Gold price today shattered previous records, surging past the critical $4,200 mark and notching a new all-time high. The dramatic advance comes amid a wave of heightened economic uncertainty and intensifying geopolitical tensions, fueling a rush into safe-haven assets. Market analysts suggest the rally may continue as investors closely monitor the market. Without a doubt, the current gold price is capturing investors attention as it surges to unprecedented levels.

Table of Contents

ToggleTechnical Analysis

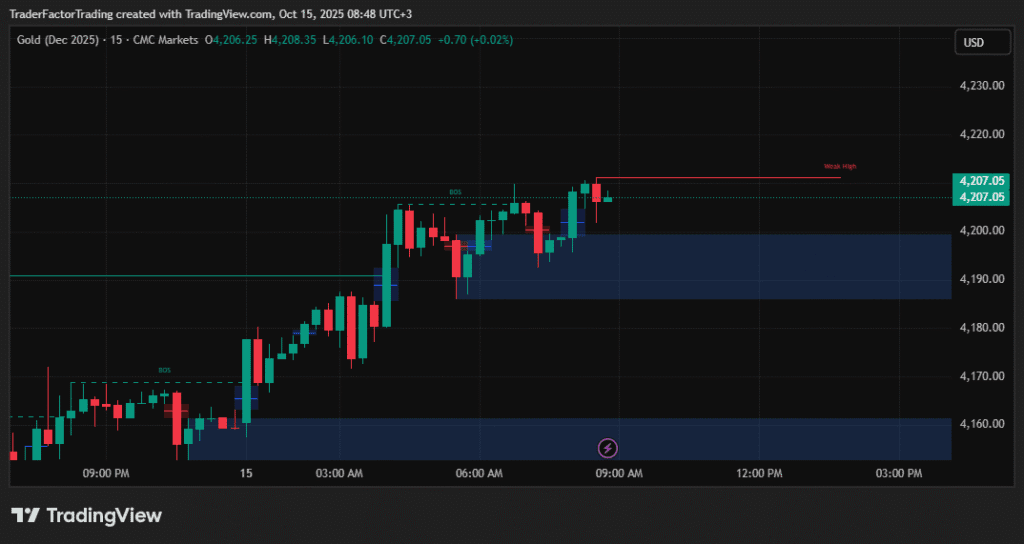

The technical indicators for the gold spot price align with the bullish fundamental picture. The price action on the gold price chart suggests strong upward momentum, and traders are looking for confirmation to enter new long positions.

- 🚀 Outlook: Further Advance!

- 📈 Target: $4,235

- 📍 Pivot: $4,135

- 💡 Strategy: The prevailing strategy is to go long on gold as long as it holds above the pivot point of $4,135. A sustained move above this level could clear the path toward the target of $4,235.

- Alternative Scenario: A break below $4,135 could trigger a technical sell-off, with a potential slide toward the next support level at $4,090.

A critical indicator supporting this bullish outlook is the Relative Strength Index (RSI). The RSI is signaling a new upleg, which indicates that strong buying pressure is driving the price action and that the upward trend has room to run before becoming exhausted.

Gold Price Today Record-Breaking Surge Above $4,200

Gold has officially entered uncharted territory. The spot price for 1 ounce of gold soared past the $4,200 mark, continuing a powerful bullish trend. Many analysts are now adjusting their gold price prediction models, with some foreseeing a push beyond the $4,235 level soon. This remarkable performance underscores gold’s enduring appeal as a store of value.

Investors who monitor the live gold price chart have witnessed a steady and aggressive climb. The momentum reflects growing confidence in the metal as a primary hedge against widespread uncertainty. The key question now is not if, but when, the next psychological barrier will be broken.

Why is the Price of Gold Rising? Key Drivers Explained

Several powerful forces are working together to propel the price of gold upward. Understanding these factors is crucial for anyone following XAU/USD news or considering an investment.

Dovish Stance from the Federal Reserve

Recent comments from Federal Reserve Chair Jerome Powell have been a significant catalyst. Powell hinted at emerging weakness in the labor market, which the market has interpreted as a strong signal that further monetary easing is on the horizon. These remarks have solidified expectations for more interest rate cuts.

Currently, traders have almost fully priced in a 25-basis-point rate cut for October. Furthermore, according to the CME FedWatch Tool, there is a 90% probability of another cut in December. Lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

A Weaker US Dollar

The prospect of lower interest rates has put considerable pressure on the US dollar. As the dollar weakens, gold, which is priced in USD, becomes cheaper for investors holding other currencies. This inverse relationship between the US dollar spot price and gold is a classic driver of demand for the precious metal. The current downtrend in the dollar is providing substantial support for the current gold price rally.

Mounting Geopolitical Tensions

A turbulent global political landscape is a primary reason for the flight to safety. Escalating trade disputes between the US and China, including new tariff threats and retaliatory measures, have unsettled markets. Former President Trump’s aggressive stance on trade has reignited fears of a prolonged economic conflict between the world’s two largest economies, pushing investors toward safe-haven assets.

Adding to the anxiety is the ongoing conflict in Ukraine. The potential for further escalation and its broader economic fallout keeps geopolitical risk at the forefront of investors’ minds. In times of instability, gold has historically been the asset of choice for preserving wealth.

Economic Uncertainty and Safe-Haven Demand

Beyond specific geopolitical flashpoints, a general sense of global economic uncertainty is fueling safe-haven demand. In the United States, a prolonged government shutdown is raising concerns about its impact on economic performance and growth. This domestic issue, combined with international trade worries and dovish central bank policies, creates an environment where investors are actively seeking to de-risk their portfolios. Gold serves as a reliable anchor during such volatile periods.

What’s Next for the Gold Price Per Ounce?

The outlook for the current gold price remains highly positive. The convergence of dovish central bank policy, a weaker US dollar, persistent geopolitical risks, and strong safe-haven demand has created a powerful tailwind for the precious metal.

While short-term pullbacks are always possible, especially given the rapid ascent, the underlying fundamentals suggest that any dips may be viewed as buying opportunities by traders. All eyes are now on the $4,200 level as the next major milestone. As long as the current market conditions persist, gold’s record-setting rally looks set to continue. Investors should continue to monitor XAU/USD news and Federal Reserve communications closely for any changes that could influence the gold price forecast.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.