When searching for the best futures prop firms, you’ll want to take into account their reputation, variety of trading instruments, and the thoroughness of their risk management strategies. Top firms like FundedNext, FTMO, Topstep Trading, and DreamTicks offer inclusive trading environments that enforce strict risk guidelines while providing substantial profit-sharing models. They present diverse market access, supporting various trading strategies and educational tools to enhance your skills. Additionally, firms like Jane Street excel in quantitative and high-frequency trading, offering competitive profit splits and advanced trading platforms. Exploring more about these firms can equip you to make a well-informed decision tailored to your trading style.

Evaluating Top Futures Prop Firms

When evaluating top futures prop firms, it’s important to consider their reputation, trading conditions, and the range of instruments they offer. You’ll want to carefully assess how these firms handle risk evaluation. It’s vital that they provide clear guidelines and tools to help you manage your trades effectively. Don’t overlook the importance of profit sharing; understanding the firm’s policies on how profits are split can greatly impact your potential earnings.

You should also take into account market diversity. A firm that offers a wide range of instruments, including commodities, forex, and indices, provides you with the flexibility to diversify your trading strategies. This can help mitigate risks and enhance your trading opportunities.

Another key factor is the trading platforms offered by the firm. Make sure they’re user-friendly and support the analytical tools you rely on. This can greatly influence your ability to execute trades swiftly and effectively.

Lastly, consider the account sizes available. Whether you’re a seasoned trader or just starting out, the firm should offer account options that suit your trading style and financial capacity. This flexibility is crucial for scaling your trading operations as your experience and confidence grow.

Table of Contents

ToggleOverview of FundedNext Proprietary Trading Firm

FundedNext is a forex proprietary trading firm based in Ajman, UAE, that stands out for providing substantial trading capital and profit-sharing opportunities. With funding options that scale from $5,000 to $200,000 and the potential to secure up to $4 million based on performance, FundedNext caters to a wide range of traders. The firm’s profit share can go as high as 90%, making it highly attractive for profitable and strategic traders.

Funding and Profit Sharing

FundedNext rewards traders not just for their profitability but also for their risk management skills. With profit shares reaching up to 90% and the ability to manage accounts worth millions, this firm provides a lucrative opportunity for traders who can meet its performance milestones. The various account types offered are tailored to different levels of trader experience and risk tolerance, ensuring that both novice and seasoned traders can find a suitable platform.

Global Reach and Market Access

Operating in over 195 countries, FundedNext emphasizes geographical expansion to tap into diverse markets and leverage local financial nuances. This global presence ensures that traders worldwide can access FundedNext’s platforms and services, benefitting from its stringent adherence to regulatory compliance and transparency.

Trading Instruments and Platforms

FundedNext offers a broad spectrum of trading instruments, including Forex, indices, metals, commodities, and cryptocurrencies. The firm supports popular trading platforms like MetaTrader 4 and 5, which are well-regarded for their robust features and user-friendly interfaces. This compatibility enables traders to utilize familiar tools for their trading activities.

Educational Support and Customer Service

FundedNext is committed to enhancing trader skills and knowledge through comprehensive educational resources, including trading courses, real-time assistance, and strategic advice. Their customer support services are designed to respond promptly and provide high-quality assistance, ensuring that traders have the support they need to succeed.

