This week, Bitcoin demonstrated sharp price fluctuations influenced by easing geopolitical tensions, particularly in the Middle East, and broader macroeconomic developments. From dipping below $100,000 early in the week to recovering above $107,000, the cryptocurrency attracted attention from traders and analysts alike. Institutional interest and supportive factors, like speculation on monetary policy shifts, further fueled the coin’s resurgence.

📈 Bitcoin’s technical indicators show bullish trends.

✨ A golden crossover between the 50-day and 200-day moving averages signals sustained upward momentum.

💪 Support at $100,000 remained strong during dips.

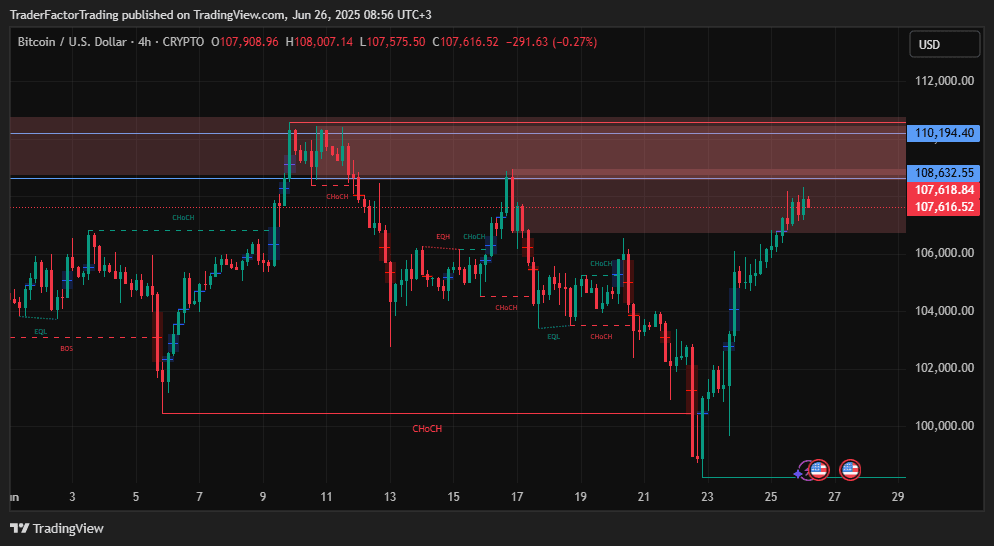

🛑 Resistance near $108,000 presents a short-term challenge.

🔮 Analysts view the technical setup as a sign of potential continued gains.

Table of Contents

ToggleBitcoin Price Trends Over the Week

Bitcoin’s price showcased notable volatility, driven by fluctuating sentiment. The week began with Bitcoin dropping to $98,400, reflecting concerns over escalating conflict in the Middle East after U.S. airstrikes on Iranian nuclear facilities. However, by June 25, the price surged close to $108,200, recovering nearly 10% within days. Much of this uptick aligned with the announcement of a ceasefire between Israel and Iran, brokered by the U.S. This pause in hostilities provided relief to investors, enabling a return to riskier asset classes. Notably, Bitcoin’s steady recovery above the $100,000 threshold underscored its resilience against external market shocks.

Impact of Geopolitical Developments

The ceasefire announcement in the Middle East significantly influenced Bitcoin markets. Geopolitical tensions earlier caused investors to shift toward safer assets, temporarily driving Bitcoin below $100,000. However, with reduced fears of prolonged instability, sentiment improved. Analysts note that Bitcoin, often considered a hedge during fiat uncertainty, benefited as energy markets stabilized. This reaction highlighted how large-scale political developments directly shape cryptocurrency demand. The prompt bounce-back also demonstrated Bitcoin’s sustained appeal amid potential economic volatility.

Institutional Activity in the Crypto Market

Institutional players played a pivotal role in Bitcoin’s price recovery. Continuous inflows into Bitcoin ETFs for ten straight weeks signaled robust demand from professional investors. Companies like MicroStrategy further supported market growth by expanding their digital asset holdings. Portfolio managers have cited decreasing selling pressure and favorable fund inflows as positive indicators for Bitcoin. Institutional interest not only reinforced short-term performance but also helped establish a more stabilized price environment. This growing participation highlights Bitcoin’s transition from speculative asset to a mainstream financial instrument.

Macroeconomic Factors at Play

Broader macroeconomic trends also supported Bitcoin’s upward movement. Speculation about potential U.S. Federal Reserve rate cuts significantly boosted risk-on sentiment. Lower interest rates generally encourage investments in high-risk assets, including cryptocurrencies. Additionally, discussions of crypto-friendly policies from central banks have enhanced investor confidence. Outside of monetary policy, falling oil prices alleviated inflationary pressures, contributing to an overall favorable environment for Bitcoin adoption. These factors collectively provided tailwinds for the cryptocurrency during the week.

The Broader Implications of Bitcoin’s Movements

Bitcoin’s performance this week reflects its dual role as a speculative asset and a hedge in uncertain times. The cryptocurrency’s recovery amid geopolitical tensions illustrates its resilience in volatile markets. Institutional support continues to elevate Bitcoin’s stature, showcasing confidence among large-scale investors. Meanwhile, Bitcoin’s responsiveness to external macroeconomic events reinforces the importance of tracking global economic shifts when evaluating cryptocurrency investments. The alignment of geopolitical and economic factors shaped a unique trading environment that further solidified Bitcoin’s position as a significant financial instrument.

Conclusion

Bitcoin’s price movements this week highlight its dynamic interplay with global events and economic trends. From geopolitical easing in the Middle East to macroeconomic policy speculation, the factors behind its recovery underscore its evolving role in modern markets. As it navigated volatility, Bitcoin demonstrated both resilience and adaptability, critical traits that underscore its standing in the financial ecosystem.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.