The Nasdaq Composite and the S&P 500 recently experienced pullbacks from their record highs. The Nasdaq saw a significant downturn, declining nearly 0.8%, primarily influenced by losses in major tech stocks such as Nvidia, which dropped over 3%. Similarly, the S&P 500, after briefly achieving the 5,500 mark, concluded the session down by 0.3%. These pullbacks reflect growing market trepidations about overvaluations in the tech sector and heightened sensitivity to dynamic economic indicators. Various factors such as fluctuating jobless claims and housing sector challenges contribute to the market’s current cautious stance. In the forex market, Friday concludes the trading week with a series of PMI releases from Europe and the U.S.

Table of Contents

ToggleMarket Performance Overview

How did the major market indices perform on June 20, 2024, amidst mixed economic signals? On this day, the financial markets displayed a complex response to conflicting economic data, resulting in divergent performances among the key indices. The Dow Jones Industrial Average experienced a positive surge, climbing approximately 0.7%, which translated to a robust gain of about 300 points. This uptick in the Dow was attributed primarily to strong performances in the energy sector, where stocks rose over 2%, buoyed by rising oil prices and positive investor sentiment towards energy commodities.

In contrast, the Nasdaq Composite, which had been on a streak of reaching new highs, reversed its course and closed down almost 0.8%. This downturn was influenced by a broader retreat in tech stocks, which faced sell-offs despite broader market gains. Meanwhile, the S&P 500 briefly touched the 5,500 mark but retreated to close down 0.3%, reflecting a mix of investor caution and sector-specific pressures.

The mixed performances were indicative of the market’s sensitivity to real-time economic signals, ranging from energy prices to tech sector dynamics, highlighting the nuanced investor landscape in mid-2024.

Tech Sector Downturn

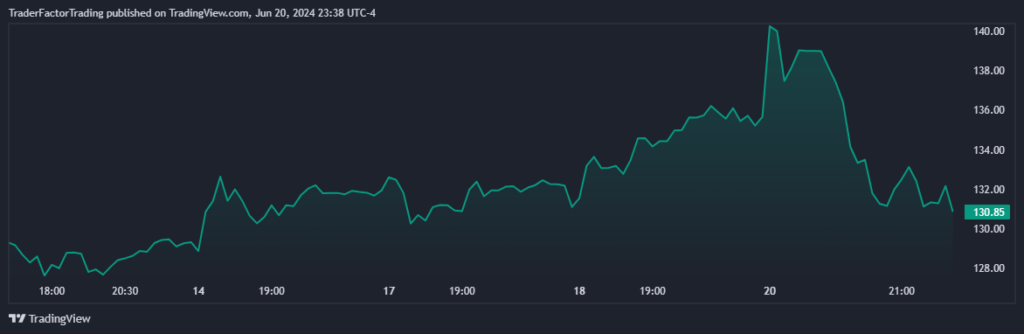

The tech sector experienced a notable downturn, primarily driven by substantial losses in major chip stocks such as Nvidia, Broadcom, and Qualcomm. These prominent semiconductor companies, essential to various technology applications from consumer electronics to data centers, saw their stock prices tumble, with Nvidia leading the losses by dropping over 3%. This decline markedly contributed to the overall pullback of the Nasdaq Composite, which deviated from its recent streak of record highs.

Nvidia Stock 5-day Chart

Chipmaker Nvidia has ascended to become the globe’s most valuable company after its share price soared to unprecedented heights on Tuesday.

Valued at a staggering $3.34 trillion (£2.63 trillion), Nvidia’s stock has nearly doubled in value since the beginning of the year. Closing the day at almost $136 per share, up 3.5%, it now surpasses Microsoft in market worth, having already eclipsed Apple earlier this month.

The intense rivalry among AI developers is palpable, with tech titans like Microsoft, Alphabet (Google’s parent company), Meta, and Apple fiercely vying to innovate a groundbreaking product. This competitive landscape has greatly benefited Nvidia, which, aside from crafting its own AI technology, commands a significant portion of the AI chip market.

Most Valuable Stocks

| Rank | Company | Market Capitalization (USD) |

|---|---|---|

| 1 | Nvidia | 3.34 trillion |

| 2 | Microsoft | 3.32 trillion |

| 3 | Apple | 3.29 trillion |

| 4 | Alphabet | 2.17 trillion |

| 5 | Amazon | 1.90 trillion |

| 6 | Saudi Aramco | 1.79 trillion |

| 7 | Meta | 1.27 trillion |

| 8 | Berkshire Hathaway Inc. | 880.94 billion |

| 9 | Eli Lilly | 847.25 billion |

| 10 | Broadcom | 839.05 billion |

Economic Data Insights

Recent economic data reveal a mixed landscape, with weekly jobless claims declining yet remaining above market expectations. This suggests a labor market that is critical, yet resilient, pointing to underlying complexities in the economic recovery. The number of Americans filing new claims for unemployment benefits dropped last week, but the figures were still higher than analysts had anticipated, indicating potential volatility in job markets.

