The forex market today, reveals dynamic activity across major currency pairs, driven by both technical movements and macroeconomic factors. The US Dollar remains a key focus, as it responds to trade policy updates, mixed PMI data, and central bank rhetoric. Meanwhile, EUR/USD and GBP/USD face unique challenges with the Eurozone’s weakening economic indicators and cautious signals from the Bank of England. USD/JPY, on the other hand, is trading at pivotal levels amid inflationary trends in Japan, adding to its volatility.

Table of Contents

ToggleEUR/USD Struggles Amid Weak Eurozone Data

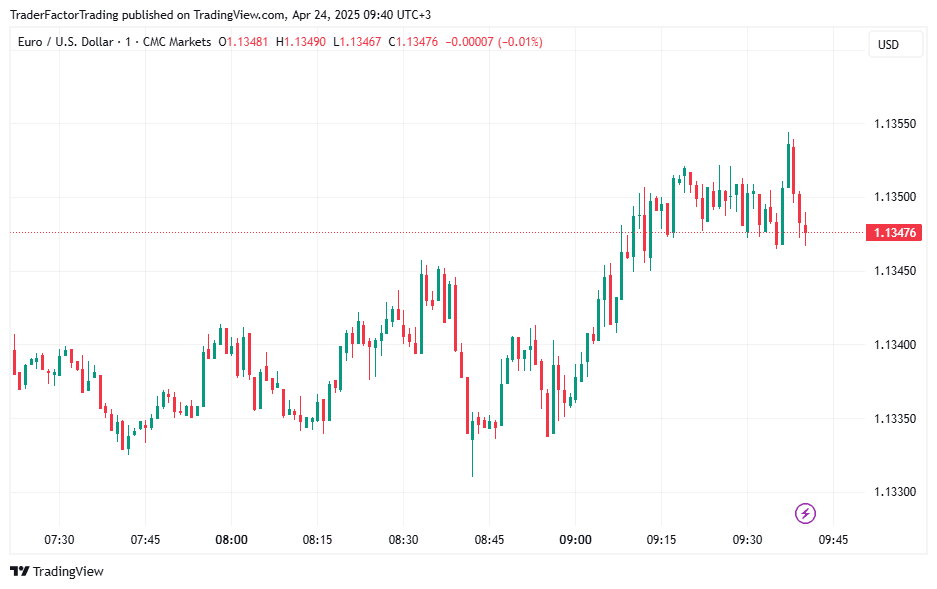

The EUR/USD remains under pressure, with the Euro losing ground against a firm US Dollar. Recent Eurozone PMI data added to concerns about economic stagnation in the region. The Composite PMI fell to 50.1, barely above the contraction zone, reflecting subdued business conditions. Despite marginal improvements in manufacturing, the services sector is dragging down overall sentiment. This data limits any possible upside for the Euro amidst the Dollar’s relative strength, bolstered by US trade progress.

Technically, the pair hovers near a key resistance level at 1.1410. Sellers continue to dominate, pushing prices towards the 1.1300 support. These levels are critical, offering potential entry points for traders, particularly with lingering concerns about the European Central Bank’s stance on rate cuts amid these weakening conditions.

