OANDA’s Prop Trader program stands out due to its strategic challenges tailored for different levels of trading expertise, offering profit splits up to 90%. Traders can choose from the Classic or Boost challenges, each with thorough evaluation phases focusing on skill and discipline. The program boasts competitive spreads, high leverage options, and fast market executions that appeal to serious traders. Additionally, OANDA provides various withdrawal and payment methods, and its association with the reputable OANDA brand adds an extra layer of trust. With such a detailed trading environment, one might find deeper insights into their trading strategies and possibly enhance their trading portfolio.

Table of Contents

ToggleOANDA Prop Trader Program Overview

The OANDA Prop Trader program offers a strong platform for emerging and experienced traders alike, ranking 3rd out of 20 top prop firms with a score of 90 out of 100. It provides two main challenge options: the Classic and Boost, each tailored to different levels of trading expertise. Furthermore, OANDA imposes specific trading restrictions to maintain consistency and risk management across all its accounts. These include limits on trading styles and strategies that could otherwise expose the firm to excessive risk. Such structured environments not only help in preserving financial integrity but also in nurturing trader development within a controlled framework.

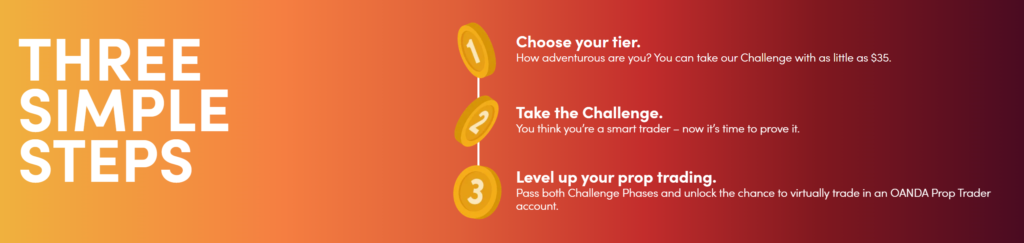

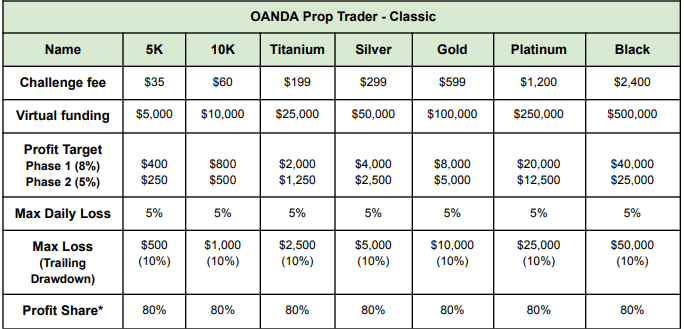

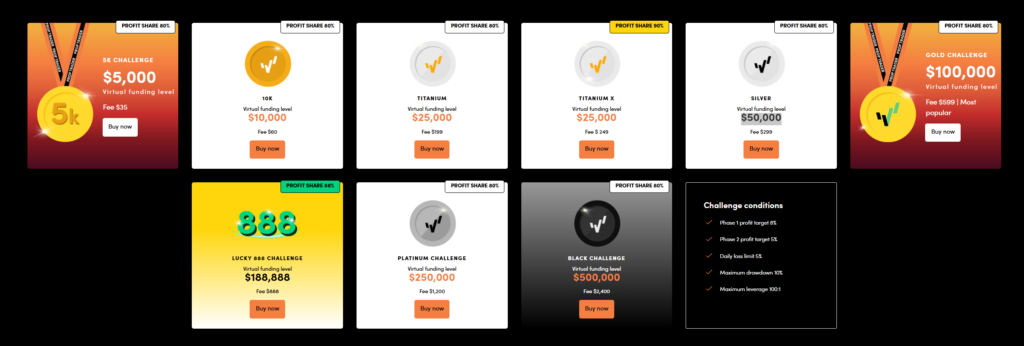

OANDA Prop Trader Challenges

OANDA Prop Trader provides a comprehensive and engaging range of challenges tailored to meet various trading ambitions and budgets. These challenges not only test traders’ skills but also offer lucrative opportunities to earn substantial profit shares. Here, we detail each challenge to help you make an informed choice.

