As the financial world braces for the release of the Non-Farm Payroll (NFP) data and Federal Reserve Chair Jerome Powell’s speech later today, markets across the board are showing mixed signals. From gold’s cautious rally to the forex market’s delicate balance, and the stock market’s recent pullback, here’s a detailed breakdown of the latest developments.

Table of Contents

ToggleGold (XAU/USD): A Tug-of-War Between Bulls and Bears

Gold prices are currently trading at $2,905 per ounce, reflecting a cautious bullish correction within a broader bearish trend. The precious metal has been oscillating within a bullish channel, with resistance looming at $2,945. Analysts suggest that a breakout above $2,950 could pave the way for a rally toward the $3,005 mark. However, a failure to sustain momentum could see prices retreat to $2,830.

Technical indicators, including moving averages, point to short-term bearish pressure, but the Relative Strength Index (RSI) suggests potential for a rebound. The formation of a Double Top reversal pattern near resistance levels adds to the uncertainty. Fundamentally, gold’s trajectory hinges on the strength of the US dollar, which is expected to react sharply to the NFP data and Powell’s remarks. A dovish tone from the Fed could reignite safe-haven demand for gold, while a hawkish stance may weigh on prices.

EUR/USD: Bulls Face a Critical Test

The EUR/USD pair has been riding a bullish wave, currently trading at 1.0820. The euro has gained significant ground this week, supported by a weaker US dollar and expectations of a hawkish European Central Bank (ECB). However, the pair faces a critical resistance level at 1.0850, which could determine its near-term direction.

Technical analysis reveals a bullish channel, with support at 1.0715 and potential upside targets at 1.1045. The RSI indicates a rebound from support levels, while moving averages confirm the bullish trend. Despite this, traders remain cautious as the pair approaches overbought territory. The NFP data and Powell’s speech are likely to influence the US dollar, which could either bolster or cap the euro’s gains.

GBP/USD: Balancing on a Knife’s Edge

GBP/USD is navigating a delicate balance, with a pivot point at 1.2860. Resistance at 1.3047 and support at 1.2721 define the pair’s immediate trading range. The pound has shown resilience, supported by a weaker dollar, but faces headwinds from domestic economic concerns.

Technical indicators suggest a bullish bias, but the pair remains vulnerable to external shocks. The NFP data could shift market sentiment, while Powell’s speech may provide further clarity on the Fed’s monetary policy trajectory.

AUD/USD: Bearish Momentum Amid Risk-Off Sentiment

The Australian dollar is under pressure, with AUD/USD trading near 0.6355. The pair has been weighed down by risk-off sentiment and weaker commodity prices. Resistance at 0.6401 and support at 0.6270 define the pair’s immediate outlook.

Technical analysis points to bearish momentum, despite a broader bullish trend. The pair’s performance will likely hinge on global risk sentiment and the US dollar’s reaction to today’s key events.

USD/JPY: A Battle Between Bulls and Bears

USD/JPY is trading near its pivot point at 148.24, with resistance at 149.98 and support at 146.96. The pair has been caught in a tug-of-war between bullish and bearish forces, driven by fluctuations in US Treasury yields and risk sentiment.

Technical indicators suggest a bearish bias, but the pair remains sensitive to external factors. The NFP data and Powell’s speech are expected to provide further direction, with a stronger dollar likely to push the pair higher.

Stock Market: A Cautious Pullback Ahead of Nonfarm Payrolls Report

The US stock market has experienced a pullback ahead of today’s key events. The Nasdaq is down 2.61% at 18,069.26, while the Dow Jones has dropped 0.99% to 42,579.08. The S&P 500 has declined 1.78% to 5,738.52, reflecting broader market concerns.

Investors are adopting a cautious stance, awaiting clarity on the Fed’s monetary policy. The NFP data is expected to provide insights into the labor market’s health, while Powell’s speech could signal the Fed’s next move. A dovish tone may support equities, while a hawkish stance could exacerbate the recent sell-off.

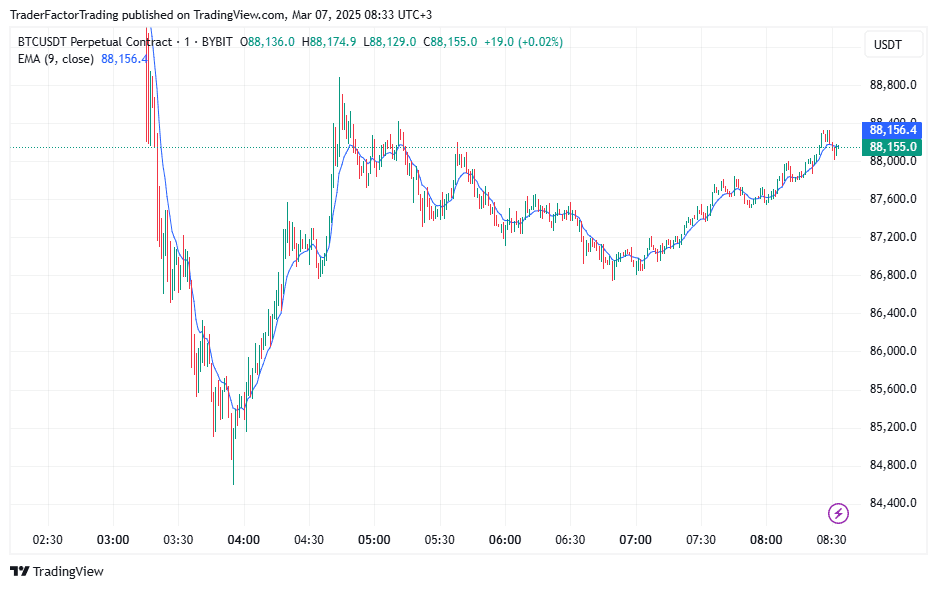

Bitcoin (BTC/USD): Testing Key Levels

Bitcoin is trading at $82,716.92, reflecting a cautious bullish trend. The cryptocurrency faces resistance at $92,463.38 and support at $80,139.21. Technical indicators suggest a potential rebound, but the asset remains vulnerable to external shocks.

Bitcoin’s performance is closely tied to risk sentiment and regulatory developments. The NFP data and Powell’s speech could influence market sentiment, with a stronger dollar likely to weigh on the cryptocurrency.

Final Thoughts

As markets brace for the dual impact of the NFP data and Powell’s speech, traders are advised to exercise caution. The outcomes of these events are expected to set the tone for the coming weeks, influencing asset prices across the board. Stay tuned for further updates as the day unfolds.