The GBP/USD pair is experiencing a notable consolidation phase following the latest UK Consumer Price Index (CPI) data. As the financial world anticipates the upcoming Federal Open Market Committee (FOMC) minutes release, traders and analysts are keeping a keen eye on the currency pair’s movements.

Table of Contents

ToggleGBP/USD Consolidates UK CPI-led Gains Below 1.2750

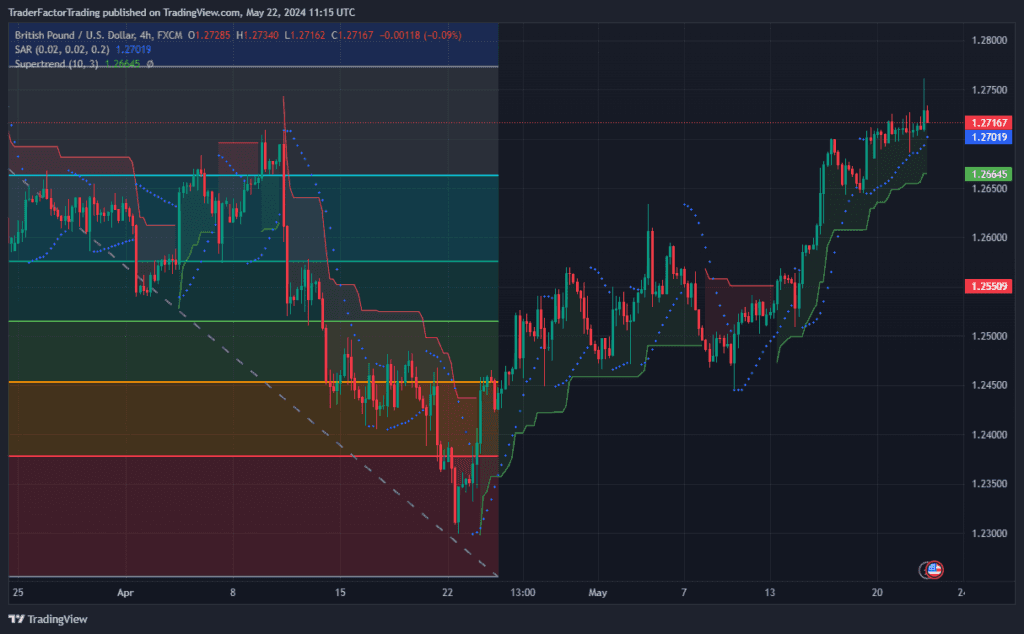

GBP/USD is currently consolidating its gains from Wednesday’s European session, trading just below 1.2750. The pair capitalized on the UK annual CPI data, which reported a rise of 2.3% in April. This figure surpassed market expectations and dampened speculation about a possible Bank of England (BoE) rate cut in June, thereby providing support for the Pound Sterling.

In the early European session, GBP/USD gained bullish momentum, reaching its highest level since March 21, above 1.2750. Although the pair has since retraced some of its gains, it remains comfortably above the 1.2700 mark.

GBP/USD 4-hour Daily Chart

UK Inflation Report: Key Details

Annual CPI and Core CPI

The UK’s Office for National Statistics (ONS) released data indicating that the annual CPI declined to 2.3% in April, down from 3.2% in March. Despite the decline, the reading came in above market expectations of 2.1%. The core CPI, which excludes volatile food and energy prices, rose to 3.9%, exceeding analysts’ estimates of 3.6%.

Monthly CPI Increase

On a monthly basis, the CPI increased by 0.3% in April, surpassing the forecasted 0.2% but below March’s 0.6% increase. This indicates a relative easing in price pressures, although the numbers still reflect persistent inflationary trends.

Services CPI

The UK April Services CPI rose by 5.9% year-over-year, slightly down from a 6.0% increase seen in March, illustrating a modest deceleration in service-related inflation.

Market Reactions and Commentary

GBP/USD Reaction

The GBP/USD pair rose sharply to near 1.2750 following the release of the UK CPI data but quickly reversed to hover around 1.2740. Currently, the pair is trading 0.27% higher on the day, reflecting a cautious optimism among traders.

Market Sentiment

The smaller-than-expected drop in UK inflation has reduced the likelihood of an imminent BoE rate cut, with markets scaling back predictions for a rate reduction in June. Analysts had forecast the annual increase in the cost of goods and services would fall to 2.1%, aligning closely with the BoE’s 2% target.

Prime Minister Rishi Sunak commented on the inflation report, stating that “today marks a major moment for the economy, with inflation back to normal.”

Implications for Forex Traders

Short-Term Outlook

For forex traders, the UK CPI data provides a mixed signal. While the inflation rate has decreased, it remains above the BoE’s target, reducing the odds of an early rate cut. This supports the Pound Sterling in the short term, although global economic factors and the upcoming FOMC minutes will also play crucial roles in determining future movements.

Long-Term Projections

Inflation trends and central bank policies will continue to influence the GBP/USD pair. Traders should remain vigilant for any updates from the BoE and Fed that could prompt significant shifts in market sentiment.

Takeaway

The GBP/USD pair is consolidating after a slight rise driven by the latest UK CPI data. Although inflation has decreased, it remains above expectations, reducing the likelihood of a June rate cut by the BoE. As traders await the release of the FOMC minutes, the GBP/USD pair is expected to navigate between the support of strong UK economic data and the potential headwinds from US monetary policy updates.

Forex traders, market watchers, and financial analysts should keep a close eye on these developments, as they will likely influence trading strategies and market dynamics in the coming days.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.