruled out in uncertain conditions. Those with a long-term approach might find the current environment favorable. On the other hand, short-term traders should exercise caution amid sudden market swings. Overall, patience and due diligence are key moderating factors.

Conclusion

Bitcoin’s performance in June 2025 showcases resilience in a volatile market. The cryptocurrency remains steady above significant price levels, supported by investor confidence and favorable trends. Predictions suggest potential growth, though risks like regulatory shifts and market volatility require focus. Careful observation of these trends will be crucial for both seasoned and new investors navigating the crypto space.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.