Further complicating the economic outlook, housing starts have hit a four-year low, underscoring the challenges in the residential construction sector. A significant downturn in construction activity highlights broader economic pressure points, including rising material costs and higher mortgage rates, which have climbed to around 7%. This uptick in rates is dampening buyer enthusiasm and could be a precursor to a broader slowdown in the housing market.

Additionally, the manufacturing sector is showing signs of strain. Preliminary reports suggest a contraction in manufacturing activity, with new orders and production levels tapering off. This sector’s significance is often a signal of future economic trends. Market participants are keenly awaiting more detailed reports, such as S&P Global’s upcoming Manufacturing and Services Purchasing Managers Indexes, to gauge the broader economic impact and adjust their strategies accordingly.

Key Stock Movements

Amid the backdrop of mixed economic signals and market volatility, key stock movements have underscored investor sentiment and strategic shifts in portfolio management. Significantly, the tech sector experienced significant fluctuations, with Nvidia (NVDA) losing more than 3% of its value. This drop is part of a broader decline in chip stocks, including Broadcom (AVGO), Qualcomm (QCOM), and Micron (MU), which collectively dampened the market’s performance.

Conversely, certain players in the tech industry saw noteworthy gains. Dell (DELL) and Super Micro Computer (SMCI) enjoyed a rise in their share prices, driven by burgeoning demand for xAI hardware, indicating a strategic pivot towards advanced AI technologies within the sector. This shift not only highlights the dynamic nature of tech investments but also suggests an increasing focus on specialized high-performance computing solutions.

Moreover, despite the general downturn in tech, Nvidia achieved a milestone by becoming the world’s most valuable public company, reflecting its significant market influence and robust growth prospects in AI and gaming. These developments paint a complex picture of the tech landscape, where sector-specific factors and broader economic indicators are in constant interplay, shaping investor strategies and market outcomes.

Energy Sector Update

Oil prices and energy stocks have experienced notable gains, reflecting a pivotal demand and geopolitical influences on the market. West Texas Intermediate (WTI) and Brent crude have witnessed an uptick, with prices buoyed by a blend of supply constraints and escalating global tensions that have stoked fears of potential disruptions in oil supply routes. This surge has directly impacted energy stocks, propelling the S&P 500 Energy Select Sector ETF (XLE) upwards by more than 2%.

Investors are closely monitoring the developments, as the energy sector‘s performance often serves as a barometer for broader economic health. The rise in oil prices is not merely a reflection of current geopolitical tensions but also of the ongoing recovery in global demand post-pandemic. This demand recovery is particularly evident in industries such as aviation and manufacturing, which are heavily reliant on energy.

Furthermore, U.S. shale producers are cautiously ramping up output, maintaining a delicate balance between supply and demand to avoid flooding the market. This strategic production management has helped stabilize prices to some extent, although the market remains sensitive to news that could sway this equilibrium. As we move forward, the energy sector’s adaptability to these complex dynamics will be pivotal in maintaining its growth trajectory amidst fluctuating market conditions.

Streaming Industry Changes

The streaming industry is undergoing significant changes, with major platforms like Amazon, Netflix, and Disney introducing ad-supported tiers to their services. This shift marks a significant transformation in the subscription-based revenue model that these companies have traditionally relied upon. The introduction of ad tiers comes in response to a more price-sensitive consumer base and the increasing competition in the streaming market. These tiers allow users to access content at a lower monthly cost, albeit with advertisements interspersed throughout the viewing experience.

This change also reflects a broader trend in digital content consumption, where flexibility and affordability increasingly dictate market dynamics. The ad-supported options not only cater to varied consumer preferences but also open up new revenue streams for these platforms. For instance, while they reduce the monthly subscription fee, they simultaneously provide a valuable new channel for targeted advertising, which can be highly lucrative.

Moreover, the strategic adjustment is indicative of the industry’s response to a maturing market where growth through new subscriptions becomes harder. By integrating ads, streaming giants aim to maintain their subscriber base, attract a broader audience, and boost profitability in a competitive landscape. This evolution in their business models will likely influence content creation and distribution strategies moving forward.

Forex Market Update

Friday concludes the trading week with a series of crucial economic releases. In the UK, the focus will be on the retail sales report, which could significantly impact the GBP. Over in the Eurozone, traders will pay close attention to the Flash Manufacturing PMI and Flash Services PMI for early indications of economic performance, potentially influencing the Euro.

In the United States, three major reports—Existing Home Sales, Flash Manufacturing PMI, and Flash Services PMI—will offer new perspectives on the country’s economic health, likely affecting the USD. Additionally, Canada’s Retail Sales report will be closely watched for its potential effects on the CAD.

Read this next: PrimeXBT Exchange Review

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.