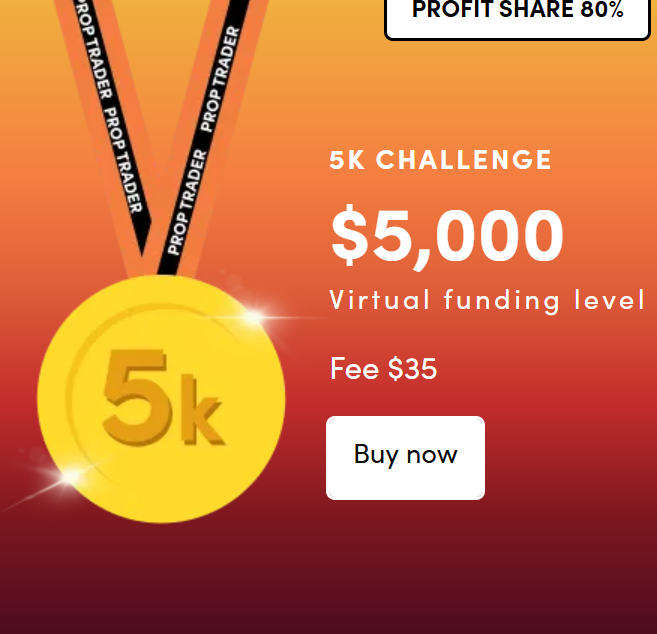

5K Challenge

The 5K Challenge is perfect for beginners or those looking to dip their toes into prop trading. With a modest entry fee of $35, participants receive $5,000 in virtual funds. This challenge offers an 80% profit share, making it an attractive start for those new to the trading world. The objectives are straightforward, with traders needing to achieve an 8% profit target in Phase 1 and a 5% target in Phase 2.

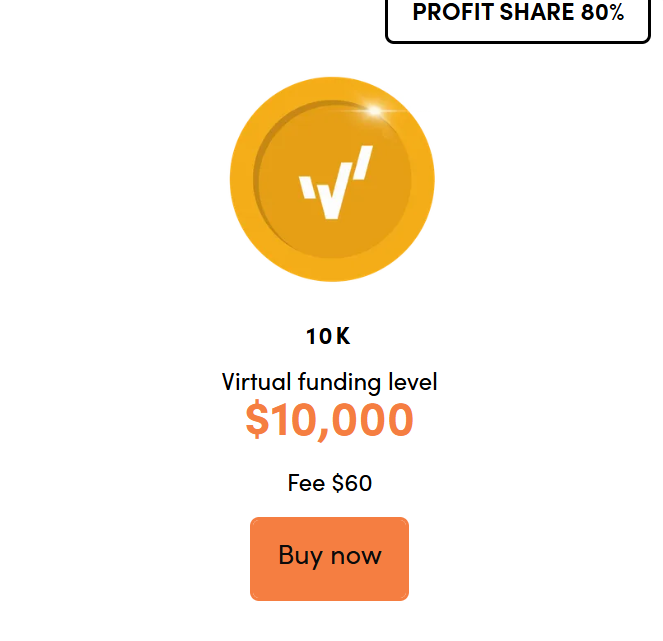

10K Challenge

For a slightly larger virtual fund, the 10K Challenge provides $10,000 for a $60 fee. Similar to the 5K Challenge, it offers an 80% profit share and follows the same phase objectives and risk parameters. This challenge is ideal for those ready to take on a bit more commitment and responsibility in their trading journey.

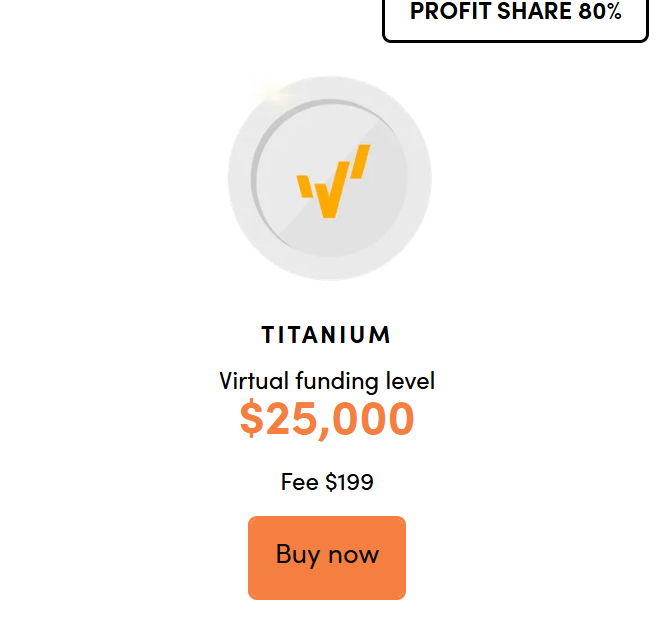

Titanium Challenge

The Titanium Challenge steps up the game with $25,000 in virtual funds, available for a $199 fee. Maintaining the 80% profit share, this challenge is suitable for traders who are confident in their strategies and ready to tackle higher stakes. The challenge structure remains the same, with two phases and set profit targets.

