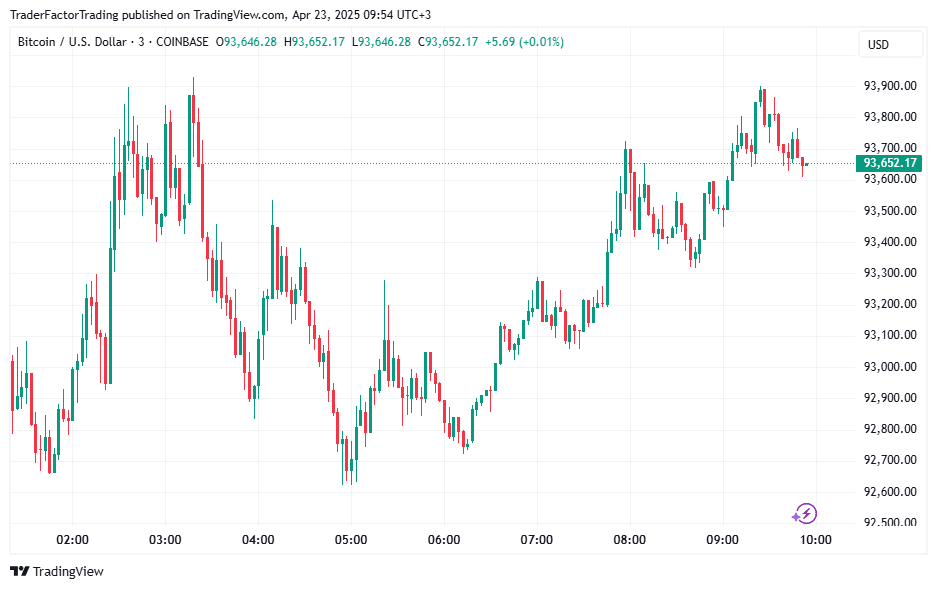

Bitcoin has surpassed the $93,000 mark, signaling a significant upswing after weeks of fluctuating market dynamics. This dramatic price increase has been driven by a combination of political developments, institutional interest, and market sentiment. With the U.S.-China trade war softening and the Federal Reserve averting political turmoil, investors are gravitating toward digital assets. Amid heightened optimism, Bitcoin’s technical indicators also suggest robust market strength, fueling speculation regarding future price movements.

Table of Contents

ToggleTechnical Analysis

Trending Indicators Highlight Strength

From a technical perspective, Bitcoin’s surge above $93,000 signals strong upward momentum. Key moving averages reflect a bullish trend. The 50-day moving average is trading above the 200-day average, a formation widely known as a golden cross. This development is typically interpreted as a long-term bullish indicator by market analysts.

Additionally, the Relative Strength Index (RSI) is nearing 70. This zone often indicates overbought conditions. While this suggests caution for short-term investors, it also underlines the robustness of current demand. Meanwhile, trading volumes have increased significantly, providing further confirmation of sustained market interest.

Resistance and Support Zones to Watch

Bitcoin is currently testing critical resistance near $94,000. Short-term traders will monitor this level carefully. If Bitcoin closes above this threshold, it could signal the start of another leg upwards. On the downside, support is evident at the $88,000 level. This area has historically served as a stabilizing range, minimizing the likelihood of drastic downturns.

For the coming sessions, maintaining trading volume above average will be key. Without it, Bitcoin could retrace to test lower support levels. However, with political optimism and institutional backing in play, the broader market outlook appears favorable.

Key Drivers Behind Bitcoin’s Price Surge

Political Developments Provide Market Relief

Recent political events have provided a stable backdrop for markets. President Donald Trump softened his rhetoric on Federal Reserve Chair Jerome Powell, offering assurances of continuity. This comes after weeks of tensions, where Trump criticized Powell for his cautious approach to interest rate cuts. Markets interpreted this reversal as a positive signal, alleviating concerns about potential instability within U.S. monetary policy.

Further, Trump has hinted at easing the U.S.-China trade war by reducing tariffs. Currently, tariffs imposed on Chinese goods stand at over 145%, affecting global trade balances. The prospect of de-escalation has heightened risk-on sentiment, driving investors to assets like Bitcoin. Historically, cryptocurrency performs well during periods of economic policy change, as it represents a hedge against traditional financial systems.

Institutional Support Boosts Momentum

Institutional activity has also contributed to Bitcoin’s rise this week. Investments in Bitcoin-focused exchange-traded funds (ETFs) have surged. Reports indicate an influx of $381 million into Bitcoin ETFs, marking the highest weekly inflow in months. At the same time, corporate interest in Bitcoin remains strong. Technology firm MicroStrategy announced its acquisition of 6,500 BTC, reaffirming its alignments with digital assets’ long-term growth.

These developments reflect growing confidence in Bitcoin’s role as an asset class. Major investors’ participation further stabilizes the market, encouraging smaller players to follow. With this institutional backing, enthusiasm surrounding Bitcoin’s potential to breach psychological resistance levels has only strengthened.

Broader Implications for Cryptocurrency Markets

Altcoins Ride the Wave

Bitcoin’s rally has had a knock-on effect across the cryptocurrency ecosystem. Major altcoins such as Ethereum and Solana have posted notable gains. Ethereum recently climbed above $1,700, while Solana saw a 12% spike. This upward movement suggests renewed risk appetite among investors, particularly as regulatory uncertainties around cryptocurrencies show signs of easing.

Political developments such as the appointment of a crypto-friendly SEC chairman have also played a part. With greater regulatory clarity expected, speculative interest in alternative cryptocurrencies could see sustained growth in tandem with Bitcoin’s bullish momentum.

Macroeconomic Trends Offer Context

Macroeconomic factors have amplified Bitcoin’s appeal as a store of value during uncertain times. Inflationary pressures persist, with central banks globally sticking to cautious monetary policies. This backdrop has made Bitcoin an attractive alternative hedge, alongside traditional assets like gold. Investors increasingly view Bitcoin’s fixed supply as a countermeasure to inflation, amplifying its role in diversified portfolios.

The Road Ahead

Bitcoin’s resurgence above $93,000 points to strong market fundamentals driven by external events and investor sentiment. However, analysts will closely monitor resistance levels and market behavior for possible corrections. External factors such as continuing U.S.-China trade discussions and potential Federal Reserve policies remain key variables. While risks persist, the framework for sustained bullish momentum appears intact.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.