The coming week is set to bring a series of critical economic events that promise to create ripples across currency markets. Here, we’ve broken down the anticipated market movers and their potential impact on the trades you’re eyeing.

In the current tranquil market waters, traders might enjoy a brief respite, but don’t get too comfortable. The economic calendar is gearing up, set to deliver a spectacle of data that could very well rechart the course of major currencies.

From central bank speeches to employment data releases, the week is stacked with pivotal events. Keeping a close watch could be the difference between navigating your portfolio to prosperous shores or being caught in an unforeseen undertow.

Table of Contents

ToggleMajor Economic Events to Watch This Week

| Day | Event | Expected Impact |

|---|---|---|

| Tuesday’s Tent-Poles | ||

| BOJ Gov Ueda Speaks | A potential mover for JPY pairs | |

| USA ISM Services PMI | Could send waves through USD-related trades | |

| Wednesday’s Waves | ||

| Australia’s GDP q/q | A determinant for the AUD’s trajectory | |

| Britain’s Construction PMI & GBP Annual Budget Release | Key GBP influencers | |

| Canada’s rate announcementshttps://traderfactor.com/fed-chair-powell-sets-the-stage-for-possible-rate-hikes-as-he-testifies-before-the-congress/ and USA statements | Eyes on CAD and USD | |

| Thursday’s Threshers | ||

| China’s Foreign Currency Reserves Report | A connective thread to the AUD | |

| ECB’s Rate Decision & Press Conference | A potential surge for EUR pairs | |

| USA Unemployment Claims & Fed Chair Powell’s Speech | Crucial for USD positions | |

| Friday’s Frontrunners | ||

| New Loans Report from China | Prepare for USD and CAD volatility | |

| Employment metrics from Canada | Prepare for USD and CAD volatility |

Tuesday’s Tent-Poles:

- BOJ Gov Ueda Speaks: A potential mover for JPY pairs.

- USA ISM Services PMI: Could send waves through USD-related trades.

Wednesday’s Waves:

- Australia’s GDP q/q: A determinant for the AUD’s trajectory.

- Britain’s Construction PMI & GBP Annual Budget Release: Key GBP influencers.

- Canada’s rate announcements and USA statements: Eyes on CAD and USD.

Thursday’s Threshers:

- China’s Foreign Currency Reserves Report: A connective thread to the AUD.

- ECB’s Rate Decision & Press Conference: A potential surge for EUR pairs.

- USA Unemployment Claims & Fed Chair Powell’s Speech: Crucial for USD positions.

Finishing with Friday’s Frontrunners:

- New Loans Report from China and employment metrics from Canada: Prepare for USD and CAD volatility.

Anticipating Market Movements Ahead of ECB Rate Decision, Powell Speech and JOLTS Report

Each economic event carries its unique brand of influence on the markets. For example, central bank decisions and speeches can have a profound and immediate effect on their respective currencies, as they often contain forward-looking statements regarding policy. On the other hand, employment reports offer a retrospective look, but they are crucial indicators of economic health and thus provoke significant trader reactions.

In particular, this Thursday’s series of releases – from China’s conservation of foreign currency reserves to America’s labor data – could spell out a busy trading session. Pair this with commentary from the Fed Chair, which has been known to trigger swift market pricing-in of interest rate expectations, and you’ve got yourself a recipe for notable swings.

Likewise, end-of-week revelations including Canada’s employment landscape will challenge traders to adjust their lenses and perhaps their positions, underpinning the intricacies of the interconnected global economic environment.

Trading Considerations

- Practice prudent risk management as the markets react.

- Stay up-to-date with real-time data and analyses.

- Monitor currency pairs closely tied to announced data.

For traders playing the game of currencies, knowledge is as valuable as currency itself. This week’s economic events hold a treasure trove of informational wealth that can guide your trading decisions. Be vigilant, flexible, and most importantly, prepared to ride the wave of market responses.

EUR/USD Sees Promising Intraday Upside Potential

In today’s trading session, the EUR/USD pair exhibits a promising upside potential, with analysts recommending a ‘BUY’ position. The entry pivot is set at 1.0820, aiming for target levels of 1.0855 and 1.0870, potentially yielding a gain of 15-30 pips. Traders are advised to maintain a risk management strategy of 2% per trade.

The Relative Strength Index (RSI) signals an upward momentum, suggesting a favorable market condition for the proposed strategy.

GBP/USD Targets Further Gains Amid Positive Momentum

The GBP/USD currency pair is on the radar for potential gains, with a ‘BUY’ recommendation in place for intraday traders. The suggested entry point is at 1.2635, with take profit levels identified at 1.2675 and 1.2695, offering an opportunity for a 15-35 pips increase.

The investment risk is capped at 2% per trade. Current RSI readings indicate a continued upside momentum, providing a solid basis for the bullish outlook.

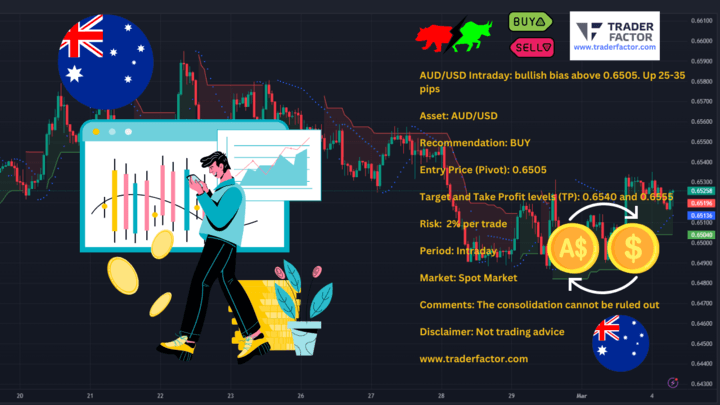

AUD/USD Exhibits Bullish Bias; Eyes on Key Targets

For traders eyeing the AUD/USD pair, a bullish bias prevails above the pivot point of 0.6505, with a ‘BUY’ strategy recommended for those looking to capitalize on intraday movements. The strategy sets its sights on targets at 0.6540 and 0.6555, translating to a potential gain of 25-35 pips.

A prudent risk management approach suggests limiting exposure to 2% per trade. Despite the optimistic outlook, the market’s consolidation phase cannot be overlooked, and participants should remain vigilant of changing dynamics. As with any trading advice, it’s crucial to consider the volatile nature of the forex market, where plans could quickly deviate from expectations.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.