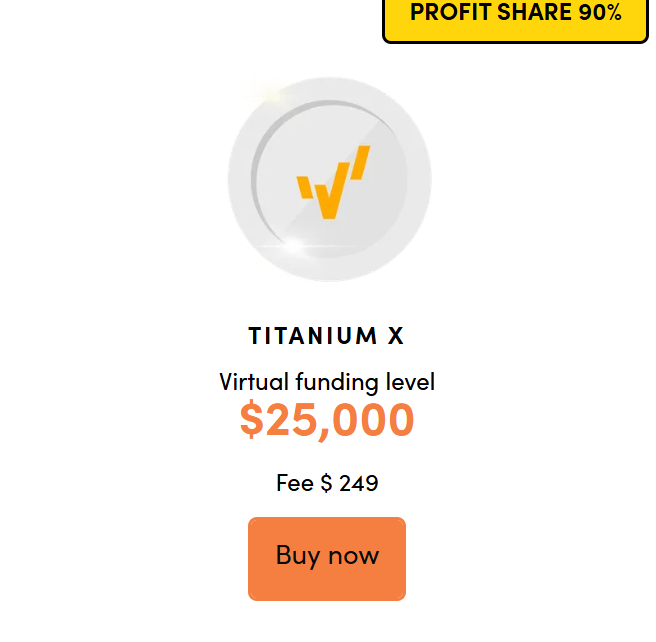

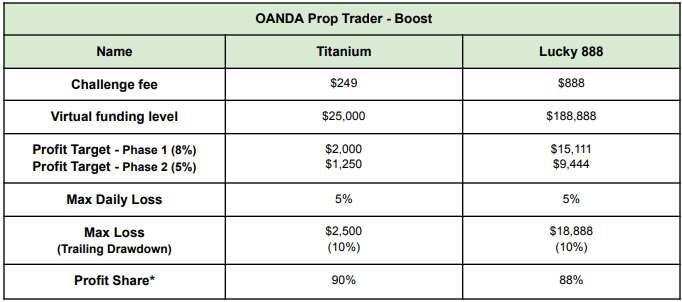

Titanium X Challenge

The Titanium X Challenge offers an enhanced opportunity with a 90% profit share for a $249 fee. Participants still trade with $25,000 in virtual funds, but the increased profit share makes this challenge particularly enticing for ambitious traders aiming for higher returns.

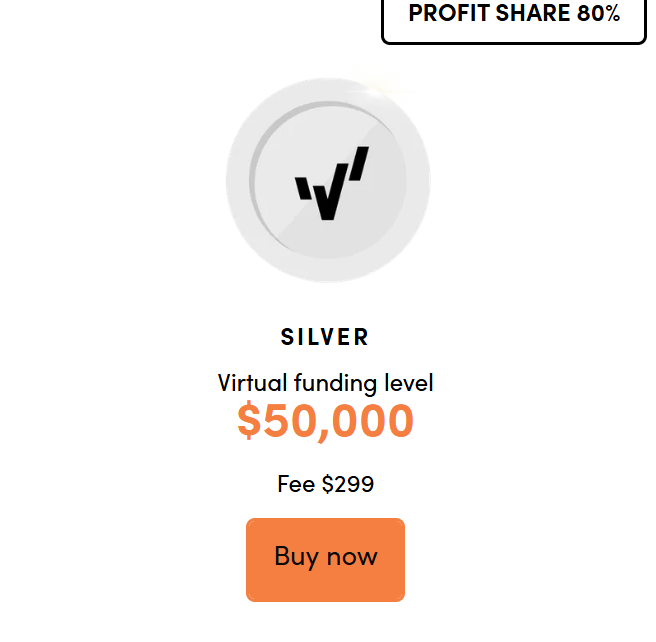

Silver Challenge

With a virtual fund level of $50,000 and a $299 entry fee, the Silver Challenge is designed for traders looking to manage larger capital. The profit share remains 80%, providing a balanced mix of risk and reward for mid-level traders.