Challenge Models

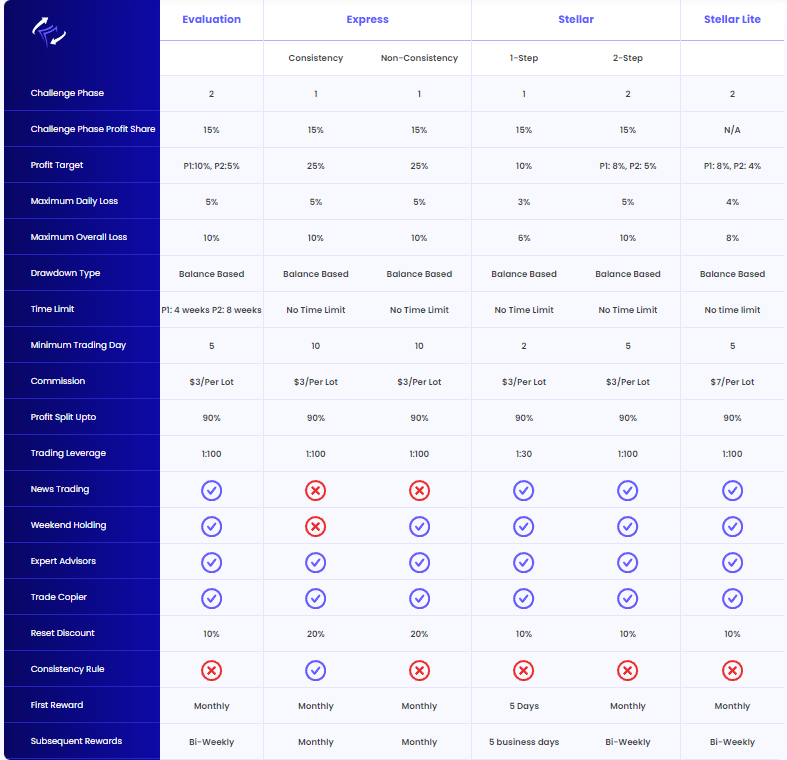

FundedNext offers several challenge models to test and qualify traders under real-market conditions:

- Evaluation Challenge: Assesses traders’ ability to meet profit targets and adhere to loss limits over a set period.

- Express Challenge: Provides a streamlined route to earning up to a 90% profit share by achieving a 25% profit target.

- Stellar Challenge: Includes three models (1-Step, 2-Step, and Lite), each with specific trading restrictions and profit targets, catering to elite traders with higher aspirations.

Pricing and Promotions

The pricing structure at FundedNext ranges from $99 to $999, offering various payment methods including credit cards, bank transfers, and cryptocurrencies. Additionally, the firm enhances trading potential through promotions like a 15% Profit Share and a 100% Reward Refund Bonus, although these are time-sensitive and require specific actions to benefit from them.

FTMO Firm Overview

FTMO stands out as a leading proprietary trading firm, offering traders significant opportunities without risking their own capital. If you’re considering different prop firms, FTMO‘s evaluation process is a critical factor to weigh. You’ll start by trading in a simulated environment, where your ability to adhere to risk management strategies is as important as generating profits. This step guarantees you’re well-prepared before handling real funds.

In any prop firm comparison, FTMO’s commitment to supporting its traders through detailed futures market analysis and access to top-tier trading platforms is notable. The firm provides thorough reviews of different platforms, allowing you to choose one that best fits your trading style. This is especially beneficial if you’re keen on aligning your strategies with the most advanced tools available.

Moreover, FTMO’s approach to risk management is stringent. You’re required to demonstrate not only profitability but also the ability to limit losses, a balance that can define your success in the volatile world of futures trading. This structured framework helps you refine your trading techniques in a controlled, risk-free setting, making FTMO a standout choice in the domain of proprietary trading firms.

Topstep Trading Insights

Exploring Topstep, you’ll find it offers unique advantages for futures traders, including the ability to trade during news events and over weekends. With proprietary insights that explore deeply into market behaviors, you’re equipped to make informed decisions that align with current trends. Topstep’s approach to profit sharing is particularly attractive, allowing you to keep a significant portion of the profits you generate.

Their robust market analysis tools help you stay ahead, providing a clear view of market dynamics and potential opportunities. This is essential for developing effective trading strategies tailored to both high volatility and normal market conditions. Topstep emphasizes strong risk management protocols to safeguard your trading capital. This includes setting precise risk parameters and teaching you how to adhere to these guidelines to minimize losses.

The trading strategies you’ll learn at Topstep are diverse. They prepare you to exploit market inefficiencies through a variety of techniques, from scalping to swing trading. Whether you’re trading commodities or indices, the skills you develop can be applied across different markets, enhancing your trading flexibility and potential for success.

IG Platform Features

The IG platform offers a user-friendly interface, allowing you to navigate and execute trades efficiently. When you’re comparing platforms, you’ll notice that IG stands out with its seamless integration of risk management tools. These features are essential as they help you minimize losses and optimize your trading strategies.

Moreover, IG is packed with educational resources. Whether you’re a novice or an experienced trader, you’ll find valuable insights and learning tools at your disposal. These resources are designed to enhance your trading knowledge and skills, enabling you to make informed decisions.

IG also supports a range of trading strategies, from day trading to long-term investments. This flexibility ensures you can adapt your approach to suit market conditions and your personal trading style. Additionally, their profit sharing model is quite attractive. It’s structured to make sure that you’re rewarded fairly for your trading acumen, encouraging a profitable trading experience.

DreamTicks Trading Options

At DreamTicks, you can trade with a variety of assets, including forex, indices, and commodities, using real capital once you’re funded. This firm offers a robust profit-sharing model that incentivizes you to maximize your trading performance. With DreamTicks, you’re not just trading; you’re also part of a platform that values risk management and rewards your success.

