GBPUSD Eyes Recovery Post-Stagnant UK Retail Sales. In the wake of the latest retail sales figures from the United Kingdom, the GBPUSD has shown signs of resilience, bouncing back towards 1.2450 during early trading hours in Europe on Friday.

This comes after the pair slightly dipped to test the 1.2400 mark, reacting to retail sales data for March 2024, which indicated a stagnation in volumes. This recovery in the forex market aligns with an uptick in risk sentiment globally, amidst speculations of missile strikes by Israel on Iran.

Table of Contents

ToggleMarch 2024 UK Retail Sales Overview

The Office for National Statistics (ONS) reported a flat growth in retail sales volumes at 0.0% for March 2024, maintaining the equilibrium observed in February 2024, which also saw a revised increase of 0.1%. Notably, the report showcased a mixed scenario within the retail sector; automotive fuel and non-food stores witnessed an uptick in sales volumes by 3.2% and 0.5% respectively. However, this growth was counterbalanced by declines in food stores and non-store retailers, which dropped by 0.7% and 1.5%.

On a quarterly basis, the data painted a brighter picture, illustrating a 1.9% increase in sales volumes for the three months leading to March 2024, as compared to the preceding quarter. Year-over-year, volumes rose by 0.8% up to March 2024, although they still languish 1.2% below the levels seen prior to the COVID-19 pandemic in February 2020.

Market Impact and Predictions

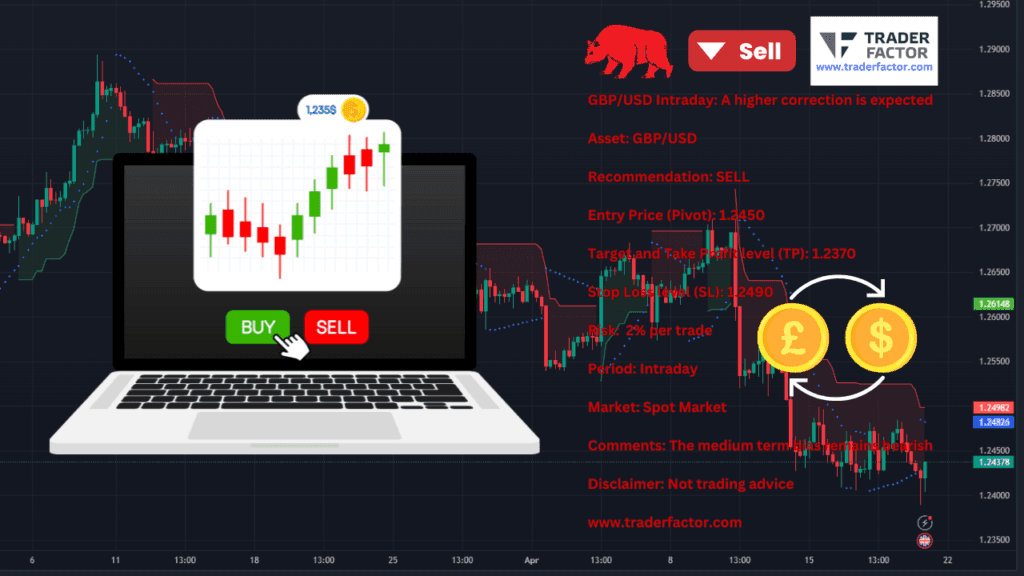

Following the release of the retail sales data, the GBP/USD pairing found its footing, showcasing a recovery trend towards 1.2450. The pair’s resilience can be attributed partly to recovering risk sentiment in the global financial markets, with traders closely monitoring geopolitical tensions between Israel and Iran.

Looking ahead, the intraday outlook for GBP/USD suggests a possible higher correction. However, the underlying medium-term bias remains bearish, prompting a recommendation to sell at the pivot level of 1.2450. Traders are advised to target a take-profit level at 1.2370 and set a stop loss at 1.2490, maintaining a risk management strategy of 2% per trade.

Industry Expert Insights

Market analysts speculate that the stagnation observed in the UK’s March retail sales volumes mirrors broader economic stagnation but also points to sectoral shifts within the economy. The mixed performance across different retail sectors underscores the uneven recovery post-pandemic, with consumer behavior and spending patterns undergoing significant changes.

Furthermore, geopolitical tensions and their potential impact on global markets are keeping traders on their toes. The cautious optimism seen in GBP/USD’s recovery could be short-lived if these tensions escalate, influencing investor sentiment and market dynamics.

While the flat growth in the UK’s retail sales for March 2024 has introduced some volatility in the GBP/USD pair, the resilience displayed in early European trading on Friday signals a cautious optimism among traders. However, with the medium-term outlook still tilting towards bearish, investors and traders alike will need to stay vigilant, keeping an eye on global geopolitical developments and their potential impacts on financial markets.

Crude Oil (WTI) Support Found at $80.74

In the latest market analysis, a key support level for Crude Oil (WTI) have been identified at $80.74, signaling a potential buying opportunity. The recommendation stands at a “BUY” position, with an entry price (pivot) set at $80.74 and target levels at $87.00 for potential take-profit opportunities.

A stop-loss level is advised at $79.14 to manage risk effectively, with a conservative risk of 1% per trade. This intraday outlook pertains to the spot market, where the trend suggests that declines in prices are consistently attracting interested buyers, reflecting a bullish sentiment in the market.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.