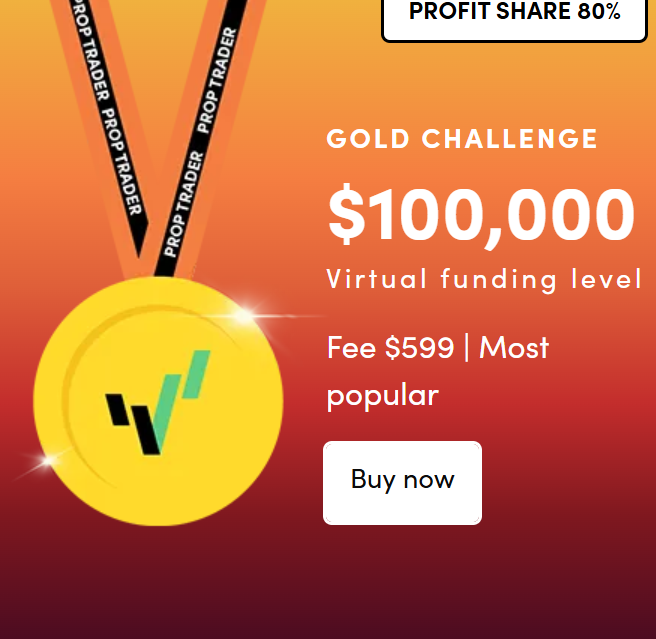

Gold Challenge

The Gold Challenge, being the most popular, offers $100,000 in virtual funds for a $599 fee. This challenge appeals to seasoned traders due to its significant capital and lucrative profit opportunities. With an 80% profit share, it provides a solid platform for those aiming to enhance their trading strategies further.

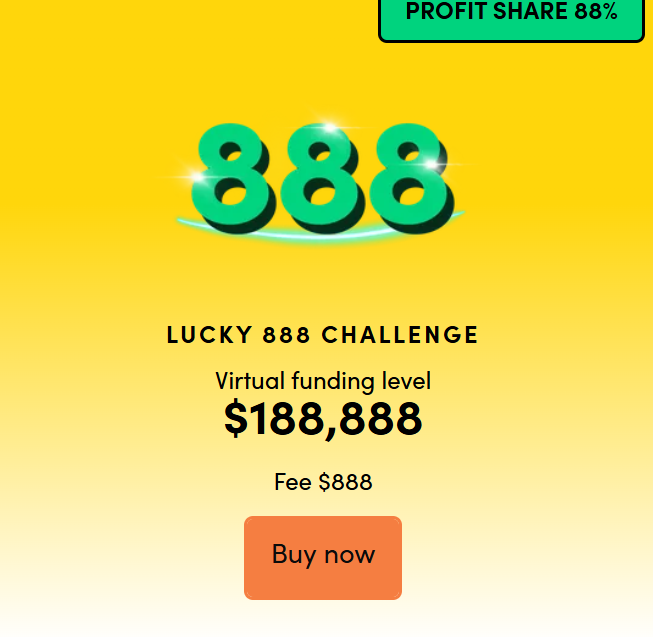

Lucky 888 Challenge

This unique challenge offers $188,888 in virtual funds for an $888 fee, with an 88% profit share. The Lucky 888 Challenge is ideal for traders who enjoy competitive environments and are ready to leverage their expertise for potentially high rewards.

Platinum Challenge

The Platinum Challenge offers $250,000 in virtual funds, accessible for a $1,200 fee. It’s tailored for traders who are ready to manage substantial virtual capital and benefit from the consistent 80% profit share on offer.

Black Challenge

The Black Challenge is the pinnacle of OANDA’s offerings, providing $500,000 in virtual funds for a $2,400 fee. This challenge is crafted for the most experienced traders looking to maximize their trading potential and earn significant profits with an 80% profit share.

Benefits of Participating in OANDA Challenges

Engaging in OANDA Prop Trader Challenges presents multiple benefits:

- With opportunities to earn up to a 90% profit share, these challenges offer financial incentives aligned with traders’ ambitions.

- Participants can experiment and refine their strategies with virtual funds, minimizing financial risks while optimizing learning.

- Access to a wide array of CFDs, including FX, commodities, precious metals, and indices, allows for diversified trading tactics.

Take the Challenge

OANDA Prop Trader Challenges offer an exciting avenue for traders to test and enhance their trading capabilities. With a variety of challenges suited to different levels of experience and financial objectives, OANDA provides a platform for significant growth and success in the trading arena. Embrace the challenge and unlock your trading potential with OANDA today. Choose your challenge and start your journey towards financial empowerment and strategic mastery.