Here’s a quick look at what DreamTicks offers:

| Feature | Details |

|---|---|

| Trading Assets | Forex, indices, commodities |

| Profit Sharing | Competitive rates to maximize your earnings |

| Risk Management | Extensive tools to limit losses |

| Trading Platforms | Access to leading platforms for a seamless experience |

| Educational Resources | In-depth materials to enhance your trading skills |

DreamTicks doesn’t just provide you with capital; they equip you with the tools and resources necessary for a successful trading career. Whether you’re a beginner or an experienced trader, the educational resources available help you refine your strategies and improve your market understanding. Explore a variety of trading platforms that are user-friendly and highly effective, ensuring that you can trade efficiently and effectively.

Jane Street Firm Analysis

Jane Street consistently stands out as a leader in high-frequency and quantitative trading since its founding in 1999. When you’re comparing prop firms, it’s important to delve into what makes Jane Street a heavyweight in the industry. Their risk management strategies are robust, ensuring that high-frequency trading maintains stability and profitability without unnecessary exposure. This careful balance is vital for your success in such a volatile trading environment.

When evaluating their trading platform, you’ll find it’s highly optimized for quantitative strategies, affording you a seamless experience that’s hard to match. This is a major advantage in your Jane Street analysis, as the right tools can greatly enhance your trading efficiency.

Profit split analysis reveals that Jane Street is competitive, though exact figures can vary based on your role and performance within the firm. This tiered approach incentivizes top-tier performance and aligns your interests with those of the firm.

Understanding Futures Prop Trading

To grasp futures prop trading, you need to understand that these firms provide traders with the capital to trade, sharing profits from successful transactions. They manage the risks associated with trading by setting guidelines that both protect and maximize investment capital. This not only safeguards the firm’s assets but also guarantees that you, as a trader, are not exposed to unnecessary financial risks.

Here are some key aspects of futures prop trading:

- Risk Management: Prop firms implement strict risk management protocols to protect both the trader’s and the firm’s investment. This includes setting loss limits and monitoring trades to prevent significant drawdowns.

- Profit Sharing: When you trade successfully, you share the profits with the firm. The typical profit split varies, but you can expect a fair percentage that reflects your contribution and skill level.

- Trading Platforms and Account Sizes: These firms provide access to advanced trading platforms and vary in account sizes. This flexibility allows you to trade with an amount that suits your experience and risk tolerance, using platforms that are equipped with tools to execute complex strategies effectively.

Understanding these elements will help you navigate the world of futures prop trading more effectively, leveraging the resources provided for optimum financial gains.

Types of Trading Firms

Trading firms vary widely, each catering to specific strategies and trader needs. You’ll find that different firms specialize in unique types of strategies, offer various trading platforms, and have differing approaches to risk management and profit sharing. It’s important for you to understand these differences as they directly impact your trading experience and potential success.

Here’s a simplified breakdown of key elements across different types of trading firms:

| Feature | Description |

|---|---|

| Types of Strategies | Some firms focus on high-frequency trading, others might specialize in event-driven strategies. |

| Risk Management | Policies vary; some firms enforce strict risk controls, while others may offer more flexibility. |

| Profit Sharing | Can range significantly; some firms offer a 50/50 split, others might offer up to 90% to traders. |

| Trading Platforms | Availability of platforms like NinjaTrader, MetaTrader varies by firm. |

| Account Sizes | Firms provide accounts of different sizes, influencing the scale at which you can trade. |

You’ll want to keep these factors in mind when looking at different firms. Each element can greatly affect your trading capacity and the growth of your portfolio. Choose wisely based on what aligns best with your trading style and financial goals.

Selecting the Right Firm

When selecting the appropriate firm, it’s imperative you assess their reputation and the quality of their trading platforms to guarantee they meet your specific needs. It’s equally important to take into account how the firm handles risk management strategies and the diversity of asset classes they offer. This ensures you’re not putting all your eggs in one basket and that you’re equipped to handle market fluctuations effectively.

Here are three critical points to take into account when choosing a futures prop firm:

Account Funding Process

- Understand the firm’s account funding process. This includes the initial deposit requirements, funding timelines, and any associated fees. It’s essential that this process is straightforward and transparent to avoid any surprises down the line.

Profit Sharing Models

- Analyze the firm’s profit sharing models. How profits are split between the firm and traders can have a significant impact on your earnings. Look for a model that aligns with your trading style and profit expectations.

Trading Platform Selection and Asset Class Diversity

- Make sure the firm offers a robust trading platform that suits your trading needs. Additionally, check for a wide range of asset classes which allows for diversification of your investments, thereby spreading risk and potentially increasing your chances for profits.