GBP/USD Cautious Ahead of Key Developments

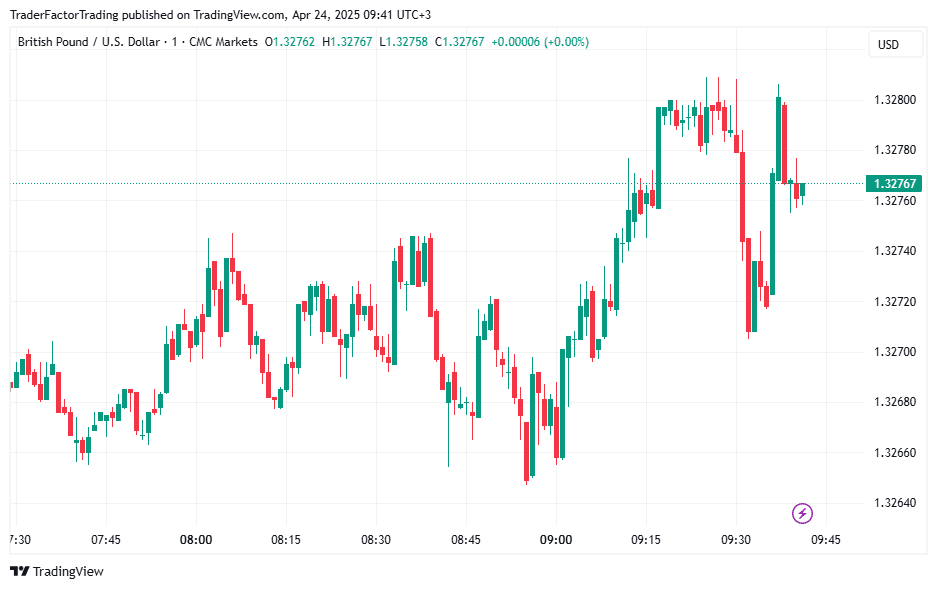

GBP/USD is treading water as traders gear up for UK economic data and responses to yesterday’s speech by Andrew Bailey, the Bank of England Governor. His message leaned towards a cautious approach, suggesting the central bank might maintain its focus on inflation and economic risks. This has dampened the Pound’s recent momentum, leaving it vulnerable to further pressure from a strengthening US Dollar.

On the technical front, the pair is wedged between resistance at 1.2985 and support at 1.2909. The upcoming UK retail sales data could trigger a breakout or breakdown from this range. Market participants remain on edge, as US trade developments and mixed PMI readings continue to influence market sentiment.

USD/JPY at Crucial Levels as Inflation Steers Focus

USD/JPY is trading near the critical psychological level of 140.00, an area with historical significance. Inflationary pressures in Japan, indicated by Tokyo’s rising Consumer Price Index, are casting a shadow over the Yen. The Bank of Japan may need to reassess its dovish position if inflation persists, adding a layer of complexity to the pair.

Meanwhile, the Dollar’s resilience has supported the pair, buoyed by optimism around US trade policy. This balance of forces leaves the pair trading sideways, with resistance at 143.96 and immediate support at 140.00. Traders are watching for a decisive break, which could signal the pair’s next trajectory in the short term.

Gold Trades Above $3,300 Per Ounce

Gold is currently trading at $3,317 per ounce, anchored by bullish momentum within a well-defined channel. Recent price movements suggest consolidation near this level, following a breakout from the $3,280-$3,300 resistance zone earlier this week. This breakout indicates strong buying interest, especially as macroeconomic uncertainties and central bank demand continue to support gold’s appeal. A sustained position above $3,300 suggests that buyers remain in control, though signs of overextension could lead to short-term corrections.

On the technical front, key resistance is observed at $3,345, a level that aligns with previous highs and Fibonacci retracement zones. A decisive break above this resistance may drive prices towards $3,370 or even $3,400, where psychological factors could influence trading behavior. Conversely, support is now at $3,300, with additional cushioning around $3,270, derived from historical pivot points. Failure to hold these levels could spark further downward movement, potentially targeting the $3,240 area.

Momentum indicators, such as the Relative Strength Index (RSI), currently sit in neutral-to-bullish territory, suggesting room exists for additional gains without entering overbought conditions. The Moving Average Convergence Divergence (MACD) also points to upward momentum, with positive histogram readings reinforcing the bullish outlook. However, downward crossings on shorter time frames could signal profit-taking activity.

Looking ahead, the future trajectory of gold largely depends on external market drivers, including central bank policies, geopolitical developments, and inflationary expectations. A shift in these factors could either strengthen the current uptrend or introduce volatility, emphasizing the importance of monitoring near-term technical levels for actionable trading insights.

Broader Macroeconomic Factors Driving Currency Flows

The broader market is influenced by a range of macroeconomic factors. Mixed PMI data in the United States, particularly weaker-than-expected manufacturing readings, indicate potential deceleration in economic growth. However, optimism about trade negotiations has helped the Dollar maintain stability.

Additionally, ECB rate-cut expectations weigh heavily on the Euro. Markets now estimate a 75% likelihood of another cut in June, further reducing its appeal. Similarly, the tariff standoff between the US and China continues to act as a double-edged sword, boosting safe-haven flows while dampening confidence in global trade stability.

Outlook

The forex market today, showcases a mix of economic and technical forces shaping the movement of major currency pairs. EUR/USD is bearish amid Eurozone weakness, GBP/USD is cautious on BOE signals, and USD/JPY trades at critical levels driven by inflation. With uncertainties across key macroeconomic factors, volatility is likely to persist as traders await more concrete data and developments. Each pair’s technical setup suggests potential for sharp movements, depending on upcoming economic releases and policy announcements.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.