OANDA Prop Trader Trading Conditions

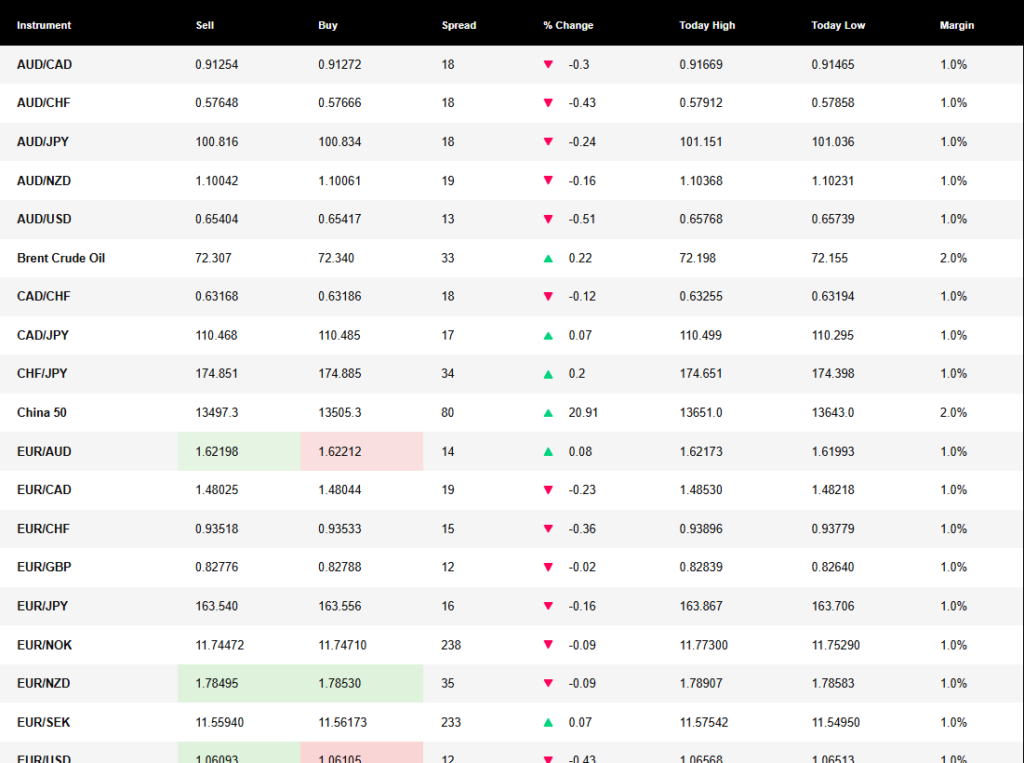

Why consider OANDA Prop Trader’s trading conditions? When evaluating trading platforms, the specifics of trading conditions such as spread analysis, leverage impact, and market execution are essential. OANDA Prop Trader offers competitive spreads that can significantly affect profitability. They’ve managed to streamline their spread costs, guaranteeing traders get the best possible rates, particularly on major currency pairs and metals trading.

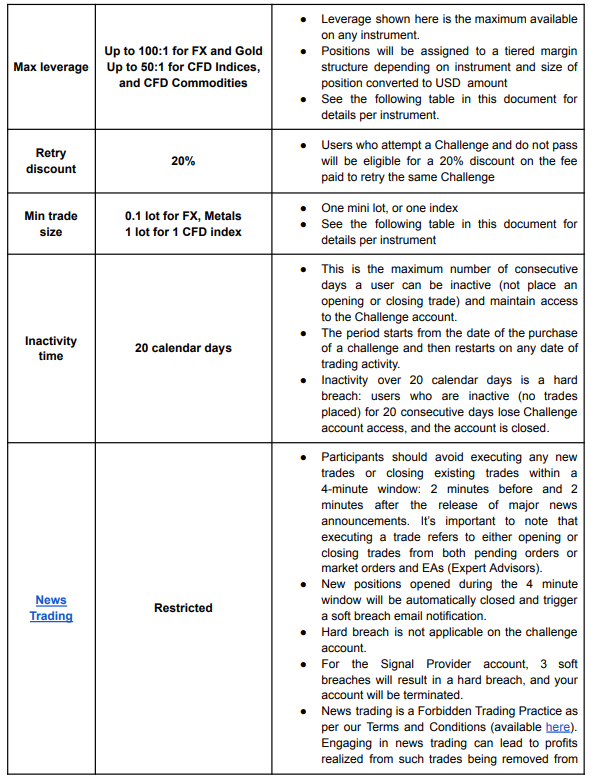

Leverage is a powerful tool in trading, and OANDA Prop Trader understands its impact. They offer up to 100:1 leverage on forex, which can amplify both gains and losses. This level of leverage makes it attractive for traders looking to maximize their trading potential but requires a sound risk management strategy.

Furthermore, OANDA excels in market execution. Traders benefit from rapid execution speeds that prevent slippage and guarantee that trades are executed at the best possible prices. This is particularly crucial during volatile market periods.

They also provide a robust selection of trading instruments. With access to a wide variety of currency pairs and the inclusion of metals trading, traders can diversify their portfolios, spreading risk and increasing potential return avenues. This combination of favorable trading conditions makes OANDA Prop Trader a compelling choice for serious traders.

OANDA Prop Trader Payment Processes

OANDA Prop Trader simplifies the payment process, enabling traders to choose from a variety of methods including credit cards, Apple Pay, Google Pay, and cryptocurrencies. This flexibility guarantees that traders can fund their accounts and access their earnings with ease. The firm’s robust payment security measures guard personal and financial information, providing peace of mind to users.

