Today, the spotlight is on the US economy with the release of final GDP and core durable goods orders data ahead of tomorrow’s pivotal core Personal Consumption Expenditures PCE inflation report. Traders and market watchers are gearing up for the Fed’s preferred inflation measure, which could signal crucial shifts in monetary policy.

What to Expect from the PCE Report

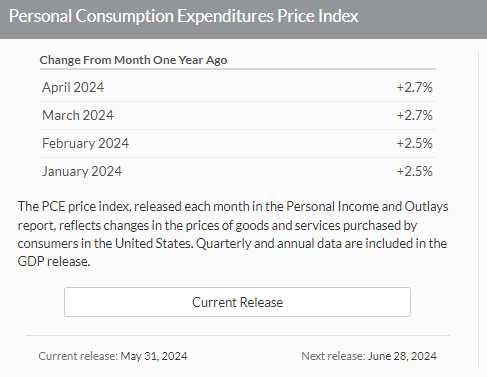

Tomorrow, the much-anticipated PCE inflation report will be unveiled. According to a survey of economists by Dow Jones Newswires and the Wall Street Journal, the forecast indicates a slight deceleration in inflation. The PCE index is expected to have risen 2.6% over the past year, down from 2.7% in April. The “core” inflation rate, which excludes volatile food and energy prices, is projected to drop to 2.6% from 2.8%, marking its lowest point since March 2021. This trend inching towards the Fed’s 2% target is promising for market stability.

Implications for Monetary Policy

Should these forecasts hold true, it would reinforce the notion that the recent surge in inflation was a temporary blip rather than a persistent threat. This aligns with the earlier Consumer Price Index (CPI) data, which suggested that while inflation remains elevated, it is gradually subsiding. The PCE report holds significant weight as the Fed closely monitors this metric when setting the influential fed funds rate, which directly impacts interest rates on mortgages, credit cards, car loans, and other forms of borrowing.

Market Expectations and Rate Cut Speculations

Financial markets are abuzz with speculation about potential rate cuts by the Federal Reserve. The CME Group’s FedWatch tool indicates a more than 60% probability of a rate cut at the September policy committee meeting. Continuous disinflation signals from the PCE report could pave the way for two rate cuts by the end of the year, with a high likelihood of the first cut in November. Such expectations are already being priced into the market, with interest rate futures reflecting these potential moves.

The Role of the PCE Inflation Index

The PCE price index measures US inflation by tracking changes in the cost of living. It considers a basket of goods and services, assigning different weightings to reflect typical household spending patterns. The PCE index is preferred by the Federal Reserve due to its comprehensive coverage and regular updates, making it a more accurate reflection of consumer behavior and expenditures compared to the Consumer Price Index (CPI).

How the PCE Index Affects the Market

A lower-than-expected PCE deflator could increase the likelihood of a rate cut in September, possibly leading to two cuts before the year ends. This scenario would generally support stock markets and weaken the US Dollar. Conversely, an upside surprise in the PCE deflator might delay the expected rate cuts, pressuring equities and boosting the US Dollar. Traders should brace for potential volatility based on tomorrow’s data.

Conclusion

Tomorrow’s PCE report is set to play a crucial role in shaping market expectations and the Federal Reserve’s monetary policy path. With inflation trends starting to align with the Fed’s goals, the prospect of rate cuts is becoming more tangible. Stay tuned for the release as it could provide critical insights and potentially steer market movements.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.