Gold price today is experiencing a remarkable rally, breaking through the critical $3,850 per ounce threshold in a powerful display of market strength. This gold price surge is not an isolated event; it’s fueled by economic uncertainty, expectations of Federal Reserve rate cuts, and heightened geopolitical risks. For investors tracking gold investment opportunities, understanding these forces is essential for making informed safe-haven asset decisions.

In this post, we’ll unpack the primary catalysts behind the gold rally, analyze the impact of a potential U.S. government shutdown, discuss the growing anticipation of Federal Reserve rate cuts, and examine recent Middle East tensions following the Trump-Netanyahu meeting. We’ll also look at technical analysis indicators, such as the bullish RSI and analysts’ price targets, to offer actionable gold investment insights.

Table of Contents

ToggleEconomic Storm Clouds Gather: The Shutdown Threat

One of the main reasons for the ongoing gold rally is the rising concern over a potential U.S. government shutdown. As the October 1st deadline approaches, investors are seeking safe-haven assets to protect their portfolios from domestic political chaos. Gold’s reputation as a reliable store of value makes it a go-to choice during times of uncertainty.

A government shutdown typically weakens the U.S. dollar, driving up demand for gold and fueling further price surges. Since gold is priced in dollars, a weaker greenback makes this safe-haven commodity more attractive to international buyers, increasing gold investment opportunities. The resulting shift away from stocks towards gold amplifies the current gold rally.

The Federal Reserve’s Pivot: Rate Cut Expectations Fuel Gold Price Surge

Another significant trigger for the gold price surge is shifting sentiment around the Federal Reserve’s policy. With the market now pricing in an 88% chance of a rate cut at the next Fed meeting in October, investors are turning to gold as lower interest rates reduce the opportunity cost of holding non-yielding safe-haven assets like gold.

Recent PCE (Personal Consumption Expenditures) inflation data reinforces the belief that the Fed has room to move toward more accommodative policies. Lower yields on bonds and cash make gold investment opportunities increasingly appealing, boosting the current gold rally further. A dovish Fed is historically bullish for gold prices.

Geopolitical Tensions Enhance Gold’s Safe-Haven Appeal

Political risk is a tried-and-true driver of gold rallies, and current Middle East tensions are magnifying gold’s safe-haven asset status. The latest meeting between U.S. President Trump and Israeli Prime Minister Netanyahu, and the announcement of a 20-point peace proposal for Gaza, highlights ongoing uncertainties.

While peace proposals are significant, the lack of agreement from Hamas leaves the region’s future uncertain, and investors are hedging against the risk of renewed conflict. Such geopolitical instability amplifies gold price surges as more investors seek gold as a safe-haven asset. Recent events have further reinforced gold’s enduring value in global portfolios.

Gold Price Today Surge Supported by Bullish Signals

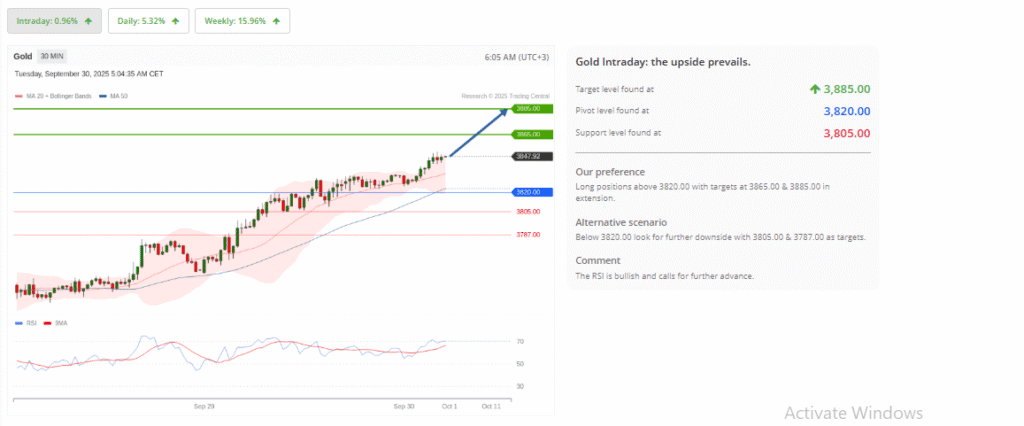

Alongside fundamental factors, technical indicators validate the ongoing gold rally. The price action has been strongly bullish, supported by favorable momentum and key metrics.

The Relative Strength Index (RSI) remains in bullish territory, signaling that buyers dominate and indicating continued upward momentum in this gold price surge. Analysts are now targeting resistance at $3,880, forecasting the possibility of a further rally toward $3,900 and beyond.

Strategic Gold Investment Opportunities: Buy the Dip

Technical analysis suggests that this is an opportune moment for gold investment. Periodic price corrections in a strong uptrend present prime buying opportunities for investors to add exposure to gold as a safe-haven asset. As long as economic and geopolitical uncertainties persist, buyers can capitalize on each dip, supporting gold’s upward trajectory.

Gold’s Safe-Haven Asset Role Shines Bright

This gold rally is a textbook case for why gold is considered the ultimate safe-haven asset. The confluence of a potential U.S. government shutdown, Fed rate cut expectations, and growing geopolitical uncertainty has positioned gold as a crucial component in diversified portfolios. Technical indicators and bullish analyst forecasts reinforce the positive outlook for gold investment opportunities.

Whether you’re protecting wealth from market volatility or seeking to benefit from the current gold price surge, now is the time to recognize gold’s enduring power as a safe-haven asset. Staying attuned to economic and geopolitical drivers can help investors make the most of this ongoing gold rally.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.