Profit payouts are particularly prompt, with funds being disbursed every 14 days. Traders benefit from a high profit share, ranging from 80% to 90%, depending on the challenge program they participate in. This generous profit sharing is part of OANDA’s incentive programs, designed to reward successful trading strategies and encourage long-term collaboration.

Withdrawal options are versatile, including methods like bank transfer, Neteller, Skrill, or direct transfers to an OANDA brokerage account. The minimum withdrawal amount is set at $200, making it accessible for traders to retrieve their earnings. These streamlined processes and clear guidelines guarantee that traders can focus on their trading activities without worrying about accessing their funds. OANDA’s commitment to efficient and secure payment processes makes it a preferred choice for prop traders globally.

OANDA Prop Trader Customer Support

Building on its dedication to trader satisfaction, OANDA Prop Trader guarantees exceptional customer support. The firm offers 24/5 availability, ensuring that traders can access assistance whenever the markets are open. Whether it’s a technical query or a trading strategy discussion, support is just a click away through the live chat feature directly on their platform.

Additionally, email support complements the live interaction, providing a more detailed response option for complex issues or feedback submissions. This affirms that every trader’s concern is addressed with the thoroughness it deserves. OANDA’s commitment extends to social media engagement, where they actively respond to queries and participate in trader discussions. This modern approach not only enhances accessibility but also builds a supportive trading community.

Moreover, OANDA Prop Trader enriches its customer support with a host of educational tools available through OANDA Labs. These tools are designed to assist traders in refining their strategies and understanding market dynamics. The educational resources, combined with reliable customer support, equip traders with the knowledge and help they need to navigate the trading world efficiently.

OANDA Prop Trader Trust and Community

The reputation of the OANDA Prop Trader program rests solidly on its association with the well-established OANDA brand, known for its robust financial services and regulatory adherence. This foundation contributes significantly to the program’s trust ratings and online reputation, which are critical in the prop trading community.

To better understand the program’s standing, consider these points:

- OANDA’s Prop Trader maintains a strong TrustPilot score of 4.1 from over 800 reviews, highlighting satisfaction and reliability.

- While direct engagement is limited, the firm’s active social media presence facilitates ongoing conversations and support among traders.

- Channels like Twitter and Facebook serve as platforms for updates and trader interactions, enhancing transparency and trust.

- Feedback from users often praises the program’s adherence to clarity in trading conditions and the competitive nature of its challenges, though some express desires for more direct community activities.

OANDA Prop Trader Funding Options

Regarding funding options, OANDA Prop Trader offers a range of opportunities tailored to various trader needs and experience levels. They’ve demonstrated a visible commitment to funding flexibility, allowing traders to choose from account sizes ranging from $10k to a substantial $500k. This wide selection caters to both novices and seasoned traders, ensuring everyone finds a comfortable starting point.

OANDA’s profit sharing is competitively rewarding, with rates up to 90% depending on the selected challenge. This high potential return reflects their confidence in their traders’ abilities and the robustness of the platforms provided. However, it’s essential to mention that while the maximum allocation reaches up to $500k, this is contingent on a trader’s ability to successfully navigate through the program’s stringent evaluation phases.

Despite these opportunities, funding challenges remain. Newcomers might find the absence of smaller funding options below $5k overwhelming, potentially excluding those looking to start with minimal risk. Additionally, the lack of an active scaling plan for increasing funding without re-entering challenges could be seen as a limitation for traders aiming to expand their capital efficiently.

These aspects suggest areas where OANDA could further enhance their funding structure to accommodate a broader array of trader aspirations.

OANDA Prop Trader Asset Availability

Although OANDA Prop Trader offers a variety of trading assets, their selection is primarily limited to Forex pairs, indices, and commodities. This specialization allows the platform to focus on providing enhanced features and educational tools that cater to traders interested in these markets. The emphasis on Forex and commodities particularly aligns with the profit potential and risk management strategies important for these volatile markets.

For traders, here are the key highlights of asset availability at OANDA Prop Trader:

- Despite the focus on Forex, indices, and commodities, the platform maintains a diverse range of options within these categories, offering multiple forex pairs and essential commodities like gold and oil.

- Users access these assets through MetaTrader 5, known for its robustness and user-friendly interface, enhancing the trading experience and accessibility.

- OANDA provides substantial educational support focusing on the available assets, which helps in strategizing and understanding market dynamics.

- The platform’s tools and features support effective risk management, which is important for maximizing profit potential in the inherently risky Forex and commodities markets.

