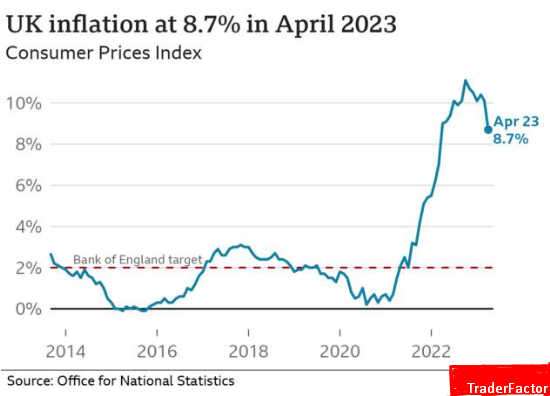

- UK inflation rates exceeded economist predictions

- CPI rose 8.7% YoY and 1.2% MoM in April

- Figures exceeded market expectations by 0.5% and 0.4% respectively

- GBP/USD rose above 1.2450 due to positive inflation rates

- UK economy is improving, making GBP investments more attractive

Britain’s inflation rate has dropped to its lowest point since the cost of living crisis began, with a decline to 8.7% in April.

The Office for National Statistics (ONS) revealed that the rate fell below double digits for the first time since August, and it has peaked at up to 11.1% in previous months.

Nonetheless, food prices continued to surge at their fastest rate in 45 years. Despite hopes for a bigger drop to 8.2%, experts believe that Rishi Sunak’s target to reduce inflation by half this year will meet with a narrower margin than expected.

The figures are expected to reinforce the Bank of England’s move to raise interest rates further in June to combat inflation.

According to the latest inflation data, the increase in electricity and gas prices played a significant role in the drop of annual inflation in April, contributing a 1.42 percentage point decrease.

Meanwhile, food and non-alcoholic beverage prices continued to rise, contributing to high annual inflation, although the rate of increase for these items eased slightly in April.

However, despite the slight easing in the annual rate of inflation for food and non-alcoholic beverages, the indicative modelled estimates suggest that it remains at its second-highest level in over 45 years.

In terms of monthly consumer prices, there was an unexpected rise of 1.2%, which was above the predicted estimate of 0.8%.

The Consumer Prices Index, which includes owner occupiers’ housing costs, experienced a decrease in the 12 months leading up to April 2023, falling from 8.9% to 7.8%.

However, excluding volatile energy, food, alcohol, and tobacco prices, the core CPI increased from 6.2% to 6.8% in March, which is likely to be a cause for concern for the Bank of England.

This increase suggests that underlying inflationary pressures are still present and could prompt the Bank of England to take action to curb inflation.

Table of Contents

ToggleAre Your Costs Skyrocketing? Here’s Why

The Office for National Statistics (ONS) tracks inflation using a basket of popular goods across the UK. But if your shopping preferences skew towards unusual or niche items, your expenses may be rising at a different rate altogether.

Stay informed about the real impact of inflation on your wallet

Can We Expect Lower Prices In The Future?

While it may seem like a good idea, it’s important to consider the potential consequences. If consumers and businesses expect prices to decrease, they may hold off on spending, hurting revenue for companies. This can lead to cost-cutting measures such as layoffs, causing a downward spiral and potential economic crisis known as “deflation”.

So, while lower prices may help our wallets in the short-term, the long-term impacts may not be worth the risk.

Discover the Impact of UK Inflation on Traders

Find out why the monthly inflation figure, as measured by the Consumer Price Index, is crucial for traders.

Keep an eye on the Bank of England’s efforts to maintain 2% inflation, as any rise or decline influences interest rates and bond buying.

Expect a surge in the currency value of the British pound if inflation goes beyond expectations.

Read next……..

GBP/USD Slightly Up After Stronger UK CPI, Traders Eagerly Awaiting FOMC Minutes

Strong UK inflation data briefly boosted the British Pound (GBP), but expectations for fewer rate hikes by the Bank of England (BoE) and a bullish US dollar (USD) have limited any further gains.

The GBP/USD pair has retreated from its intraday spike to 1.2470 and is hovering around 1.2420, vulnerable to extending its recent retracement slide.

The USD Index (DXY) is near a two-month high and continues to draw support from the possibility of further rate hikes by the Federal Reserve (Fed), as well as from its relative safe-haven status amid global economic concerns and US debt ceiling worries.

Investors will turn to the FOMC minutes for clues about the Fed’s rate-hike path, which may influence the near-term USD price dynamics and provide a fresh directional impetus to the GBP/USD pair.

Despite this, bearish sentiment surrounds the GBP/USD pair, with technical indicators suggesting a likely extension of its pullback from over a one-year high reached earlier this month.

Technical Levels To Monitor

Looking to keep an eye on the GBP/USD? Here are the essential technical details to know:

- The last price today is 1.2425 with a daily change of 0.0014 and an increase of 0.11%.

- The daily SMAs are 1.2515, 1.2421, 1.2278, and 1.1972 for 20, 50, 100, and 200 days, respectively.

- The key levels to watch include the previous highs and lows, weekly and monthly highs and lows, and daily Fibonacci percentages.

- For instance, the previous daily high and low are 1.2446 and 1.2373, respectively.

- The daily pivot point S1, S2, and S3 are between 1.2374 and 1.23, while R1, R2, and R3 are between 1.2448 and 1.2521.

EUR/USD Continues to Hold Ground Against Mixed German Data

Despite mixed results from Germany’s IFO survey, EUR/USD has remained steady around the 1.0800 mark. However, there is a risk of a prolonged slide should the pair close below the 1.0770 support level. On the upside, a push beyond 1.0800 would pave the way for targets at 1.0830 and 1.0870.

The IFO Business Climate Index fell to 91.7 in May from 93.4 in April, but the IFO Expectations Index improved to 94.8, exceeding analysts’ estimates. Nevertheless, this data had little impact on the steady EUR/USD pair.

On the other hand, Euro Stoxx 50 index fell more than 1% while US stock index futures declined around 0.3%.Investors are staying cautious due to the lack of progress in US debt-limit negotiations, which could potentially destabilise the market.

However, the release of the Federal Reserve policy meeting minutes could provide some short-term market response and possibly reveal the timing of a policy pivot.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.