Red Flags in Prop Trading

Why should you be wary of prop trading firms that promise guaranteed high returns? Identifying warning signs in such offers is important for evaluating legitimacy and avoiding pitfalls in your trading career. First off, guaranteed high returns in trading are virtually impossible due to market volatility. Any firm that assures you of high profits is likely stretching the truth, and recognizing this risk will prevent potential losses.

You should also stay informed about the firm’s operational history and transparency. A legitimate firm will have clear, accessible records of their trading history and financial health. Be cautious of firms that lack this transparency or provide vague details about their operations. This could indicate they’re hiding unfavorable outcomes or financial instability.

Furthermore, excessive fees or complicated fee structures are major red flags. Evaluating these costs upfront can save you from entering disadvantageous contracts that erode your profits. Lastly, make sure the firm has a robust support system. Avoid firms that don’t offer timely or knowledgeable support, as this is essential for resolving issues that might arise during trading.

Key Features of Leading Firms

Understanding the pitfalls in prop trading firms equips you to appreciate the key features of leading firms, which include robust risk management practices and transparent profit-sharing models. When you’re sizing up potential firms, here are essential elements you shouldn’t overlook:

- Profit Sharing Models

Top firms offer clear and fair profit sharing models. You’ll find that the most reputable ones provide up to 90% profit returns to their traders after covering initial costs. These models motivate traders as they directly benefit from successful trades.

- Risk Management Strategies

Effective risk management is the backbone of sustained trading success. Leading firms implement thorough risk management strategies, including stop-loss orders and daily loss limits, to safeguard both the trader’s and the firm’s capital.

- Trading Platforms Comparison

It’s essential to work with a firm that provides reliable and versatile trading platforms. Look for those offering comparisons and trials to choose the best fit for your trading style. This feature is pivotal as it affects your trading execution and overall experience.

Before you commit, always review these features to make sure they align with your trading goals and risk tolerance.

Basics of Proprietary Trading

Proprietary trading involves firms using their own capital to trade financial markets for direct gain, rather than trading on behalf of clients. You’ll find that prop firms adopt various trading strategies to maximize returns, incorporating sophisticated market analysis to stay ahead. These strategies are important because they determine how the firm interacts with market dynamics and volatility.

Risk management is another cornerstone of proprietary trading. Effective risk strategies protect the firm’s capital and your potential earnings. You’re not just trading on intuition; you’re leveraging controlled risks that align with thorough market analysis to navigate through unpredictable market movements.

Profit sharing is an enticing aspect of working with a prop firm. Once you’re profitable, a percentage of those profits is yours. This system motivates you to hone your trading skills and align your goals with the firm’s objectives.

Most prop firms provide access to advanced trading platforms. These platforms are the tools you need to execute trades efficiently and analyze markets in real-time. They are essential for applying your trading strategies effectively and for performing robust market analysis.

Understanding these basics helps you appreciate the depth and potential of proprietary trading, ensuring you’re well-prepared to immerse yourself into this dynamic field.

Criteria for Choosing Firms

When selecting a futures prop firm, it’s important to assess their reputation, trading conditions, and the resources they offer to support your trading career. You’ll want a firm that not only enhances your trading capabilities but also aligns with your financial goals and risk tolerance. Here are three key factors to take into account:

Profit Sharing and Account Sizes

- Look for firms that offer favorable profit-sharing terms. Typically, you’d want a higher percentage of the profits to go to you, especially after proving your trading skills. Additionally, consider the account sizes available. Whether you’re a novice or a seasoned trader, the right account size can have a significant impact on your trading strategy and risk management.

Risk Management Policies

- Effective risk management is important in futures trading. Opt for firms that have clear, stringent risk management policies. This includes drawdown limits and rules around trading certain products or during volatile market periods. A firm with robust risk management can help protect your capital and longevity in trading.

Trading Tools and Software

- Make sure the firm provides access to advanced trading platforms that suit your trading style. Whether it’s MetaTrader, NinjaTrader, or any other platform, having the right tools at your disposal can make a big impact on your trading performance.

Benefits of Prop Trading

After considering the practical aspects of choosing a futures prop firm, let’s explore how prop trading can greatly benefit your financial strategies. Prop trading offers you the unique advantage of trading with substantial capital without risking your own money. This setup enhances your ability to manage larger positions and diversify across various asset classes, from commodities to cryptocurrencies, depending on the firm’s offerings.

You’ll benefit from a profit split arrangement, which motivates you to maximize your trading strategies while the firm handles most of the risk management. This symbiosis ensures that both you and the firm aim for high profitability with controlled risks. Moreover, prop firms provide access to advanced trading platforms, allowing you to execute trades at professional speeds and with greater efficiency.