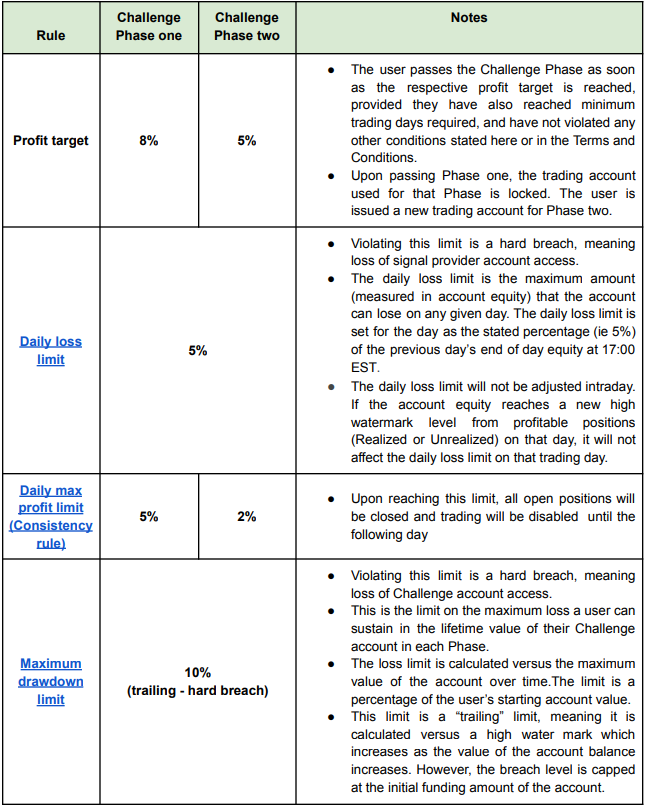

OANDA Prop Trader Trading Rules

OANDA Prop Trader enforces specific trading rules designed to maintain market integrity and protect the interests of its traders. These rules focus on risk management through daily limits and drawdown control to make sure that trading activities remain sustainable and profitable. Traders are required to adhere to a maximum daily loss limit, which caps the allowable loss to 5% of the account equity per day. This limit is essential for preventing significant losses that could jeopardize both the trader and the firm.

Furthermore, OANDA implements a trailing drawdown mechanism that restricts the maximum allowable drawdown to 10% of the account equity. This drawdown control helps in preserving capital and encouraging careful trading strategies. Profit targets are also set, with traders needing to achieve specific earnings milestones before advancing to higher levels or receiving payouts. This guarantees that only skilled and consistent traders progress within the program.

Trade restrictions are another key aspect, particularly around major news events where market volatility can lead to rapid losses. By imposing these trade restrictions, OANDA minimizes risks associated with sudden market movements, thereby fostering a more controlled trading environment. These combined rules form a thorough framework that supports both trader success and firm stability.

See full Prop Trader Challenge Rules and Trading Conditions here.

OANDA Prop Trader Fee Structure

Understanding the fee structure is as crucial as the trading rules when participating in the OANDA Prop Trader program. OANDA’s fees are designed to accommodate different levels of traders, from beginners to seasoned professionals, with various account sizes and trading strategies. The fee comparison with other proprietary trading firms shows that OANDA’s fees might be on the higher side, but the potential profit sharing of up to 90% balances this out.

Here’s a breakdown of the key elements of the fee structure:

- Traders can start with as little as $35, scaling up to $500,000 for higher-tier challenges.

- OANDA offers a competitive profit share range from 80% to 90%, depending on the challenge and account performance.

- Commissions are included in the spread costs, which vary by account type and market conditions, ensuring transparency in every transaction.

- Traders can withdraw their profits every 14 days using methods like bank transfer, Neteller, or Skrill, with a minimum withdrawal amount set at $200.

OANDA Prop Trader Educational Resources

Educational resources play a pivotal role in the OANDA Prop Trader program, equipping participants with the necessary skills to navigate complex markets effectively. They’ve designed an array of educational tools to enhance traders’ understanding and proficiency.

One standout feature is their interactive tutorials. These are not just basic guides; they’re immersive experiences that allow traders to learn by doing, which is essential for retaining complex information such as trading strategies and market analysis. The tutorials cover everything from the basics of Forex trading to advanced technical analysis, making sure that all participants, regardless of their experience level, can enhance their trading skills.

OANDA also emphasizes the importance of risk management through their educational content. They provide detailed insights into how to manage trading risks, which is critical for long-term success in trading. This is complemented by extensive resources on technical analysis, helping traders make informed decisions based on historical data and market trends.

Frequently Asked Questions

Is OANDA Prop Trader legit?

Yes, OANDA Prop Trader is legitimate. It is part of OANDA, a reputable and fully regulated trading platform with over 25 years of industry experience, holding regulatory licenses in multiple jurisdictions.

