This week, the financial markets brace for a series of pivotal events with potential sweeping effects on currency and precious metals markets. From central bank decisions to crucial economic data releases, traders are advised to stay vigilant. Here’s what you need to know:

| Date | Event | Expected Impact |

| Tuesday | RBA Rate Decision, Global PMIs | AUD, GBP, CAD |

| Wednesday | US 10-year Treasury Bond Auction | Gold, USD |

| Thursday | BoE Rate Decision, US 30-year Bond Auction, US Unemployment Claims | GBP, Gold, USD |

| Friday | UK GDP m/m, Canada Employment Report, US UoM Consumer Sentiment | GBP, CAD, USD |

Table of Contents

ToggleTuesday’s Spotlight: RBA Rate Decision

RBA’s Key Policy Rate Announcement

On Tuesday, all eyes turn to the Reserve Bank of Australia (RBA) as it announces its latest policy decision. Analysts widely anticipate the RBA to maintain the cash rate at 4.35%, a stance it has upheld for the last four meetings.

Despite previous expectations of rate cuts, a surprising resilience in inflation figures and a tight labor market have shifted conversations towards prolonged high rates or even potential hikes.

Given the robust inflation at 3.6%, exceeding forecasts and pressing against the RBA’s target range, the central bank could adopt a more hawkish tone than anticipated.

This development might bolster the Australian Dollar (AUD), especially against the US Dollar (USD), which has shown weakness following disappointing US data. Traders holding AUD/USD positions should prepare for potential volatility amid these proceedings.

AUDUSD CHART

Global PMIs

Further influencing market dynamics on Tuesday are the release of the Construction PMI from Britain and the Ivey PMI from Canada. These indicators, reflective of economic health in their respective sectors, could sway the GBP and CAD significantly. A stronger-than-expected showing in either metric may fortify the associated currency, presenting traders with opportunities in pairs like GBPUSD and USDCAD.

Wednesday’s Economic Indicator: U.S. Treasury Bond Auction

The U.S. will conduct its 10-year Treasury bond auction on Wednesday, a key event for precious metal investors, particularly gold traders. The auction results often influence bond yields, inversely affecting gold prices.

A retreat in yields could extend gold’s bullish momentum, providing a lucrative window for XAU/USD traders. On the flip side, escalating geopolitical tensions or dovish remarks from Fed officials could also amplify gold’s appeal as a safe haven.

XAUUSD CHART

Thursday’s Central Bank Focus: Bank of England

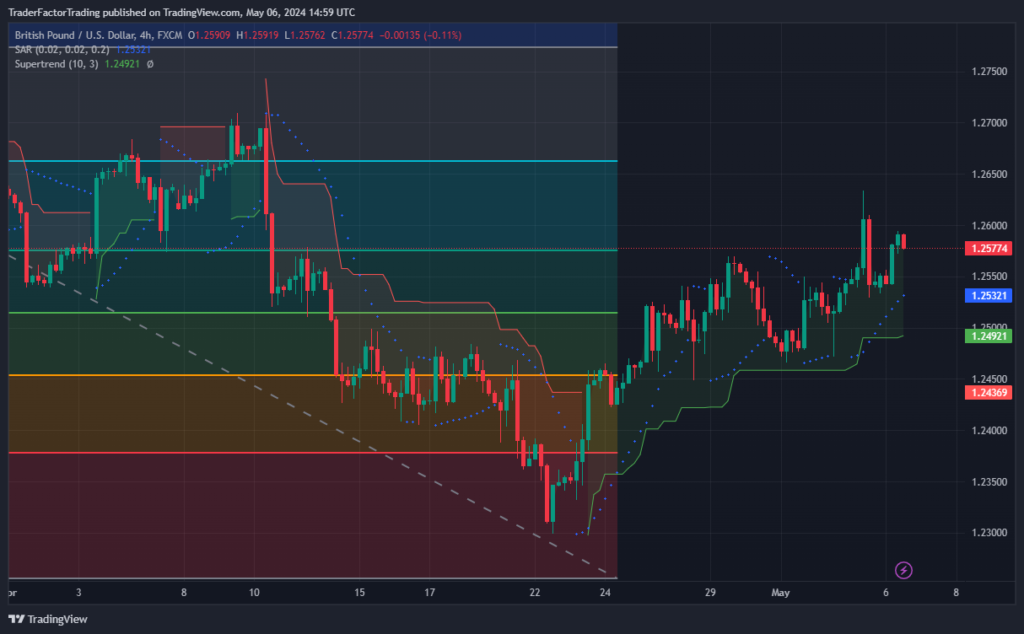

On Thursday, the Bank of England (BoE) is slated to release its monetary policy report alongside its interest rate decision. While rates are expected to hold at 5.25%, the monetary policy report is anticipated to shed light on the UK’s economic outlook and inflation trajectory. Traders should monitor any hints regarding future rate cuts, as this could significantly impact the GBP and its crosses, notably GBPUSD.

GBPUSD CHART

In addition, the U.S. will hold its 30-year bond auction, and initial unemployment claims data will be released, offering further insights into the health of the U.S. economy. These events could sway the dollar, affecting a broad range of currency pairs and commodities priced in USD.

Friday’s Economic Data: GDP and Employment Reports

Wrapping up the week, Friday features several high-impact releases, including the UK’s GDP month-over-month figures, which could provide directional cues for the GBP. Canada’s employment report for April will give an update on the labor market’s status, potentially influencing the CAD.

CADUSD CHART

Lastly, the USA’s Preliminary University of Michigan Consumer Sentiment Report will offer clues about consumer confidence, a key driver of economic activity, affecting the dollar’s strength.

Conclusion

This week’s financial landscape is dotted with significant events that could herald volatility across currency and precious metals markets. Traders are advised to exercise caution, stay informed, and leverage these key moments to position themselves advantageously. With a careful strategy and a keen eye on central bank policies and economic indicators, opportunities abound for the astute trader.