The account sizes vary significantly among firms, giving you the flexibility to start small or go big, depending on your confidence and skill level. Through account funding from the firm, you’re able to leap into trading scenarios that might have been out of reach due to capital limitations. Additionally, these firms often have robust capital management systems in place, ensuring that both the firm and its traders adhere to predefined risk thresholds, safeguarding against potential financial overreach.

Support and Liquidity in Trading

Support and liquidity are essential elements that you’ll find readily available in most top trading firms, ensuring you can execute trades efficiently and without unnecessary delays. These firms employ robust support systems and effective liquidity management strategies that help in risk mitigation and enhance your trading performance. Here’s how they do it:

Support Systems:

- You’ll have access to a dedicated support team that’s available around the clock to address any issues you may encounter. This quick resolution guarantees that your trading activities aren’t hindered by technical difficulties.

Liquidity Management:

- Top prop firms provide high liquidity, which means you can enter and exit trades at competitive prices. This is essential, especially in fast-moving markets, to prevent substantial slippage and to maximize potential profits.

Trading Community and Profit Sharing Models:

- Being part of a trading community allows you to share strategies, get insights, and learn from experienced traders. Additionally, profit sharing models are designed to motivate you by offering a fair share of the profits, aligning the firm’s success with your own.

These features not only support your trading endeavors but also contribute to a more stable and profitable trading experience.

Frequently Asked Questions

Which prop firm pays out the fastest?

The speed of payouts can vary significantly among prop firms, but some of the best futures prop firms are known for their swift payment processes. Top firms like the FTMO prop firm and the Topstep prop firm are often highlighted in discussions for their efficiency in handling withdrawals. For the latest and most comprehensive information, checking a Futures prop firms list can provide insights into firms with the fastest payouts.

Which prop firm is better than FTMO?

Determining which prop firm is better than FTMO depends on individual trading needs and objectives. While FTMO is renowned for its robust platform and support, other firms like the Topstep prop firm and FundedNext prop firm also offer competitive terms and resources. The Top 10 best prop firms Forex list often provides a comparative look at these leading firms.

Does FTMO trade futures?

FTMO primarily focuses on forex, indices, and commodities, but they continually expand their offerings. While they are not traditionally known for futures trading, traders looking for this option might explore Futures prop firms that use TradingView for more specialized services. It’s advisable to check FTMO’s latest updates and offerings to see if futures are now part of their trading instruments.

Which futures account is best?

The best futures account often depends on a trader’s specific needs, including fees, platform features, and support. Some of the best futures prop firms in the world, like Topstep, offer excellent futures accounts with a focus on trader education and risk management. For those looking ahead, reviewing insights from the Best futures prop firms 2024 can help identify accounts that align with future trading goals.

What is the most trusted prop firm?

Trust in a prop firm is built on transparency, favorable trading conditions, and positive trader experiences. The FTMO prop firm is frequently mentioned as a trusted entity due to its solid reputation and structured evaluation process. Exploring reviews and comparisons on the Top 10 best prop firms Forex can offer a broader perspective on other reputable firms.

Is FTMO banned in the US?

FTMO is not banned in the US, but there are specific regulatory considerations for US-based traders. As a global firm, FTMO navigates various international regulations, and US traders can typically participate with certain limitations. It’s essential for US traders to verify the latest compliance details directly with FTMO or consult relevant financial regulations.

How Do Global Economic Events Impact Futures Prop Trading?

Global economic events like interest rate changes, commodity price shifts, and geopolitical tensions have a substantial impact on market volatility, influencing your futures prop trading strategies and outcomes, especially under new trade agreements.

Are There Specific Tax Implications for Profits Earned Through Prop Trading?

Yes, profits from prop trading involve specific tax implications including capital gains tax, deduction eligibility, loss carryforward, and withholding requirements. You’ll need to stay on top of tax reporting for accurate filings.

How Do Prop Firms Handle Trader Data Privacy and Security?

To handle your data privacy and security, prop firms use data encryption methods, secure data storage, and access control systems. They also conduct regular security audits and offer privacy training programs.

What Are the Career Progression Opportunities Within a Prop Firm?

Career progression at a prop firm includes performance bonuses, mentorship programs, and role diversification. You’ll find opportunities for leadership pathways and skill specialization to enhance your trading and professional development.

Can Traders Collaborate or Form Teams Within Prop Firms?

Yes, you can collaborate or form teams within prop firms. Team strategies enhance performance, leveraging shared resources and communication tools. Collaboration benefits include pooled knowledge and improved performance metrics.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.