Global financial markets are displaying cautious sentiment as traders prepare for today’s CPI data and await the impact of the latest inflation report. Yesterday’s PPI report delivered mixed results, leaving many investors searching for stronger direction. Equities are currently recording slim gains across major indexes this week, with focus on the Nasdaq Composite, Dow Jones Industrial Average, and S&P 500. The US dollar has managed to remain steady, as shown by the US Dollar Index, reflecting an uncertain outlook. Commodities, especially gold, continue to hover near their recent record highs. Attention is focused on the upcoming inflation print, as it will likely have a significant effect on central bank decisions.

Table of Contents

ToggleEquities Show Tentative Optimism

Investors in global stock markets are moving with extra caution this session. They are carefully weighing new inflation data and today’s CPI release against the outlook for economic growth. The overall mood remains watchful and defensive as traders await further clarity from this crucial inflation report.

Detailed US Indices Performance

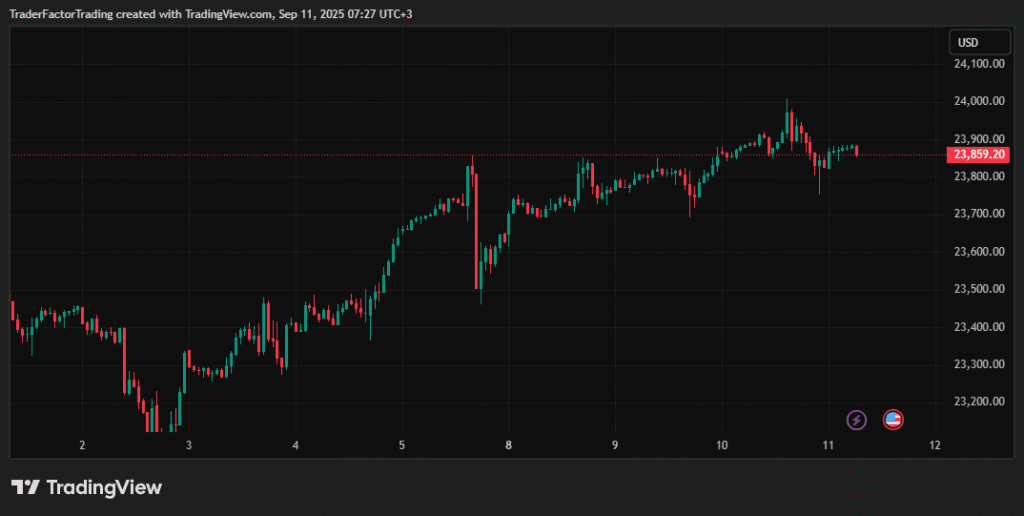

US stock indices ended the previous session higher but lacked robust conviction, as investors looked ahead to today’s CPI data. The S&P 500 gained 0.30% to close at 6,532.03, while the Nasdaq Composite advanced by 0.04% and settled at 23,849.27. The Dow Jones Industrial Average rose by 0.27% to end at 38,922.32.

These results reflect slight optimism, likely tempered by macroeconomic uncertainty and cautious positioning prior to the latest inflation report. Trading remained focused on technology and consumer discretionary sectors, with names like Nvidia and Tesla leading advances.

Tech Sector and Market Leaders

Tech stocks once again provided key support for the overall equity market, contributing to positive Nasdaq Composite and S&P 500 performances. Nvidia and Tesla both delivered strong results, helping to push major indices higher. Continued enthusiasm for artificial intelligence and next-generation technologies has kept investor interest in this sector elevated.

Other leading performers included companies in the software and semiconductor spaces. Despite these gains, most institutional traders kept risk exposure modest ahead of the much-anticipated CPI data release.

European and Asian Markets Diverge

In Europe and Asia, markets registered mixed performances reflecting different regional factors and responses to US inflation data. Japan’s Nikkei 225 climbed 1.17%, primarily due to strength in tech-related shares and expectations about US Federal Reserve rate policy following the inflation report. Meanwhile, European equities were less clear during the session.

Germany’s DAX index dropped by 0.36% amid lingering concerns about economic growth and monetary tightening. The UK FTSE 100 also fell back, losing 0.19% by the close.

Forex and Commodities in Focus Ahead of CPI News Today

Currency and commodity markets are also showing notable reactions to inflation expectations and the upcoming US CPI data. The trajectory of the US Dollar Index has become a closely watched signal for global investors. Meanwhile, gold prices continue to attract strong interest due to ongoing risk concerns and inflation hedging.

Performance of Major Currency Pairs

The US Dollar Index, or DXY, remained generally steady during the recent session as traders absorbed the latest inflation report. It recorded a minor gain of just 0.04%, closing at 97.843. EUR/USD traded near 1.1694, with the euro under slight pressure ahead of both US and ECB decisions and in anticipation of the CPI data. GBP/USD hovered around the 1.3530 level, supported by stable sentiment in UK markets.

AUD/USD hit a ten-month high, trading at 0.6627, as risk appetite improved amid positive Australian economic updates. USD/JPY closed at 147.47, reflecting ongoing demand for the dollar versus the yen. USD/CAD advanced to 1.3865, with gains in the US dollar fueled by mixed Canadian data releases and fluctuating oil prices.

Drivers of Currency Movements

Recent moves in key currency pairs such as EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD have mostly reflected risk positioning and hedging activity ahead of the latest CPI data and inflation report. Markets anticipate that a higher-than-expected inflation reading will bolster the US dollar further, likely pressuring the euro and yen lower while disrupting carry trades.

Meanwhile, upbeat commodity prices and steady global risk appetite continue to provide the Australian and Canadian dollars with a measure of support. Currency traders remain alert to headline inflation numbers and central bank commentary, as these factors will drive volatility, currency trends, and cross-border capital flows.

Gold Holds Near Record Highs

Gold prices have continued to trade near their all-time highs in recent days, making the precious metal a focal point for those tracking inflation risk. The latest session saw gold close around $3,669 per ounce. Several important factors are supporting gold’s current price strength. Heightened geopolitical tensions in the Middle East have increased demand for safe-haven assets, reinforcing gold’s position.

Ongoing inflation concerns, reflected in strong PPI data and nervously awaited CPI data, have also driven more investors toward hedging with gold. Many large investors are utilizing gold to maintain portfolio protection, as gold prices often respond positively to higher inflation readings. Its future trajectory remains closely tied to the outcome of the next US inflation report. If inflation comes in high, gold prices could see another significant upward push as investors seek security.

Bitcoin and Cryptocurrency Market

Bitcoin performance remains in focus for digital asset traders, as cryptocurrency markets respond to shifting expectations around US inflation data and central bank policy. Bitcoin was last seen trading at $114,266, posting a modest gain of 0.24% on the session. The performance came as cryptocurrencies reacted to changing inflation expectations and increased institutional participation following the PPI and ahead of the CPI.

Ethereum also saw an increase, trading up 1.18% at $4,401.5. Across digital assets, sentiment remains mixed, as traders assess whether inflows to crypto markets can sustain recent advances as the latest CPI data is released. Volatility in Bitcoin and other top cryptocurrencies remains elevated with traders on alert for outsized price swings following the inflation report’s publication.

Conclusion

The global markets are now clearly in a holding pattern, as traders and investors await new inflation signals from today’s CPI data and the broader US inflation report. Today’s data is likely to play a key role in shaping future central bank decisions and global trading sentiment. Recent equity gains are modest while the US dollar index trades stable, gold prices remain resilient, and Bitcoin performance stays closely watched. Increased volatility is expected across major asset classes following the release of this highly anticipated inflation data.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.