Does OANDA offer prop trading?

Yes, OANDA offers proprietary trading through its OANDA Prop Trader program, providing traders with opportunities to trade with virtual funds and earn a profit share.

What is the profit split on OANDA Prop Trader?

The profit split on OANDA Prop Trader can be as high as 90%, depending on the specific challenge undertaken by the trader.

What is the leverage for OANDA prop trader?

OANDA Prop Trader offers a maximum leverage of 100:1 across all its challenges, allowing traders to potentially amplify their trading positions.

How much money do you need to start trading with OANDA Prop Trader?

To start trading with OANDA Prop Trader, participants need as little as $35 for the entry fee of the 5K Challenge, which provides $5,000 in virtual funds.

How much do prop traders make?

The earnings of prop traders vary widely based on the profit share and trading success, with the potential to earn a significant portion of profits, up to 90% in some cases.

OANDA Prop firm Challenge

The OANDA Prop Firm Challenge involves traders completing two phases with specific profit targets, using virtual funds ranging from $5,000 to $500,000, and aims to test and refine their trading strategies.

What is the most trusted prop firm?

The most trusted proprietary trading firms are those that are well-established, fully regulated, and have a transparent track record. They often provide clear terms and conditions and have positive reviews from traders who have successfully used their services.

How to check legit prop firms?

To verify a prop firm’s legitimacy, check for regulatory licenses, transparency in their terms and conditions, and positive testimonials from other traders. It is also helpful to research their history and reputation within the trading community.

Do prop firms really pay?

Yes, legitimate prop firms pay traders their share of profits as agreed upon in the terms of their contracts. It’s crucial to work with firms that have a proven track record of timely and reliable payments.

What are the risks of prop firms?

Risks associated with prop firms include the potential for financial loss if trading strategies are unsuccessful and the possibility of dealing with fraudulent or unregulated companies. Additionally, traders may face high pressure to meet specific performance targets.

How much does it cost to join a prop firm?

The cost to join a prop firm varies widely depending on the firm’s requirements and the trading capital offered, with fees ranging from a few dozen to several thousand dollars. It’s essential to understand what these fees cover before committing.

What prop firm pays out the fastest?

While specific payout speeds can vary, firms that offer transparent withdrawal processes and have a history of efficient payouts are generally preferred by traders. It’s advisable to read reviews and verify their payment policies.

What happens if you lose money in a prop firm?

If you lose money while trading with a prop firm, the loss is typically deducted from your account balance or the firm’s capital allocation, depending on the agreement. Some firms may have specific rules regarding how losses impact your standing with them.

Which prop firm accepts EA?

Many prop firms accept the use of Expert Advisors (EAs) as long as they comply with the firm’s trading rules and do not exploit system vulnerabilities. It’s important to confirm this with the firm before beginning to trade.

What is the prop firm EA strategy?

A prop firm EA strategy involves using automated trading systems to analyze and execute trades based on predefined rules and algorithms. These strategies aim to optimize trading decisions and manage risk effectively.

How hard is it to pass a prop firm challenge?

Passing a prop firm challenge can be challenging, as it requires meeting specific profit targets and adhering to risk management rules within a limited timeframe. Success often depends on a trader’s skill, strategy, and discipline.

What is the most profitable EA?

The most profitable EA varies depending on market conditions and individual trading styles. It is important to test and adapt different EAs to find one that aligns with your objectives and risk tolerance.

How many people pass the prop challenge?

The pass rate for prop firm challenges can be low, as they are designed to test a trader’s skill and discipline rigorously. Precise statistics vary, but successful traders often have well-prepared strategies and strong risk management.

What happens if you fail a prop firm challenge?

If you fail a prop firm challenge, you typically forfeit your entry fee and may need to pay again if you wish to retry. Some firms offer discounted retake options or feedback to help improve performance.

How to win prop firm competition?

Winning a prop firm competition involves a combination of a solid trading strategy, effective risk management, and adaptability to changing market conditions. Continuous learning and practice are also key factors in achieving success.

Which is the best EA to pass prop firm challenge free?

The best free EA to pass a prop firm challenge depends on its compatibility with the firm’s rules and the trader’s strategy. It is advisable to test different EAs on demo accounts to determine which one suits your trading style and objectives best.

Conclusion

OANDA Prop Trader stands out in the proprietary trading world with its well-structured challenges and appealing profit shares up to 90%. It offers a perfect blend of competitive conditions and educational tools, supporting traders through every step. The platform’s transparent fee structure and reliable payment processes enhance its trustworthiness. Whether you’re starting out or scaling up, OANDA provides a robust trading environment that caters to diverse needs, making it a top choice for serious traders.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.