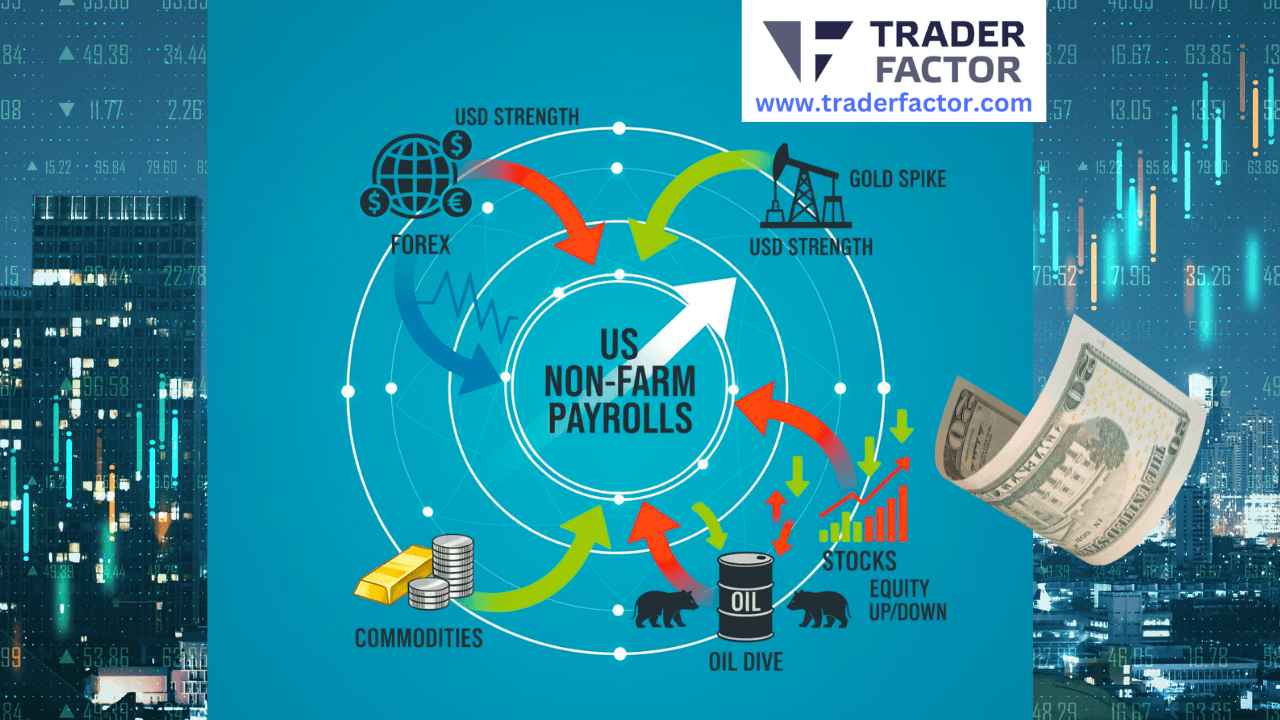

Financial markets around the globe are pausing in anticipation of the upcoming United States NFP report. This critical economic release is scheduled for Friday and serves as a primary indicator of the health of the American economy. Investors and analysts use this data to gauge potential shifts in monetary policy from the Federal Reserve.

With the previous month showing a modest increase of 50,000 jobs, the current consensus estimate points to a slight improvement of 66,000 new positions. This specific data point often triggers significant price movements across various asset classes, making it a focal point for traders managing portfolios in currencies, commodities, and equities this week.

Table of Contents

ToggleImpact on Currency Markets

US Dollar Strength and Volatility

The currency markets are particularly sensitive to labor data because employment trends directly influence interest rate decisions. When job growth is stronger than expected, it typically supports the value of the US Dollar against other major currencies. Traders often buy the dollar in these scenarios because a strong economy suggests the Federal Reserve might keep interest rates steady or raise them to control inflation.

Conversely, if the report shows fewer than 66,000 new jobs, the dollar could weaken significantly. Investors might move their capital into other currencies like the Euro or Japanese Yen, anticipating that the central bank will need to lower rates to stimulate economic growth. This dynamic creates opportunities and risks for those trading major currency pairs during the release.

Commodities and Energy Sector Outlook

Gold as a Safe Haven

Gold prices usually react strongly to employment data because the metal is priced in dollars and does not pay interest to its owners. If the jobs report is strong, it often boosts the dollar and treasury yields, which makes gold less attractive to hold compared to interest-bearing assets. As a result, prices for the precious metal could fall if the NFP figure beats expectations. However, if the job numbers are disappointing, it signals economic weakness. In this environment, investors often flock to gold as a safe store of value, potentially driving prices higher. Traders monitor these shifts closely because gold is often used as a hedge against economic instability and currency devaluation.

Crude Oil Demand Signals

Oil markets also look to the payroll report for clues about future energy consumption in the world’s largest economy. A robust labor market typically means more people are commuting and businesses are active, which translates to higher demand for gasoline and other fuel products. Therefore, a figure above 66,000 could provide support for crude oil prices, suggesting the economy remains resilient despite global headwinds. On the other hand, weak hiring data raises concerns that economic activity is slowing down. If businesses are not hiring, they may also be cutting back on energy usage. This negative sentiment can push oil prices down as traders adjust their forecasts for future demand.

Equity Market Reactions

Stock Indices and Sector Performance

The stock market often has a complex relationship with good economic news, depending on the current inflation environment. Generally, strong job growth is positive for corporate earnings because it implies consumers have money to spend. Sectors like banking and industrial manufacturing tend to perform well when the economy is adding jobs at a healthy pace. However, if the number is too high, it might worry investors that the economy is overheating, which could lead to tighter financial conditions. Conversely, a report that misses the 66,000 target might cause an initial sell-off due to growth fears. Yet, it could also lead to a rally if investors believe it will force the Federal Reserve to adopt a more supportive, easy-money policy stance that benefits high-growth technology stocks.

Conclusion

The upcoming Non-Farm Payrolls report stands as a defining moment for market direction in the short term. Whether the final number exceeds or falls short of the 66,000 forecast, volatility is expected across forex, commodities, and equities. Market participants remain vigilant, ready to adjust their strategies based on the fresh economic signals provided by the labor data.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.