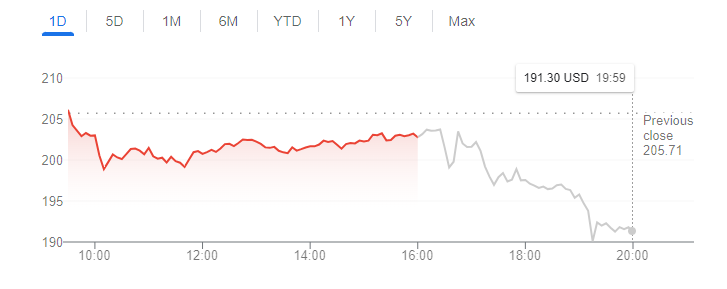

After Tesla’s Investor Day events, the stock prices dropped more than 5%, leaving investors disappointed due to its lack of concrete details.

Tesla CEO Elon Musk shared his bold vision for the company’s future at its 2023 Investor Day in Austin. Tom Zhu, head of manufacturing, proudly revealed that they had produced 4 million cars up to Wednesday.

While this presentation was abundant with ambition and successes so far, no specific details were given regarding any new products or services. Yet investors were waiting to find out what exciting developments are coming next from Tesla.

Tesla’s Investor Day was the talk of Texas this week! CEO Elon Musk took center stage to discuss his “Master Plan 3” – a vision for Tesla that focuses on scaling up in an increasingly competitive landscape.

Despite being short on details about new products and services, it was clear Mr. Musk wasn’t lacking enthusiasm when it came to sharing the steps he sees Tesla taking over the next five years.

Presentation In Details: Tesla Apocalypse Train

Elon Musk kicked off his presentation with a compelling thesis – that it’s possible for humanity to create an Earth powered by sustainable energy without sacrificing comfort or natural habitats.

What’s more, he even suggested our newly-discovered green tech could support a population larger than the current 8 billion of us!

Elon Musk and Drew Baglino took the stage to discuss the vision for Tesla’s future. They plan on supplying clean, renewable energy sources back into our grid while also ramping up battery production – both of which are key components in futuristic electric vehicles!

With over 1 million cars delivered already this year, they have their sights set high: 20 million EVs by 2030! All aboard the Tesla Apocalypse train…

After a three-hour presentation, the panel of Tesla executives faced not just any question… but one about how they could expand their presence in China!

Tom Zhu, Tesla’s leader in global production and their China/APAC businesses for years, confidently shared his strategy on successful customer demand:

“We offer a quality product at an affordable price. We find ways to cut costs so that we can pass the savings onto our customers.”

Pricing Impacts

Elon Musk then chimed in about pricing impacts – stressing the importance of affordability over desire; emphasizing how slight changes have major effects on demand. Wednesday marked another milestone as they had produced 4 million cars!

Zhu declared that the company has increased its operational efficiency exponentially over time, constructing their first million after 12 years and each subsequent milestone in shorter succession.

He also mentioned plans to build new factories for cars and batteries as well as increase production at existing facilities.

Tesla continues to lead the charge in electric car charging with an impressive 9 terawatt hours of electricity provided across different methods, like 40,000 Superchargers!

To put it in perspective that’s more than double the amount consumed by all U.S. citizens each year and half of their EU chargers are even accessible for other vehicles! Plus they just opened 10 additional locations dedicated solely to non-Tesla owners.

Tesla is staying tight-lipped about their latest and greatest vehicle model, but design leader Franz von Holzhausen and VP Lars Moravy took the stage to reveal some awesome manufacturing improvements that will help speed up production for future car models.

Technology Advancements

Colin Campbell, Tesla’s powertrain vice president, revealed that the carmaker’s next factory will have advanced technology despite being half the size of its Austin facility.

Not only are they working on a game-changing drive unit to work with any type of battery cell out there but also crafting an eco-friendly motor that won’t need rare earth metals!

On Tuesday, President Lopez Obrador announced that Tesla had committed to building a large factory in Mexico’s Monterrey – complete with eco-conscious initiatives like using recycled water.

Musk confirmed the news on Wednesday and emphasized how this new production would complement existing factories instead of replacing them!

Tesla is returning to the top of its game after a rocky start this year, as shares have risen over 60%.

Despite taking a slight dip ahead of Wednesday’s Investor Day event, analysts at Mizuho Securities remain positive about the electric vehicle manufacturer.

They see it continuing to be in front for fully-electric vehicles with competitors entering into their market soon.

When it comes to finding an electric vehicle on a budget, the Tesla Model 3 sedan is not at the top of the list. Seven models from other automakers are priced lower than its starting point of $43K – so you don’t have to break your wallet for greener wheels!

Elon Musk’s 2016 Master Plan Part Deux Recap

Elon Musk’s 2016 Master Plan Part Deux was an ambitious project. It included big ideas, like the creation of “stunning solar roofs” with battery storage and a range of electric vehicles for all major segments.

Plus self-driving technology that could be 10X safer than manual driving! On top of it all, he wanted to make sure you have the ability to earn money from your car when you’re not using it.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.